Accounting

27th Edition

ISBN: 9781337272094

Author: WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.26EX

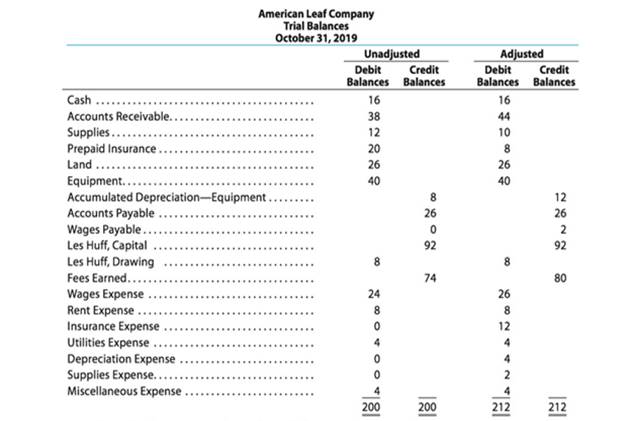

The unadjusted and adjusted trial balances for American Leaf Company on October 31, 2019, follow:

Journalize the five entries that adjusted the accounts at October 31, 2019. None of the accounts were affected by more than one adjusting entry.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Need help

Quick answer of this accounting questions

MCQ

Chapter 3 Solutions

Accounting

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (a) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - If the effect of the credit portion of an...Ch. 3 - Does every adjusting entry affect net income for...Ch. 3 - Prob. 9DQCh. 3 - (a) Explain the purpose of the two accounts:...

Ch. 3 - Accounts requiring adjustment Indicate with a Yes...Ch. 3 - Accounts requiring adjustment Indicate with a Yes...Ch. 3 - Prob. 3.2APECh. 3 - Type of adjustment Classify the following items as...Ch. 3 - Adjustment for accrued revenues At the end of the...Ch. 3 - Adjustment for accrued expense Prospect Realty Co....Ch. 3 - Adjustment for accrued expense We-Sell Realty Co....Ch. 3 - Adjustment for unearned revenue On June 1, 2019,...Ch. 3 - Adjustment for unearned revenue The balance in the...Ch. 3 - Adjustment for prepaid expense The prepaid...Ch. 3 - Adjustment for prepaid expense The supplies...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Vertical analysis Two income statements for...Ch. 3 - Vertical analysis Two income statements for Cornea...Ch. 3 - Classifying types of adjustments Classify the...Ch. 3 - Classifying adjusting entries The following...Ch. 3 - Adjusting entry for accrued fees At the end of the...Ch. 3 - Effect of omitting adjusting entry The adjusting...Ch. 3 - Adjusting entries for accrued salaries Garcia...Ch. 3 - Determining wages paid The wages payable and wages...Ch. 3 - Effect of omitting adjusting entry Accrued...Ch. 3 - Effect of omitting adjusting entry When preparing...Ch. 3 - Adjusting entries for unearned fees The balance in...Ch. 3 - Effect of omitting adjusting entry At the end of...Ch. 3 - Adjusting entry for supplies The balance in the...Ch. 3 - Determining supplies purchased The supplies and...Ch. 3 - Effect of omitting adjusting entry At August 31,...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for unearned and accrued fees...Ch. 3 - Adjusting entries for prepaid and accrued taxes...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Determining fixed asset's book value The balance...Ch. 3 - Book value of fixed assets In a recent balance...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements The...Ch. 3 - Effects of errors on financial statements If the...Ch. 3 - Adjusting entries for depreciation; effect of...Ch. 3 - Adjusting entries from trial balances The...Ch. 3 - Adjusting entries from trial balances The...Ch. 3 - Prob. 3.28EXCh. 3 - Prob. 3.29EXCh. 3 - Prob. 3.30EXCh. 3 - Adjusting entries On December 31, the following...Ch. 3 - Prob. 3.2APRCh. 3 - Adjusting entries Milbank Repairs Service, an...Ch. 3 - Adjusting entries Good Note Company specializes in...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Adjusting entries and errors At the end of April,...Ch. 3 - Adjusting entries On May 31, the following data...Ch. 3 - Prob. 3.2BPRCh. 3 - Adjusting entries Crazy Mountain Outfitters Co.,...Ch. 3 - Adjusting entries The Signage Company specializes...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Prob. 3.6BPRCh. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Prob. 3.1CPCh. 3 - Ethics in Action Daryl Kirby opened Squid Realty...Ch. 3 - Prob. 3.4CPCh. 3 - Prob. 3.5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bradford Enterprises estimated manufacturing overhead for the year at $350,000. Manufacturing overhead for the year was underapplied by $15,000. The company applied $300,000 to Work in Process. The amount of actual overhead would have been_____.arrow_forwardWhat was its charge for depreciation and amortization of this financial accounting question?arrow_forwardhelp me to solve this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY