Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

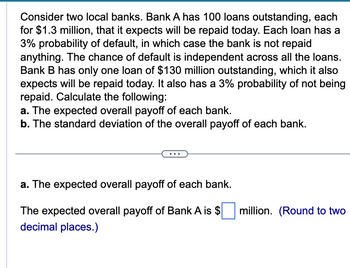

Transcribed Image Text:Consider two local banks. Bank A has 100 loans outstanding, each

for $1.3 million, that it expects will be repaid today. Each loan has a

3% probability of default, in which case the bank is not repaid

anything. The chance of default is independent across all the loans.

Bank B has only one loan of $130 million outstanding, which it also

expects will be repaid today. It also has a 3% probability of not being

repaid. Calculate the following:

a. The expected overall payoff of each bank.

b. The standard deviation of the overall payoff of each bank.

a. The expected overall payoff of each bank.

The expected overall payoff of Bank A is $

decimal places.)

million. (Round to two

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Describe how taxes and tax adjustment coefficients influence investment rankings?arrow_forwardDefinition of size ratio and growth ratio for comparing between Banksarrow_forwardWhat is the relationship between the stock market and the real economy in terms of measures such as gross domestic product (GDP), inflation, and interest rates? Please provide references and links if any.arrow_forward

- A centerpiece of any study of finance is "valuation." A simple function, "V=l/R," can be used to describe an asset's "value." What does the "R" in that expression stand for? O a future cash flow O a current cash flow O a market-determined discount rate O a variable income measure O a measure of probabilityarrow_forwardIllustrate the process of computing the equivalent present worth when all cash flows are given in actual dollars?arrow_forward28. Help me selecting the right answer. Thank youarrow_forward

- What is the prime rate and how is it used by financial institutions?arrow_forward7. Explain the importance of financial management. 8. What if financial statement? 9. What is financial statement analysis? 10. Discuss various types of financial statement analysis. 11. Explain various methods of financial statement analysis. 12. What are the differences between fund flow and cash flow? 13. What is ratio analysis? Explain its typesarrow_forwardA company’s current fi nancial position would best be evaluated using the:C . statement of cash fl ows.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education