Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 7EA

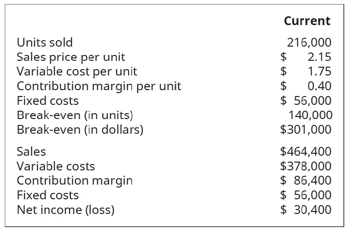

Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.

The following names are to be used when completing this problem:

Operating Income

Variable Costs

Sales

Fixed Costs per Unit

Selling Price per Unit

Variable Cost per Unit

Contribution Margin

Fixed Costs

Operating Loss

If Flanders purchases the new machinery, what will be the company’s break-even point in units? . Use commas as needed (i.e. 1,234).

If Flanders purchases the new machinery, what will be the company’s break-even point in dollars? . Rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345).

Assuming Flanders purchases the new machinery, construct a contribution margin income statement for sale of 216,000 units. Rounded to whole dollars and shown with "$" and commas as needed (i.e.…

Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.

The following names are to be used when completing this problem:

Operating Income

Variable Costs

Sales

Fixed Costs per Unit

Selling Price per Unit

Variable Cost per Unit

Contribution Margin

Fixed Costs

Operating Loss

Revised Fixed costs = 56000 + 18250 = $74250

Variable cost per unit = 1.75 - 0.15 = $1.6 per unit

Contribution margin per unit = Sales price per unit - Variable cost per unit

= 2.15 - 1.6 = $0.55 per unit

Breakeven point in units = Fixed costs/ Breakeven point in units

= 74250/0.55 = 135000 units

Breakeven sales revenue = 135000*2.15 = $290,250

1. Complete the following contribution margin income statement to properly reflect the break-even information given in the problem. Rounded to whole dollars and shown…

The Fence Company is setting up a new production line to produce top rails. The relevant data for two alternatives are shown below. Solve, a. Based on MARR of 8%, determine the annual rate of production for which the alternatives are equally economical. b. If it is estimated that production will be 300 top rails per year, which alternative is preferred and what will be the total annual cost?

Chapter 3 Solutions

Principles of Accounting Volume 2

Ch. 3 - The amount of a units sales price that helps to...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys product sells for $150 and has variable...Ch. 3 - A companys contribution margin per unit is $25. It...Ch. 3 - A company sells its products for $80 per unit and...Ch. 3 - If a company has fixed costs of $6.000 per month...Ch. 3 - Company A wants to earn $5,000 profit in the month...Ch. 3 - A company has wants to earn an income of $60,000...Ch. 3 - A company has pre-tax or operating income of...Ch. 3 - When sales price increases and all other variables...

