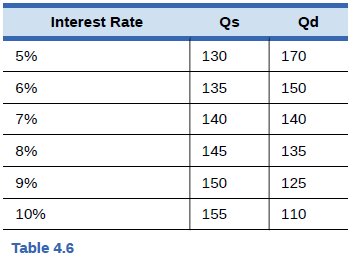

Table 4.6 shows the amount of savings and barrowing in a market for loans lo purchase homes, measured in millions of dollars, at various interest rates. What is the equilibrium interest rate and quantity in the capital financial market? How can you tell? Now, imagine that because of a shift in the perceptions of foreign investors, the supply curve shifts so that there will be

Trending nowThis is a popular solution!

Chapter 4 Solutions

Principles of Economics 2e

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Construction Accounting And Financial Management (4th Edition)

Managerial Accounting (4th Edition)

Principles of Accounting Volume 2

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Imagine that you are in the position of buying loans in the secondary market (that is, buying the right to collect the payments on loans) for a bank or other financial services company. Explain why you would be willing to pay more or less for a given loan If: The borrower has been late on a number of loan payments Interest rates In the economy as a whole have risen since the bank made the loan The borrower Is a firm that has just declared a high level of profits Interest rates in the economy as a whole have fallen since the bank made the loanarrow_forwardInterest Rate Qty. supplied Qty. demanded 5% 130 170 6% 135 150 7% 140 140 8% 145 135 9% 150 125 10% 155 110 The table above shows the amount of savings and borrowing in a market for loans to purchase homes, measured in millions of dollars, at various interest rates. What is the equilibrium interest rate and quantity in the capital financial market? Describe how you can tell? Now, imagine that because of a shift in the perceptions of foreign investors, the supply curve shifts so that there will be $10 million less supplied at every interest rate level. Calculate the new equilibrium interest rate and quantity and explain why the direction of the interest rate shift makes sense.arrow_forwardThe following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. INTEREST RATE (Percent) 10 8 O 0 Supply 100 200 300 400 500 600 Demand 700 800 LOANABLE FUNDS (Billions of dollars) 900 1000 ?arrow_forward

- Predict how each of the following economic changes will affect the equilibrium price and quantity in the financial market for home loans. Sketch a demand and supply diagram to support your answers. a. The number of people at the most common ages for home-buying increases. b. People gain confidence that the economy is growing and that their jobs are secure. c. Banks that have made home loans find that a larger number of people than they expected are not repaying those loans. d. Because of a threat of a war, people become uncertain about their economic future. e. The overall level of saving in the economy diminishes. f. The federal government changes its bank regulations in a way that makes it cheaper and easier for banks to make home loans.arrow_forwardWhich of the following changes in the financial market will lead to a decline in interest rates: (Select all that apply) O A. a rise in demand for money O B. a fall in demand for money OC. a rise in supply of money O D. a fall in supply of moneyarrow_forwardIf interest rates in the economy rise over time this is: O Good for lenders but bad for borrowers O Good for borrowers but bad for lenders O Good for lenders and borrowers Bad for lenders and borrowersarrow_forward

- QUESTION 2 If the quantity of money demanded exceeds the quantity of money supplied, then O the quantity of nonmonetary assets demanded exceeds the quantity supplied. you can make no conclusions about the relative supply and demand of nonmonetary assets the quantity of nonmonetary assets demanded will still equal the quantity supplied, all else being equal. the quantity of nonmonetary assets supplied exceeds the quantity demanded.arrow_forwardThe following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. INTEREST RATE (Percent) 10 9 8 7 3 2 1 0 0 100 Supply Demand 200 300 400 500 600 700 800 LOANABLE FUNDS (Billions of dollars) 900 1000 ?arrow_forwardAssume that oil speculators buy oil and put it in storage. Shift one of the curves in the accompanying graph to show the effect of this speculation and then place the equilibrium point, E, at the new equilibrium price and quantity. What is the new price? $ Why is speculation advantageous for future consumption? O Speculation is not advantageous. Today's prices are higher than future prices. Future prices will be higher. O It tends to smooth prices over time. Price ($/barrel) 100 95 90 85 80 75 70 65 60 55 50 45 40 35 30 25 20 15 10 5 0 0 50 1 2 Is 4 D 3 4 5 6 Quanity (millions of barrerls) 7 8 9 10arrow_forward

- In the Graph, what is the equilibrium level of real GDP and equilibrium price? S 120 110 100 S 5,000 6,000 7,500 Real GDP (billions of dollars per year) $5,000 billion real GDP and price level of 120 $5,000 billion real GDP and price level of 110 $6,000 billion real GDP and price level of 110 $7,500 billion real GDP and price level of 100 O O O O Price Levelarrow_forwardINTEREST RATE (Percent) 12 11 10 9 co 5 4 3 2 1 0 Supply Demand 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 LOANABLE FUNDS (Billions of dollars) ? Investment is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied decreases Suppose the interest rate is 5.5%. Based on the previous graph, the quantity of loanable funds supplied is greater than the quantity of loans demanded, resulting in a surplus of loanable funds. This would encourage lenders to lower the interest rates they charge, thereby decreasing the quantity of loanable funds supplied and increasing the quantity of loanable funds demanded, moving the market toward the equilibrium interest rate of 5%arrow_forwardRent / Unit m lo O Equilibrium occupancy O Market rent O Vacancy O Shortage O Interest rate D Supply Demand Existing Stock of Space Consider the figure above. Point E represents: Units of Spacearrow_forward

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax