Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN: 9781305635937

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 16P

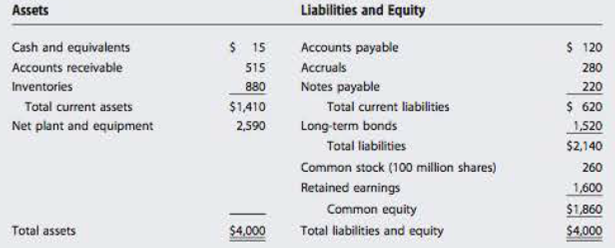

FINANCIAL STATEMENTS The Davidson Corporation's

Davidson Corporation: Balance Sheet as of December 31, 2016 (Millions of Dollars)

Davidson Corporation: Income Statement for Year Ending December 31, 2016 (Millions of Dollare)

| Sales | $6.250 |

| Operating costs excluding |

5.230 |

| EBITDA | $1.000 |

| Depreciation & amortization | 2.20 |

| EBIT | $ 800 |

| Interest | 180 |

| EBT | $ 620 |

| Taxes (40%) | 248 |

| Net income | $ 372 |

| Common dividends paid | $ 146 |

| Earnings per share | $ 3,72 |

- a. Construct the statement of

stockholders equity for December 31, 2016. No common stock was issued during 2016. - b. How much money has been reinvested in the firm over the years?

- c. At the present time, how large a check could be written without it bouncing?

- d. How much money must be paid to current creditors within the next year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial information for Powell Panther Corporation is shown below:

Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars)

2018

Sales

$

1,625.0

$

2017

1,300.0

Operating costs excluding depreciation and amortization

1,300.0

1,105.0

EBITDA

$

325.0

$

195.0

Depreciation and amortization

39.0

31.0

Earnings before interest and taxes (EBIT)

$

286.0

$

164.0

Interest

36.0

29.0

Earnings before taxes (EBT)

$

250.0

$

135.0

Taxes (40%)

100.0

54.0

Net income

$

150.0

$

81.0

Common dividends

$

135.0

$

65.0

Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars)

2018

Assets

Cash and equivalents

$

23.0

$

2017

18.0

Accounts receivable

164.0

143.0

Inventories

343.0

312.0

Total current assets

$

530.0

$

473.0

Net plant and equipment

390.0

312.0

Total assets

$

920.0

$

785.0

Liabilities and Equity…

Financial information for Powell Panther Corporation is shown below:

Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars)

2018

2017

Sales

$

1,800.0

$

1,500.0

Operating costs excluding depreciation and amortization

1,395.0

1,275.0

EBITDA

$

405.0

$

225.0

Depreciation and amortization

43.0

39.0

Earnings before interest and taxes (EBIT)

$

362.0

$

186.0

Interest

40.0

33.0

Earnings before taxes (EBT)

$

322.0

$

153.0

Taxes (40%)

128.8

61.2

Net income

$

193.2

$

91.8

Common dividends

$

174.0

$

73.0

Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars)

2018

2017

Assets

Cash and equivalents

$

23.0

$

18.0

Accounts receivable

248.0

225.0

Inventories

396.0

360.0

Total current assets

$

667.0

$

603.0

Net plant and equipment

429.0

390.0

Total assets

$

1,096.0

$

993.0

Liabilities and Equity

Accounts…

Financial information for Powell Panther Corporation is shown below:

Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars)

2018

2017

Sales

$

3,900.0

$

3,000.0

Operating costs excluding depreciation and amortization

2,925.0

2,550.0

EBITDA

$

975.0

$

450.0

Depreciation and amortization

90.0

69.0

Earnings before interest and taxes (EBIT)

$

885.0

$

381.0

Interest

86.0

66.0

Earnings before taxes (EBT)

$

799.0

$

315.0

Taxes (40%)

319.6

126.0

Net income

$

479.4

$

189.0

Common dividends

$

431.0

$

151.0

Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars)

2018

2017

Assets

Cash and equivalents

$

38.0

$

30.0

Accounts receivable

432.0

360.0

Inventories

819.0

630.0

Total current assets

$

1,289.0

$

1,020.0

Net plant and equipment

897.0

690.0

Total assets

$

2,186.0

$

1,710.0

Liabilities and Equity…

Chapter 3 Solutions

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

Ch. 3 - Prob. 1QCh. 3 - Who are some of the basic users of financial...Ch. 3 - If a typical firm reports 20 million of retained...Ch. 3 - Explain the following statement: Although the...Ch. 3 - Prob. 5QCh. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - How are managements actions incorporated in EVA...Ch. 3 - Explain the following statement: Our tax rates are...

Ch. 3 - Prob. 11QCh. 3 - How does the deductibility of interest and...Ch. 3 - BALANCE SHEET The assets of Dallas Associates...Ch. 3 - INCOME STATEMENT Byron Books Inc recently reported...Ch. 3 - INCOME STATEMENT Patterson Brothers recently...Ch. 3 - STATEMENT OF STOCKHOLDERS EQUITY In its most...Ch. 3 - MVA Harper Industries has 900 million of common...Ch. 3 - Prob. 6PCh. 3 - EVA Barton Industries has operating income for the...Ch. 3 - PERSONAL TAXES Susan and Stan Britton are a...Ch. 3 - BALANCE SHEET Which of the following actions are...Ch. 3 - STATEMENT OF STOCKHOLDERS EQUITY Electronics World...Ch. 3 - EVA For 2016, Gourmet Kitchen Products reported 22...Ch. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - FREE CASH FLOW Arlington Corporations financial...Ch. 3 - INCOME STATEMENT Edmonds Industries is...Ch. 3 - FINANCIAL STATEMENTS The Davidson Corporation's...Ch. 3 - Prob. 17PCh. 3 - Prob. 18PCh. 3 - FINANCIAL STATEMENTS, CASH FLOW, AND TAXES Laiho...Ch. 3 - Prob. 20ICCh. 3 - Prob. 1DQCh. 3 - Prob. 2DQCh. 3 - Prob. 3DQCh. 3 - Prob. 4DQCh. 3 - Prob. 5DQ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Financial Information for Powell Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) 2020 $2,500.0 2,125.0 $375.0 75.0 $300.0 55.0 $ 245.0 98.0 $147.0 $152.1 $117.6 Common dividends Powell Panther Corporation: Balance Sheets as of December 31 (millions of dollars) 2020 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization Earnings before interest and taxes (EBIT) Interest Earnings before taxes (EBT) Taxes (25%) Net Income Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets 2021: $ b. What was the 2021 free cash flow? 2021 $2,875.0 2,444.0 $ 431.0 86.0 $345.0 63.3 $281.7 112.7 $ 169.0 $ -Select- 2021 46.0 450.0 540.0 $1,036.0 863.0 $1,899.0 Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities $601.5 Long-term bonds 575.0 Total liabilities $1,176.5 661.5 Common…arrow_forwardTrying to calculate, Times Interest Earned. tax rate is 22% 3M Company Consolidated Statements Of Earnings $ millions Dec. 31, 2018 Dec. 31, 2017 Net sales $ 32,765 $ 31,657 Cost of sales $ 16,682 $ 16,055 Research, development and engineering expenses $ 1,821 $ 1,870 Selling, general and administrative expenses $ 7,602 $ 6,626 Gain on sale of business -$ 547 -$ 586 Total operating expenses $ 25,558 $ 23,965 Operating income $ 7,207 $ 7,692 Nonoperating expense, net $ 207 $ 144 Earnings before income taxes $ 7,000 $…arrow_forwardRFT Corporation 2018 Statement of comprehensive income ($ in millions) Sales $10,850 Costs of goods sold $8,410 Depreciation $190 EBIT $2,250 Interest $ 165 EBT $2,085 Taxes $710 Net income $1,375 Dividends paid $300 Addition to retained earnings $ 1,075 RFT Corporation Statement of financial position Years ended 2017 and 2018 ($ in millions ) 2017 2018 2017 2018 Cash $980 $960 Accounts payable $950 $730 Accounts rec. $950 $880 Notes payable $40 $150 Inventory $2,120 $1,750 Total $990 $ 880 Total $5,050 $3,590 Long-term debt $2,225 $100 Fixed assets $1,700 $2,540 Common stock $2,030 $ 3,570 Retained earnings $505 $1,580 Total assets $ 5,750 $6,130 Total liabilities and Owner's equity $5,750 $6, 130 During 2018, the quick ratio: Question 22 options: Increased. Decreased. Remained constant. Changed, but the direction of the change cannot be determined. None of the choices are correct.arrow_forward

- es Current assets Cash Accounts receivable Inventory Total Assets Sales Cost of goods sold Depreciation Fixed assets Net plant and equipment $49,749 $74,097 Total assets $70,215 $97,107 EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INC. Balance Sheets as of December 31, 2015 and 2016 2015 2016 SMOLIRA GOLF, INC. 2016 Income Statement Net income Dividends Retained earnings $3,251 4,777 $ 3,407 5,801 13,802 12,438 $20,466 $23,010 $11,885 23,322 $186,970 126,003 5,353 $ 55,614 1,450 $ 54,164 18,957 $ 35,207 2015 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total 2016 $ 2,143 $ 2,580 1,740 2,096 88 105 $3,971 $4,781 $13,600 $16,360 $37,000 15,644 $37,000 38,966 $52,644 $75,966 Total liabilities and owners' equity $70,215 $97,107 Construct the DuPont identity for Smolira Golf. (Do not round intermediate calculations and round your answers to 2…arrow_forwardPARROTHEAD ENTERPRISES 2020 and 2021 Partial Balance Sheets Assets 2020 2021 Liabilities and Owners’ Equity 2020 2021 Current assets $ 1,278 $ 1,403 Current liabilities $ 566 $ 613 Net fixed assets 5,057 6,120 Long-term debt 2,760 2,939 PARROTHEAD ENTERPRISE 2021 Income Statement Sales $ 15,874 Costs 7,243 Depreciation 1,435 Interest paid 436 a. What is owners' equity for 2020 and 2021? b. What is the change in net working capital for 2021? c-1. In 2021, Parrothead Enterprises purchased $2,640 in new fixed assets. How much in fixed assets did the company sell? c-2. In 2021, Parrothead Enterprises purchased $2,640 in new fixed assets. What is the cash flow from assets for the year? The tax rate is 24 percent. d-1. During 2021, Parrothead Enterprises raised $564 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? d-2. During 2021, Parrothead Enterprises raised $564 in new…arrow_forwardAssets Current assets Cash Accounts receivable Inventory Total Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (23%) Earnings before interest and taxes Interest paid Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Dividends Retained earnings Fixed assets Net plant and equipment $465,700 $ 521,583 Total Cash, beginning of the year Operating activities 2020 $35,685 $39,032 28.936 43,152 $58,136 $111,120 Net cash from operating activities Investment activities SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 18,451 4,000 Cash, end of year Net cash from investment activities Financing activities Net cash from financing activities SMOLIRA GOLF CORPORATION Statement of Cash Flows For 2021 $ 523,836 $ 632,703 Total liabilities and owners' equity Liabilities and Owners' Equity Current liabilities $ 24,000 39,144 Accounts payable Notes payable Other Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Prepare…arrow_forward

- Here are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales $ 887.00 Cost of goods sold 747.00 Depreciation 37.00 Earnings before interest and taxes (EBIT) $ 103.00 Interest expense 18.00 Income before tax $ 85.00 Taxes 17.85 Net income $ 67.15 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Current assets $ 375 $ 324 Long-term assets 270 228 Total assets $ 645 $ 552 Liabilities and shareholders’ equity Current liabilities $ 200 $ 163 Long-term debt 114 127 Shareholders’ equity 331 262 Total liabilities and shareholders’ equity $ 645 $ 552 The company’s cost of capital is 8.5%. Required: What is the company’s return on capital? (Use start-of-year rather than average capital.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. P.S- Answer is not 26.48%arrow_forwardHere are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales $ 887.00 Cost of goods sold 747.00 Depreciation 37.00 Earnings before interest and taxes (EBIT) $ 103.00 Interest expense 18.00 Income before tax $ 85.00 Taxes 17.85 Net income $ 67.15 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Current assets $ 375 $ 324 Long-term assets 270 228 Total assets $ 645 $ 552 Liabilities and shareholders’ equity Current liabilities $ 200 $ 163 Long-term debt 114 127 Shareholders’ equity 331 262 Total liabilities and shareholders’ equity $ 645 $ 552 The company’s cost of capital is 8.5%. Required: Calculate Watervan’s economic value added (EVA). Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. What is the company’s return on capital? (Use start-of-year rather than average capital.) Note: Do not…arrow_forwardHere are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales $900.00 Cost of goods sold Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax 760.00 50.00 $ 90.00 31.00 $ 59.00 12.39 $ 46.61 Taxes Net income BALANCE SHEET (Figures in $ millions) End of Start Year of Year Assets Current assets $ 388 $ 350 Long-term assets 296 241 Total assets $ 684 $ 591 Liabilities and shareholders' equity Current liabilities $ 176 $ 213 Long-term debt Shareholders' equity 127 140 344 256 Total liabilities and shareholders' equity $ 684 $ 572 The company's cost of capital is 8.5%. a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's return on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2…arrow_forward

- WESTON ENTERPRISES 2019 and 2020 Partial Balance Sheets Assets Liabilities and Owners’ Equity 2019 2020 2019 2020 Current assets $ 1,248 $ 1,305 Current liabilities $ 568 $ 600 Net fixed assets 5,777 6,023 Long-term debt 3,228 3,489 WESTON ENTERPRISES 2020 Income Statement Sales $ 17,529 Costs 5,203 Depreciation 1,532 Interest paid 708 a. What was owners' equity for 2019 and 2020? (Do not round intermediate calculations.) b. What was the change in net working capital for 2020? (Do not round intermediate calculations.) c-1. In 2020, the company purchased $3,110 in new fixed assets. How much in fixed assets did the company sell? (Do not round intermediate calculations.) c-2. In 2020, the company purchased $3,110 in new fixed assets. What was the cash flow from assets for the year? The tax rate is 25 percent. (Do not round intermediate calculations.) d-1. During 2020, the company raised $772 in new…arrow_forwardFinancial information for Powell Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (millions of dollars) 2021 2020 Sales $ 2,500.0 $ 2,000.0 Operating costs excluding depreciation and amortization 1,938.0 1,700.0 EBITDA $ 562.0 $ 300.0 Depreciation and amortization 62.0 54.0 Earnings before interest and taxes (EBIT) $ 500.0 $ 246.0 Interest 55.0 44.0 Earnings before taxes (EBT) $ 445.0 $ 202.0 Taxes (25%) 178.0 80.8 Net income $ 267.0 $ 121.2 Common dividends $ 240.3 $ 97.0 Powell Panther Corporation: Balance Sheets as of December 31 (millions of dollars) 2021 2020 Assets Cash and equivalents $ 36.0 $ 30.0 Accounts receivable 375.0 300.0 Inventories 468.0 360.0 Total current assets $ 879.0 $ 690.0 Net plant and equipment 621.0 540.0 Total assets $ 1,500.0 $ 1,230.0 Liabilities and Equity Accounts payable $ 250.0 $ 200.0 Accruals 75.0…arrow_forwardPartial Income Statement of ABC Corp. In 2021 Sales revenue $350,200 Cost of goods sold $142,000 Fixed costs $43,000 Selling, general, and administrative expenses $27,800 Depreciation $45,800 Interest expense $0 Tax rate 40% The Net Income for ABC Corp. in 2021 is $___________ (round to the nearest dollar amount)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License