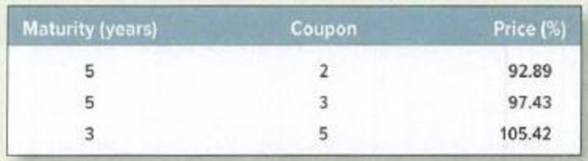

Prices and spot interest rates What spot interest rates are implied by the following Treasury bonds? Assume for simplicity that the bonds pay annual coupons. The price of a one-year strip is 97.56%, and the price of a four-year strip is 87.48%.

To determine: The spot interest rates implied by treasury bonds.

Explanation of Solution

Determine

Hence,

Determine

Hence,

Determine

Determine

Solve equation 1 and 2

Determine

Hence, the spot rates are 2.50%, 3.22%, 3.09%, 3.40% and 3.60 for years 1 to 5.

Want to see more full solutions like this?

Chapter 3 Solutions

PRIN.OF CORP.FINANCE-CONNECT ACCESS

- Interest premium. Estimate the default premium and the maturity premium given the following three investment opportunities: a Treasury bill with a current interest rate of 2.75%; a Treasury bond with a twenty-year maturity and a current interest rate of 4.75%; and a AAA, corporate bond with a twenty-year maturity and an interest rate of 9.5%. What is the default premium? % (Round to two decimal places.) What is the maturity premium? % (Round to two decimal places.)arrow_forwardInterest premium. Estimate the default premium and the maturity premium given the following three investment opportunities: a Treasury bill with a current interest rate of 3.25%; a Treasury bond with a twenty-year maturity and a current interest rate of 4.5%; and a AAA, corporate bond with a twenty-year maturity and an interest rate of 9%. What is the default premium? % (Round to two decimal places.)arrow_forwardIf the interest rates on 1-, 5-, 20-, and 30-year bonds are (respectively)4%, 5%, 6%, and 7%, then how would you describe the yield curve?How would you describe it if the rates were reversed?arrow_forward

- Estimate the default premium and the maturity premium given the following three investment opportunities: a Treasury bill with a current interest rate of 3.5%; a Treasury bond with a twenty-year maturity and a current interest rate of 5.25%; and a AAA, corporate bond with a twenty-year maturity and an interest rate of 7.5%. What is the default premium? nothing% (Round to two decimal places.)arrow_forwardThe outstanding bonds of Winter Tires Inc. provide a real rate of return of 3.2 percent. If the current rate of inflation is 2.1 percent, what is the actual nominal rate of return on these bonds?arrow_forwardSuppose you can observe that 1-year bond interest rate is 4%, 2-year bond interest rate is 8%, and 3-year bond interest rate is 10% at time t. It is also known that the term premium on a 2-year bond is 1% and the term premium on a 3-year bond is 1.5%. a) What are the market's expected 1-year bond interest rates for the next two years from time t? b) How to interpret those expected short-term interest rates? (what would be the "possible" economic meanings in the expected short- term interest rates?) Discuss as least two "candidates" to explain them.arrow_forward

- Consider information on the following bonds (with face value 100): Bond Maturity (years) Coupon rate Yield-to-maturity А 1 0% 5.0% В 2 5% 5.5% C 3 6% 6.0% Coupons are paid annually. What is the three-year spot interest rate?arrow_forwardSuppose that the current one-year rate (one-year spot rate) and expected one-year government bonds over years 2, 3 and 4 are as follows: 1R1 = 4.80%, E(2r1) = 5.45%, E(3r1) = 5.95%, E(4r1) = 6.10% Assume that there are no liquidity premiums. To the nearest basis point, what is the current rate for the four-year-maturity government bond? 5.57% 5.62% 5.83% 6.10%arrow_forwardSuppose that the market interest rate rises overnight from 3.5% to 8%. Calculate the present values of the 5.5%, 3-year bond and of the 5.5%, 30-year bond both before and after this change in interest rates. Which bond price fluctuates more to interest rate change? Why?arrow_forward

- The following information is about the spot rates on Treasury securities and BBB corporate bond: Spot 1 Year Spot 2 Year Spot 3 Year Treasury 3% 4.75% 5.5% BBB Corporate Debt 7.5% 9.15% 10.5% Question: Using the implied forward rates, estimate the annual marginal default probability for the one-year BBB corporate debt in year 3?arrow_forwardThebond shown in the following table pays interest annually. Par value Coupon interest rate Years to maturity Current value $1,000 8% 9 $700 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain.arrow_forwardSuppose that the prices of zero-coupon bonds with various maturities are given in the following table. The face value of each bond is $1,000. Maturity (Years) 1 2 3 4 5 Required: a. Calculate the forward rate of interest for each year. b. How could you construct a 1-year forward loan beginning in year 3? c. How could you construct a 1-year forward loan beginning in year 4? Required A Price $940.93 Complete this question by entering your answers in the tabs below. 868.39 800.92 735.40 670.48 Required B Maturity (years) 2 3 Calculate the forward rate of interest for each year. Note: Round your answers to 2 decimal places. Required C Forward Rate % % Prov 12 of 12 Nextarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education