PRINCIPLES OF CORPORATE FINANCE

13th Edition

ISBN: 9781264052059

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Chapter 31, Problem 1PS

Summary Introduction

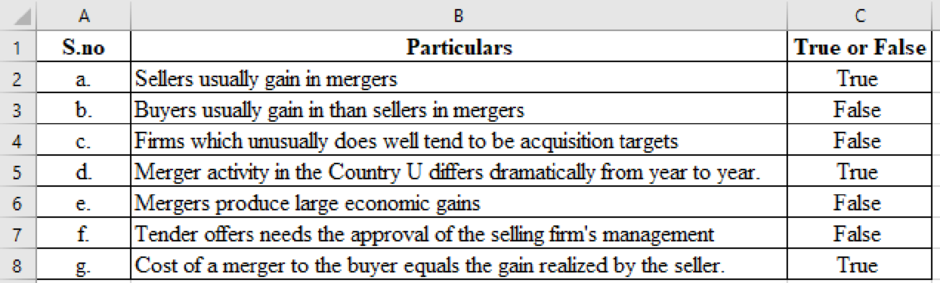

To indicate: Whether the transactions are true or false.

Expert Solution & Answer

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

q10. The hubris motive for M&As refers to which of the following?

Explains why mergers may happen even if the current market value of the target firm reflects its true economic value

The ratio of the market value of the acquiring firm’s stock exceeds the replacement cost of its assets

Agency problems

Market power

The Q ratio

Diversification is often a poor motive for mergers because:

vertical integration is rarely successful.

investors can diversify on their own account.

it does not produce economies of scale.

the increase in taxes overcomes any gains in earnings.

Which is not a valid, acceptable reason for companies to merge?

Synergistic benefits arising from mergers.

Reduction in competition resulting from mergers.

Acquisition of assets at below replacement value.

Attempts to minimize taxes by acquiring a firm with large accumulated losses that can be used immediately.

Using surplus cash to acquire another firm and prevent unfavorable tax consequences for shareholders.

Knowledge Booster

Similar questions

- Hello, could you please answer the following question in details. Thank you very much! Are the following statements true or false? Justify your answer. Mergers inspired by vertical integration motives are very rare nowadays, as transaction costs have decreased substantially since the second merger wave. “It is always advisable for a company to diversify its activities, in order to limit the risk of being too exposed to one activity”arrow_forwardIf a firm wishes to achieve immediate appreciation in earnings per share as a result of a merger, how can this be best accomplished in terms of exchange variables? What is a possible drawback to this approach in terms of long-range considerations?arrow_forwardWhich of the following statements regarding forfaiting is/are accurate? A. The costs associated with forfaiting are often higher than conventional financing B. Forfaiting is typically a short-term transaction, less than one year C. Forfaiting is readily available to small businesses D. Forfaiting eliminates commercial, political, and foreign exchange risks E. Both a and d are accurate In international trade disputes, this ADR relies on a third-party doing their analysis alone and imposing a binding decision A. Arbitration B. Mediation C. Litigation D. Conciliationarrow_forward

- 21. Which of the following are generally true about wealth gains or losses to stockholders following a merger? A. Stockholders of the target firm have zero or negative wealth gains B. Stockholders of the acquiring firm have zero or negative wealth gains C. Stockholders of competing firms have zero or negative wealth gains D. Stockholders of the target firm have positive wealth gains E. Both B and D 22. Empirical research about the method payment for mergers has shown that A. Returns for acquiring firm stockholders are much lower when cash is used for payment B. Returns for target firm stockholders are much lower when cash is used for payment C. Returns for competing firms are much lower when cash is used for payment D. Returns for acquiring firm stockholders are much higher when cash is used for payment E. None of the above 23. If a firm wishes to expand geographically, it is often preferable to do it by acquiring an existing firm rather than greenfield entry, because A. The…arrow_forwardIf an acquisition does not create value and the market is smart, then the: Multiple Choice earnings per share of the acquiring firm must be the same both before and after the acquisition. earnings per share can change but the stock price of the acquiring firm should remain constant. price per share of the acquiring firm should increase because of the growth of the firm. earnings per share will most likely increase while the price-earnings ratio remains constant. price-earnings ratio should remain constant regardless of any changes in the earnings per share.arrow_forwardAs a merger arbitrageur you are considering an investment in two target companies of a merger, A and B. The deal spread for A is 16 % and for B the deal spread is 8 %. Which of the following statements is correct? O A. The probability of deal failure is higher for A than for B. O B. The probability of deal failure is higher for B than for A.arrow_forward

- which of the following does not explain the poor performance of mergers and acquisitions ? i. Managers inaccurately value a target firm beacuse they believe the target firm is undervalued. ii. Mergers benefit may be underestimated iii. Managers mayhave priorities other than the interest of the shareholders a. II only b. III only c. I only d. e. II and III onlyarrow_forwardSuppose you are the CEO of a large firm in a service business and you think that by acquiring a certain competing firm, you can generate growth and profits at a greater rate for the combined firm. Youhave asked some financial analysts to study the proposed acquisition/merger. Do you think valuechain analysis would be useful to them? Why or why not?arrow_forward“Merger may be profitable but are they good for the economy?” Explain your answer towards this statement.arrow_forward

- Which of the following statements is CORRECT? a. A good goal for a rm's management is maximization of expected EPS. b. Most business in the U.S. is conducted by corporations, and corporations' popularity resultsprimarily from their favorable tax treatment. c. Because most stock ownership is concentrated in the hands of a relatively small segment ofsociety, rms' actions to maximize their stock prices have little benet to society. d. Corporations and partnerships have an advantage over proprietorships because a sole proprietoris exposed to unlimited liability, but the liability of all investors in the other types of businesses ismore limited. e. The potential exists for agency conicts between stockholders and managers. Please explain.arrow_forward9. Which of the following firms are more likely to hold NFAA. A firm who operates in a competitive industry and has done many acquisitions in recent years.B. An international firm that faces restriction in repatriating its profit back to the home country. C. A firm that has been operating for many years with stable profitability in a traditional industry. D. A firm whose operational risk is very high.arrow_forwardPlease answer all parts! Part II: Essays and Problems 1) Suppose an industry has 8 firms with the following market shares: 40, 15, 15, 10, 5, 5, 5, 5. a. Derive the four-firm concentration ratio b. Derive the HHI. c. Derive the effect of a merger between the fourth largest and fifth largest firms on the HHI. d. Does this merger violate Justice Department Merger Guidelines? Why or why not?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education