Concept explainers

Learning Goals 2, 3, 4, 5

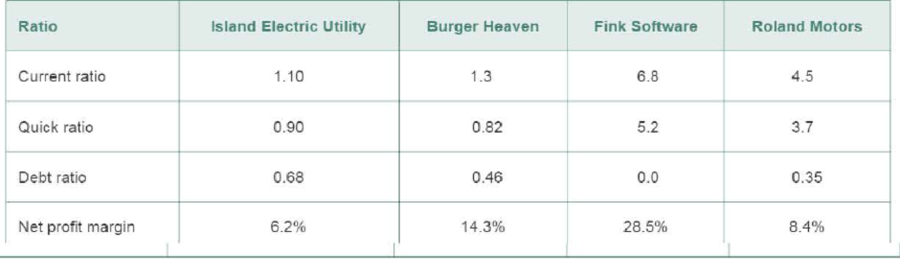

P3-10 Ratio comparisons Robert Arias recently inherited a stock portfolio from his uncle. Wishing to learn more about the companies in which he is now invested, Robert performs a ratio analysis on each one and decides to compare them to one another. Some of his ratios are listed below.

Assuming that his uncle was a wise investor who assembled the portfolio with care, Robert finds the wide differences in these ratios confusing. Help him out.

- a. What problems might Robert encounter in comparing these companies to one another on the basis of their ratios?

- b. Why might the current and quick ratios for the electric utility and the fast-food stock be so much lower than the same ratios for the other companies?

- c. Why might it be all right for the electric utility to carry a large amount of debt, but not the software company?

- d. Why wouldn't investors invest all their money in software companies instead of in less profitable companies? (Focus on risk and return.)

Trending nowThis is a popular solution!

Chapter 3 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Additional Business Textbook Solutions

Foundations Of Finance

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Corporate Finance

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Principles of Accounting Volume 1

Managerial Accounting (4th Edition)

- Using the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered for $4.61 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are summarized in the following table, a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share. b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond year 4 will be 3% rather than 2%. What effect would this finding have on your responses in parts a and b? a. The value of CoolTech's entire company is $ Data table (Click on…arrow_forwardUsing the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc., an IPO being offered for $22.92 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are summarized in the following table, E a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share. b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond 2023 will be 7% rather than 6%. What effect would this finding have on your responses in parts a and b? a. The value of CoolTech's entire company is $| (Round to the nearest…arrow_forwardQuestion 3 You just graduated with MBA in Accounting and Finance from the University of Professional Studies and are employed by JEK Investments Ltd, a brokerage firm in Ghana. Kweku The Don, an illiterate businessman, visited your firm for a piece of investment advice and possibly make some investments. Although an accomplished businessman, he was advised by his son to buy some shares on the Ghana Stock Exchange in other to diversify his portfolio. Your boss has asked you to consider either Cronox Industries or Zealous Incorporated The share prices and dividends for the two companies and the returns on the Ghana Stock Exchange are shown below for the period 2016 - 2021. Zealous Incorporated Stock price Dividend Stock price Dividend (GHe) Cronox Industries Year GSE Returns (GHe) Market Returns ) 2016 7.62 55.75 2017 2018 2019 12 0.90 60.00 2.25 0.07 10.75 17 0.95 57.25 48.75 2.50 0.12 1.00 2.75 0.08 2020 15.75 1.06 52.30 2.90 0.23 2021 17.25 1.15 48.75 3.00 0.18 a. Compare the two…arrow_forward

- Using Past Information to Estimate Required Returns Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. Chapter 8 discussed the basic trade-off between risk and return. In the capital asset pricing model (CAPM) discussion, beta was identified as the correct measure of risk for diversified shareholders. Recall that beta measures the extent to which the returns of a given stock move with the stock market. When using the CAPM to estimate required returns, we would like to know how the stock will move with the market in the future, but because we dont have a crystal ball, we generally use historical data to estimate this relationship with beta. As mentioned in Web Appendix 8A, beta can be estimated by regressing the individual stock's returns against the returns of the overall market. As an alternative to running our own regressions, we can rely on reported betas from a variety of sources. These published sources make it easy for us to readily obtain beta estimates for most large publicly traded corporations. However, a word of caution is in order. Beta estimates can often be quite sensitive to the time period in which the data are estimated, the market index used, and the frequency of the data used. Therefore, it is not uncommon to find a wide range of beta estimates among the various Internet websites. 4. Select one of the four stocks listed in question 3 by entering the company's ticker symbol on the financial website you have chosen. On the screen you should see the interactive chart. Select the six-month time period and compare the stock's performance to the SP 500's performance on the graph by adding the SP 500 to the interactive chart. Has the stock outperformed or underperformed the overall market during this time period?arrow_forwardReflection paper about this principle Principle #2: Expect Volatility (unexpected changes) and Profit from itinvesting in stocks means dealing with volatility. Instead of running for the exits during times of market stress, the smart investor greets downturns as chances to find great investments. Graham illustrated this with the analogy of "Mr. Market," the imaginary business partner of each and every investor. Mr. Market offers investors a daily price quote at which he would either buy an investor out or sell his share of the business. Sometimes, he will be excited about the prospects for the business and quote a high price. Other times, he is depressed about the business's prospects and quotes a low price.arrow_forwardCONCEPTUAL: RETURN ON EQUITY Which of the following statements is most correct? (Hint: Work Problem 4-16 before answering 4-17, and consider the solution setup for 4-16 as you think about 4-17.) a. If a firms expected basic earning power (BEP) is constant for all of its assets and exceeds the interest rate on its debt, adding assets and financing them with debt will raise the firms expected return on common equity (ROE). b. The higher a firms tax rate, the lower its BEP ratio, other things held constant. c. The higher the interest rate on a firms debt, the lower its BEP ratio, other things held constant. d. The higher a firms debt ratio, the lower its BEP ratio, other things held constant. e. Statement a is false, but statements b, c, and d are true.arrow_forward

- USING PAST INFORMATION TO ESTIMATE REQUIRED RETURNS Use online resources to work on this chapters questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. Chapter 8 discussed the basic trade-off between risk and return. In the capital asset pricing model (CAPM) discussion, beta was identified as the correct measure of risk for diversified shareholders. Recall that beta measures the extent to which the returns of a given stock move with the stock market. When using the CAPM to estimate required returns, we would like to know how the stock will move with the market in the future, but because we dont have a crystal ball, we generally use historical data to estimate this relationship with beta. As mentioned in Web Appendix 8A, beta can be estimated by regressing the individual stocks returns against the returns of the overall market. As an alternative to running our own regressions, we can rely on reported betas from a variety of sources. These published sources make it easy for us to readily obtain beta estimates for most large publicly traded corporations. However, a word of caution is in order. Beta estimates can often be quite sensitive to the time period in which the data are estimated, the market index used, and the frequency of the data used. Therefore, it is not uncommon to find a wide range of beta estimates among the various Internet websites. On the summary screen, you should see an interactive chart. Typically, you can chart performance over the last 24 hours, 1 month, 6 monthsup to 5 years, or even longer. Select different time periods and watch how the graph changes. On this screen you should also see a menu to select historical prices (historical data). Some websites will not only show daily activity but also weekly or monthly activity In addition, some websites will allow you to download the data into an Excel spreadsheet.arrow_forwardTutorial Questions Explain to John, your mentor, the primary goal of the organization? Your manager is requesting you to provide an explanation to the question. Would the role of a financial manager be likely to increase or decrease in importance if the rate of inflation increased? What is the difference between stock price maximization and profit maximization? What are the three principal forms of business organization? What are the advantages and disadvantages of each? What mechanisms exist to influence managers to act in shareholders’ best interests? What is an agency relationship? What agency relationships exist within a corporation? What are financial intermediaries, and what economic functions do they perform? How does an efficient capital market help to reduce the prices of goods and services? What is the term structure of interest rates? What is a yield curve? How should users and savers of…arrow_forwardQUESTION 5 1. Investor A is seeking to invest in commercial real estate (CRE). While Investor A employs talented individuals they lack the depth necessary to invest directly in the asset class. Investor A has a moderate risk tolerance, and desires income stability with the opportunity to realize meaningful property appreciation. Which answer choice best describes the investment quadrant and investment vehicle Investor A would most likely select to invest in CRE? a. Private Debt, Commingled Funds b. Public Debt, CMBS c. Public Equity, Individual Assets d. Public Equity, REITSarrow_forward

- QUESTION 1 INDICATE THE CORRECT ANSWER BY CHOOSING ONE OF THE FOUR OPTIONS A,B,C OR D. 1.1. The primary goal of the financial manager is _____A. minimising risk.B. maximising profit.C. maximising wealth.D. minimising return. 1.2. Shareholders receive realisable returns through _____A. earnings per share and cash dividends.B. increase in share price and cash dividends.C. increase in share price and earnings per share.D. profit and earnings per share. 1.3. The wealth of the owners of a company is represented by _____A. profits.B. earnings per share.C. share value.D. cash flow. 1.4. Wealth maximisation as the stated goal of a company implies enhancing the wealth of the _____A. board of directors.B. company’s employees.C. national government.D. company’s shareholders. 1.5. The goal of profit maximisation would result in prioritising _____A. cash flows available to shareholders.B. risk of the investment. C. earnings per share.D. timing of the returns. 1.6. Profit maximisation as a goal is…arrow_forwardElon is a financial manager with Wealth Creation, an investment advisory company. He must select specific investments, for example, stocks and bonds from a variety of investment alternatives. Which of the following statements is most likely to be the objectiuve function in this scenario? Your choice: Maximization of tax dues Maximization of expected return Minimization of the number of stocks held Maximization of investment risk Submit 3/6 Qsarrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning