The

*$15,000 tax liability ($50,000 income ×30%)- $12,000 tax lass carryover ($40,000 × 30%)

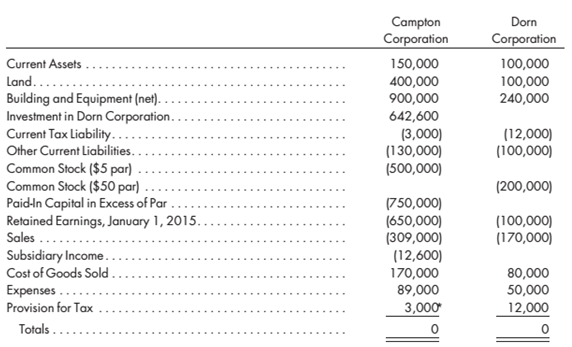

On January 1, 2015. Campion purchases 90% of the outstanding stock of Dorn Corporation for $630,000. The acquisition is a tax-free exchange for the seller. At the purchase date, Dorn's equipment is undervalued by $100,000 and has a remaining life of 10 years. All other assets have book values that approximate their fair values. Dorn Corporation has a tax loss carryover of $200,000, of which $50,000 is utilizable in 2015 and the balance in future periods. 1 he tax loss carryover is expected to be fully utilized. Any remaining excess is considered to be

2. Prepare the 2015 consolidated worksheet. Include columns for the eliminations and adjustments, the consolidated income statement, the NCl, the controlling

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Advanced Accounting

- On January 1, 2021, Knight Corporation purchases all the outstanding shares of Craig Company for $950,000. It has been decided that Craig Company will use push-down accounting principles to account for this transaction. The current balance sheet is stated at historical cost. The following balance sheet is prepared for Craig Company on January 1, 2021: (see attachment)Knight Corporation receives the following appraisals for Craig Company’s assets and liabilities: Cash . . . . . . . . . . . . . . . . . . . . . . $ 80,000 Accounts receivable . . . . . . . . . . 260,000 Prepaid expenses . . . . . . . . . . . . 20,000 Land. . . . . . . . . . . . . . . . . . . . . . . 250,000 Building (net) . . . . . . . . . . . . . . . . 700,000 Current liabilities . . . . . . . . . . . . . 90,000 Bonds payable . . . . . . . . . . . . . . 280,000 Deferred tax liability . . . . . . . . . . 40,000 1. Record the investment. 2. Prepare the value analysis schedule and the determination and distribution of…arrow_forwardOcean Ltd is the parent entity to the wholly owned subsidiaries of River Ltd, Creek Ltd, and Puddle Ltd. During the year ended 30 June 2022 the following transactions occurred within Ocean Ltd group. The perpetual inventory system has been adopted by all entities in the Ocean Ltd group and the tax rate is 30% for all accounting periods. On 01 July 2021 Ocean Ltd sold an item of equipment to Creek Ltd for $850,000 cash. The original cost of the equipment was $950,000. Ocean Ltd adopted an accounting policy whereby equipment was being depreciated on a straight line basis over its useful life of 8 years. The carrying amount of the equipment in Ocean Ltd financial statements at the date of sale was $520,000. Subsequent to the transfer, Creek Ltd depreciated the equipment on a straight line basis over its remaining useful life of 3 years. Required: Fill in the missing amount for the following accounts that will appear in the consolidated adjusting journal…arrow_forwardApples Corporation bought 2,000 shares of Oranges Corporation on January 2, 2020 at ₱150 per share and paid ₱2,250 as brokerage fee and ₱1,500 non-refundable tax. The investment is measured at fair value through other comprehensive income. Prior to the date of acquisition, information revealed that on December 8, 2019, Oranges Corporation declared a ₱10 cash dividend to shareholders on record as of January 31, 2020 payable on April 30, 2020. There were no other transactions in 2020 affecting the investment in Oranges Corporation. What is the historical or acquisition cost of the investment account? A.₱ 302,250 B.₱ 300,000 C.₱ 303,750 D.₱ 283,750arrow_forward

- Tall acquires 80% of Short on May 1, 2010. For the first 4 months of 2010, Short has total revenues of $1,000,000 and total expenses of $600,000. For the last & months of the year, Short has total revenues of $1,800,000 and total expenses of $800,000. a. How much is the noncontrolling interest in Short net income in 2010 b. How much subsidiary net income is allocated to the controlling interestarrow_forwardCompany R owns a 30% interest in Company E, which it acquires at book value. Company E reports net income of $50,000 for 2015 (ignore taxes). There is an intercompany sale of equipment at a gain of $20,000 on January 1, 2015. The equipment has a 5-year life. What is Company R’s investment income for 2015, and what adjusting entry (if any) does Company R need to make as a result of the equipment sale, if: a. Company E made the sale? b. Company R made the sale?arrow_forwardGreat Ltd owns all of the share capital of Barrier Ltd. The income tax rate is 30%. The following transactions took place during the periods ended 30 June 2020 or 30 June 2021. On 1 January 2020, Barrier Ltd lent Great Ltd the sum of $25 000. The loan is repayable in ten years and carries an annual interest charge of 4%. At 30 June 2021, both companies have recognized the interest for the year but no cash has been exchanged. In February 2021, Great Ltd sells inventories to Barrier Ltd for $11 000 in cash. These inventories had previously cost Great Ltd $8 000, and are on-sold externally on 2 April 2021. On 28 June 2021, Barrier Ltd declared a final dividend of $15 000. Shareholder approval is not required in relation to dividends. In March 2021, Great Ltd sold inventories for $15 000 to Zara Ltd, an external entity. These inventories were transferred from Barrier Ltd on 1 June 2020. The inventories had originally cost Barrier Ltd $4000, and were sold to Great Ltd for $11 000.…arrow_forward

- aste Company owns an 80% controlling interest in the Bastion Company. Bastion regularly sells merchandise to Baste, which then sold to outside parties. The gross profit on all such sales is 40%. On January 1, 2019, Baste sold land and a building to Bastion. The value of the parcel is 20% to land and 80% to structures. The data are the following:Baste BastionInternally generated net income, 2019 P1,560,000 P750,000Internally generated net income, 2020 10,320,000 705,000Intercompany merchandise sales, 2019 300,000Intercompany merchandise sales, 2020 360,000Intercompany inventory, December 31, 2019 45,000Intercompany inventory, December 31, 2020 60,000Cost of real estate sold on January 1, 2019 1,800,000Sales price of real estate on January 1, 2019 2,400,000Depreciable life of building 20 yearsFor 2019, what is the consolidated comprehensive income attributable to controlling interest?a. 1,575,000b. 1,597,500c. 1,569,600d. 1,875,000arrow_forwardOn January 1, 2020, Ayayai Corporation purchased 20% of the common shares of Pina Company for $191,000. During the year, Pina earned net income of $71,000 and paid dividends of $17,750. Prepare the entries for Ayayai to record the purchase and any additional entries related to this investment in Pina Company in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record purchase of stock.) (To record receipt of dividends.) (To record revenue.)arrow_forwardX purchased 40% of Y on January 1,2019 for $400,000. Y paid dividends of $50,000 in each year. Y's income statements for 2019 and 2020 showed the following: 2019 2020 Income (loss) before income taxes $100,000 (60,000) Income tax expense (recovery) 40,000 (15,000) Net income (loss) $60,000 ($45,000) Other comprehensive income (net of tax) 20,000 25,000 Comprehensive income (loss) $80,000 ($20,000) At December 31, 2019, the fair value of the investment was $440,000 and at December 31, 2020, the fair value of the investment was $420,000. Required: Prepare X's journal entries for 2019 and 2020, assuming that is a significant influence investment.arrow_forward

- Zeno, Incorporated sold two capital assets in 2022. The first sale resulted in a$53,000 capital loss, and the second sale resulted in a $25,600 capital gain. Zenowas incorporated in 2018, and its tax records provide the following information:2018 2019 2020 2021Ordinary income $ 443,000 $ 509,700 $ 810,300 $ 921,Net capital gain 22,000 0 4,120 13,Taxable income $ 465,000 $ 509,700 $ 814,420 $ 934,Required:a.Compute Zeno’s tax refund from the carryback of its 2022 nondeductible capitalloss. Zeno’s marginal tax rate was 21 percent for each prior year.b. Compute Zeno’s capital loss carryforward into 2023.arrow_forwardZeno, Incorporated sold two capital assets in 2022. The first sale resulted in a$53,000 capital loss, and the second sale resulted in a $25,600 capital gain. Zenowas incorporated in 2018, and its tax records provide the following information:2018 2019 2020 2021Ordinary income $ 443,000 $ 509,700 $ 810,300 $ 921,Net capital gain 22,000 0 4,120 13,Taxable income $ 465,000 $ 509,700 $ 814,420 $ 934,Required:a Compute Zeno’s tax refund from the carryback of its 2022 nondeductible capitalloss. Zeno’s marginal tax rate was 21 percent for each prior year.b. Compute Zeno’s capital loss carryforward into 2023.arrow_forwardOn July 1, 2020, Blue George Company purchased 25% interest of Pink Conrad for P150,000. Blue George incurred transaction cost equal to 5% on the transaction price. On October 1, 2020, Pink Conrad declared dividends of P80,000. At the end of 2020, Pink Conrad reported net income of P200,000. On January 1, 2021, the fair values of Pink Conrad's net assets were as follows:Current Assets - P100,000;Equipment - P150,000;Patent – P120,000;Land - P50,000;Buildings - P300,000; andLiabilities - P80,000. On January 1, 2021, Blue George Company purchased 50% interest of the Pink Conrad Company by issuing 100,000 shares of its P1 par value stock when the fair value of the stock was P6.20. Pink Conrad paid for the legal fees of P10,000 and securities SEC registration of P20,000 which was reimbursed by Blue George. The Patent of Pink Conrad refers to the technology purchased by Pink Conrad from Blue George years ago. Blue George had an outstanding unearned revenue related to the Patent amounting to…arrow_forward