Managerial Accounting

16th Edition

ISBN: 9781259995484

Author: Ray Garrison

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 16P

PROBLEM 4-16 Comprehensive Problem-Weighted-Average Method LO4-2, LO4-3, LO4-4, LO4-5

Builder Products, Inc., uses the weighted-average method in its

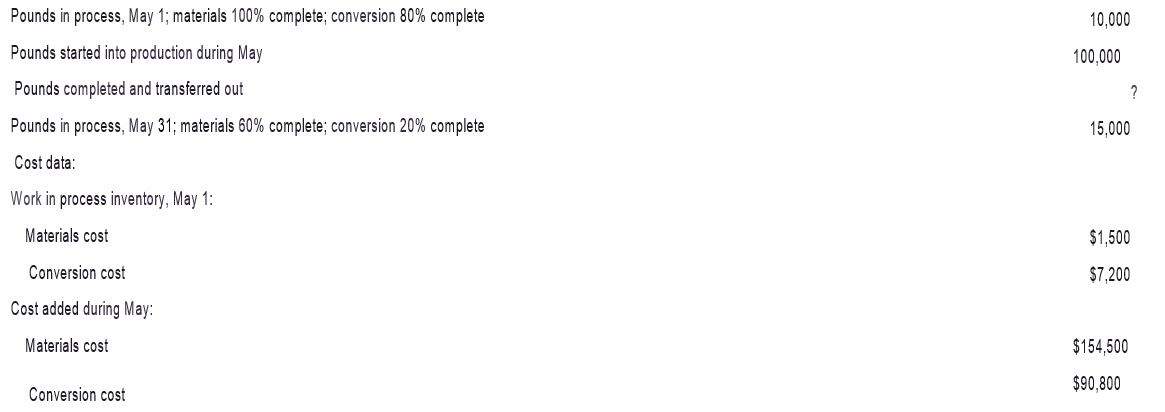

Production data:

Required:

- Compute the equivalent units of production for materials and conversion for May.

- Compute the cost per equivalent unit for materials and conversion for May.

- Compute the cost of ending work in process inventory’ for materials, conversion, and in total for May.

- Compute the cost of units transferred out to the nest department for materials, conversion, and in total for May.

- Prepare a cost reconciliation report for May

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Comprehensive Problem—Weighted-Average Method

Builder Products, Inc., uses the weighted-average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion. Information on work in the first department, Cooking, is given below for May:

Required:

1. Compute the equivalent units of production for materials and conversion for May.

2. Compute the cost per equivalent unit for materials and conversion for May.

3. Compute the cost of ending work in process inventory for materials, conversion, and in total for May.

4. Compute the cost of units transferred out to the next department for materials, conversion, and in total for May.

5. Prepare a cost reconciliation report for May.

Problem 4-16 (Algo) Comprehensive Problem-Weighted-Average Method [LO4-2, LO4-3, LO4-4, LO4-5]

Builder Products, Inc., uses the weighted-average method in its process costing system. It manufactures a caulking compound that

goes through three processing stages prior to completion. Information on work in the first department, Cooking, is given below for

May:

Production data:

Pounds in process, May 1; materials 100% complete;

conversion 90% complete

Pounds started into production during May

Pounds completed and transferred out

Pounds in process, May 31; materials 75% complete;

conversion 25% complete

Cost data:

71,000

360, 000

31,000

Work in process inventory, May 1:

Materials cost

Conversion cost

Cost added during May:

Materials cost

Conversion cost

$ 90,100

$ 46,400

$ 468,590

$ 255,335

Required:

1. Compute the equivalent units of production for materials and conversion for May.

2. Compute the cost per equivalent unit for materials and conversion for May.

3. Compute the cost of ending…

Sagar

Chapter 4 Solutions

Managerial Accounting

Ch. 4.A - EXERCISE 4A-1 Computation of Equivalent Units of...Ch. 4.A - EXERCISE 4A-2 Cost per Equivalent Unit-FIFO Method...Ch. 4.A - EXERCISE 4A-3 Assigning Costs to Units-FIFO Method...Ch. 4.A - EXERCISE 4A-4 Cost Reconciliation Report-EIFO...Ch. 4.A - EXERCISE 4A-5 Computation of Equivalent Units of...Ch. 4.A - EXERCISE 4A-6 Equivalent Units of Production-FIFO...Ch. 4.A - EXERCISE 4A-7 Equivalent Units of Production and...Ch. 4.A -

EXERCISE 4A-8 Equivalent Units of Production—FIFO...Ch. 4.A - EXERCISE 4A-9 Equivalent Units; Equivalent Units...Ch. 4.A - PROBLEM 4A-10 Equivalent Units of Production;...

Ch. 4.A - Prob. 11PCh. 4.A - Prob. 12CCh. 4.B - Prob. 1ECh. 4.B - EXERCISE 4B-2 Step-Down Method LO4-11 Madison Park...Ch. 4.B - Prob. 3ECh. 4.B - EXERCISE 4B-4 Direct Method LO4-10 Refer to the...Ch. 4.B - PROBLEM 4B-5 Step-Down Method L04-11 Woodbury...Ch. 4.B - PROBLEM 4B-6 Step-Down Method versus Direct...Ch. 4.B - CASE 4B-7 Step-Down Method versus Direct Method...Ch. 4 - Prob. 1QCh. 4 - In what ways are job-order and process costing...Ch. 4 - Why is cost accumulation simpler in a process...Ch. 4 - How many Work in Process accounts are maintained...Ch. 4 - Prob. 5QCh. 4 - Prob. 6QCh. 4 - Prob. 7QCh. 4 - Prob. 8QCh. 4 - Prob. 1AECh. 4 - This exercise relates to the Double Diamond Skis’...Ch. 4 - This exercise relates to the Double Diamond Skis’...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Prob. 10F15Ch. 4 - Prob. 11F15Ch. 4 - Prob. 12F15Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 - Prob. 14F15Ch. 4 - Prob. 15F15Ch. 4 - Prob. 1ECh. 4 - Prob. 2ECh. 4 - Prob. 3ECh. 4 - EXERCISE 4-4 Assigning Costs to...Ch. 4 - EXERCISE 4-5 Cost Reconciliation...Ch. 4 - Prob. 6ECh. 4 - Prob. 7ECh. 4 - Prob. 8ECh. 4 -

EXERCISE 4-9 Equivalent Units and Cost per...Ch. 4 - Prob. 10ECh. 4 - Prob. 11ECh. 4 - Prob. 12ECh. 4 - Prob. 13PCh. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - PROBLEM 4-16 Comprehensive...Ch. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19CCh. 4 - (

CASE 4-20 Ethics and the Manager, Understanding...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Seacrest Company uses a process-costing system. The company manufactures a product that is processed in two departments: A and B. As work is completed, it is transferred out. All inputs are added uniformly in Department A. The following summarizes the production activity and costs for November: Required: 1. Using the weighted average method, prepare the following for Department A: (a) a physical flow schedule, (b) an equivalent unit calculation, (c) calculation of unit costs (Note: Round to four decimal places.), (d) cost of EWIP and cost of goods transferred out, and (e) a cost reconciliation. 2. CONCEPTUAL CONNECTION Prepare journal entries that show the flow of manufacturing costs for Department A. Use a conversion cost control account for conversion costs. Many firms are now combining direct labor and overhead costs into one category. They are not tracking direct labor separately. Offer some reasons for this practice.arrow_forwardUse the following information for Brief Exercises 4-34 and 4-35: Sanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Brief Exercises 4-34 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Sanjay Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Assembly and the other for Painting.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forwardUse the following information for Brief Exercises 4-27 and 4-28: Quillen Company manufactures a product in a factory that has two producing departments, Cutting and Sewing, and two support departments, S1 and S2. The activity driver for S1 is number of employees, and the activity driver for S2 is number of maintenance hours. The following data pertain to Quillen: Brief Exercises 4-27 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Quillen Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Cutting and the other for Sewing.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forward

- e. A cost reconciliation Problem 6.36 Weighted Average Method, Journal Entries Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct mate- rials are added at the beginning of the process; in the Assembly Department, additional materials are added at the end of the process. In both departments, conversion costs are incurred JECTIVE 156 uniformly throughout the process. As work is completed, it is transferred out. The following table summarizes the production activity and costs for February: Molding Assembly Beginning inventories: Physical units 10,000 8,000 Costs: $ 45,200 Transferred in Direct materials Conversion costs $ 22,000 $ 13,800 $ 16,800 Current production: Units started ? 25,000 30,000 35,000 Units transferred out Costs: Transferred in Direct materials Conversion costs $ 56,250 $103,500 $ 39,550 $136,500 Percentage of completion: Beginning inventory Ending…arrow_forwardWeighted Average Method, Journal EntriesSeacrest Company uses a process-costing system. The company manufactures a product that isprocessed in two departments: A and B. As work is completed, it is transferred out. All inputsare added uniformly in Department A. The following summarizes the production activity andcosts for November: Required:1. Using the weighted average method, prepare the following for Department A: (a) aphysical flow schedule, (b) an equivalent unit calculation, (c) calculation of unit costs(Note: Round to four decimal places.), (d) cost of EWIP and cost of goods transferredout, and (e) a cost reconciliation. 2. CONCEPTUAL CONNECTION Prepare journal entries that show the flow ofmanufacturing costs for Department A. Use a conversion cost control account forconversion costs. Many firms are now combining direct labor and overhead costs intoone category. They are not tracking direct labor separately. Offer some reasons for thispractice.arrow_forwardQuestion 4: Process Costing: FIFO Cultural Cuisines Pty Ltd uses the first-in, first-out method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Work in process, beginning Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Materials cost Conversion cost Work in process, ending: Units in process Percent complete with respect to materials Percent complete with respect to conversion 700 80% 20% $1,814 $1,406 25,200 25,300 $94,125 $619,951 600 inventory. Round your final answer to the nearest whole number. In Determine the material, conversion and total cost to complete the units in beginning WIP. Round your final answer to the nearest whole number. 60% 50%…arrow_forward

- Question: Ebony Company uses the weighted-average method of process costing to assign production costs to the products. Information for April follows. Assume that all materials are added at the beginning of the production process, and that direct labor and factory overhead are added uniformly throughout the process. Complete a process cost summary using the following sections: Beginning WIP Units completed and transferred Units Material Conversion 5000 50000 100000 20000 250000 500000 Ending WIP 80% complete with 7000 respect to conversion and 100% for materials 1. Costs charged to production 2. Unit cost information 3. Equivalent units of production 4. Cost per Equivalent unit of productionarrow_forwardtopic : Process Costing PLS HELP ME ANSWER THE REQUIRED ANSWERS!arrow_forwardExercise 5S-7 (Algo) Equivalent Units of Production and Cost per Equivalent Unit-FIFO Method [LO 5S-6, LO 5S-7] Pureform, Incorporated, uses the FIFO method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: Work in process inventory, beginning Units started in process Units transferred out Work in process inventory, ending Cost added during the month Units 66,000 629,000 1. Equivalent units of production 2. Cost per equivalent unit 650,000 45,000 Materials Materials $ 54,800 $ 876,820 $ 407,680 $ 439,040 The beginning work in process inventory was 70% complete with respect to materials and 55% complete with respect to labor and overhead. The ending work in process inventory was 50% complete with respect to materials and 30% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the…arrow_forward

- Subject- accountingarrow_forwardQuestion 4 ABC Manufacturing uses activity-based costing. Each product consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information is as follows: Acitivity Materials handling Machine operations Assembling Packaging Allocation Base Number of parts Number of hours Number of parts Number of completed products $0.09 $5.22 $0.35 $2.00 Cost Allocation Rate What is the cost of materials handling per product? Enter your response with two decimals but without a comma or $ sign.arrow_forwardQuestion 2 Vaasa Chemicals makes a product by way of two processes - costing system in the Mixing Department has two direct cost categories (Chemical P & Chemical Q) and one conversion costs pool. Chemical P is introduced at the start of the operations in the Mixing Department and Chemical Q is added when the product is three- fourths (75%) completed in the Mixing Department. The following information pertains to the Mixing department for July: Mixing & Refining. Its process Units Work in process inventory, July 1 Started production Completed and transferred to Refining Department Ending work in process inventory [two-thirds (66½%)of the way through the Mixing process] 50,000 35,000 15,000 Costs Beginning WIP inventory $0 Costs added during July: Chemical P 250,000 Chemical Q 70,000 Direct Labour 32,000 Manufacturing overhead 103,000 Required: i) Compute the equivalent units in the Mixing Department for direct materials and for conversion costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY