INTERMEDIATE ACCOUNTING

8th Edition

ISBN: 9780078025839

Author: J. David Spiceland

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

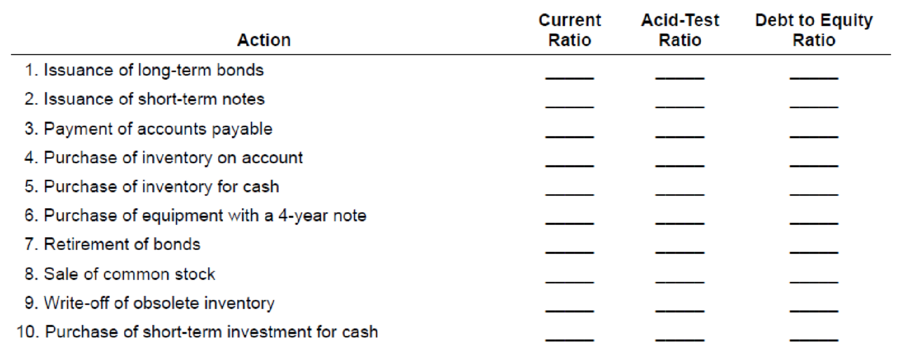

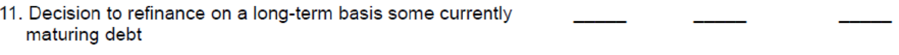

Textbook Question

Chapter 3, Problem 3.20E

Effect of management decisions on ratios

• LO3–8

Most decisions made by management impact the ratios analysts use to evaluate performance. Indicate (by letter) whether each of the actions listed below will immediately increase (I), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is less than 1.0 before the action is taken.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

View Policies A

Current Attempt in Progress

What is "balanced" in the balanced scorecard approach?

A

O The number of products produced.

O The number of defects found on each product.

O The amount of costs allocated to products.

O The emphasis on financial and non-financial performance measurements.

Save for Later

Attempts: 0 of 1

n

Ex. 11-9

Exercise 11-9 (Static) Return on Investment (ROI) and Residual Income Relations [LO11-1, LO11-2]

A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector

industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Round your percentage

answers to nearest whole percent.)

Sales

Net operating income

Average operating assets

Return on investment (ROI)

Minimum required rate of return:

Percentage

Dollar amount

Residual income

$ 9,000,000

$ 3,000,000

18 %

16 %

$

$

$

Company

B

7,000,000

280,000

14 %

320,000

%

Saved

C

$ 4,500,000

$ 1,800,000

$

%

15 %

90,000

Determining Missing Items in Return Computation

One item is omitted from each of the following computations of the return on investment:

Rate of Returnon Investment

=

Profit Margin

x

InvestmentTurnover

13.2%

=

6%

x

(a)

(b)

=

10%

x

1.80

10.5%

=

(c)

x

1.50

15%

=

5%

x

(d)

(e)

=

12%

x

1.10

Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places.

(a)

fill in the blank 1

(b)

fill in the blank 2%

(c)

fill in the blank 3%

(d)

fill in the blank 4

(e)

fill in the blank 5%

Chapter 3 Solutions

INTERMEDIATE ACCOUNTING

Ch. 3 - Prob. 3.1QCh. 3 - Prob. 3.2QCh. 3 - Define current assets and list the typical asset...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Prob. 3.6QCh. 3 - Describe the common characteristics of assets...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Define the terms paid-in-capital and retained...

Ch. 3 - Disclosure notes are an integral part of the...Ch. 3 - A summary of the companys significant accounting...Ch. 3 - Define a subsequent event.Ch. 3 - Prob. 3.14QCh. 3 - Prob. 3.15QCh. 3 - Prob. 3.16QCh. 3 - Prob. 3.17QCh. 3 - Show the calculation of the following solvency...Ch. 3 - Prob. 3.19QCh. 3 - Prob. 3.20QCh. 3 - (Based on Appendix 3) Segment reporting...Ch. 3 - Prob. 3.22QCh. 3 - Prob. 3.23QCh. 3 - Current versus long-term classification LO32,...Ch. 3 - Prob. 3.2BECh. 3 - Prob. 3.3BECh. 3 - Prob. 3.4BECh. 3 - Prob. 3.5BECh. 3 - Prob. 3.6BECh. 3 - Balance sheet preparation; missing elements LO32,...Ch. 3 - Financial statement disclosures LO34 For each of...Ch. 3 - Prob. 3.9BECh. 3 - Prob. 3.10BECh. 3 - Calculating ratios; solving for unknowns LO38 The...Ch. 3 - Prob. 3.1ECh. 3 - Prob. 3.2ECh. 3 - Prob. 3.3ECh. 3 - Prob. 3.4ECh. 3 - Prob. 3.5ECh. 3 - Prob. 3.6ECh. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Financial statement disclosures LO34 The...Ch. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.13ECh. 3 - FASB codification research LO32, LO34 Access the...Ch. 3 - Prob. 3.15ECh. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - Effect of management decisions on ratios LO38...Ch. 3 - Prob. 3.21ECh. 3 - Prob. 3.22ECh. 3 - Prob. 1CPACh. 3 - Prob. 2CPACh. 3 - Prob. 3CPACh. 3 - Prob. 4CPACh. 3 - Prob. 5CPACh. 3 - Prob. 6CPACh. 3 - Prob. 7CPACh. 3 - Prob. 8CPACh. 3 - Prob. 1CMACh. 3 - Prob. 2CMACh. 3 - Prob. 3CMACh. 3 - Balance sheet preparation LO32, LO33 Presented...Ch. 3 - Prob. 3.2PCh. 3 - Prob. 3.3PCh. 3 - Prob. 3.4PCh. 3 - Prob. 3.5PCh. 3 - Prob. 3.6PCh. 3 - Prob. 3.7PCh. 3 - Prob. 3.8PCh. 3 - Prob. 3.9PCh. 3 - Prob. 3.10PCh. 3 - Communication Case 31 Current versus long-term...Ch. 3 - Analysis Case 32 Current versus long- term...Ch. 3 - Prob. 3.4BYPCh. 3 - Prob. 3.5BYPCh. 3 - Prob. 3.6BYPCh. 3 - Prob. 3.7BYPCh. 3 - Prob. 3.8BYPCh. 3 - Prob. 3.9BYPCh. 3 - Prob. 3.11BYPCh. 3 - Analysis Case 3–14

Balance sheet information

LO3–2...Ch. 3 - Prob. 3.15BYPCh. 3 - Ethics Case 316 Segment reporting Appendix 3 You...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Time left 1:46 Which of the following statements about CVP analysis is false? O a. Unit selling price, unit variable costs, and total fixed costs are known and remain constant. Ob. All of the given answers are true. Oc. Managers use (CVP) analysis to study the behavior of and relationship among the elements such as total revenues, total costs, and income O d. Total revenues and total costs are linear in relation to output units. O e. Operating income calculations in CVP analysis are based on contribution margin not gross margin. 14:13 A O A d0 ENG 15-04-2021 re to search hp end brt sc delete home & num 23 + backspace 24 4. lock 8. 3. 6 7 V 8 A home enter 5 0 D F G J K L. pause 51 B ↑ shift 11 2 N M end alt ctrl insarrow_forward$2.97 O e. $0.48 Which of the following statements about CVP analysis is false? O a. Operating income calculations in CVP analysis are based on contribution margin not gross margin. O b. Unit selling price, unit variable costs, and total fixed costs are known and remain constant. O c. Total revenues and total costs are linear in relation to output units. O d. Managers use (CVP) analysis to study the behavior of and relationship among the elements such as total revenues, total costs, and income O e. All of the given answers are true. pe here to search hp 4+ & 7 V % 2$ 4 @ #3 8 6. 3 W E R. G H. J K. S D M. V B 近arrow_forwardQ.Do you agree with Petrocal’s decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced scorecard? Explain briefly.arrow_forward

- Sargassum Caribbean Incorporated Balance Sheet as at December 31, 2020 Assets Liabilities Current Assets: Current Liabilities: Cash Accounts Payable 600,000 300,000 200,000 400,000 Notes Payable 900,000 1,500,000 Total Current Liabilities Accounts Receivable Inventory Total Current Assets 900,000 Fixed Assets: Long-Term Liabilities: Property, Plant & Equipment Less: Accumulated Depreciation 1,200,000 Long-Term Debt 1,000,000 Total Long Term Liabilities 200,000 300,000 300,000 Net Fixed Assets Owners' Equity: Common Stock ($1 Par) Capital Surplus Retained Earnings Total Owners' Equity 100,000 300,000 100,000 500,000 1,700,000 Total Liabilities & Owners' Equity Total Assets 1,700,000 Sargassum Caribbean Incorporated Income Statement for Year Ending December 31, 2020 Sales Less: Cost of Goods Sold Less: Administrative Expenses Less Depreciation Earnings Before Interest and 2,500,000 800,000 100,000 104,000 1,496,000 Тахes Less: Interest Expense Taxable Income 20.000 1,476,000 663,000…arrow_forwardDetermining Missing Items in Return Computation One item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 19 % = 10 % x (a) (b) = 28 % x 0.75 15 % = (c) x 1.5 16 % = 20 % x (d) (e) = 15 % x 1.8 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) (b) % (c) % (d) (e) %arrow_forwardDetermining missing items in return on investment computation One item is omitted from each of the following computations of the return on investment: Return on Investment = Profit Margin x Investment Turnover 24 % = 10 % x (a) (b) = 24 % x 0.75 12 % = (c) x 1.5 16 % = 20 % x (d) (e) = 15 % x 2.2arrow_forward

- Determining missing items in return on investment computation One item is omitted from each of the following computations of the return on investment: Return on Investment = Profit Margin x Investment Turnover 27 % = 10 % x (a) (b) = 16 % x 0.75 24 % = (c) x 1.5 14 % = 20 % x (d) (e) = 15 % x 1.8 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank 1 (b) fill in the blank 2 % (c) fill in the blank 3 % (d) fill in the blank 4 (e) fill in the blank 5 %arrow_forward9. In a Balanced Scorecard, what perspective would a measure of the number of repeat orders be most likely to appear? (a) Market perspective (b) Customer perspective (c) Internal perspective (d) Financial perspectivearrow_forwardWhen should a company recognize revenue under GAAP? Multiple Choice When the promised performance has been satisfied. k ces All of the choices are necessary to recognize revenue. When delivery has occurred or services have been provided (rendered). When the price is measurable.arrow_forward

- Chapter 10: Applying Excel: Exercise (Part 2 of 2) Requirement 2: Revise the data in your worksheet as follows: A 1 Chapter 10: Applying Excel 2 3 Data 4 Sales 5 6 7 Net operating income ROI Average operating assets Minumum required rate of return If your formulas are correct, you should get the correct answers to the following questions. a. What is the ROI? Residual income B % c. Why is the residual income positive? $ 64,000,000 $ 7,680,000 $ 16,000,000 25% b. What is the residual income? (Negative amount should be indicated by a minus sign.)arrow_forwardDetermining missing items in return on investment computation One item is omitted from each of the following computations of the return on investment: Return on Investment Profit Margin Investment Turnover %3D 15 % 10 % (a) %3D (b) 24 % X 0.75 24 % (c) X 1.5 %3D 12 % 20 % (d) (e) 15 % 1.4 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) (b) % (c) % (d) (e) % IIarrow_forwardDetermining Missing Items in Return Computation One item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 20% 10 % (a) (b) 24 % 0.75 21 % (c) 1.5 10 % 20% (d) (e) 15 % 2. Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) (b) (c) (d) (e) %3Darrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License