Concept explainers

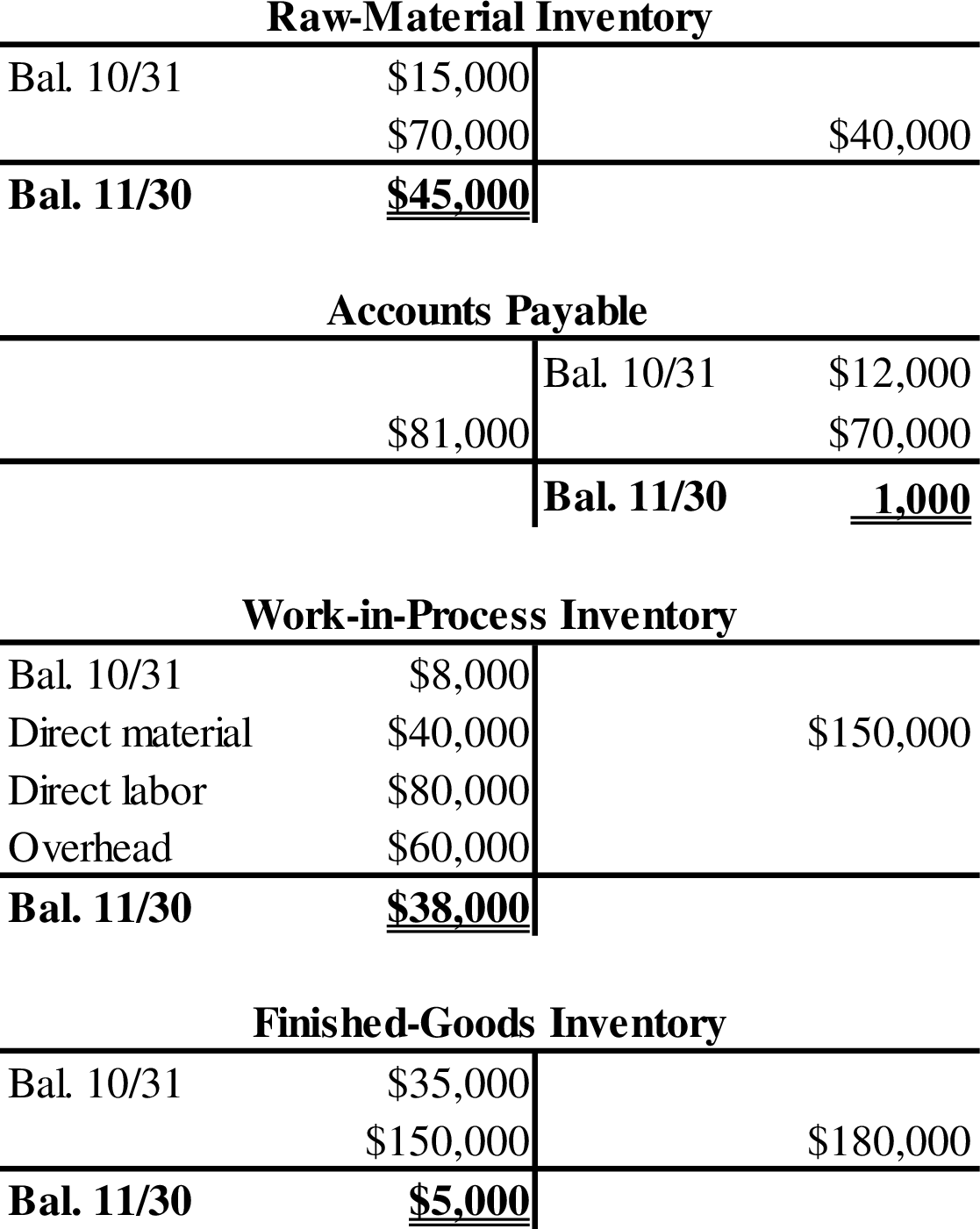

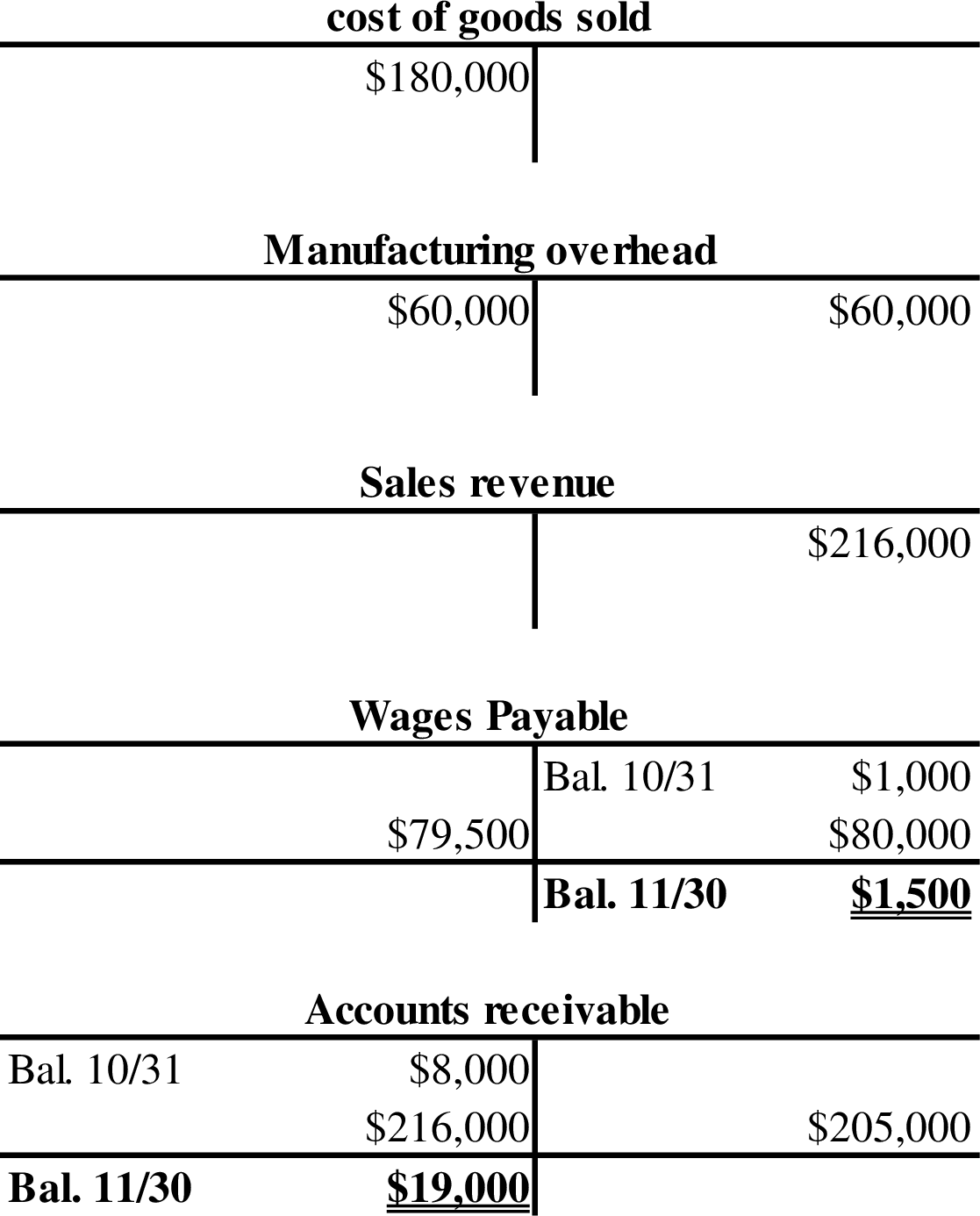

Calculate the missing amounts and prepare the T-accounts.

Explanation of Solution

- 1. Calculate the sales revenue for November.

Thus, the sales revenue for November is $216,000.

- 2. Calculate the ending balance of accounts receivable.

Thus, the ending balance in accounts receivable is $19,000.

- 3. Calculate the cost of raw materials purchased during November.

Thus, the cost of raw materials purchased during November is $70,000.

- 4. Calculate the ending balance in the work-in-process inventory.

Step 1: Calculate the budgeted direct-labor hours.

Step 2: Calculate the predetermined overhead rate.

Step 3: Calculate the ending balance in the work-in-process inventory.

Thus, the ending balance in the work-in-process inventory is $38,000.

- 5. Calculate the amount of direct labor added to work in process during November.

Thus, the amount of direct labor added to work in process during November is $80,000.

- 6. Calculate the amount of applied overhead for November.

Step 1: Calculate the direct-labor hours.

Step 2: Calculate the amount of applied overhead for November.

Thus, the applied overhead for November is $60,000.

- 7. Calculate the cost of goods completed during November.

Thus, the cost of goods completed during November is $150,000.

- 8. Calculate the amount of raw materials used during November.

Thus, the amount of raw materials used during November is $40,000.

- 9. Calculate the amount of October 31 balance in raw-material inventory.

Thus, the amount of October 31 balances in raw-material inventory is $15,000.

- 10. Calculate the amount of overapplied or underapplied for November.

Thus, there is no underapplied or overapplied overhead for the month November.

Prepare the T-accounts.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Quality Move Company made the following expenditures on one of its delivery trucks: Mar. 20 Replaced the transmission at a cost of $1,720. June 11 Paid $1,255 for installation of a hydraulic lift. Nov. 30 Paid $55 to change the oil and air filter. Prepare journal entries for each expenditure. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTSQuality Move CompanyGeneral Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Delivery Truck 124 Accumulated Depreciation-Delivery Truck 125 Equipment 126 Accumulated Depreciation-Equipment 130 Mineral Rights 131 Accumulated Depletion 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner's…arrow_forwardA fire wiped out Plymouth Paper Company's Inventory. The insurance company will accept an estimate using the retail method Last year's balance sheet stated that the ending inventory was $13,000 and it would usually sell for $38,000 Mr Pichai knows that the cost of purchases was $160,000 and the retail selling prices for the paper totalled $297,000. Credit card receipts indicate that there was $238,000 of sales since the beginning of the year Calculate the cost of the lost ending inventory for the insurance company. (Round the retail ratio to two decimal places and the final answer to the nearest dollar.) The lost ending inventory is $arrow_forwardOn January 1, a store had inventory of P 48,000. January purchases were P 46,000 and January sales were P 90,000. On February 1 a fire destroyed most of the inventory. The rate of gross profit was 25% of cost. Merchandise with a selling price of P 5,000 remained undamaged after the fire. Compute the amount of the fire loss, assuming the store had no insurance coveragearrow_forward

- When Mary Potts arrived at her store on the morning of January 29, she found empty shelves and display racks; thieves had broken in during the night and stolen the entire inventory. Accounting records showed that Potts had inventory costing $55,000 on January 1. From January 1 to January 28, Potts had made net sales of $77,000 and net purchases of $88,000. The gross profit during the past several years had consistently averaged 43 percent net sales. Potts plans to file an insurance claim for the theft loss. a. Using the gross profit method, estimate the cost of inventory at the time of the theft. Estimated ending inventoryarrow_forwardThe owner of a large machine shop has just finished its financial analysis from the prior fiscal year. Following is an excerpt from the final report: Net revenue $ 345,000 Cost of goods sold 304,000 Value of production materials on hand 42,500 Value of work-in-process inventory 49,000 Value of finished goods on hand 18,500 a. Compute the inventory turnover ratio (ITR). (Round your answer to 1 decimal place.) b. Compute the weeks of supply (WS). (Do not round intermediate calculations. Round your answer to 1 decimal place.)arrow_forwardCullumber Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $ 49,400. Purchases since January 1 were $ 93,600; freight-in, $ 4,420; purchase returns and allowances, $ 3,120. Sales are made at 33 /3% above cost and totaled $ 156,000 to March 9. Goods costing $ 14,170 were left undamaged by the fire; remaining goods were destroyed.arrow_forward

- Ralph’s Mini-Mart store in Alpine experienced the following events during the current year: 1. Incurred $391,000 in selling costs. 2. Incurred $1,216,000 of administrative costs. 3. Purchased $381,000 of merchandise. 4. Paid $35,000 for transportation-in costs. 5. Took an inventory at year-end and learned that goods costing $202,000 were on hand. This compared with a beginning inventory of $311,000 on January 1. 6. Determined that sales revenue during the year was $2,972,000. 7. Debited all costs incurred to the appropriate account and credited to Accounts Payable. All sales were for cash. Required: Give the amounts for the following items in the Merchandise Inventory account: Beginning Balance = Transfers In = Transfers Out = Ending Balance =arrow_forwardBlossom Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $39,520. Purchases since January 1 were $74,880; freight-in, $3,536; purchase returns and allowances, $2,496. Sales are made at 33 1/3% above cost and totaled $117,000 to March 9. Goods costing $11,336 were left undamaged by the fire; remaining goods were destroyed. Compute the cost of goods destroyed = ? Compute the cost of goods destroyed, assuming that the gross profit is 33 1/3% of sales = ?arrow_forwardOn March 1, AYE Merchandising had an inventory of P560,000 in its retail store. Purchases made in March amount to P480,000 and March sales total P870,000. On April 1, a fire destroyed most of the inventory and the records kept by the enterprise. Gross profit rate on cost is 25%. Merchandise with a selling price of P10,000 remained undamaged after the fire while inventory with a selling price of P15,000 can be sold for P5,000. What is the estimated amount of fire loss?arrow_forward

- On September 5, 20x4, a fire damaged the warehouse of Texas company. All inventory items and many accounting records stored in the warehouse was destroyed. However, a portion of the inventory could be sold for scrap. The company's backup files provide the following information: Inventory, January 1 P 750,000 Cash sales, January 1-September 5 445,000 Purchases, January 1-September 5 2,770,000 Collection of accounts receivable, January 1-September 5 4,230,000 Accounts Receivable, January 1 350,000 Accounts Receivable, September 5 530,000 Salvage value of Inventory 15,000 Gross profit ratio 32% What is the estimated inventory fire loss?arrow_forwardOn January 1, a store had inventory of $48,000. January purchases were $46,000 and January sales were $95,000. On February 1 a fire destroyed most of the inventory. The rate of gross profit was 20% of sales. Merchandise with a selling price of $5,000 remained undamaged after the fire. Compute the amount of the fire loss, assuming the store had no insurance coverage. Label all figures.arrow_forwardTim Legler requires an estimate of the cost of goods lost by fire on March 9. Merchandise on hand on January 1 was $38,000. Purchases since January 1 were $72,000; freight-in, $3,400; purchase returns and allowances, $2,400. Sales are made at 33⅓% above cost and totaled $100,000 to March 9. Goods costing $10,900 were left undamaged by the fire; remaining goods were destroyed. Instructions a. Compute the cost of goods destroyed. b. Compute the cost of goods destroyed, assuming that the gross profit is 33⅓% of sales.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage