Orbital Industries of Canada, Inc. manufactures a variety of materials and equipment for the aerospace industry. A team of R & D engineers in the firm’s Winnipeg plant has developed a new material that will be useful for a variety of purposes in orbiting satellites and spacecraft. Tradenamed Ceralam, the material combines some of the best properties of both ceramics and laminated plastics. Ceralam is already being used for a variety of housings in satellites produced in three different countries. Ceralam sheets are produced in an operation called rolling, in which the various materials are rolled together to form a multilayer laminate. Orbital Industries sells many of these Ceralam sheets just after the rolling operation to aerospace firms worldwide. However, Orbital also processes many of the Ceralam sheets further in the Winnipeg plant. After rolling, the sheets are sent to the molding operation, where they are formed into various shapes used to house a variety of instruments. After molding, the sheets are sent to the punching operation, where holes are punched in the molded sheets to accommodate protruding instruments, electrical conduits, and so forth. Some of the molded and punched sheets are then sold. The remaining units are sent to the dipping operation, in which the molded sheets are dipped in a special chemical mixture to give them a reflective surface.

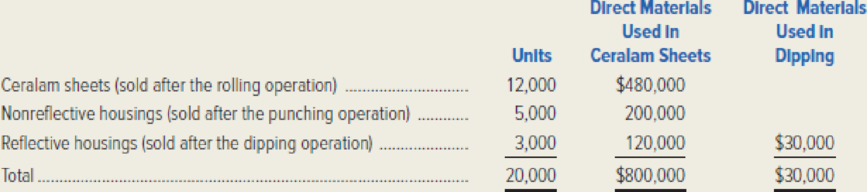

During the month of March, the following products were manufactured at the Winnipeg plant. The direct-material costs also are shown.

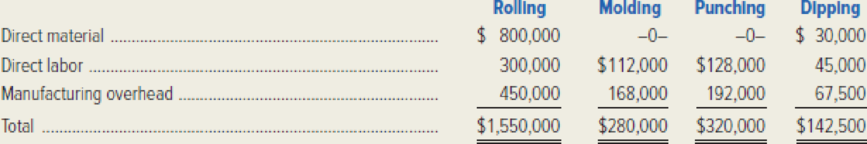

The costs incurred in producing the various Ceralam products in the Winnipeg plant during March are shown in the following table. Manufacturing

Orbital Industries of Canada uses operation costing for its Ceralam operations in the Winnipeg plant.

Required:

- 1. Prepare a table that includes the following information for each of the four operations.

- Total conversion costs.

- Units manufactured.

- Conversion cost per unit.

- 2. Prepare a second table that includes the following information for each product (i.e., rolled Ceralam sheets, nonreflective Ceralam housings, and reflective Ceralam housings).

- Total

manufacturing costs . - Units manufactured.

- Total cost per unit.

- Total

- 3. Prepare

journal entries to record the flow of all manufacturing costs through the Winnipeg plant’s Ceralam operations during March. (Ignore the journal entries to record sales revenue.) - 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements 1 and 2 above. Show how the solution will change if the following data change: the cost of direct material used in dipping was $45,000 and the overhead application rate is 200% of direct-labor cost.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Comm Devices (CD) is a division of Worldwide Communications, Inc. CD produces restaurant pagers and other personal communication devices. These devices are sold to other Worldwide divisions, as well as to other communication companies. CD was recently approached by the manager of the Personal Communications Division regarding a request to make a special emergency- response pager designed to receive signals from anywhere in the world. The Personal Communications Division has requested that CD produce 12,000 units of this special pager. The following facts are available regarding the Comm Devices Division. Selling price of standard pager Variable cost of standard pager Additional variable cost of special pager For each of the following independent situations, calculate the minimum transfer price, and determine whether the Personal Communications Division should accept or reject the offer. (a) The Personal Communications Division has offered to pay the CD Division $105 per pager. The CD…arrow_forwardMonty Company manufactures automobile components for the worldwide market. The company has three large production facilities in Virginia, New Jersey, and California, which have been operating for many years. Brett Harker, vice president of production, believes it is time to upgrade operations by implementing computer-integrated manufacturing (CIM) at one of the plants. Brett has asked corporate controller Connie Carson to gather information about the costs and benefits of implementing CIM. Carson has gathered the following data: Initial equipment cost $ 7,400,000 Working capital required at start-up $ 600,000 Salvage value of existing equipment $ 107,400 Annual operating cost savings $ 1,202,880 Salvage value of new equipment at end of its useful life $ 286,400 Working capital released at end of its useful life 2$ 600,000 Useful life of equipment 10 years Monty Company uses a 12% discount rate.arrow_forwardThe firm, Bolta Ltd, manufactures high precision specialized nuts and bolts that are customized for the needs of specific applications. It has received an enquiry from the Spaceways Company to supply high precision bolts that are needed for their new spacecraft designed to take passengers for a flight over the earth to the limit of earth’s atmosphere of 100 kms and back, hopefully alive and safe. Special bolts are needed that will not be affected by the temperature difference as the spacecraft goes up to the outer atmosphere and on its decent back to the ground. It is expected that the requirements will be about 3 million units in year 1, which will increase by 15% for 2 years up to year 3, and then decrease by 15% for another 2 years. Current plans foresee demand for these specialized nuts for only 5 years. The price per bolt in year 1 is expected to be $ 50 which will increase by 8% each year to account for inflation. Variable cost is 50% of sales. Fixed cost is $ 6 million in year 1…arrow_forward

- QualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the Denver Cover Plant, which makes seat covers. Ted Vosilo is the plant manager of the Denver Cover Plant but also serves as the regional production manager for the company. His budget as the regional manager is charged to the Denver Cover Plant. Vosilo has just heard that QualSupport has received a bid from an outside vendor to supply the equivalent of the entire annual output of the Denver Cover Plant for $35 million. Vosilo was astonished at the low outside bid because the budget for the Denver Cover Plant’s operating costs for the upcoming year was set at $52 million. If this bid is accepted, the Denver Cover Plant will be closed down. The budget for Denver Cover’s operating costs for the coming year is presented below. Denver Cover PlantAnnual Budget for Operating Costs Materials $ 14,000,000…arrow_forwardJCL Inc. is a major chip manufacturing firm that sells its products to computer manufacturers like Dell, Gateway, and others. In simplified terms, chip making at JCL Inc. involves three basic operations: depositing, patterning, and etching. • Depositing: Using chemical vapor deposition (CVD) technology, an insulating material is deposited on the wafer surface, forming a thin layer of solid material on the chip. • Patterning: Photolithography projects a microscopic circuit pattern on the wafer surface, which has a light-sensitive chemical like the emulsion on photographic film. It is repeated many times as each layer of the chip is built. • Etching: Etching removes selected material from the chip surface to create the device structures. Table 7.4 lists the required processing times and setup times at each of the steps. There is unlimited space for buffer inventory between these steps. Assume that the unit of production is a wafer, from which individual chips are cut at a later stage.a.…arrow_forwardualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the Denver Cover Plant, which makes seat covers. Ted Vosilo is the plant manager of the Denver Cover Plant but also serves as the regional production manager for the company. His budget as the regional manager is charged to the Denver Cover Plant. Vosilo has just heard that QualSupport has received a bid from an outside vendor to supply the equivalent of the entire annual output of the Denver Cover Plant for $20.19 million. Vosilo was astonished at the low outside bid because the budget for the Denver Cover Plant’s operating costs for the upcoming year was set at $23.49 million. If this bid is accepted, the Denver Cover Plant will be closed down. The budget for Denver Cover’s operating costs for the coming year is presented below. Denver Cover Plant Annual Budget for Operating Costs Materials $…arrow_forward

- The Pittsburgh division of Vermont Machinery, Inc., manufactures drill bits.One of the production processes for a drill bit requires tipping, whereby carbide tips are inserted into the bit to make it stronger and more durable. This tipping process usually requires four or five operators, depending on the weekly workload. The same operators are also assigned to the stamping operation, where the size of the drill bit and the company's logo is imprinted on the bit. Vermont is considering acquiring three automatic tipping machines to replace the manual tipping and stamping operations. If the tipping process is automated, the division's engineers will have to redesign the shapes of the carbide tips to be used in the machine. The new design requires less carbide, resulting in savings on materials. The following financial data have been compiled: Project life: six years. Expected annual savings: reduced labor, $56,000; reduced material, $75,000; other benefits (reduced carpal tunnel syndrome…arrow_forwardAKL Foundry manufactures metal components for different kinds of equipment used by the aerospace, commercial aircraft, medical equipment, and electronic industries. The company uses investment casting to produce the required components. Investment casting consists of creating, in wax, a replica of the final product and pouring a hard shell around it. After removing the wax, molten metal is poured into the resulting cavity. What remains after the shell is broken is the desired metal object ready to be put to its designated use. Metal components pass through eight processes: gating, shell creating, foundry work, cutoff, grinding, finishing, welding, and strengthening. Gating creates the wax mold and clusters the wax pattern around a sprue (a hole through which the molten metal will be poured through the gates into the mold in the foundry process), which is joined and supported by gates (flow channels) to form a tree of patterns. In the shell-creating process, the wax molds are alternately dipped in a ceramic slurry and a fluidized bed of progressively coarser refractory grain until a sufficiently thick shell (or mold) completely encases the wax pattern. After drying, the mold is sent to the foundry process. Here, the wax is melted out of the mold, and the shell is fired, strengthened, and brought to the proper temperature. Molten metal is then poured into the dewaxed shell. Finally, the ceramic shell is removed, and the finished product is sent to the cutoff process, where the parts are separated from the tree by the use of a band saw. The parts are then sent to the grinding process, where the gates that allowed the molten metal to flow into the ceramic cavities are ground off using large abrasive grinders. In the finishing process, rough edges caused by the grinders are removed by small handheld pneumatic tools. Parts that are flawed at this point are sent to welding for corrective treatment. The last process uses heat to treat the parts to bring them to the desired strength. In 20X1, the two partners who owned AKL Foundry decided to split up and divide the business. In dissolving their business relationship, they were faced with the problem of dividing the business assets equitably. Since the company had two plantsone in Arizona and one in New Mexicoa suggestion was made to split the business on the basis of geographic location. One partner would assume ownership of the plant in New Mexico, and the other would assume ownership of the plant in Arizona. However, this arrangement had one major complication: the amount of WIP inventory located in the Arizona plant. The Arizona facilities had been in operation for more than a decade and were full of WIP. The New Mexico facility had been operational for only 2 years and had much smaller WIP inventories. The partner located in New Mexico argued that to disregard the unequal value of the WIP inventories would be grossly unfair. Unfortunately, during the entire business history of AKL Foundry, WIP inventories had never been assigned any value. In computing the cost of goods sold each year, the company had followed the policy of adding depreciation to the out-of-pocket costs of direct labor, direct materials, and overhead. Accruals for the company are nearly nonexistent, and there are hardly ever any ending inventories of materials. During 20X1, the Arizona plant had sales of 2,028,670. The cost of goods sold is itemized as follows: Upon request, the owners of AKL provided the following supplementary information (percentages are cumulative): Gating had 10,000 units in BWIP, 60% complete. Assume that all materials are added at the beginning of each process. During the year, 50,000 units were completed and transferred out. The ending inventory had 11,000 unfinished units, 60% complete. Required: 1. The partners of AKL want a reasonable estimate of the cost of WIP inventories. Using the gating departments inventory as an example, prepare an estimate of the cost of the EWIP. What assumptions did you make? Did you use the FIFO or weighted average method? Why? (Note: Round unit cost to two decimal places.) 2. Assume that the shell-creating process has 8,000 units in BWIP, 20% complete. During the year, 50,000 units were completed and transferred out. (Note: All 50,000 units were sold; no other units were sold.) The EWIP inventory had 8,000 units, 30% complete. Compute the value of the shell-creating departments EWIP. What additional assumptions had to be made?arrow_forwardABC Chemical Company manufactures industrial chemicals. The company plans to introduce a new chemical solution and needs to develop a standard product cost. The new chemical solution is made by combining a chemical compound (nyclyn) with a solution (salex), heating the mixture to boiling point, adding a second compound (protet), and bottling the resulting solution in 15-litre containers. The initial mix, which is 12 litres in volume, consists of 14 kilograms of nyclyn and 11.6 litres of salex. A 1-litre reduction in volume occurs during the boiling process. The solution is cooled slightly before 8 kilograms of protet are added. The protet evaporates, so it does not affect the total liquid volume. The purchase prices of the raw materials used in the manufacture of this new chemical solution are as follows: Nyclyn $4.90 per kilogram Salex $5.60 per litre Protet $6.80 per kilogram a. 102.36 b. None of the answers given c. 98.36 d. 93.36arrow_forward

- Recently, Mewah Designs expanded its market by becoming an original equipment supplier toJee Wrangler. Mewah Designs produces factory upgraded speakers specifically for JeeWrangler. The Kicker components and speaker cabinets are outsourced with assemblyremaining in-house. Mewah Designs assemble the product by placing the speakers and othercomponents in cabinets that define an audio package upgrade and that can be placed into theJee Wrangler, producing the desired factory-installed appearance. Speaker cabinets andassociated Kicker components are added at the beginning of the assembly process.Assume that Mewah Designs uses the weighted-average method to cost out the audio package.The following are cost and production data for the assembly process for April: Production:Units in process, April 1, 60% complete 60,000Units completed and transferred out 150,000Units in process, April 30, 20% complete 30,000Costs:WIP, April 1:Cabinets RM 1,200,000Kicker components RM 12,600,000Conversion costs…arrow_forwardLansing Electronics Inc. manufactures a variety of printers, scanners, and fax machines in itstwo divisions: the PSF Division and the Components Division. The Components Division produces electronic components that can be used by the PSF Division. All the components thisdivision produces can be sold to outside customers. However, from the beginning, nearly allof its output has been used internally. The current policy requires that all internal transfers ofcomponents be transferred at full cost.Recently, Cam DeVonn, the chief executive officer of Lansing Electronics, decided to investigate the transfer pricing policy. He was concerned that the current method of pricing internaltransfers might force decisions by divisional managers that would be suboptimal for the firm. Aspart of his inquiry, he gathered some information concerning Component Y34, which is usedby the PSF Division in its production of a basic scanner, Model SC67.The PSF Division sells 40,000 units of Model SC67 each year…arrow_forwardCapstone Turbine Corporation is the world's leading provider of microturbine based MicroCHP (combined heat and power) systems for clean, continuous. distributed-generation electricity. The MicroCHP unit is a compact turbine generator that delivers electricity on-site or close to the point where it is needed. This form of distributed-generation technology, designed to operate on a variety of gaseous and liquid fuels, first debuted in 1998. The microturbine is expected to operate on-demand or continuously for up to a year between recommended maintenance (filter cleaning/replacement). The generator is cooled by air now into the gas turbine, thus eliminating the need for liquid cooling. It can make electricity from a variety of fuels-natural gas, kerosene, diesel oil, and even waste gases from landfills, sewage plants, and oil fields. Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, and hybrid electric vehicles.…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning