Fundamental Accounting Principles

24th Edition

ISBN: 9781259916960

Author: Wild, John J., Shaw, Ken W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 2E

Exercise 3.2

Classifying

C3

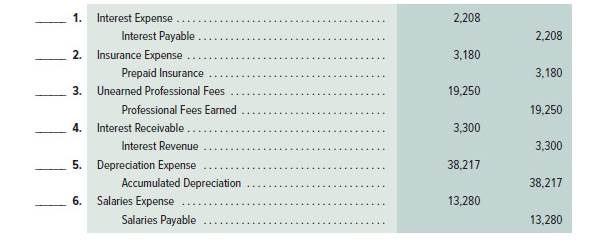

In the blank space beside each adjusting entry, enter the letter of the explanation A through F that most closely describes the entry.

A. To record this period’s depreciation expense.

B. To record accrued salaries expense.

C. To record this period’s use of a prepaid expense.

D. To record accrued interest revenue.

E. To record accrued interest expense.

F. To record the earning of previously unearned income.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

25.Adjusting entries

a. Bring asset and liability accounts to correct balances.

b. Assign revenues to the period in which they are earned.

c. Help to properly measure the period’s net income or net loss.

d. All of the above.

What adjusting journal entry is needed to record depreciation expense for the period?

Group of answer choices

1.a debit to Depreciation Expense; a credit to Cash

2.a debit to Accumulated Depreciation; a credit to Depreciation Expense

3.a debit to Depreciation Expense; a credit to Accumulated Depreciation

4.a debit to Accumulated Depreciation; a credit to Cash

Question 38

Which of the following adjusting entries need to be reversed in the folowing year?

Adjusting entry for the depreciation

Adjusting entries for the accruals

Adjusting entry for the bad debts

Adjusting entries are not reversed

Chapter 3 Solutions

Fundamental Accounting Principles

Ch. 3 - Prob. 1DQCh. 3 - Why is the accrual basis of accounting generally...Ch. 3 - Prob. 3DQCh. 3 - What is a prepaid expense and where is it reported...Ch. 3 - What type of assets requires adjusting entries to...Ch. 3 - 6. What contra account is used when recording and...Ch. 3 - What is an accrued revenue? Give an example..Ch. 3 - 8. If a company initially records prepaid expenses...Ch. 3 - Review the balance sheet of Apple in Appendix À....Ch. 3 - Prob. 10DQ

Ch. 3 - Prob. 11DQCh. 3 - Prob. 12DQCh. 3 - Periodic reporting C1 Choose from the following...Ch. 3 - Prob. 2QSCh. 3 - Identifying accounting adjustments Classify the...Ch. 3 - Concepts 0f adjusting entries During the year, a...Ch. 3 - Prepaid (deferred) expenses adjustments Pl For...Ch. 3 - Prepaid (deferred) expenses adjustments For each...Ch. 3 - Prob. 7QSCh. 3 - Accumulated depreciation adjustments Pl For each...Ch. 3 - Adjusting for depreciation P1 For each separate...Ch. 3 - Unearned (deferred) revenues adjustments For each...Ch. 3 - Adjusting for unearned (deferred) revenues P2 For...Ch. 3 - Accrued expenses adjustments Pl For each separate...Ch. 3 - Prob. 13QSCh. 3 - Accrued revenues adjustments P4 For each separate...Ch. 3 - Recording and analysing adjusting entries A1...Ch. 3 - QS3-16

