FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:e.

A cost reconciliation

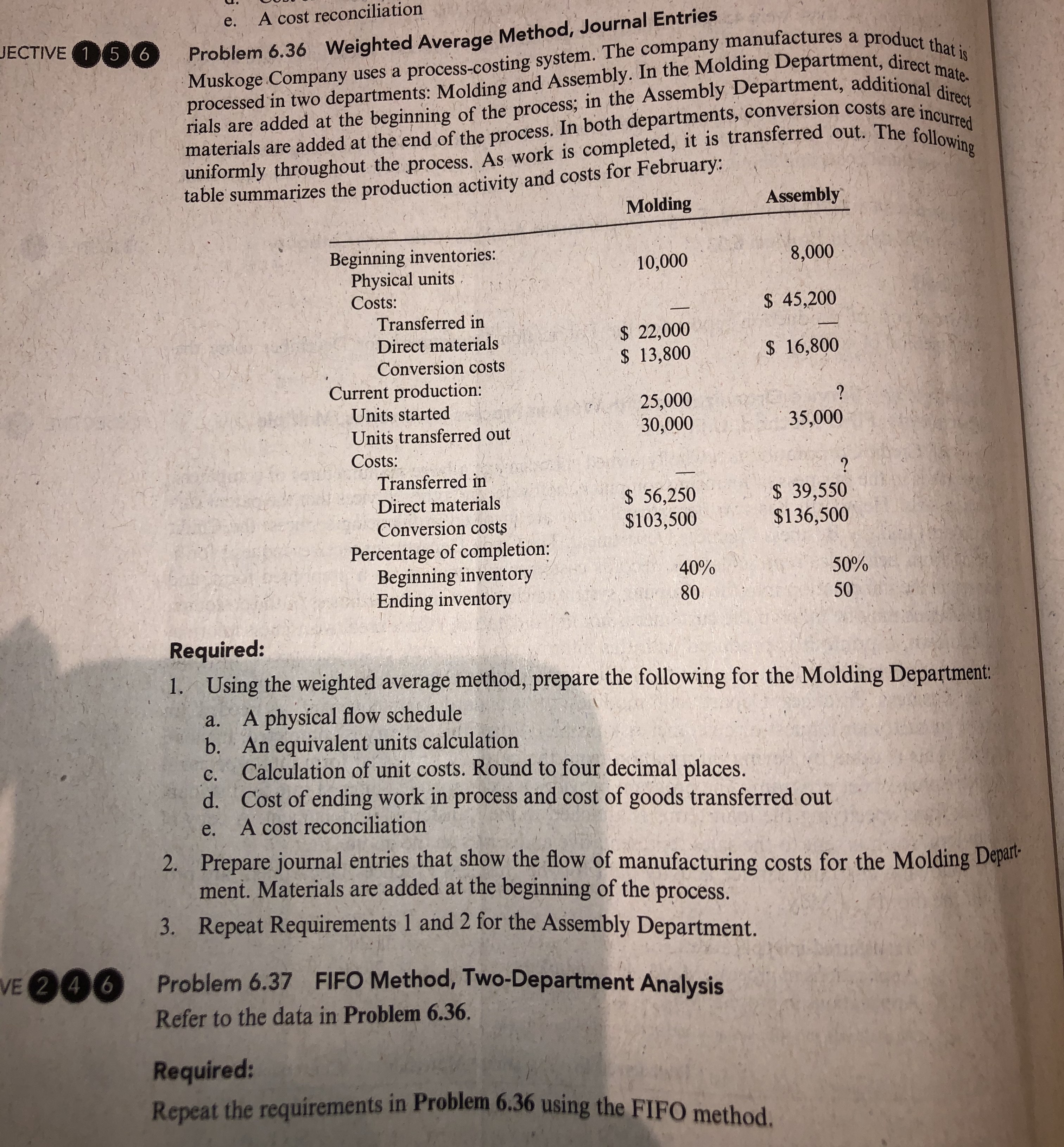

Problem 6.36 Weighted Average Method, Journal Entries

Muskoge Company uses a process-costing system. The company manufactures a product that is

processed in two departments: Molding and Assembly. In the Molding Department, direct mate-

rials are added at the beginning of the process; in the Assembly Department, additional

materials are added at the end of the process. In both departments, conversion costs are incurred

JECTIVE 156

uniformly throughout the process. As work is completed, it is transferred out. The following

table summarizes the production activity and costs for February:

Molding

Assembly

Beginning inventories:

Physical units

10,000

8,000

Costs:

$ 45,200

Transferred in

Direct materials

Conversion costs

$ 22,000

$ 13,800

$ 16,800

Current production:

Units started

?

25,000

30,000

35,000

Units transferred out

Costs:

Transferred in

Direct materials

Conversion costs

$ 56,250

$103,500

$ 39,550

$136,500

Percentage of completion:

Beginning inventory

Ending inventory

40%

50%

80

50

Required:

1. Using the weighted average method, prepare the following for the Molding Department:

a. A physical flow schedule

b. An equivalent units calculation

Calculation of unit costs. Round to four decimal places.

d. Cost of ending work in process and cost of goods transferred out

C.

e.

A cost reconciliation

2. Prepare journal entries that show the flow of manufacturing costs for the Molding Depare

ment. Materials are added at the beginning of the process.

3. Repeat Requirements 1 and 2 for the Assembly Department.

VE 246 Problem 6.37 FIFO Method, Two-Department Analysis

Refer to the data in Problem 6.36.

Required:

Repeat the requirements in Problem 6.36 using the FIFO method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 12 images

Knowledge Booster

Similar questions

- Question: Ebony Company uses the weighted-average method of process costing to assign production costs to the products. Information for April follows. Assume that all materials are added at the beginning of the production process, and that direct labor and factory overhead are added uniformly throughout the process. Complete a process cost summary using the following sections: Beginning WIP Units completed and transferred Units Material Conversion 5000 50000 100000 20000 250000 500000 Ending WIP 80% complete with 7000 respect to conversion and 100% for materials 1. Costs charged to production 2. Unit cost information 3. Equivalent units of production 4. Cost per Equivalent unit of productionarrow_forwardEquivalent Units Calculations—Weighted Average Method Ferris Corporation makes a powdered rug shampoo in two sequential departments, Compounding and Drying. Materials are added at the beginning of the process in the Compounding Department. Conversion costs are added evenly throughout each process. Ferris uses the weighted average method of process costing. In the Compounding Department, beginning work in process was 2,000 pounds (70% processed), 18,500 pounds were started in process, 18,000 pounds transferred out, and ending work in process was 30% processed. Calculate equivalent units for March 2016 for the Compounding Department. Ferris CorporationFlow of Units and Equivalent Units Calculation, March 2016 Equivalent Units % Workdone DirectMaterials % WorkDone ConversionCosts Complete/Transferred Answer Answer Answer Answer Answer Ending Inventory Answer Answer Answer Answer Answer Total Answer Answer Answerarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Manjiarrow_forwardRequired information [The following information applies to the questions displayed below.] Dengo Company makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. October data for the Roasting department follow. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Costs added this period Direct materials Conversion Total costs to account for Units 4,300 20,500 24,800 3,700 $ 309,760 1,382,724 Direct Materials Percent Complete 100% 100% Conversion Percent Complete 40% $ 124,510 1,692,484 $ 1,816,994 80%arrow_forwardAssigning indirect costs to departments is completed by ________. applying the predetermined overhead rate debiting the manufacturing costs incurred applying the costs to manufacturing overhead applying the costs to work in process inventory In a process costing system, which account shows the overhead assigned to the department? cost of goods sold • finished goods inventory raw material inventory work in process inventory A print shop produces custom paintings. It has received four different orders (a/B/C/D) The total cost for the four orders is labor $6000, materials $10,000 and overheads for 5,000. What processes/systems would you implement if you wanted to know the cost for each of the orders which are not similar.arrow_forward

- Equivalent Units; Cost per Equivalent Unit; Assigning Costs to Units—Weighted-Average Method Helix Corporation uses the weighted-average method in its process costing system. It produces prefabricated flooring in a series of steps carried out in production departments. All of the material that is used in the first production department is added at the beginning of processing in that department. Data for May for the first production department follow: Required: 1. Calculate the first production department’s equivalent units of production for materials and conversion for May. 2. Compute the first production department’s cost per equivalent unit for materials and conversion for May. 3. Compute the first production department’s cost of ending work in process inventory for materials, conversion, and in total for May. 4. Compute the first production department’s cost of the units transferred to the next production department for materials, conversion, and in total for May.arrow_forwardHelp me tutorarrow_forwardFIFO Method, Two-Department Analysis Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Department, additional direct materials are added at the end of the process. In both departments, conversion costs are incurred uniformly throughout the process. As work is completed, it is transferred out. The following table summarizes the production activity and costs for February: Molding Assembly Beginning inventories: Physical units 10,000 8,000 Costs: Transferred in — $45,300 Direct materials $22,000 — Conversion costs $13,800 $16,900 Current production: Units started 25,000 ? Units transferred out 30,000 35,000 Costs: Transferred in — ? Direct materials…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education