Ch. 3 - When sales price decreases and all other variables...Ch. 3 - When variable costs increase and all other...Ch. 3 - When fixed costs decrease and all other variables...Ch. 3 - When fixed costs increase and all other variables...Ch. 3 - If the sales mix in a multi-product environment...Ch. 3 - Break-even for a multiple product firm. can be...Ch. 3 - Waskowski Company sells three products (A. B. and...Ch. 3 - Beaucheau Farms sells three products (E, F, and G)...Ch. 3 - A company sells two products, Model 101 and Model...Ch. 3 - Wallace Industries has total contribution margin...Ch. 3 - Macom Manufacturing has total contribution margin...Ch. 3 - If a firm has a contribution margin of $59,690 and...Ch. 3 - If a firm has a contribution margin of $78M90 and...Ch. 3 - Define and explain contribution margin on a per...Ch. 3 - Define and explain contribution margin ratio.Ch. 3 - Explain how a contribution margin income statement...Ch. 3 - In a cost-volume-profit analysis, explain what...Ch. 3 - What is meant by a products contribution margin...Ch. 3 - Explain how a manager can use CVP analysis to make...Ch. 3 - After conducting a CVP analysis, most businesses...Ch. 3 - Explain how for is possible for costs to change...Ch. 3 - Explain what a sales mix is and how changes in the...Ch. 3 - Explain how break-even analysis for a...Ch. 3 - Explain margin of safety and why it is an...Ch. 3 - Define operating leverage and explain its...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $150 and a per-unit...Ch. 3 - A product has a sales price of $250 and a per-unit...Ch. 3 - Maple Enterprises sells a single product with a...Ch. 3 - Marlin Motors sells a single product with a...Ch. 3 - Flanders Manufacturing is considering purchasing a...Ch. 3 - Marchete Company produces a single product. They...Ch. 3 - Brahma Industries sells vinyl replacement windows...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Salvador Manufacturing builds and sells...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $10,000,000 and a...Ch. 3 - Marshall s target margin of safety be in units and...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - Calculate the per-unit contribution margin of a...Ch. 3 - A product has a sales price of $175 and a per-unit...Ch. 3 - A product has a sales price of $90 and a per-unit...Ch. 3 - Cadre, Inc., sells a single product with a selling...Ch. 3 - Kerr Manufacturing sells a single product with a...Ch. 3 - Delta Co. sells a product for $150 per unit. The...Ch. 3 - Shonda & Shonda is a company that does land...Ch. 3 - Baghdad Company produces a single product. They...Ch. 3 - Keleher Industries manufactures pet doors and...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Manufacturing builds and sells switch harnesses...Ch. 3 - Use the information from the previous exercises...Ch. 3 - Company A has current sales of $4,000,000 and a...Ch. 3 - Best Wholesale recently calculated their...Ch. 3 - A company sells small motors as a component part...Ch. 3 - A company manufactures and sells racing bicycles...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - Markham Farms reports the following contribution...Ch. 3 - Kylies Cookies is considering the purchase of a...Ch. 3 - Morris Industries manufactures and sells three...Ch. 3 - Manatoah Manufacturing produces 3 models of window...Ch. 3 - Jakarta Company is a service firm with current...Ch. 3 - A company sells mulch by the cubic yard. Grade A...Ch. 3 - A company manufactures and sells blades that are...Ch. 3 - Fill in the missing amounts for the four...Ch. 3 - West Island distributes a single product. The...Ch. 3 - Wellington, Inc., reports the following...Ch. 3 - Karens Quilts is considering the purchase of a new...Ch. 3 - Abilene Industries manufactures and sells three...Ch. 3 - Tim-Buck-Il rents jet skis at a beach resort....Ch. 3 - Fire Company is a service firm with current...Ch. 3 - Mariana Manufacturing and Bellow Brothers compete...Ch. 3 - Roald is the sales manager for a small regional...Ch. 3 - As a manager, you have to choose between two...Ch. 3 - Coutures Creations is considering offering Joe, an...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Horizontal analysis(Learning Objective 2)15-20 min What were the dollar and percentage changes in Rozzis Gift S...

Financial Accounting, Student Value Edition (5th Edition)

Management accounting should not fit the straitjacket of financial accounting. Explain and give an example.

Cost Accounting (15th Edition)

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (11th Edition)

When calculating a ratio with numbers from the balance sheet and income statement, why must you use the balance...

Construction Accounting And Financial Management (4th Edition)

Target costs, effect of product-design changes on product costs. Neuro Instruments uses a manufacturing costing...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Color Explosion prepares and packages paint products. Color Explosion has two departments: Blending and Packagi...

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forwardFlanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.10. The machine will increase fixed costs by $12,000 per year. The information they will use to consider these changes is shown here. A. What will the impact be on the break-even point if Flanders purchases the new machinery? Round per unit cost answers to two decimal places. Current New Machine Units Sold 221,000 Sales Price Per Unit $2.10 Variable Cost Per Unit $1.70 Contribution Margin Per Unit $0.40 %24 Fixed Costs $60,000 Break-Even (in units) 150,000 Break-Even (in dollars) $315,000 B. What will the impact be on net operating income if Flanders purchases the new machinery? Current New Machine Sales $464,100 Variable Costs 375,700 Contribution Margin $88,400 Fixed Costs 60,000 Net Income (Loss) $28,400 C. What would your recommendation be to Flanders regarding this purchase? a. The new equipment will increase fixed costs substantially but net income will still…arrow_forwardMKM International is seeking to purchase a new CNC ma-chine in order to reduce costs. Two alternative machines arein consideration. Machine 1 costs $500,000 but yields a 15 per-cent savings over the current machine used. Machine 2 costs$900,000 but yields a 25 percent savings over the current ma-chine used. In order to meet demand, the following forecastedcost information for the current machine is also provided.a. Based on the NPV of the cash flows for these five years,which machine should MKM International Purchase? As-sume a discount rate of 12 percent.b. If MKM International lowered its required discount rate to8 percent, what machine would it purchase?Year Projected Cost1 1,000,0002 1,350,0003 1,400,0004 1,450,0005 2,550,000arrow_forward

- A company planning to market a new model of motor scooter analyzes the effect of changes in the selling price of the motor scooter, the number of units that will be sold, and the cost of making the motor scooter on the estimated net present value (NPV) of the project. They predict that the break-even point for sales price for the motor scooter is $2,480. What does this mean? O If the motor scooter is sold for $2,480, then the project will make a profit. The net present value (NPV) of the project equals to zero at the sale price of the motor scooter equal to $2,480. O At the price of $2,480, the revenue for the scooter will exactly equal its production cost. O The predicted selling price of the motor scooter is $2,480. O The maximum that the motor scooter can sell for and still make the project have a positive net present value (NPV) is $2,480.arrow_forwardAssume that if Sunland Water accepts Clifton’s offer, the company can use the freed-up manufacturing facilities to manufacture a new line of growing lights. The company estimates it can sell 86,490 of the new lights each year at a price of $11. Variable costs of the lights are expected to be $8 per unit. The timer unit supervisory and clerical staff would be transferred to this new product line. Calculate the total relevant cost to make the timer units and the net cost if they accept Clifton's offer.arrow_forwardInteliSystems needs 79,000 optical switches next year . By outsourcing them, InteliSystems can use its idle facilities to manufacture another product that will contribute $140,000 to operating income, but none of the fixed costs will be avoidable. Should InteliSystems make or buy the switches? Show your analysis based on the information in the table below for making 70,000 switches.arrow_forward

- The maker of Winglow is purchasing a new stamping machine. Two options are being considered, Rooney and Blair. The sales forecast for Winglow is 8,000 units for next year. If purchased, the Rooney will increase plant fixed costs by $20,000 and reduce variable costs by $5.60 per unit. The Blair will increase fixed costs by $5,000 and reduce variable costs by $4.00 per unit. If variable costs are now $20 per unit, which machine should be purchased?arrow_forwardMary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinking through the production process and the costs of raw materials and new equipment, Williams estimates the variable costs of each unit produced and sold at $6 and the fixed costs per year at $60,000.a. If the selling price is set at $18 each, how many units must be produced and sold for Williams to break even? Use both graphic and algebraic approaches to get your answer.b. Williams forecasts sales of 10,000 units for the first year if the selling price is set at $14 each. What would be the total contribution to profits from this new product during the first year?c. If the selling price is set at $12.50, Williams forecasts that first-year sales would increase to 15,000 units. Which pricing strategy ($14.00 or $12.50) would result in the greater total contribution to profits?d. What other considerations would be crucial to the final decision about making and marketing the new…arrow_forwardMKM International is seeking to purchase a new CNC machine in order to reduce costs. Two alternative machines are in consideration. Machine 1 costs $450,000, but yields a 15 percent savings over the current machine used. Machine 2 costs $800,000, but yields a 25 percent savings over the current machine used. In order to meet demand, the following forecasted cost information for the current machine is also provided. LOADING... Year Project Cost 1 1,000,000 2 1,350,000 3 1,450,000 4 1,550,000 5 2,550,000 a. Based on the NPV of the cash flows for these 5 years, which machine should MKM International purchase? Assume a discount rate of 12 percent. Assuming a discount rate of 12 percent, MKM International should purchase ▼ machine 1 or machine 2 because the NPV of machine 1 is $------ and the NPV of machine 2 is $--------. (Enter your responses…arrow_forward

- Frieden’s management is considering a major upgrade to the manufacturing equipment, which would result in fixed expenses increasing by $360,000 per month. However, variable expenses would decrease by $9 per unit. Selling price would not change. Prepare two contribution format income statements, one showing current operations and one showing how operations would appear if the upgrade is completed. Show an Amount column, a Per Unit column, and a Percentage column on each statement.arrow_forwardAshley’s company is looking to add two new printers that will increase fixed costs by $75,000. The variable costs are $50 per order. The two new printers allow the business to increase their orders by 5000 annually. How many orders would have to be added to justify buying these new printers, vs not making any changes and continuing as they are? What other considerations might you consider in whether or not to make this purchase or not?arrow_forwardFlanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.10. The machine will increase fixed costs by $11,500 per year. The information they will use to consider these changes is shown here. A. What will the impact be on the break-even point if Flanders purchases the new machinery? Round per unit cost answers to two decimal places. Current New Machine Units Sold 218,000 fill in the blank 1 Sales Price Per Unit $2.15 $fill in the blank 2 Variable Cost Per Unit $1.75 $fill in the blank 3 Contribution Margin Per Unit $0.40 $fill in the blank 4 Fixed Costs $56,000 $fill in the blank 5 Break-Even (in units) 140,000 fill in the blank 6 Break-Even (in dollars) $301,000 $fill in the blank 7 B. What will the impact be on net operating income if Flanders purchases the new machinery? Current New Machine Sales $468,700 $fill in the blank 8 Variable Costs 381,500 fill in the blank 9 Contribution Margin…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License