Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 2AE

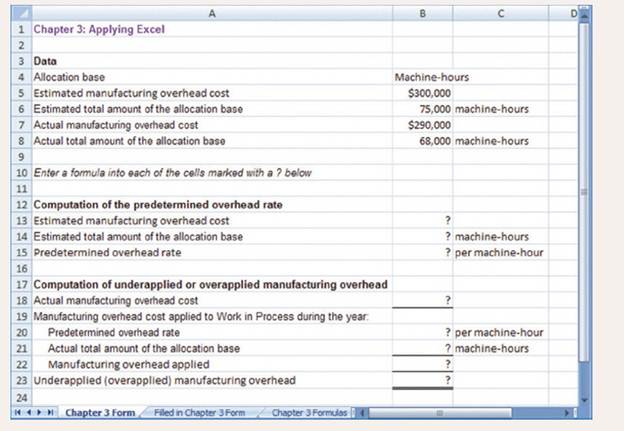

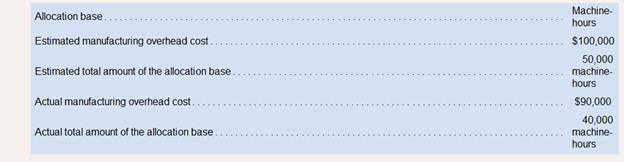

The Excel worksheet form that appears below is to be used to recreate part of the example relating to Turbo Crafters that appears earlier in the chapter. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

2. Determine the under applied (over applied) manufacturing

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate the gross profit percentage

MCQ

need this general accounting subject solutions

Chapter 3 Solutions

Introduction To Managerial Accounting

Ch. 3.A - Carmen Company is a manufacturer that completed...Ch. 3.A - Transaction Analysis L03-5 Adams Company is a...Ch. 3.A - Transaction Analysis L03-5 Dixon Company is a...Ch. 3.A - A Transaction Analysis L03-5 Morrison Company uses...Ch. 3.A - Prob. 5PCh. 3.A - Transaction Analysis Brooks Corporation uses a...Ch. 3 - What is the link that connect the schedule of cost...Ch. 3 - What account is credited when overhead cost is...Ch. 3 - What is under applied overhead? Over applied...Ch. 3 - Provide two reason why overhead might be under...

Ch. 3 - What adjustment is made for under applied overhead...Ch. 3 - How do you compute the raw materials used in...Ch. 3 - How do you compute the total manufacturing cost...Ch. 3 - How do you compute the cost of goods manufactured?Ch. 3 - How do you compute the unadjusted cost of goods...Ch. 3 - How do direct labor costs flows through a...Ch. 3 - The Excel work sheet form that appears below is to...Ch. 3 - The Excel worksheet form that appears below is to...Ch. 3 - The Excel worksheet form that appears below is to...Ch. 3 - The Excel worksheet form that appears below is to...Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Prob. 4F15Ch. 3 - Prob. 5F15Ch. 3 - Prob. 6F15Ch. 3 - Prob. 7F15Ch. 3 - Prob. 8F15Ch. 3 - Prob. 9F15Ch. 3 - Bunnell Corporation is a manufacturer tint uses...Ch. 3 - Prob. 11F15Ch. 3 - Prob. 12F15Ch. 3 - Prob. 13F15Ch. 3 - Prob. 14F15Ch. 3 - Prob. 15F15Ch. 3 - Prepare Journal Entries L03-1 Larned Corporation...Ch. 3 - Prepare Accounts L03-2, L03-4 Jurvin Enterprises...Ch. 3 - Schedules of Cost of Goods Manufactured and Cost...Ch. 3 - Under applied and Overapplied Overhead Osborn...Ch. 3 - Journal Entries and T-Accounts 103-1,103-2 The...Ch. 3 - EXERCISE 3-6 Schedules of Cost of Goods...Ch. 3 - Applying Overhead; Cost of Goods Manufactured...Ch. 3 - Applying Overhead; Journal Entries; Disposing of...Ch. 3 - Applying Overhead; T-Accounts; Journal Entries...Ch. 3 - Applying Overhead; Journal Entries; T-accounts...Ch. 3 - PROBLEM 3-11 T-Account Analysis of cost Flows...Ch. 3 - PROBLEM 3-12 Predetermined Overhead Rate;...Ch. 3 - Schedules of Cost of Goods Manufactured and Cost...Ch. 3 - Schedule of Cost of Goods Manufactured; Overhead...Ch. 3 - Journal Entries; T-Accounts; Financial Statements...Ch. 3 - Comprehensive problem L03-1, L03-2, L03-4 Gold...Ch. 3 - Cost Flows; T-Accounts; Income Statement L03-z...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hii expert please provide correct answer general Accountingarrow_forwardchoose best answerarrow_forwardConsider the following information for a particular company and calculate the gross profit percentage. Sales Cost of goods sold Beginning inventory Ending inventory Beginning accounts receivable $29,100,120 $21,225,000 55,612 53,644 2,279,112 Beginning allowance for bad debts (125,560) Ending accounts receivable 2,345,591 Ending allowance for bad debts (113,824)arrow_forward

- Please help me with this question general Accountingarrow_forwardcorrect answer please managerial accountingarrow_forwardGiven the following information how much raw material was transferred to work in progress on January 31? Inventory on January 1 is $350,000, raw materials purchased in January are $860,000, and raw materials inventory on January 31 is $240,000. A: $880,000 B: $970,000 C: $650,000 D: $780,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY