Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

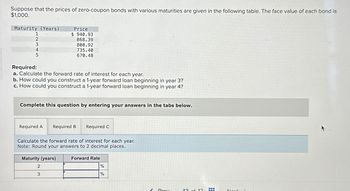

Transcribed Image Text:Suppose that the prices of zero-coupon bonds with various maturities are given in the following table. The face value of each bond is

$1,000.

Maturity (Years)

1

2

3

4

5

Required:

a. Calculate the forward rate of interest for each year.

b. How could you construct a 1-year forward loan beginning in year 3?

c. How could you construct a 1-year forward loan beginning in year 4?

Required A

Price

$940.93

Complete this question by entering your answers in the tabs below.

868.39

800.92

735.40

670.48

Required B

Maturity (years)

2

3

Calculate the forward rate of interest for each year.

Note: Round your answers to 2 decimal places.

Required C

Forward Rate

%

%

Prov

12 of 12

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction to forward rate of interest

VIEW Step 2: Part (A) Calculation of the forward rate of interest for each year

VIEW Step 3: Part (B) Calculation of construct a 1-year forward loan beginning in year 3

VIEW Step 4: Part (C)Calculation of construct a 1-year forward loan beginning in year 4

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need assistance with the following: Suppose you have bough the above zero-coupon bond, with value and duration equal to your obligation. Now suppose the rates immediately increase to 9%. What happens to your net position? How much is the tuition obligation? How much is the zero-coupon bond? How much is the net position?arrow_forwardSuppose that a 1-year zero-coupon bond with face value $100 currently sells at $90.44, while a 2-year zero sells at $82.64. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 12% per year. Required: a. What is the yield to maturity of the 2-year zero? b. What is the yield to maturity of the 2-year coupon bond? c. What is the forward rate for the second year? d. If the expectations hypothesis is accepted, what are (1) the expected price of the coupon bond at the end of the first year and (2) the expected holding-period return on the coupon bond over the first year? e. Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis?…arrow_forwardPlease answer all 4 yield to maturity with explanations thxarrow_forward

- Calculate YTC using a financial calculator by entering the number of payment periods until call for N, the price of the bond for PV, the interest payments for PMT, and the call price for FV. Then you can solve for 1/YR YTC. Again, remember you need to make the appropriate adjustments for a semiannual bond and realize that the calculated 1/YR is on a periodic basis so you will need to multiply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the signs for PMT and FV are identical and the opposite sign is used for PV; otherwise, your answer will be incorrect. A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be called if its price is above par-because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 8.4%…arrow_forwardYou find a bond with 27 years until maturity that has a coupon rate of 9 percent and a yield to maturity of 10 percent. What is the Macaulay duration? The modified duration? Note: Do not round intermediate calculations. Round your answers to 3 decimal places.arrow_forwardA plot of the yields on bonds with different terms to maturity but the same risk, liquidity, and tax considerations is known as O A. a yield curve. B. a risk-structure curve. OC. a term-structure curve. 5- O D. an interest-rate curve. Suppose people expect the interest rate on one-year bonds for each of the next four years to be 3%, 6%, 5%, and 6%. If the expectations theory of the term structure of interest rates is correct, then the implied interest rate on bonds with a maturity of four years is nearest whole number). %. (Round your response to the 2- Refer to the figure on your right. Suppose the expected interest rates on one-year bonds for each of the next four years are 4%, 5%, 6%, and 7%, respectively. 1. 1.) Use the line drawing tool (once) to plot the yield curve generated. 3 Term to Maturity in Years 2.) Use the point drawing tool to locate the interest rates on the next four years. 5. 3- Interest Rate .....arrow_forward

- Bond A makes semi-annual interest payments of $30. Bond B makes an annual payment of $50. All else equal, which one has the lower coupon rate? Select one: a. B b. A=B c. Aarrow_forwardFind the price a purchaser should be willing to pay for the given bond. Assume that the coupon interest is paid twice a year. $19,000 bond with coupon rate 6% that matures in 4 years; current interest rate is 5% The purchaser should be willing to pay $ (Simplify your answer. Round to the nearest cent as needed.)arrow_forwardConsider two bonds, a 3-year bond paying annual coupons at 5% and a 10-year bond also paying annual coupons at 5%. Coupons are paid annually (not semiannually). Both are currently trading at par (i.e., price = face value). A. What must be the current discount rate for these bonds? B. Suppose that the discount rate for these bonds suddenly rise to 9%. What is the new price of the 3-year bond? What is the new price of the 10-year bond? C. Compare the price changes (i.e., the current price of $1,000 vs. the new bond price from Part B) of two bonds. Determine whether long-term or short-term bonds are more sensitive to interest rate fluctuation.arrow_forward

- Suppose that you want to construct a 2-year maturity forward loan commencing in 3 years. The face value of each bond is $1,000. Maturity (Years) 1 2 3 4 5 Price $ 996.04 895.89 833.92 772.80 675.18 Required: a. Suppose that you buy today one 3-year maturity zero-coupon bond with face value $1,000. How many 5-year maturity zeros would you have to sell to make your initial cash flow equal to zero (specifically, what must be the total face value of those 5-year zeros)? b. What are the cash flows on this strategy in each year? c. What is the effective 2-year interest rate on the effective 3-year-ahead forward loan? d. & e. Confirm that the effective 2-year forward interest rate equals (1 + f4) ×(1 + f5)-1. You therefore can interpret the 2-year loan rate as a 2-year forward rate for the last two years. Alternatively, show that the effective 2-year forward rate equals (1 + y5) 15 + (1+y3) ³. - 1arrow_forwardK Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): Period 0 2 Cash Flows $19.12 $19.12 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) 39 $19.12arrow_forwardSuppose the current interest rate on a one-year bond is 2% and the current interest rate on a two-year bond is 4%. The term premium on a two-year bond is 1%. According to the expectations hypothesis, what interest rate should we expect on a one-year bond next year? Answer as a percentage to one decimal place and do not include symbols (e.g. $, %, commas) in your answer. Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education