FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

infoPractice Pack

Question

infoPractice Pack

Transcribed Image Text:Moving to another ques

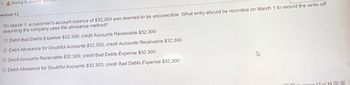

uestion 12

On March 1, a customer's account balance of $32,300 was deemed to be uncollectible. What entry should be recorded on March 1 to record the write-off

assuming the company uses the allowance method?

O Debit Bad Debts Expense $32,300; credit Accounts Receivable $32,300

O Debit Allowance for Doubtful Accounts $32,300; credit Accounts Receivable $32,300

O Debit Accounts Receivable $32,300; credit Bad Debts Expense $32,300

O Debit Allowance for Doubtful Accounts $32,300; credit Bad Debts Expense $32,300

Question 12 of 15 >>>>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please avoid solutions in image format thank youarrow_forwardQuestion Content Area Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class PercentUncollectible Not past due 1% 1-30 days past due 5 31-60 days past due 25 61-90 days past due 35 Over 90 days past due 50 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff IndustriesAging of Receivables Scheduleblank Customer Balance Not PastDue 1-30 DaysPast Due 31-60 DaysPast Due 61-90 DaysPast Due Over 90 DaysPast Due Subtotals 840,000 495,600 184,800 75,600 42,000 42,000 Conover Industries 18,100 18,100 Keystone Company 18,200 18,200 Moxie Creek Inc. 6,600 6,600 Rainbow Company 10,000 10,000 Swanson Company 23,100 23,100 Total receivables 916,000 518,700 194,800 82,200 60,200 60,100 Percentage uncollectible 1% 5% 25% 35% 50% Allowance for Doubtful…arrow_forwardDo not give answer in image formatearrow_forward

- TB MC Qu. 07-94 (Algo) Gideon Company uses... Gideon Company uses the allowance method of accounting for uncollectible accounts. On May 3, the Gideon Company wrote off the $2,300 uncollectible account of its customer, A. Hopkins. The entry or entries Gideon makes to record the write off of the account on May 3 is: Multiple Choice Account Title Debit Credit Accounts Receivable-A. Hopkins Allowance for Doubtful Accounts 2,300 2,300 Account Title Allowance for Doubtful Accounts Debit Credit 2,300 Bad debts expense 2,300 Account Title Debit Credit Accounts Receivable-A. Hopkins 2,300 ( Prev 14 of 20 Next > MAR 15 tv MacBook Air DD F2 F4 F5 F6 F7 F8 F9 # %24 & 2 3 8. W R T Y D F G H J Karrow_forward! Required information [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $16,000. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 820,000 Age of Accounts Receivable Not yet due Expected Percent Uncollectible 1.30% 328,000 1 to 30 days past due 2.05 65,600 31 to 60 days past due 6.55 32,800 13,120 61 to 90 days past due Over 90 days past due 33.00 69.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Note: Round percentage answers to nearest whole percent. Do not round intermediate calculations.arrow_forwardGive Answer with Explanationarrow_forward

- Using the Allowance method supply the journal entries to bring back the written off Account Receivable and the payment for it. Direct Write Off Method Allowance Method Bad debt expense $500 Allowance for doubtful accounts $500 Accounts Receivable $500 Accounts Receivable $500arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable Age of Accounts Receivable Expected Percent Uncollectible $ 820,000 Not yet due 1.25% 328,000 1 to 30 days past due 2.00 65,600 31 to 60 days past due 6.50 32,800 61 to 90 days past due 32.75 13,120 Over 90 days past due 68.00 Required:1. Compute the required balance of the Allowance for Doubtful Accounts at December 31 using an aging of accounts receivable.arrow_forwardQUESTION Caviler Company determines that it cannot collect a total of $500 from a customer. Using the allowance method, the journal entry to write off the amount would be: ANSWER Date Date Date Date Accounts Accounts Receivable Allowance for Bad Debts Accounts Bad Debts Expense Accounts Receivable Accounts Accounts Receivable Bad Debts Expense Accounts Debit Credit 500 500 Debit Credit 500 Debit Credit 500 500 500 Debit Credit 11:35 PMarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education