Contrasting ABC and Conventional Product Costs L04−2, L04−3, L04−4

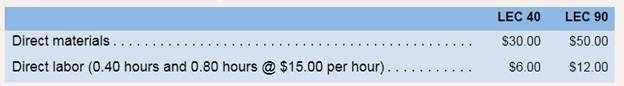

For many years. Thomson Company manufactured a single product called LEC 40. Then three years ago,the company automated a portion of its plant and at the same time introduced a second product called LEC 90 that has become increasingly popular. The LEC 90 is a more complex product, requiring 0.80 hours of direct labor time per unit to manufacture and extensive machining in the automated portion of the plant. The LEC 40 requires only 0.40 hours of direct labor time per unit and only a small amount of machining. Manufacturing

Management estimates that the company will incur $912,000 in manufacturing overhead costs duringthe current year and 60,000 units of the LEC 40 and 20.000 units of the LEC 90 will be produced and sold.

Required:

1. Compute the predetermined overhead rate assuming that the company continues to apply

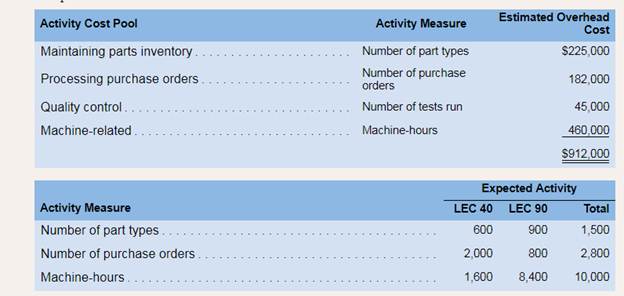

2. Management is considering using activity-based costing to assign manufacturing overhead page 178cost to products. The activity-based costing system would have the following four activity cost pools:

Determine the activity rate for each of the four activity cost pools.

3. Using the activity rates you computed in part (2) above, do the following:

a. Determine the total amount of manufacturing overhead cost that would be assigned to each product using the activity-based costing system. After these totals have been computed, determinethe amount of manufacturing overhead cost per unit of each product.

b. Compute the unit product cost of each product.

4. From the data you have developed in parts (1) through (3) above. Identify factors that may account forthe company’s declining profits.

1

Predetermined overhead rate

It is a rate that is used by a company to allocate its manufacturing overhead cost to all the products. This rate is calculated by using the estimated data (estimated cost and hours).

Unit product cost

Unit product cost is the total cost incurred by a company to produce one unit. It is calculated by the division of total cost and total number of units manufactured.

To calculate: Predetermined overhead rate and unit product cost by using the predetermined overhead rate.

Answer to Problem 16P

Predetermined overhead rate is calculated as $22.8.

Unit product cost for product LEC 40 is $45.12 and for product LEC 90 is $80.24.

Explanation of Solution

Predetermined overhead rate is calculated by the following formula:

Here, total manufacturing overhead cost is given as $912,000 and total direct labor hours will be calculated as:

So, predetermined overhead rate will be,

Unit product cost can be calculated by dividing total cost incurred by the total number of manufactured units or by adding per unit cost of direct material, direct labor and overheads. Here, per unit cost of direct material and direct labor is given and per unit cost of manufacturing overheads will be calculated as follows:

So, unit product cost will be calculated as follows:

| Particulars | LEC 40 (in $) | LEC 90 (in $) |

| Direct material (per unit) | 30 | 50 |

| Direct labor (per unit) | 6 | 12 |

| Manufacturing overheads | 9.12 | 18.24 |

| Unit product cost | 45.12 | 80.24 |

Therefore, predetermined overhead rate is $22.8, unit product cost for product LEC 40 is $45.12 and unit product cost for product LEC 90 is $80.24.

2

Activity rates

Activity rates are calculated when ABC system is used, these rates are used in the process of cost allocation and are calculated by dividing estimated cost and total estimated activity.

To compute: Activity cost rates for the given four cost pools.

