Principles of Financial Accounting.

24th Edition

ISBN: 9781260158601

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 2AP

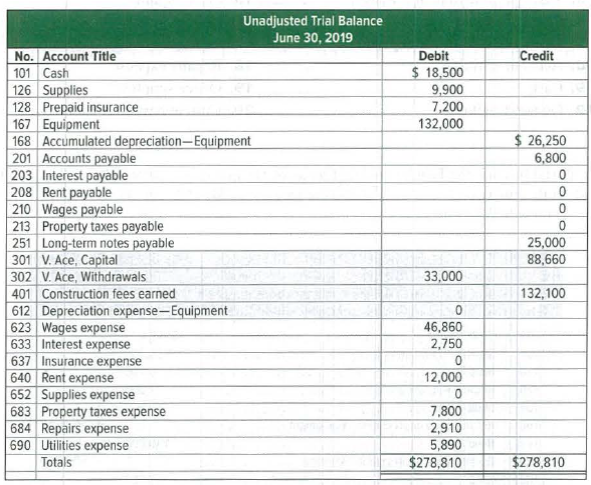

The following unadjusted

Required

- 1. Prepare and complete a I0-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts.

- a. The supplies available at the end of fiscal year 2019 had a cost of $3,300.

- b. The cost of expired insurance for the fiscal year is $3,800.

- c. Annual depreciation on equipment is $8,400.

- d. The June utilities expense of $650 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $650 amount owed needs to be recorded.

e. The company’s employees have earned $1,800 of accrued and unpaid wages at fiscal year-end.

f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $500.

g. Additional property taxes of $1,000 have been assessed for this fiscal year but have not been paid or recorded in the accounts.

h. The $250 accrued interest for June on the long-term notes payable has not yet been paid or recorded.

- 2. Using information from the completed 10-column work sheet in part 1, journalize the

adjusting entries and the closing entries. - 3. Prepare the income statement and the statement of owner’s equity for the year ended June 30 and the classified

balance sheet at June 30, 2019.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On June 7,2019, Dilby Mechanical Corp completed $50,00 of servicing work for a client and billed them for that amount plus a GST of $2,500 and PST of $3,50; terms are N20.

Required:

a. Prepare the journal entry as it would appear in Dilby's accounting records.

b. Assume the receivable established on June 7 was collected on June 27. Record the entry.

On November 30, 2019, Davis Company and the following account balances:

1. Prepare general journal entries to record preceding transactions. 2. Post to general ledger T-accou11ts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b ) for simplicity, the building and equipment are being depreciated using the stright-line method over an estimated life of 20 years with no residual all c) supplies on hand at the end of the year total $630; (d ) bad debts expense for the year totals $830; and (e ) the income tax rate is 30%; income taxes are payable in the first quarter of 2020. 4. Prepare company's financial statements for 2019 . 5. Prepare 2019 (a) adjusting and (b) closing entries in the general journal.

Prepare journal entries to record the following transactions. You are required to show all calculations: the financial year-end of the client is 30 November 2021.

3.1

The company adopted the straight-line depreciation method. Record the 15% depreciation on the plant and equipment purchased On 1 December 2020 for R125 000.

3.2

The allowance for credit losses account has an opening balance of R4 500. The policy requires the allowance to equate 8% of the total accounts receivable. The debtors sub-ledger totaled R52 000 prior receiving 40c in the rand on an account of R3 000. The financial manager instructed the write off on the balance WITH GENERAL LEDGER ENTERIES:

Please dont provide answer in image format thnku

Chapter 4 Solutions

Principles of Financial Accounting.

Ch. 4 - G. Venda, owner of Venda Services, withdrew 25,000...Ch. 4 - The following information is available for the R....Ch. 4 - Which of the following errors would cause the...Ch. 4 - The temporary account used only in the closing...Ch. 4 - Prob. 5MCQCh. 4 - Prob. 1DQCh. 4 - What accounts are affected by closing entries?...Ch. 4 - What two purposes are accomplished by recording...Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQ

Ch. 4 - Prob. 6DQCh. 4 - Prob. 7DQCh. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Prob. 10DQCh. 4 - What are the characteristics of plant assets?Ch. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 14DQCh. 4 - Prob. 15DQCh. 4 - Prob. 16DQCh. 4 - Prob. 17DQCh. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Prob. 3QSCh. 4 - The ledger of Claudell Company includes the...Ch. 4 - Choose from the following list of terms/phrases to...Ch. 4 - The ledger of Mai Company includes the following...Ch. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Classifying balance sheet items C3 The following...Ch. 4 - Prob. 10QSCh. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - Prob. 13QSCh. 4 - These 16 accounts are from the Adjusted Trial...Ch. 4 - The Adjusted Trial Balance columns of a 10-column...Ch. 4 - Use the following information from the Adjustments...Ch. 4 - The following data are taken from the unadjusted...Ch. 4 - Capri Company began the current period with a...Ch. 4 - Prob. 6ECh. 4 - Prob. 7ECh. 4 - Use the May 31 fiscal year-end information from...Ch. 4 - Prob. 9ECh. 4 - The adjusted trial balance for Salon Marketing Co....Ch. 4 - Prob. 11ECh. 4 - Prob. 12ECh. 4 - Use the following adjusted year-end trial balance...Ch. 4 - Following are Nintendos revenue and expense...Ch. 4 - Prob. 15ECh. 4 - Hawk Company records prepaid assets and unearned...Ch. 4 - The following two events occurred for Trey Co. on...Ch. 4 - On April 1, Jiro Nozomi created a new travel...Ch. 4 - The following unadjusted trial balance is for Ace...Ch. 4 - Prob. 3APCh. 4 - The adjusted trial balance for Tybalt Construction...Ch. 4 - The adjusted trial balance of Karise Repairs on...Ch. 4 - The following six-column table for Hawkeye Ranges...Ch. 4 - On July 1, Lula Plume created a new self-storage...Ch. 4 - Prob. 2BPCh. 4 - Prob. 3BPCh. 4 - The adjusted trial balance for Anara Co. as of...Ch. 4 - Santo Companys adjusted trial balance on December...Ch. 4 - The following six-column table for Solutions Co....Ch. 4 - This serial problem began in Chapter 1 and...Ch. 4 - Accounting Analysis Refer to Apples financial...Ch. 4 - Prob. 2AACh. 4 - Prob. 3AACh. 4 - Prob. 1BTNCh. 4 - One of your classmates states that a companys...Ch. 4 - Review this chapters opening feature involving...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive On November 30, 2019. Davis Company had the following account balance. During the month of December, Davis entered into the following transactions: Required: a.Prepare generaljournal entries to record the preceding transactions. b.Post to general ledger T accoun c.Prepare a year-end trial balance on a worksheet and complete theworksheet using the following information: (a) accrued salaries at year-end total s1,200; (b) for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 yean with no residual value;(c) supplies on hand at the end of the year total $630; (d) bad debts expense for the year totals $830; and (e)the income tax rate is 30%; income taxes are payable in the first quarter of d.Prepare the companis financial statements for 2019. e.Prepare the 2019 (a) adjusting and (b) closing entries in the general journal.arrow_forwardThe following information is available for the first three years of operations for Swift Company: (file attached) Requirements : 1. Prepare a schedule comparing depreciation for financial reporting and tax purposes 2. Determine the deferred tax (asset) or liability at the end of 2018 3. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019arrow_forwardAccounting Two fixed assets are purchased during 2021: a copier for $10,987.65 on September 30, 2021 and an office desk for 5,432.10 on December 31, 2021. Depreciation entries are recorded at the end of each month. What will be general journal adjusting entry on December 31, 2021 for the depreciation of these fixed assets, if tax basis 150% MACRS is used?arrow_forward

- From the following trial balance of Faris Ali Qureshi & Bros. and additional information, prepare Trading and Profit & Loss account and Balance sheet for the year ended June 30th, 2020. Additional Information:- a) Depreciation furniture by 10% by written down method (WDM).b) A provision for doubtful debts is to be created to the extent of 5% on sundry debtors.c) Salaries for the month of June, 2019 amounting to Rs. 3,000 were unpaid which must be provided for. However, salaries included Rs. 2,000 paid in advance. Office expenses outstanding Rs. 8,000.d) Insurance amounting to Rs. 2,000 is prepaid.e)Stock use for private purpose Rs. 6,000 and closing stock Rs. 60,000.arrow_forwardRequired 1. Prepare and complete a 10-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts. a. The supplies available at the end of fiscal year 2019 had a cost of $7,900. b. The cost of expired insurance for the fiscal year is $10,600. c. Annual depreciation on equipment is $7,000. d. The April utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded. e. The company’s employees have earned $2,000 of accrued and unpaid wages at fiscal year-end. f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $3,000. g. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The $300 accrued interest for April on the long-term notes payable has not yet been paid or recorded. 2. Using information…arrow_forwardThe information necessary for preparing the 2021 year-end adjusting entries for Winter Storage appears below. Winter's fiscal year-end is December 31.Depreciation on the equipment for the year is $7,000.Salaries earned by employees (but not paid to them) from December 16 through December 31, 2021, are $3,400.On March 1, 2021, Winter lends an employee $12,000 and a note is signed requiring principal and interest at 6% to be paid on February 28, 2022.On April 1, 2021, Winter pays an insurance company $15,000 for a one-year fire insurance policy. The entire $15,000 is debited to prepaid insurance at the time of the purchase.$1,500 of supplies are used in 2021.A customer pays Winter $4,200 on October 31, 2021, for six months of storage to begin November 1, 2021. Winter credits deferred revenue at the time of cash receipt.On December 1, 2021, $4,000 rent is paid to a local storage facility. The payment represents storage for December 2021 through March 2022, at $1,000 per month. Prepaid…arrow_forward

- As an accounting intern at Roddick Company, you have been tasked with the review of certain transactions which dealt with intangible assets for the financial year ended December 31, 2020: A. January 5, 2020, Roddick Company application for a patent (August 2019) was granted. Legal and registration costs incurred were $140,000. The patent runs for 20 years. The manufacturing process will be useful to Roddick for 10 years. Required: Prepare the journal entry needed at the date of the transaction and on December 31, 2020 to record any resultant amortization.arrow_forwardSafety First Company completed all of its October 31,2020 adjustments in preparation for preparing its financial statements which resulted in the following trial balance Other information: All accounts have normal balances $26,400 of the Notes payable balance is due by October 31, 2021 The final task in the year end process was to access the assets for impairment, which resulted in the following schedule Required: Prepare the entries to record any impairment losses at October 31, 2020. Assume the company recorded no impairment losses in the previous years Prepare a classified balance sheet at October 31, 2020 What is the impact on the financial statements of an impairment loss?arrow_forwardSoon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.arrow_forward

- At the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.arrow_forwardComprehensive Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows: Required: Prepare journal entries to record the preceding transactions of Shadrach Computer Corporation for 2019. Include year-end accruals. Round all calculations to the nearest dollar.arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License