Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 10SP

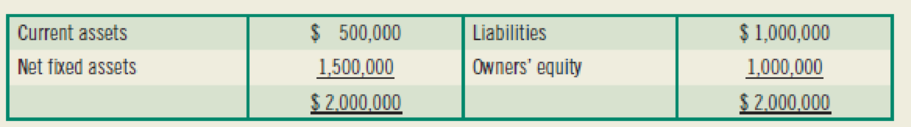

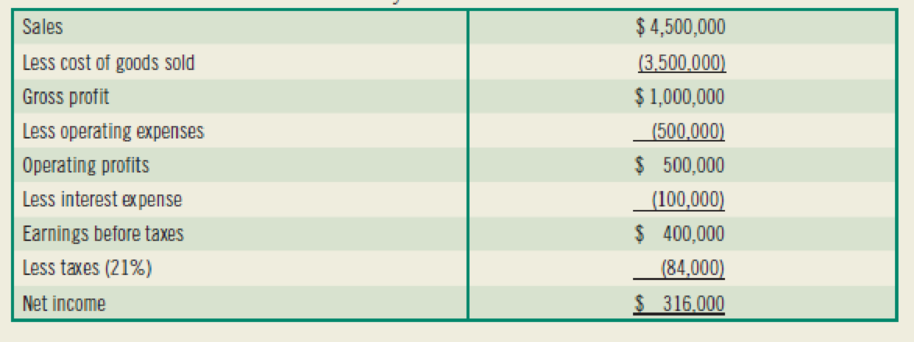

(Evaluating current and proforma profitability) (Financial ratios—investment analysis) The annual sales for Salco Inc. were $4.5 million last year. All sales are on credit. The firm’s end-of-year balance sheet was as follows:

The firm’s income statement for the year was as follows:

- a. Calculate Salco’s total asset turnover, operating profit margin, and operating

return on assets . - b. Salco plans to renovate one of its plants, which will require an added investment in plant and equipment of $1 million. The firm will maintain its present debt ratio of 0.5 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13 percent. What will be the new operating return on assets for Salco after the plant’s renovation?

- c. Given that the plant renovation in part (b) occurs and Salco’s interest expense rises by $50,000 per year, what will be the return earned on the common stockholders’ investment? Compare this

rate of return with that earned before the renovation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The average total assets of Party Favors, Inc. amount to $110,000. The firm's total receivables are $7,000, representing 25 days' sales. The firm's profit margin is 8 percent. Use a 365-day year and round your answers to two decimals.

A) What is Party Favor's asset turnover ratio?

B) What is its ROA?

Peyton's Palace has net income of $13.4 million on sales revenue of $114 million. Total assets were $80 million at the beginning of the

year and $88 million at the end of the year.

Calculate Peyton's return on assets, profit margin, and asset turnover ratios. (Enter your answers in millions. (i.e., $5,500,000 should

be entered as 5.5).)

Return on Assets

Numerator/Denominator

Amounts

Peyton's Palace

%

Profit Margin

Numerator/Denominator

Amounts

Peyton's Palace

%

Asset Turnover

Numerator/Denominator

Amounts

Peyton's Palace

times

Barry's BBQ had sales revenue for the year of $450 million and net income of $75 million. Total assets were $70 million at the beginning of the year, and $80 million at the end of the year.Calculate Barry's return on assets, profit margin, and asset turnover ratios. (Do not round intermediate calculations. Round your answers to 1 decimal place.)

Return on assets

%

Profit margin

%

Asset turnover

times

Chapter 4 Solutions

Foundations Of Finance

Ch. 4 - Describe the five-question approach to using...Ch. 4 - What are the limitations of industry average...Ch. 4 - What is the difference between a firms gross...Ch. 4 - Prob. 9RQCh. 4 - Prob. 1SPCh. 4 - Prob. 2SPCh. 4 - Prob. 3SPCh. 4 - (Price/ book) Chang, Inc.s balance sheet shows a...Ch. 4 - Prob. 5SPCh. 4 - (Ratio analysis) The balance sheet and income...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The earnings after taxes and earnings available for common stockholders when the M Company pays $12,000 as inte...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

(Evaluating liquidity) The Tabor Sales Company had a gross profit margin (gross profits ÷ sales) of 30 percent...

Foundations of Finance (9th Edition) (Pearson Series in Finance)

The reason behind sometimes it is optimal to invest in stages. Introduction: Investment refers to the act of pu...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

The Net Present Value, IRR and PI for each plant expansion and its acceptability. Introduction: The difference ...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

The interest tax shield from its debt and WACC. Introduction: WACC (Weighted Average Cost of Capital) is the ra...

Corporate Finance

If a 3-percent increase in the price of corn flakes causes a 6-percent decline in the quantity demanded, what i...

Microeconomics (9th Edition) (Pearson Series in Economics)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Profitability analysis) Last year Triangular Resources earned $4.6 million in net operating income and had an operating profit margin of 19.7 percent. If the firm's total asset turnover ratio was 1.56, what was the firm's investment in total assets? The company's total assets are $ million. (Round to one decimal place.)arrow_forwardBased on the financial statements calculate the (1) efficiency ratios, (2) liquidity ratios, (3) leverage ratios, and (4) profitability ratios for KPC Corporation for this year. Where data is available, also calculate ratios for last year. Use a 360-day year. All sales are on credit to business customers. Assume an income tax rate of 30 percent.arrow_forwardPeyton’s Palace has net income of $15 million on sales revenue of $130 million. Total assets were $96 million at the beginning of the year and $104 million at the end of the year. Calculate Peyton’s return on assets, profit margin, and asset turnover ratios.arrow_forward

- Using the AFN formula approach, calculate the total assets of Harmon Photo Company given the following information: Sales this year = $3,000; increase in sales projected for next year = 20%; net income this year = $250; dividend payout ratio = 40%; projected excess funds available next year = $100; accounts payable = $600; notes payable = $100; and accrued wages and taxes = $200. Except for the accounts noted, there were no other current liabilities. Assume that the firm’s profit margin remains constant and that the firm is operating at full capacity. $3,000 $2,200 $2,000 $1,200 $1,000arrow_forwardPresented is the income statement and balance sheet for PartsCo, a $1.2 billion supplier of machinery parts. The company is expected to increase revenues by 8 percent annually for the next five years. Forecast the next five years of income statements for PartsCo. Assume that the next five years’ forecast ratios are identical to this year’s ratios. Forecast depreciation as a percentage of the prior year’s property, plant, and equipment. Forecast interest as a percentage of the prior year’s total debt.arrow_forwardBarry's BBQ had sales revenue for the year of $400 million and net income of $30 million. Total assets were $50 million at the beginning of the year, and $60 million at the end of the year. Required: Calculate the following ratios: (Do not round intermediate calculations. Round your answers to one decimal place.) 1. Return on assets ratio 2. Profit margin ratio 3. Asset turnover ratio Return on assets Profit margin Asset turnover % timesarrow_forward

- Muscat Industrial Company has the following data which is extracting from its financial statements at the beginning 2020. Calculate the following ratios : Total Asset Turnover (TAT). Debt Ratio (DR%). Net Profit Margin 10% Sales 2500 thousand (OMR) Financial Leverage Multiplier 1.5 Times Return on Asset (ROA) 8 %arrow_forwardcalculate the • efficiency ratios, • liquidity ratios, • leverage ratios, and • profitability ratios for KPC Corporation for this year. Where data is available, also calculate ratios for last year. Use a 360-day year. All sales are on credit to business customers. Assume an income tax rate of 30 percent.arrow_forwardUse the following information for numbers 23 to 25: Corporate Valuators, Inc. is assessing the value of two companies, Capital Corp. and Earm, Inc. which projects the following net cash flows in the next five years, with its desired required rate of return. Net cash flows approximate to be its earnings also. The balance sheet of Capital Corp. and Eam, Inc. has recorded Property, Plant and Equipment of P100 million and P200 million, respectively. Operating assets are estimated at 80% and 70% respectively and the rest are considered idle. Capital Corp. 8,000,000 8,800,000 9,680,000 10,648,000 11,712,800 Required return 8% Net cash flows Net cash flows Earn, Inc. 9,600,000 10,560,000 11,616,000 12,777,000 14,055,3 6% Year 1 2 3 4 23. Using capitalization of earnings, compute for the equity value of Capital Corp. 24. Using capitalization of earnings, compute for the equity value of Eam, Inc. 25. Which company has higher equity value?arrow_forward

- Following are financial statement numbers and ratios for Martin Corp. for the year ended December 31, Year 1. Total revenue (in millions) $47,248 Net operating profit margin (NOPM) 8.8% Net operating asset turnover (NOAT) 3.3 If we expected revenue growth of 3.5% in the next year, what would projected revenue be for Year 2? Select one: a. $47,248.0 b. $44,598.3 c. None of these are correct d. $48,901.7 e. $53,205.0arrow_forwardWhy are Old Men so Daggum Stubborn (OMDS) had the following information for the previous calendar year: Operating income: $66,880 Invested assets: $167,200 Sales: $836,000 What is OMDS' investment turnover? For percentages, please enter your answer as a decimal (i.e., 20% is 0.20). For dollar amounts, please provide your answer to two decimal places (i.e. $3.00 is 3.00)arrow_forwardDisturbed, Incorporated, had the following operating results for the past year: sales = $22,563; depreciation = $1,360; interest expense = $1,096; costs = $16,515. The tax rate for the year was 23 percent. What was the company's operating cash flow?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License