Determining effects of adjusting...Ch. 3 - Preparing an adjusted trial balance P5 Following...Ch. 3 - Prob. 18QSCh. 3 - Prob. 19QSCh. 3 - Prob. 20QSCh. 3 - Preparing adjusting entries P4 Garcia Company had...Ch. 3 - Preparing adjusting entries P4 Cal Consulting...Ch. 3 - Prob. 1ECh. 3 - Exercise 3.2 Classifying adjusting entries C3 In...Ch. 3 - Exercise 3-3 Adjusting and paying accrued wages P3...Ch. 3 - Prob. 4ECh. 3 - Exercise 3-5 Adjusting and paying accrued expenses...Ch. 3 - Exercise 3-6 Preparing adjusting entries P1 P2 P3...Ch. 3 - Exercise 3-7 Preparing adjusting entries P1 P3 P4...Ch. 3 - Exercise 3-8 Analyzing and preparing adjusting...Ch. 3 - Prob. 9ECh. 3 - Preparing financial statements from a trial...Ch. 3 - Prob. 11ECh. 3 - Exercise 3-11 Adjusting for prepaid recorded as...Ch. 3 - Prob. 13ECh. 3 - Exercise 3-14 Preparing adjusting entries P1 P2 P3...Ch. 3 - Problem 3-1A Identifying adjusting entries with...Ch. 3 - Problem 3-2B Preparing adjusting and subsequent...Ch. 3 - Problem 3-3A Preparing adjusting entries, adjusted...Ch. 3 - Problem 3-4A Interpreting unadjusted and adjusted...Ch. 3 - Problem 3-5A Preparing financial statements from...Ch. 3 - Problem 3-6A

Recording prepaid expenses and...Ch. 3 - Prob. 1BPSBCh. 3 - Problem 3-2B Preparing adjusting and subsequent...Ch. 3 - Problem 3-3B Preparing adjusting entries, adjusted...Ch. 3 - Prolme 3-4B Interpreting unadjusted and adjusted...Ch. 3 - Problem 3-5B Preparing financial statements from...Ch. 3 - Problem 3-6B Recording prepaid expenses and...Ch. 3 - Prob. 3SPCh. 3 - Prob. 1GLPCh. 3 - Using transactions from the following assignments,...Ch. 3 - Using transactions from the following assignments,...Ch. 3 - Prob. 4GLPCh. 3 - Prob. 5GLPCh. 3 - Prob. 1AACh. 3 - Key figures for the recent two years of both Apple...Ch. 3 - Key comparative figures for Samsung. Apple, and...Ch. 3 - Prob. 1BTNCh. 3 - Prob. 2BTNCh. 3 - Access EDGAR online (SEC.gov) and locate the...Ch. 3 - Prob. 4BTNCh. 3 - BTN 3-5 Access EDGAR online (SEC.gov) and locate...Ch. 3 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What adjusting journal entry is needed to record depreciation expense for the period? A. a debit to Depreciation Expense; a credit to Cash B. a debit to Accumulated Depreciation; a credit to Depreciation Expense C. a debit to Depreciation Expense; a credit to Accumulated Depreciation D. a debit to Accumulated Depreciation; a credit to Casharrow_forwardReversing entries are used in income collected in advance when the | point adjusting entry has a Debit to an asset Debit to a Liabilty credit to Expense Credit to Incomearrow_forward2 3 1 4 5 7 8 9 10 12 Depreciation Expense Accumulated Depreciation Uneamed Revenue Services Revenue Insurance Expense Prepaid Insurance Salaries Payable Cash Prepaid Rent Cash Salaries Expense Salaries Payable Interest Receivable Interest Revenue Cash Accounts Receivable (from consulting) Cash Unearned Revenue Cash Interest Receivable Rent Expense Prepaid Rent Interest Expense Interest Payable 1,400 4,300 3,300 4,500 2,000 3,700 5,400 4,900 9,000 6,000 3,000 1,700 1,400 4,300 3,300 4,500 2,000 3,700 5,400 4,900 9,000 6,000 3,000 1,700arrow_forward

- Question 40 If the unearned interest is credited in the adjusting entry, which of the following will be affected? a llability account a nominal account "a capital account an asset accountarrow_forwardTime left 0:51:0 The statement 'revenue is recognized in the accounting period in which the performance obligation is satisfied' best describes the a. consistency characteristic O b. expense recognition principle Ос. revenue recognition principle O d. relevance characteristic Next pagearrow_forwardThe revenue recognition principle dictates that revenue be recognized in the accounting period Select one: a. after it is earned. b. before it is earned. wh the performance obligation is satisfied. C. d. in which it is collected Previous page Next pa hparrow_forward

- Explain the relationships between adjustments and thefollowing Chapter 3 concepts: ( a ) the time period assumption, ( b ) the revenue recognition principle, and ( c ) theexpense recognition principlearrow_forwardFor journal entries 1 through 10, identify the explanation that mostly closely describes it. A. To record this period's depreciation expense. B. To record accrued salaries expense. C. To record this period's use of a prepaid expense. D. To record accrued interest revenue. E. To record accrued interest expense. F. To record the earning of previously unearned income. G. To record cash receipt of unearned revenue. H. To record cash payment of an accrued expense. 1. To record cash receipt of an accrued revenue. J. To record cash payment of a prepaid expense. Explanation Insurance Expense Journal Entries Prepaid Insurance Interest Receivable Interest Revenue Interest Expense Interest Payable Accounts Payable Cash Cash Accounts Receivable (from services) Prepaid Rent Cash Unearned Revenue Services Revenue Cash Unearned Revenue Depreciation Expense Accumulated Depreciation Debit 3,180 3,300 2,208 1,700 12,300 500 19,250 4,200 38,217 Credit 3,180 3,300 2,208 1,700 12,300 500 19,250 4,200…arrow_forwardJ. To record cash payment of a prepaid expense. Explanation Insurance Expense Journal Entries Prepaid Insurance Interest Receivable Interest Revenue Interest Expense Interest Payable Accounts Payable Cash Cash Accounts Receivable (from services) Prepaid Rent Cash Unearned Revenue Cash Services Revenue Unearned Revenue Depreciation Expense Accumulated Depreciation Salaries Expense Salaries Payable ma Dobit 3,180 3,300 2,208 1,700 12,300 500 19,250 4,200 38,217 13,280 Credit 3,180 3,300 2,208 1,700 12,300 500 19,250 4,200 38,217 13,280arrow_forward

- Match the terms in column A with the correct definitions in column B, e.g. 1.12 C Column A 1.1 Provisions 1.2 Adjusting event 1.3 Onerous contract 1.4 Reimbursement asset 1.5 non-adjusting event 1.7 Contingent liabilities 1.8 Past events 1.9 Restructuring Column B 1.10 Contingent assets A) Possible assets, the existence of which is still to beconfirmed B) Events that occurred on or before the recognition date 1.6 Future operating losses F) Changes either the scope of the business or the manner in which the business is conducted. C) Those that do not meet either the definition or recognitioncriteria of a liability. D) A provision may never be recognized as they areavoidable. E) Liabilities that involve uncertainty in terms of either theamount or timing of its settlement G) Events that provide evidence of conditions that existed asat the end of the period. H) Contract where the unavoidable costs of meeting theobligation are more than economics benefits expected 1) Events that are…arrow_forwardQuestion 7 Which of the following best describes the following entry: Recognizing revenue relating to work that you just completed that you were paid for in advance? O Adjusting entry O Paid bill entry O Accrual entry O Deferral entry O Cash entryarrow_forwardQUESTION 49 Match the statements below with the accounting assumption, characteristic, or principle to which the statement relates. Assumptions/characteristics/principles may be used once, more than once, or not at all. V Recorded when the performance obligation is satisfied. a. Revenue recognition principle V The reason for recording accruals and deferrals in adjusting entries. b. Matching principle Valuing assets at amounts originally paid for them. C. Historical cost principle d. Entity assumed to have a long life Going concern assumption Description of significant accounting policies and unusual events. e. Full disclosure principle f. Information has predictive and confirmatory value. Relevance characteristic 8. Consistency characteristicarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License