Concept explainers

Compute equivalent units, unit costs, and costs assigned. (10 5), AP

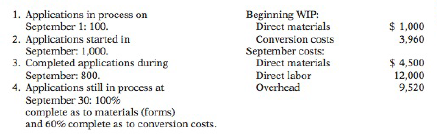

Using the data in E3-15, assume Santana Mortgage Company uses the FIFO method. Also, assume chat the applications in process on September 1 were 100% complete as to materials (forms) and 40% complete as to conversion costs. Assume

Instructions

(a) Determine the equivalent units of service (production) for materials and conversion costs.

(b) Compute the unit costs and prepare a cost reconciliation schedule.

E3-15 Santana Mortgage Company uses a

Determine equivalent units, unit costs, and assignment of costs. (LO 3, 4), AP

Materials are the forms used in the application process, and these costs are incurred at the beginning of the process. Conversion costs are incurred uniformly during the process.

Instructions

(a) Determine the equivalent units of service (production) for materials and conversion costs.

(b) Compute the unit costs and prepare a cost reconciliation schedule.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting: Tools for Business Decision Making

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Operations Management

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Financial Accounting: Tools for Business Decision Making, 8th Edition

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Pat and Company's ending inventory (at cost) was $87,500. The company would have had to pay $100,000 to replace the ending inventory. Before consideration of the lower-of-cost-or-market rule, the company's cost of goods sold was $60,000. What is the correct application of the LCM rule?(general account)arrow_forwardJuan company's output for the current solve this general accounting questionarrow_forwardProvide account answer and choose correct optionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning