Concept explainers

Question:

SERIAL PROBLEM

Business Solutions

P1 P2 P3 P4 PS P6

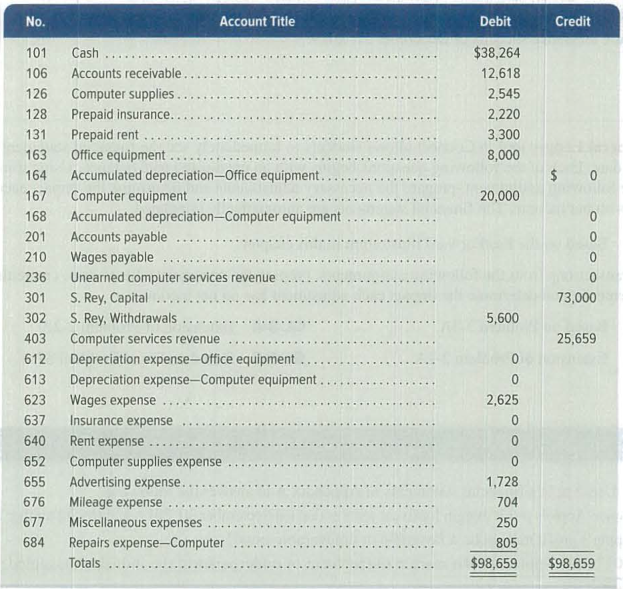

SP 3 After the success of the company's first two months, Santana Rey continues to operate Business Solutions. (Transactions for the first two months are described in the Chapter 2 serial problem.) The November 30,2019, unadjusted

Business Solutions had the following transactions and events in December 2019.

Dec. 2 Paid $1,025 cash to Hillside Mall for Business Solutions's share of mall advertising costs.

3 Paid $500 cash for minor repairs to the company's computer.

4 Received $3,950 cash from Alex's Engineering Co. for the receivable from November.

10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day.

14 Notified by Alex's Engineering Co. that Business Solutions's bid of $7,000 on a proposed project has been accepted. Alex's paid a $1,500 cash advance to Business Solutions.

15 Purchased $1,100 of computer supplies on credit from Harris Office Products.

16 Sent a reminder to Gomez Co. to pay the fee for services recorded on November 8.

20 Completed a project for Liu Corporation and received $5,625 cash.

22-26 Took the week off for the holidays.

28 Received $3,000 cash from Gomez Co. on its receivable.

29 Reimbursed S. Rey for business automobile mileage (600 miles at $0.32 per mile).

31 S. Rey withdrew $1,500 cash from the company for personal use.

The following additional facts are collected for use in making

a. The December 31 inventory count of computer supplies shows $580 still available.

b. Three months have expired since the 12-month insurance premium was paid in advance.

c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day.

d. The computer system, acquired on October 1, is expected to have a four-year life with no salvage value.

e. The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value.

f. Three of the four months' prepaid rent have expired.

Required

1. Prepare

2. Prepare adjusting entries to reflect a through Post those entries to the accounts in the ledger.

3. Prepare an adjusted trial balance as of December 31, 2019.

4. Prepare an income statement for the three months ended December 31, 2019.

5. Prepare a statement of owner's equity for the three months ended December 3 1, 2019.

6. Prepare a

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Principles of Financial Accounting.

- Review the following transactions and prepare any necessary journal entries for Woodworking Magazine. Woodworking Magazine provides one issue per month to subscribers for a service fee of $240 per year. Assume January 1 is the first day of operations for this company, and no new customers join during the year. A. On January 1, Woodworking Magazine receives advance cash payment from forty customers for magazine subscription services. Handyman had yet to provide subscription services as of January 1. B. On April 30, Woodworking recognizes subscription revenues earned. C. On October 31, Woodworking recognizes subscription revenues earned. D. On December 31, Woodworking recognizes subscription revenues earned.arrow_forwardService Revenue Softball Magazine Company received advance payments of $75,000 from customers during 2019. At December 31, 2019, $20,000 of the advance payments still had not been earned. Required: After the adjustments are recorded and posted at December 31, 2019, calculate what the balances will be in the Unearned Magazine Revenue and Magazine Revenue accounts. Use the following information for Cornerstone Exercises 5-23 and 5-24: Bolton sold a customer service contract with a price of S37 000 to Sammys Wholesale Company. Bolton offered terms of 1/10, n/30 and expects Sammy to pay within the discount period.arrow_forwardQuestion 1: Super Decorators Co had the following transactions with a customer during the year ended on 31 December 2019; November 1:Sold decoration material on account OMR 7,500, terms 1.5/10, n/30. November 4:Customer retuned some faulty materials of OMR 1,000 November 8:Customer paid OMR 2,500. December 1:Accepted a 90 days, 12% note from the customer for the balance amount. Required: a. Determine the date of maturity of the note. b. Determine the interest payable on maturity of the note. c. Journalize all the above transactions in the books of Super Decorators when the note is i)honoured on maturity and ii)dishonoured on maturityarrow_forward

- A. You are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019.B. GYV Ltd has the following deferred tax balances as at 30 June 2019.Deferred tax asset $9 00 000Deferred tax liability $7 00 000The above balances were calculated when the tax rate, was 20 per cent. On 1 December 2019 the government raises the corporate tax rate to 25 per cent.Required:Provide the journal entries to adjust the carry-forward balances of the deferred tax asset and deferred tax liability.arrow_forwardComprehensive On November 30, 2019. Davis Company had the following account balance. During the month of December, Davis entered into the following transactions: Required: a.Prepare generaljournal entries to record the preceding transactions. b.Post to general ledger T accoun c.Prepare a year-end trial balance on a worksheet and complete theworksheet using the following information: (a) accrued salaries at year-end total s1,200; (b) for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 yean with no residual value;(c) supplies on hand at the end of the year total $630; (d) bad debts expense for the year totals $830; and (e)the income tax rate is 30%; income taxes are payable in the first quarter of d.Prepare the companis financial statements for 2019. e.Prepare the 2019 (a) adjusting and (b) closing entries in the general journal.arrow_forwardK The following selected transactions occurred during 2024 and 2025 for Arabian Importers. The company ends its accounting year on April 30. (Click the icon to view the transactions.) Journalize all required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Feb. 1: Loaned $11,000 cash to Britt Durant on a one-year, 6% note. Date Accounts and Explanation 2024 Feb. 1 Note Receivable-Britt Durant Cash Etext pages Note Receivable-Putt Masters Sales Revenue Accepted note in exchange for cash. Apr. 6: Sold goods to Putt Masters, receiving a 90-day, 9% note for $9,000. Ignore Cost of Goods Sold. Date Accounts and Explanation Debit Credit 2024 Apr. 6 ere to search Accrued interest revenue. Get more help. Debit i 11,000 Sold goods for a note. Apr. 30: Made a single entry to accrue interest revenue on both notes. (Use months for the one-year note interest computation and a 365-day…arrow_forward

- On 1.7.2019 XY company received rental revenue in advance from customer of OMR 3600 for two years. in the journal entry, the credit side is: Select one: a. Accrued rent 3600 b. Unearned rental revenue 3600 O c. Accrued rent 3600 O d. Unearned rental revenue 1800 e. Rent outstanding 3600arrow_forwardBrief Exercise 8-4 (Part Level Submission) At the end of 2019, Sheffield Corp. has accounts receivable of $739,200 and an allowance for doubtful accounts of $67,900. On January 24, 2020, the company learns that its receivable from Megan Gray is not collectible, and managernent authorizes a write-off of $6,500. > (a) v (b) X Your answer is incorrect. Try again. What is the cash realizable value of the accounts receivable (1) before the write-off and (2) after the write-off? Before Write-Off After WWrite-Off Cash realizable value 671100 671100 SHOW LIST OF ACCOUNTSarrow_forwardOn the 1.7.2019 XY company received rental revenue in advance from customers of OMR 2400 for two years. in the journal entry, the credit side is: Select one: a. None of These b. Prepaid rent 2400 c. unearned revenue 2400 d. Accrued rent 2400.arrow_forward

- Use the following question to answer next 10 Questions. Comprehensive Problem Dell Company is selling sounds and lights equipment. The company’s fiscal year ends on March 31. The following information relates to the obligations of the company as of March 31, 2021: Trade payables Accounts payable for suppliers, goods, and services purchases on open account amount to P1,670,000 as of March 31, 2021 before considering of the following items: On March 31, 2021, the company has a P50,000 debit balance in its accounts payable to a supplier, resulting from a P50,000 advance payment for goods ordered by the company. The balance also includes an advance payment of P20,000 made by a customer to Dell in anticipation of a purchase to be made by the customer in April 2021. Additional information: Goods were in transit to the company from a vendor on March 31, 2021. The invoice cost was P35,000. The goods were shipped FOB seller on March 29, 2021 and were received on April 4, 2021. Goods shipped FOB…arrow_forwardHELP ME PREPARE A CLASSIFIED BALANCE SHEET AT DEC.31,2019. THE NOTE PAYABLE HAS A STATED INTEREST RATE OF 6% AND THE PRINCIPAL AND INTEREST ARE DUE ON NOV.6,2021 ?? Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance. COOKIE CREATIONSAdjusted Trial BalanceDecember 31, 2019 Debit Credit Cash $1,460 Accounts Receivable 1,085 Supplies 430 Prepaid Insurance 1,500 Equipment 1,500 Accumulated Depreciation—Equipment $50 Accounts Payable 95 Salaries and Wages Payable 69 Interest Payable 20 Unearned Service Revenue 370 Notes Payable 2,500 Owner’s Capital 990 Owner’s Drawings 620 Service Revenue 5,588 Salaries and Wages Expense 1,247 Utilities Expense 155…arrow_forwardAssuming a year-end in March 31,it is now April 4.A staff member asks you to process an unpaid invoice with details as follows: The invoice is for bus transportation in the amount of P800 and is dated April. The invoice indicates the charges relate to transportation on March 20.A transfer is processed to pay the invoice on April 7. Hiw would you proceed? You may describe how you would record the transaction in the general ledger, including a description of journal entries and the dates each item will be recordedarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning