Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 30, Problem 12P

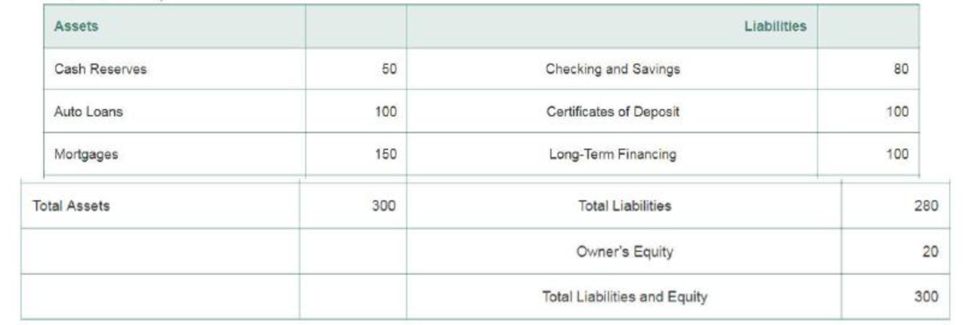

You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn’s

When you analyze the duration of loans, you find that the duration of the auto loans is two years, while the mortgages have a duration of seven years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of two years and the long-term financing has a 10-year duration.

- a. What is the duration of Acorn’s equity?

- b. Suppose Acorn experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $150 million to $100 million, and increasing cash reserves to $100 million. What is the duration of Acorn's equity now? If interest rates are currently 4% but fall to 3%, estimate the approximate change in the value of Acorn’s equity.

- c. Suppose that after the prepayments in part (b), but before a change in interest rates, Acorn considers managing its risk by selling mortgages and/or buying 10-year Treasury STRIPS (zero-coupon bonds). How many should the firm buy or sell to eliminate its current interest rate risk?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

An investor has accumulated $4,450 and is looking for the best rate of

return that can be earned over the next year. A bank savings account

will pay 9%. A one-year bank certificate of deposit will pay 11%, but the

minimum investment is $7,450.

Required:

a. Calculate the amount of return the investor would earn if the $4,450

were invested for one year at 9%.

b. Calculate the net amount of return the investor would earn if $3,000

were borrowed at a cost of 19%, and then $7,450 were invested for

one year at 11%.

c. Calculate the net rate of return on the investment of $4,450 if the

investor accepts the strategy of part b.

Note: Round your answer to 2 decimal places.

a. Amount of return

b. Net amount of return

c. Net rate of return

%

You are in need of regular short term financing to support your business. Three options appear attractive:

1. A standard line of credit in the sum of $500,000 at 18% annual interest for the funds used. You have between

$75,000 and $1000,000 in cash coming in in a typical month, and usual monthly expenses of $80,000. At the start of

the loan period, you have $120,000 in accounts payable.

2. Your bank is also offering a $1,000,000 5 year loan at 12%, and a requirement to keep $150,000 of that loan in your

bank account at all times. You only need to pay the interest each moth, and pay off the million dollar principal at the

end of the loan. You have the same revenue and expense profile given above.

3. A factor is also willing to buy your accounts receivable as they come in. They will buy 90% of your receivables at an

80% of fave value. All of your revenue is business-to-business and therefore starts life as A/R. Your customers

currently pay on average within 60 days, which the factor…

Pace Electronics sells a diagnostic machine to a hospital with a four-year payment plan. The company would like to estimate the bad debt allowance needed to cover the notes outstanding over the next four years. Estimated lost cash flows and the probability of occurrence for each of the next four years are summarized in the following schedule. The risk-free rate is 3% .

Begin by computing the estimated cash flow loss each year. (Enter all amounts as positive amounts.)

Projected Cash Flow

Expected

Loss from Uncollected

Probability of

Cash Flow

Year

Notes

Loss Occurring

Loss

2023

$9,000

65

%

20,000

35

%

Total expected cash flow loss in 2023

2024

$15,000

20

%

26,000

45

%

65,000

35

%

Total expected cash flow loss in 2024

2025

$5,000

85

%

19,000

15

%

Total expected cash flow loss in 2025…

Chapter 30 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 30.1 - How can insurance add value to a firm?Ch. 30.1 - Prob. 2CCCh. 30.2 - Prob. 1CCCh. 30.2 - What are the potential risks associated with...Ch. 30.3 - How can firms hedge exchange rate risk?Ch. 30.3 - Prob. 2CCCh. 30.4 - How do we calculate the duration of a portfolio?Ch. 30.4 - How do firms manage interest rate risk?Ch. 30 - The William Companies (WMB) owns and operates...Ch. 30 - Genentechs main facility is located in South San...

Ch. 30 - Prob. 3PCh. 30 - Your firm faces a 9% chance of a potential loss of...Ch. 30 - BHP Billiton is the worlds largest mining firm....Ch. 30 - Prob. 6PCh. 30 - Prob. 7PCh. 30 - Prob. 9PCh. 30 - Prob. 10PCh. 30 - Prob. 11PCh. 30 - You have been hired as a risk manager for Acorn...Ch. 30 - Prob. 13PCh. 30 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use this information for questions 9 to 12: You are put in charge of starting a credit card business for a bank. This is what you've learned so far: Your boss wants you to get to $10 million in outstanding loans within a year. It costs you $75,000 a year to employ a risk officer to approve or deny loan applications. You need two loan collectors, paid $50,000 each. Your salary is $125,000 a year. The bank is paying depositors 1%, in line with the inflation rate. You can change the credit card interest rate any time you want. You expect 6% of your customers to default each year. 9. You need to charge your credit card customers % to cover the costs of running the business. 10. Yes No. You need to charge your customers to cover the risk of a rise in future inflation. 11. You expect your dollar losses for customer defaults to be $ a year. 12. The minimum amount you need to charge the credit card customers per year to break even is: (A) (B) 8% 10% (C) (D) 12% 15%arrow_forwardA bank features a savings account that has an annual percentage rate of r=5.6% with interest compounded daily. Dylan deposits $2,500 into the account. The account balance can be modeled by the exponential formula S(t)=P(1+rn)nt, where S is the future value, P is the present value, r is the annual percentage rate, n is the number of times each year that the interest is compounded, and t is the time in years. What values should be used for P, r, and n? P= , r= , n= How much money will Dylan have in the account in 10 years? Answer = $ . Round answer to the nearest penny.What is the annual percentage yield (APY) for the savings account? (The APY is the actual or effective annual percentage rate which includes all compounding in the year). APY= %.arrow_forwardPlease provide the steps to solving this problem using a financial calculator: You just opened a brokerage account, depositing $3,500. You expect the account to earn an interest rate of 9.652%. You also plan on depositing $4,500 at the end of years 5 through 10. What will be the value of the account at the end of 20 years, assuming you earn your expected rate of return?arrow_forward

- For the following economic calculations, write the factors (multipliers) that should be used,in (i) using the parameter values, and in (ii) calculate the result by showing your computations. Write the results you find in the spaces left. (Use factors for your calculations.)EXAMPLE: If you deposit $ 100 to a bank account that earns 8% annual interest, how much money will you have in this account after five years?(i)(F/P, 8%, 5) (ii)146.93100 * (F/P, 8%, 5) = 100 * 1.4693 = 146.93 TLa. You plan to take a credit with $1500 installment size per year with an annual interest rate of 8% over six years from a bank. What is the amount of your current credit?(i) (ii)b. A bank is required to deposit money for four years with an interest rate 10%. The money deposited at the end of the first year is 6000 TL and the amount of money deposited in the next three years will be reduced by 500 TL every year. How much money will be in the bank at the end of the fourth year?(i) (ii)arrow_forwardSuppose that as a loan officer for a bank you just completed a £1 million loan to a small business. This is a senior unsecured loan, with one-year maturity and carries a 10% p.a. interest rate. You rate the borrower internally as B-, which translates into a one-year probability of default (PD) estimate of 10%. Loss given default (LGD) for the loan is estimated as 30%. Determine the expected cash flow from the loan at maturity. O a. £1,034,000 O b. £1,067,000 O c. £1,123,000arrow_forwardA bank features a savings account that has an annual percentage rate of r=3.4% with interest compounded weekly. Alfonso deposits $11,500 into the account. The account balance can be modeled by the exponential formula S(t)=P(1+r/n)^nt, where S is the future value, P is the present value, rr is the annual percentage rate, nn is the number of times each year that the interest is compounded, and tt is the time in years. What values should be used for P, r, and n?P= , r= , n= How much money will Alfonso have in the account in 10 years?Answer = $ .Round answer to the nearest penny. What is the effective annual rate for the savings account?effective rate = %.Round answer to 3 decimal places.arrow_forward

- A credit card holder has $12,000 on a credit card that charges a nominal annual rate of interest compounded 12 times a year. If the card holder wants to pay off the credit card in 6 years, how much will the card holder need to pay? Use this information to complete the following: 1) If the card holder is a low-risk customer, and the credit card company will charge 12.3% nominal annual rate of interest compounded 12 times a year. Compute: i. Monthly payment: | ii. Total amount of money the card holder will pay: iii. Total interest amount the credit card company will earn:arrow_forwardA bank features a savings account that has an annual percentage rate of r=3.1r=3.1% with interest compounded quarterly. Breanna deposits $6,500 into the account. The account balance can be modeled by the exponential formula S(t)=P(1+rn)ntS(t)=P(1+rn)nt, where SS is the future value, PP is the present value, rr is the annual percentage rate written as a decimal, nn is the number of times each year that the interest is compounded, and tt is the time in years. (A) What values should be used for PP, r, and nn? P=P= , r=r= , n=n= (B) How much money will Breanna have in the account in 88 years? Answer = $ . Round answer to the nearest penny.arrow_forwardThe left bank is offering CDs at 5%. The right bank is offering a money market account at 4%. If I have a total of $10,000 to invest in these accounts and want a return (accrued interest) on my money of $436 from both accounts at the end of one year, how much should I put into each account? Fill in below with the information to set up the system of equations: State your answer in complete sentences. $ put into CD account(________) + $ put into money market(_________) = Total $$ invested(__________) CD interest Money(_________) + Money market interest(________)=Total interest(__________)arrow_forward

- Billy roe visited his local bank to see how long it will take for $1,000 to amount to $1,900 at a simple interest rate of 12 1/2 percent. Provide Bill with the solution to this problem in years. PROVIDE THE FOLLOWING FOR EACH PROBLEM N= I= PV= PMT= FV= C/Y= P/Y =arrow_forwardConsider two local banks. Bank A has 100 loans outstanding, each for $1.3 million, that it expects will be repaid today. Each loan has a 3% probability of default, in which case the bank is not repaid anything. The chance of default is independent across all the loans. Bank B has only one loan of $130 million outstanding, which it also expects will be repaid today. It also has a 3% probability of not being repaid. Calculate the following: a. The expected overall payoff of each bank. b. The standard deviation of the overall payoff of each bank. a. The expected overall payoff of each bank. The expected overall payoff of Bank A is $ decimal places.) million. (Round to twoarrow_forwardA bank features a savings account that has an annual percentage rate of r = 5.1% with interest compounded quarterly. Kimberly deposits $12,000 into the account. The account balance can be modeled by the exponential formula A(t) = a(1+ r kt where A is account value after t years , a is the principal (starting amount), r is the annual percentage rate, k is the number of times each year that the interest is compounded. (A) What values should be used for a, r, and k? k = = D (B) How much money will Kimberly have in the account in 10 years? Amount = $ Round answer to the nearest penny. (C) What is the annual percentage yield (APY) for the savings account? (The APY is the actual or effective annual percentage rate which includes all compounding in the year). АРY Round answer to 3 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is a mortgage; Author: Kris Krohn;https://www.youtube.com/watch?v=CFjY-58ooi0;License: Standard YouTube License, CC-BY

Topic 10 Accounting for Liabilities Mortgage Payable; Author: Accounting Thinker;https://www.youtube.com/watch?v=EPJOphrbArM;License: Standard YouTube License, CC-BY