Answer to Problem 16P

Activity rates are:

| Maintaining parts inventory | $150 per part |

| Processing purchase orders | $65 per order |

| Quality control | $1.125 per DLH |

| Machine related | $46 per hour |

Explanation of Solution

Activity rates will be calculated as follows:

| Cost pools | Activity measure | Estimated overhead cost (in $) (A) | Estimated activity (B) | Activity rates (A/B) (in $) |

| Maintaining parts inventory | Part types | 225,000 | 1,500 | 150 per part |

| Processing purchase orders | Purchase orders | 182,000 | 2,800 | 65 per order |

| Quality control | Direct labor hours * | 45,000 | 40,000 | 1.125 per hour |

| Machine related | Machine hours | 460,000 | 10,000 | 46 per hour |

Note*: Activity measure of quality control is number of tests run but since information of tests run is not provided in the question, direct labor hours are used to calculate the activity rate. Total direct labor hours are 40,000 (computed in sub part 1).

So, activity rate for maintenance of inventory part is $150 per part, for processing purchase orders is $65 per order, for quality control is $1.125 per DLH and for machine related activity is $46 per machine hour.

3

Manufacturing overheads

It includes all the costs incurred by a company while providing certain manufacturing facilities and does include costs related to direct materials and direct labors. These costs are indirectly related to a product.

To calculate: Amount of variable overhead rate and efficiency variances. To explain the relation between variable overhead efficiency and labor efficiency variances.

Answer to Problem 16P

Total overhead cost allocated to product LEC 40 is $320,600 and to product LEC 90 is $591,400. Per unit overhead cost is $5.34 for product LEC 40 and $29.57 for product LEC 90.

Total per unit cost is $41.34 for product LEC 40 and $91.57 for product LEC 90.

Explanation of Solution

Part a

In the ABC system, manufacturing overhead costs are allocated to each product in the ratio in which products consume different activities. So, that ratio will be calculated first.

Calculation of ratio:

| Particulars | LEC 40 | LEC 90 | RatioLEC 40: LEC 90 |

| Maintaining parts inventory (parts) | 600 | 900 | 6:9 or 2:3 |

| Purchase orders (orders) | 2,000 | 800 | 20:8 or 5:2 |

| Quality control (DLHs) | 24,000 | 16,000 | 24:16 or 3:2 |

| Machine related (Machine hours) | 1,600 | 8,400 | 16:84 or 4:21 |

Now, overhead costs will be allocated as follows:

| Activity cost pool | Overhead expense(in $) | Ratio | LEC 40 (in $) | LEC 90 (in $) |

| Maintaining part inventory | 225,000 | 2:3 | 90,000 | 135,000 |

| Purchase orders | 182,000 | 5:2 | 130,000 | 52,000 |

| Quality control | 45,000 | 3:2 | 27,000 | 18,000 |

| Machine related | 460,000 | 4:21 | 73,600 | 386,400 |

| Total overhead cost | 320,600 | 591,400 | ||

Per unit manufacturing cost will be calculated as follows:

| Particulars | LEC 40 | LEC 90 |

| Total manufacturing overhead cost | 320,600 | 591,400 |

| Total units | 60,000 | 20,000 |

| Manufacturing cost per unit | $5.34 | $29.57 |

Therefore, total manufacturing overhead cost allocated to product LEC 40 is $320,600 and allocated to product $591,400. Per unit manufacturing cost of product LEC 40 is $5.34 and of product LEC 90 is $29.57.

Part b

Unit product cost will be calculated as follows:

| Particulars | LEC 40 (in $) | LEC 90 (in $) |

| Direct material (per unit) | 30 | 50 |

| Direct labor (per unit) | 6 | 12 |

| Manufacturing overheads | 5.34 | 29.57 |

| Unit product cost | 41.34 | 91.57 |

Unit product cost for product LEC 40 is $41.34 and LEC 90 is $91.57.

4

Decline in profits

Profit is calculated by deducting all the expenses from the generated revenue. It starts declining when there is an increase in the expenses or decrease in sales.

To identify: Possible factors for decline in company’s profits.

Answer to Problem 16P

Possible factors for a decrease in profit are increase in cost or decrease in sales.

Explanation of Solution

When the management decided to use ABC system, cost of product LEC 40 is declining by $3.78 (45.12 − 41.34) but cost of product LEC 90 is increasing by $11.33 (91.57-80.24). Therefore, profits of the company are declining. There will be a decrease in the company’s profits because of the following factors-

1 Increase in cost of product LEC 40.

2 There is no increase in the units sold.

Profits of the company are decreasing because cost of the company is increasing but units sold are the same.

Want to see more full solutions like this?

Chapter 4 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

- Tharp Company operated a small factory in which it manufactures two products: C and D Production and sale results for last year were as follows. C D Unit Sold 9000 20,000 Selling Price $95 $75 VC per unit $0 $40 FC per unit 24 24 For purpose and simplicity, the firm averages total fixed costs over the total number of units of C and D produced and sold. The research department has developed an new product E as a replacement for product D. Market studies show that Tharp Company could sell 10,000 unit of E next year at price of $115. The variable cost per unit of E is $45. The introduction of product E will lead to a 10% increase of demand of product C and a discontinuation of product D. If the company does not introduce the new product, it expects next year's result to be the same as last year's. Should Tharp Company should introduce Product E next year? Explain why or why not. Show your calculations clearly.arrow_forwardVariable costs, fixed costs, relevant range. Gummy Land Candies manufactures jaw-breaker candies in a fully automated process. The machine that produces candies was purchased recently and can make 5,000 per month. The machine costs $6,500 and is depreciated using straight-line depreciation over 10 years assuming zero residual value. Rent for the factory space and warehouse and other fixed manufacturing overhead costs total $1,200 per month. Gummy Land currently makes and sells 3,900 jaw-breakers per month. Gummy Land buys just enough materials each month to make the jaw-breakers it needs to sell. Materials cost 40¢ per jaw-breaker. Next year Gummy Land expects demand to increase by 100%. At this volume of materials purchased, it will get a 10% discount on price. Rent and other fixed manufacturing overhead costs will remain the same. 1. What is Gummy Land’s current annual relevant range of output? 2. What is Gummy Land’s current annual fixed manufacturing cost within the relevant range?…arrow_forwardVariable costs, fixed costs, relevant range. Gummy Land Candies manufactures jaw-breaker candies in a fully automated process. The machine that produces candies was purchased recently and can make 5,000 per month. The machine costs $6,500 and is depreciated using straight-line depreciation over 10 years assuming zero residual value. Rent for the factory space and warehouse and other fixed manufacturing overhead costs total $1,200 per month. Gummy Land currently makes and sells 3,900 jaw-breakers per month. Gummy Land buys just enough materials each month to make the jaw-breakers it needs to sell. Materials cost 40¢ per jaw-breaker. Next year Gummy Land expects demand to increase by 100%. At this volume of materials purchased, it will get a 10% discount on price. Rent and other fixed manufacturing overhead costs will remain the same. Required: What is Gummy Land’s current annual relevant range of output? What is Gummy Land’s current annual fixed manufacturing cost within the relevant…arrow_forward

- Millennium Printers Inc. manufactures color laser printers. Model L-1819 presently sells for $150 and has a total product cost of $120, as follows: Direct materials $90 Direct labor 20 Factory overhead 10 Total $120 It is estimated that the competitive selling price for color laser printers of this type will drop to $140 next year. Millennium Printers wants to establish a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost reduction ideas: Purchase a plastic printer cover with snap-on assembly. This will reduce the amount of direct labor by nine minutes per unit. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $3 per unit. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead is related to running injection molding machines. The direct…arrow_forwardMillennium Printers Inc. manufactures color laser printers. Model L-1819 presently sells for $150 and has a total product cost of $120, as follows: Direct materials $90 Direct labor 20 Factory overhead 10 Total $120 It is estimated that the competitive selling price for color laser printers of this type will drop to $140 next year. Millennium Printers wants to establish a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost reduction ideas: Purchase a plastic printer cover with snap-on assembly. This will reduce the amount of direct labor by nine minutes per unit. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $3 per unit. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead is related to running injection molding machines. The direct…arrow_forwardRoland Company operates a small factory in which it manufactures two products: A and B. Production and sales result for last year were as follow: A B Units sold 8,000 16,000 Selling price per unit 65 52 Variable costs per unit 35 30 Fixed costs per unit 15 15 For purposes of simplicity, the firm allocates total fixed costs over the total number of units of A and B produced and sold. The research department has developed a new product (C) as a replacement for product B. Market studies show that Roland Company could sell 11,000 units of C next year at a price of $80, the variable costs per unit of C are $39. The introduction of product C will lead to a 10% increase in demand for product A and discontinuation of product B. If the company does not introduce the new product, it expects next year’s result to be the same as last year’s. Instructions Should Roland Company introduce product C next year? Explain why or why not. Show calculations to support your decisionarrow_forward

- ColorPro uses part 87A in the production of color printers. Unit manufacturing costs for part 87A are: Direct materials $8 Direct labor 2 Variable overhead 1 Fixed overhead 4 ColorPro uses 100,000 units of 87A per year. Filbert Company has offered to sell ColorPro 100,000 units of 87A per year for $12. Fixed overhead is unavoidable. Now suppose that ColorPro discovers that other costs will increase by $7,000 per year if the component is purchased rather than made internally. Should ColorPro make or buy the part? Make the part because it will save $100,000 over buying it. Make the part because it will save $107,000 over buying it. Buy the part because it will save $107,000 over making it. Buy the part because it will save $100,000 over making it. e. Make the part because it will save $10,000 over buying it.arrow_forwardMillennium Printers Inc. manufactures color laser printers. Model L-1819 presently sells for $375 and has a total product cost of $300, as follows: Direct materials $220 Direct labor 60 Factory overhead 20 Total $300 It is estimated that the competitive selling price for color laser printers of this type will drop to $360 next year. Millennium Printers wants to establish a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost reduction ideas: Purchase a plastic printer cover with snap-on assembly. This will reduce the amount of direct labor by nine minutes per unit. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $8 per unit. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead is related to running injection molding machines. The direct…arrow_forwardHelmer Containers manufactures a variety of boxes used for packaging. Sales of its Model A20 box have increased significantly to a total of 460,000 A20 boxes. Helmer has enough existing production capacity to make all of the boxes it needs. The variable cost of making each A20 box is $0.82.By outsourcing the manufacture of these A20 boxes, Helmer can reduce its current fixed costs by $115,000. There is no alternative use for the factory space freed up through outsourcing, so it will just remain idle. What is the maximum Helmer will pay per Model A20 box to outsource production of this box?arrow_forward

- XYZ Corp. currently produces a part but is looking to reduce costs. Units 20,000 Per Unit Total Cost Direct Materials $ 10 $ 200,000 Direct Labor $ 5 $ 100,000 Mfg. Overhead $ 8 $ 160,000 Total $ 23 $ 460,000 The fixed mfg. overhead includes $75,000 of costs that will continue even if outsourced. If the part is outsourced, the space can be used to make other parts and generate an additional $27,000 of contribution margin. A. Show calculations to determine how much XYZ would consider paying for the part from an outside source.arrow_forwardDesayuno Products, Inc., produces cornflakes and branflakes. The manufacturing process is highly mechanized; both products are produced by the same machinery by using different settings. For the coming period, 200,000 machine hours are available. Management is trying to decide on the quantities of each product to produce. The following data are available: Cornflakes Branflakes Machine hours per unit 1.00 0.50 Unit Selling Price $2.50 $3.00 Unit Variable Cost $1.50 $2.25 Determine the units of each product that should be produced in order to…arrow_forwardLaser Cast Inc. manufactures color laser printers. Model J20 presently sells for $325 and has a product cost of $260, as follows: Line Item Description Amount Direct materials $190 Direct labor 50 Factory overhead 20 Total $260 It is estimated that the competitive selling price for color laser printers of this type will drop to $310 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit.2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $7 per unit.3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead are related to running injection…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education