Concept explainers

Schedules of Cost of Goods

L03-3

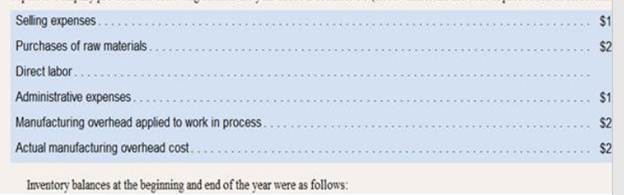

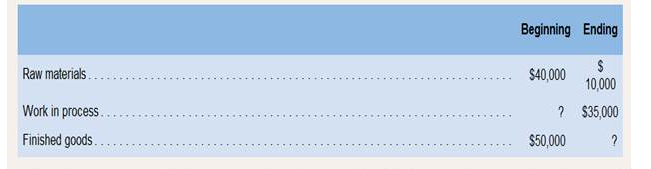

Superior Company provided the following data for the et2ded December 31 (all raw materials are in production as direct materials):

The total manufacturing costs for the year were $683,000; the cost of goods available for sale totaled $740,000; the unadjusted cost of gods sold totaled $660,000; and the net operating income was $30,000. The company's under applied or over appliedoverhead is closed to Cost of Goods Sold.

Required:

Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured)

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Introduction To Managerial Accounting

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardCost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for 400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips accounting records provide the following information: Required: 1. Prepare a statement of cost of goods manufactured. 2. Compute the average cost of producing one unit of product in the year. 3. Prepare an income statement for external users.arrow_forward

- During the year, a company purchased raw materials of $77,321 and incurred direct labor costs of $125,900. Overhead Is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardOrinder Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 275,800, direct labor cost was 153,000, and overhead cost was 267,300. There were 25,000 units produced. Unit manufacturing cost (rounded to the nearest cent) is a. 28.40 b. 27.98 c. 34.95 d. 27.55arrow_forwardCost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forward

- The following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the year ended December 31: Assume that 8,500 million of cost of goods sold and 4,000 million of selling, administrative, and other expenses were fixed costs. Inventories at the beginning and end of the year were as follows: Also, assume that 30% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Caterpillar Inc. Round numbers to nearest million. b. Explain the difference between the amount of operating income reported under the absorption costing and variable costing concepts. Round numbers to nearest million.arrow_forwardMV Company showed cost of goods sold of P4,320,000 in the statement of comprehensive income after the first year of operations. The total manufacturing cost comprised the following: Materials used 50% Direct labor incurred 30% Manufacturing overhead 20% Goods in process at year-end amounted to 10% of the total manufacturing cost. Finished goods at year-end amounted to 20% of the cost of goods manufactured. What is the amount of the direct labor cost incurred?arrow_forwardMaterials used, P326,000. Total manufacturing costs charged to production during the year (including direct materials, direct labor, and factory overhead applied at the rate of 60% of direct labor cost), P686,000. Cost of goods available for sale, P826,000. Selling and general expenses, P25,000. 1.What is the amount of direct materials purchased during the year? 2.What is the total conversion cost? 3.What is the direct labor costs charged to production during the year? 4.How much is the total prime cost? 5.The following selected information pertains to Top Gun Manufacturing Inc.: Direct materials of P625,000, indirect materials of P125,000, direct labor of P750,000, indirect labor of P112,500, and factory overhead (not including indirect materials and indirect labor) of P375,000. How much is the conversion cost.arrow_forward

- The following information is given for the activity of the accounts of the company "PLIADES" during the cost period from 1/1 – 30/6. Initial stock (r.a.) of direct materials = 5100, n.a. of semi-finished products = 6200, n.a. of finished products = 7700. During the period, purchases of materials worth 29,000 were made in cash. The cost of direct labor was 58000. The charging rate of the CBS was 25% of the cost of direct labour. Sales totaled 198,000, before returns were 1.5% of sales. Sales were made as follows: 1/3 with promissory notes, 1/3 cash and 1/3 with credit. The promissory notes incurred interest worth 1400 euros. The final stocks were: direct materials = 4500, semi-finished products = 3900 and finished products = 6800. The company's expenses during the above period were: depreciation = 1500, exhibition expenses = 800, factory insurance premiums = 650, administrative employees' fees=22000, depreciation of factory machinery = 1400, rent=6500, salesmen's travel expenses =…arrow_forwardThe following information is given for the activity of the accounts of the company "PLIADES" during the cost period from 1/1 – 30/6. Initial stock (r.a.) of direct materials = 5100, n.a. of semi-finished products = 6200, n.a. of finished products = 7700. During the period, purchases of materials worth 29,000 were made in cash. The cost of direct labor was 58000. The charging rate of the CBS was 25% of the cost of direct labour. Sales totaled 198,000, before returns were 1.5% of sales. Sales were made as follows: 1/3 with promissory notes, 1/3 cash and 1/3 with credit. The promissory notes incurred interest worth 1400 euros. The final stocks were: direct materials = 4500, semi-finished products = 3900 and finished products = 6800. The company's expenses during the above period were: depreciation = 1500, exhibition expenses = 800, factory insurance premiums = 650, administrative employees' fees=22000, depreciation of factory machinery = 1400, rent=6500, salesmen's travel expenses =…arrow_forwardThe total manufacturing costs for the year were $680,000; the cost of goods available for sale totaled $725,000; the unadjusted cost of goods sold totaled $665,000; and the net operating income was $30,000. The company’s underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.)arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,