College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 11SPA

CORRECTING ERRORS Assuming that all

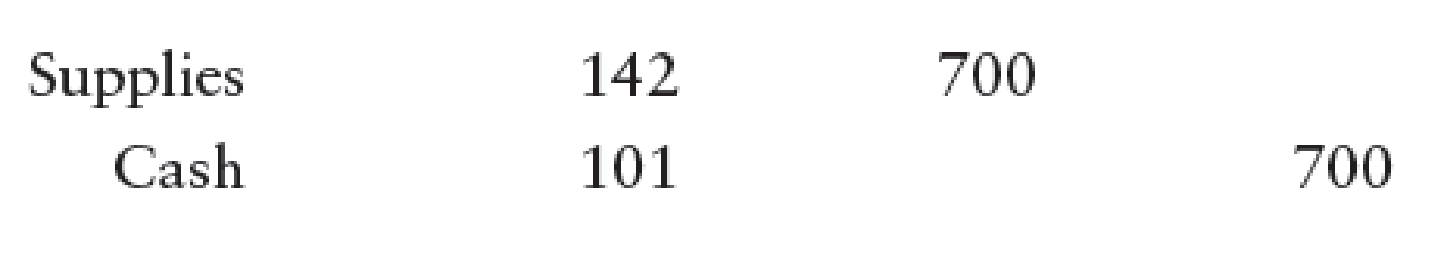

1. The following entry was made to record the purchase of $700 in supplies on account:

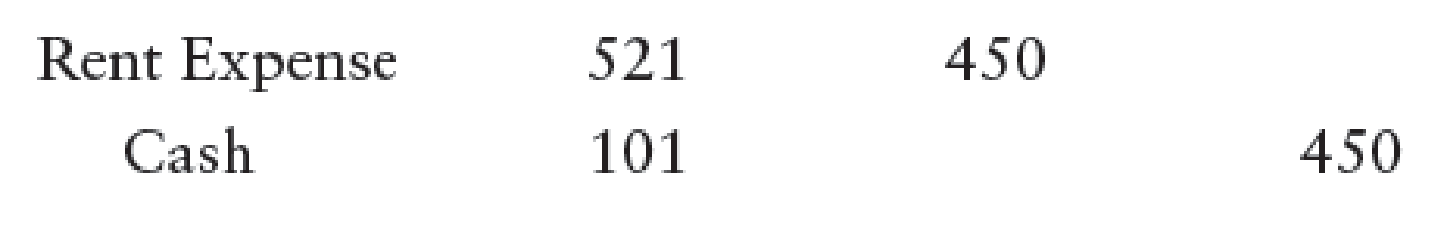

2. The following entry was made to record the payment of $450 in wages:

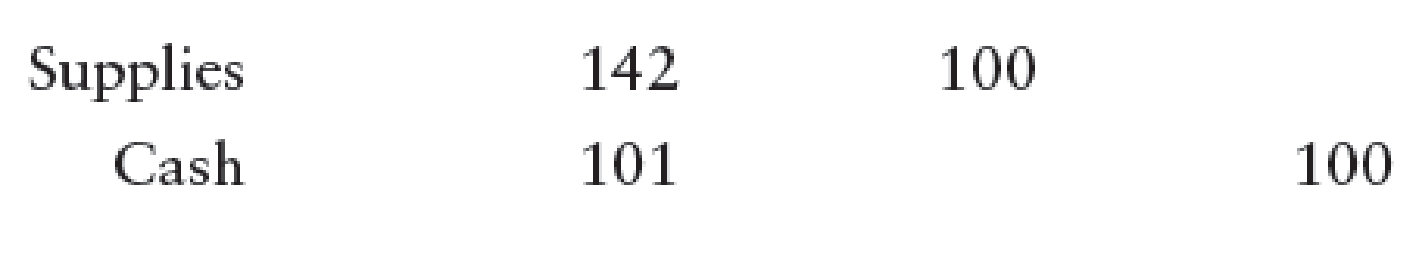

3. The following entry was made to record a $300 payment to a supplier on account:

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

1. The following entry was made to record the purchase of $700 in supplies on account:

142

Supplies

Cash

101

2. The following entry was made to record the payment of $450 in wages:

Rent Expense

Cash

3. The following entry was made to record a $400 payment to a supplier on account:

Supplies

142

200

Cash

101

1

2

3

4 2

5

DATE

6

7 3.

8

Required:

Assuming that all entries have been posted, prepare correcting entries for each of the errors. If an amount box does not require an entry, leave it blank.

Page:

9

521

101

10

700

450

700

450

200

ACCOUNT TITLE

To correct error in which a purchase of supplies on account was credited to Cash

To correct error in which a payment of wages was debited to Rent Expense

To correct error in which a $400 payment on account was recorded as a $200 cash purchase of supplies

DOC. POST.

NO. REF.

DEBIT

CREDIT

1

IN M+S

6

7

8

9

10

Entries to Write Off Accounts Receivable

Capstone Solutions Company, a computer consulting firm, has decided to write off the $45,800 balance of an account owed by a customer, Philadelphia Inc.

a. Journalize the entry to record the write-off, assuming that the direct write-off method is used. If an amount box does not require an entry, leave it blank.

b. Journalize the entry to record the write-off, assuming that the allowance method is used. If an amount box does not require an entry, leave it blank.

Journalize the entries to correct the following errors:

a. A purchase of supplies for $201 on account was recorded and posted as a debit to Supplies for $595 and as a credit to Accounts Receivable for $595. (Record the entry to

reverse the error first.) If an amount box does not require an entry, leave it blank.

b. A receipt of $5,900 from Fees Earned was recorded and posted as a debit to Fees Earned for $5,900 and a credit to Cash for $5,900. If an amount box does not require an

entry, leave it blank.

Chapter 4 Solutions

College Accounting, Chapters 1-27

Ch. 4 - Source documents serve as historical evidence of...Ch. 4 - The chart of accounts lists capital accounts...Ch. 4 - No entries are made in the Posting Reference...Ch. 4 - When entering the credit item in a general...Ch. 4 - When an incorrect entry has been journalized and...Ch. 4 - Prob. 1MCCh. 4 - A revenue account will begin with the number...Ch. 4 - To purchase an asset such as office equipment on...Ch. 4 - When fees are earned and the customer promises to...Ch. 4 - When the correct numbers are used but are in the...

Ch. 4 - Prob. 1CECh. 4 - Prob. 2CECh. 4 - Prob. 3CECh. 4 - Prob. 4CECh. 4 - Trace the flow of accounting information through...Ch. 4 - Name a source document that provides information...Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Where is the first formal accounting record of a...Ch. 4 - Describe the four steps required to journalize a...Ch. 4 - In what order are the accounts customarily placed...Ch. 4 - Explain the primary advantage of a general ledger...Ch. 4 - Explain the five steps required when posting the...Ch. 4 - Prob. 10RQCh. 4 - Explain why the ledger can still contain errors...Ch. 4 - Prob. 12RQCh. 4 - What is a transposition error?Ch. 4 - What is a correcting entry?Ch. 4 - Prob. 1SEACh. 4 - GENERAL JOURNAL ENTRIES For each of the following...Ch. 4 - GENERAL LEDGER ACCOUNTS Set up T accounts for each...Ch. 4 - GENERAL JOURNAL ENTRIES Diane Bernick has opened...Ch. 4 - GENERAL LEDGER ACCOUNTS; TRIAL BALANCE Set up...Ch. 4 - FINANCIAL STATEMENTS From the information in...Ch. 4 - Prob. 7SEACh. 4 - FINDING AND CORRECTING ERRORS On May 25, after the...Ch. 4 - SERIES A PROBLEMS JOURNALIZING AND POSTING...Ch. 4 - JOURNALIZING AND POSTING TRANSACTIONS Jim Andrews...Ch. 4 - CORRECTING ERRORS Assuming that all entries have...Ch. 4 - Prob. 1SEBCh. 4 - GENERAL JOURNAL ENTRIES For each of the following...Ch. 4 - GENERAL LEDGER ACCOUNTS Set up T accounts for each...Ch. 4 - GENERAL JOURNAL ENTRIES Sengel Moon opened The...Ch. 4 - GENERAL LEDGER ACCOUNTS; TRIAL BALANCE Set up...Ch. 4 - FINANCIAL STATEMENTS From the information in...Ch. 4 - Prob. 7SEBCh. 4 - FINDING AND CORRECTING ERRORS On April 25, after...Ch. 4 - JOURNALIZING AND POSTING TRANSACTIONS Benito...Ch. 4 - Prob. 10SPBCh. 4 - CORRECTING ERRORS Assuming that all entries have...Ch. 4 - MANAGING YOUR WRITING You are a public accountant...Ch. 4 - MASTERY PROBLEM Barry Bird opened the Barry Bird...Ch. 4 - CHALLENGE PROBLEM Journal entries and a trial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CORRECTING ERRORS Assuming that all entries have been posted, prepare correcting entries for each of the following errors. The following entry was made to record the purchase of 400 in equipment on account: The following entry was made to record the payment of 200 for advertising: The following entry was made to record a 600 payment to a supplier on account:arrow_forwardOn March 1, it was discovered that the following errors took place in journalizing and posting trarkactions: a. Rent expense of $3,220 paid for the current month was recorded as a debit to Miscellaneous Expense and a credit to Rent Expense. b. The payment of $5,080 from a customer on account was recorded as a debit to Cash and a credit to Accounts Payable. Journalize the entries on March 1 to correct the errors. Use two entries to correct the error described in (a). (That is, record an entry to reverse the incorrect entry and a second entry to record the correct entry) Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is enteredarrow_forwardA journal entry for a $75 payment for rent expense was posted as a debit to Salaries Expense and a credit to Cash. Which of the following statements correctly states the effect of the error on the trial balance? O A. The sum of the debits will exceed the sum of the credits by $75. O B. The sum of the debits will exceed the sum of the credits by $150. O C. The sum of the credits will equal the sum of the debits. O D. The sum of the credits will exceed the sum of the debits by $150.arrow_forward

- On February 1, a customer's account balance of $3,600 was deemed to be uncollectible. What entry should be recorded on February 1 to record the write-off assuming the company uses the allowance method? Multiple Choice Debit Allowance for Doubtful Accounts $3,600; credit Accounts Receivable $3,600. Debit Allowance for Doubtful Accounts $3,600; credit Bad Debts Expense $3,600. Debit Bad Debts Expense $3,600; credit Accounts Receivable $3,600. Debit Bad Debts Expense $3,600; credit Allowance for Doubtful Accounts $3,600. Debit Accournts Receivable $3,600; credit Allowance for Doubtful Accounts $3,600. < Prev 9 of 10 Nex MacBook Airarrow_forwardOn February 1, a customer's account balance of $2,600 was deemed to be uncollectible. What entry should be recorded on February 1 to record the write-off assuming the company uses the allowance method? Multiple Choice Debit Allowance for Doubtful Accounts $2,600; credit Bad Debts Expense $2,600. O Debit Accounts Receivable $2,600; credit Allowance for Doubtful Accounts $2,600. O Debit Bad Debts Expense $2,600; credit Accounts Receivable $2,600. O Debit Allowance for Doubtful Accounts $2,600; credit Accounts Receivable $2,600. O Debit Bad Debts Expense $2,600; credit Allowance for Doubtful Accounts $2,600.arrow_forwardDetermine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $8,710. Line Item Description Amount Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $973,000 for the year. Line Item Description Amount Amount added $fill in the blank 3 Ending balance $fill in the blank 4arrow_forward

- Moving to another ques uestion 12 On March 1, a customer's account balance of $32,300 was deemed to be uncollectible. What entry should be recorded on March 1 to record the write-off assuming the company uses the allowance method? O Debit Bad Debts Expense $32,300; credit Accounts Receivable $32,300 O Debit Allowance for Doubtful Accounts $32,300; credit Accounts Receivable $32,300 O Debit Accounts Receivable $32,300; credit Bad Debts Expense $32,300 O Debit Allowance for Doubtful Accounts $32,300; credit Bad Debts Expense $32,300 Question 12 of 15 >>>>arrow_forwardGideon Company uses the allowance method of accounting for uncollectible accounts. On May 3, the Gideon Company wrote off the $3,900 uncollectible account of its customer, A. Hopkins. The entry or entries Gideon makes to record the write off of the account on May 3 is:arrow_forwardOn March 1, it was discovered that the following errors took place in journalizing and posting transactions: a. Rent expense of $3,220 paid for the current month was recorded as a debit to Miscellaneous Expense and a credit to Rent Expense. b. The payment of $5,080 from a customer on account was recorded as a debit to Cash and a credit to Accounts Payable. Journalize the entries on March 1 to correct the errors. Use two entries to correct the error described in (a). (That is, record an entry to reverse the incorrect entry and a second entry to record the correct entry.) Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31, 20Y6. Journalize the adjusting entry for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?arrow_forwardJournalize correcting entries for each of the following errors. A cash purchase of office equipment for $635 was journalized as a cash purchase of store equipment for $635. (Use the ruling method; assume that the entry has not been posted and the incorrect accounts have been crossed out.) An entry for a $260 payment for office supplies was journalized as $620. (Use the ruling method; assume that the entry has not been posted. Also assume that the $620 amounts in the journal entry have been crossed out.) A $480 payment for repairs was journalized and posted as a debit to Equipment instead of a debit to Repair Expense. (Use the correcting entry method to journalize the correction. Use the one-step approach.) A $750 bill for vehicle insurance was received and immediately paid. It was journalized and posted as $640. (Use the correcting entry method to journalize the correction. Use the one-step approach.) GENERAL JOURNAL PAGE DATE DESCRIPTION DOC. NO. POST. REF. DEBIT…arrow_forwardPlease Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. If an amount box does not require an entry, leave it blank. The schedule that needs to be comis attached to this post below References: 1 Not Days Past Due Days Past Due Days Past Due Days Past Due Days Past Due 2 Past 3 Customer Balance Due 1-30 31-60 61-90 91-120 Over 120 4 AAA Outfitters 20,700.00 20,700.00 5 Brown Trout Fly Shop 7,100.00 7,100.00 6 ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ 7 8 Zigs Fish Adventures 3,900.00 3,900.00 9 Subtotals 1,307,400.00 756,200.00 292,000.00 118,400.00 41,000.00 18,100.00 81,700.00 The following accounts were unintentionally omitted…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License