Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 27, Problem 2P

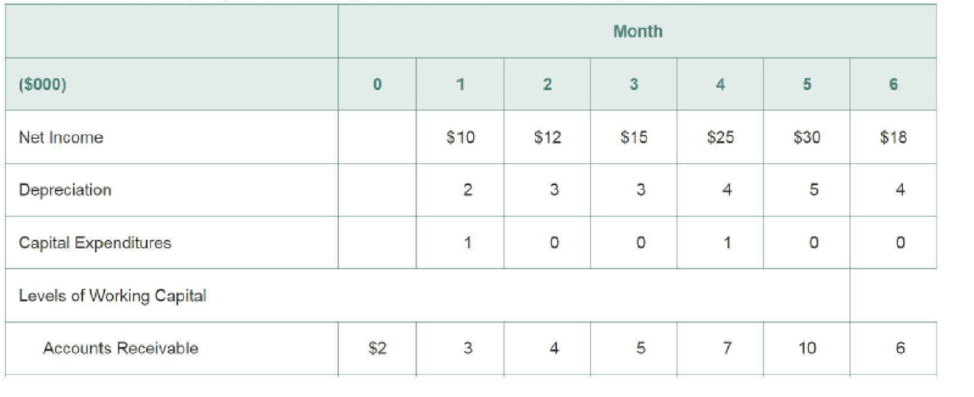

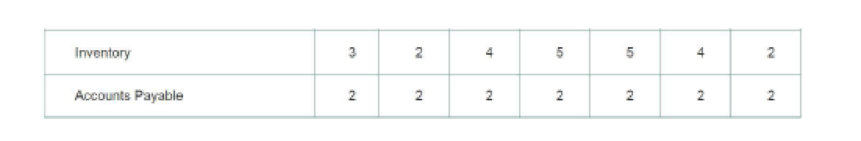

Sailboats Etc. is a retail company specializing in sailboats and other sailing-related equipment. The following table contains financial

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Assume that you have started a date fruit processing business in Ibri. Your business will reach to peak stage from the month of June to October (because of season) and again it will become normal from November to May. Therefore you need some extra capital for the period of 5 months. There are some options to mobilize the capital from the local financial market like equity shares, preference shares, term bonds and serial bonds.

Which of the given source is suitable for your business? Explain your answer with suitable reason.

Problem 3-21 Income versus Cash Flow (LO3)

Ponzi Products produced 100 chain-letter kits this quarter, resulting in a total cash outlay of $10 per unit. It will sell 50 of the kits next

quarter at a price of $11, and the other 50 kits in the third quarter at a price of $12. It takes a full quarter for Ponzi to collect its bills from

its customers. (Ignore possible sales in earlier or later quarters.) (Negative amount should be indicated by a minus sign.)

a. What is the net income for Ponzi next quarter?

Net income in second quarter

b. What are the cash flows for the company this quarter?

Cash flow in first quarter

You have been provided Income Statement and Financial Position Statement of Oman Cement Company SAOG for the year 2018 and 2019.

1. Discuss some of the factors that could impact the working capital management of Oman Cement Company SAOG?

Chapter 27 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 27.1 - Prob. 1CCCh. 27.1 - What is the effect of seasonalities on short-term...Ch. 27.2 - Prob. 1CCCh. 27.2 - What is the difference between temporary and...Ch. 27.3 - Prob. 1CCCh. 27.3 - Describe common loan stipulations and fees.Ch. 27.4 - What is commercial paper?Ch. 27.4 - How is interest paid on commercial paper?Ch. 27.5 - Prob. 1CCCh. 27.5 - What is the difference between a floating lien and...

Ch. 27 - Prob. 1PCh. 27 - Sailboats Etc. is a retail company specializing in...Ch. 27 - What is the difference between permanent working...Ch. 27 - Quarterly working capital levels for your firm for...Ch. 27 - Prob. 5PCh. 27 - Prob. 6PCh. 27 - Prob. 7PCh. 27 - Prob. 8PCh. 27 - Which of the following one-year 1000 bank loans...Ch. 27 - The Needy Corporation borrowed 10,000 from Bank...Ch. 27 - Prob. 11PCh. 27 - Prob. 12PCh. 27 - Prob. 13PCh. 27 - The Signet Corporation has issued four-month...Ch. 27 - Prob. 15PCh. 27 - Prob. 16PCh. 27 - Prob. 17PCh. 27 - Prob. 18P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following historical information is from Assisi Community Markets. Calculate the working capital and current ratio for each year. What observations do you make, and what actions might the owner consider taking?arrow_forwardYou are a financial Manager of Chevron Corp. You need to assess the effectiveness of working capital management of the company for 2018 using the following data. What is the 2018 Receivable turnover? 2017 Account Receivable = 15,353 000 2018 Account Receivable = 15.050,00O 2017 Inventory = 5,585.000 2018 Inventory = 5 704.00O 2017 Accounts Payable= 14 565 00I 2018 Accounts Payable = 13 953 000 2017 Sales 134,674 000 2018 Sales 158.902 000. 2017 Cost of Sales = 95 114.000 2018 Cost of Sales = 113 997 000 2017 Purchases= 95 114 000 2018 PurchaSes = 123 435 000arrow_forwarda) Prepare a projected cash flow statement for the six months ending 30 November that shows the cash balance at the end of each month b) Compute the projected inventories levels at the end of each month for the six months to 30 November c) Prepare a projected income statement for the six months ending 30 November. d) What problems is Newtake Records Ltd likely to face in the next six months? Can you suggest how the business might deal with these problemsarrow_forward

- Karen Lamont is in the process of starting a new business and wants to forecast the first year's income statement and balance sheet. She has made several assumptions, which are shown below: Lamont has projected the firm's sales will be $1 million in the first year. She believes that the operating and gross profit margins will be 20 percent and 50 percent, respectively. For working capital, Lamont has estimated the following: Accounts receivable as a percentage of sales: 12% Inventory as a percentage of sales: 15% Accounts payable as a percentage of sales: 7% Accruals as a percentage of sales: 5% A bank has agreed to loan her $300,000, consisting of $100,000 in short-term debt and $200,000 in long-term debt. Both loans will have an 8 percent interest rate. The firm's tax rate will be 30 percent. Lamont will need to purchase $350,000 in plant and equipment. Lamont will provide any other financing needed.Based on Lamont's assumptions in Situation 3, prepare a pro forma income…arrow_forwardKaren Lamont is in the process of starting a new business and wants to forecast the first year's income statement and balance sheet. She has made several assumptions, which are shown below: Lamont has projected the firm's sales will be $1 million in the first year. She believes that the operating and gross profit margins will be 20 percent and 50 percent, respectively. For working capital, Lamont has estimated the following: Accounts receivable as a percentage of sales: 12% Inventory as a percentage of sales: 15% Accounts payable as a percentage of sales: 7% Accruals as a percentage of sales: 5% A bank has agreed to loan her $300,000, consisting of $100,000 in short-term debt and $200,000 in long-term debt. Both loans will have an 8 percent interest rate. The firm's tax rate will be 30 percent. Lamont will need to purchase $350,000 in plant and equipment. Lamont will provide any other financing needed.If her estimates in Situation 3 are correct, what will be the firm's current…arrow_forwardhttps://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf Working Capital Management: Use Republic Bank Limited Annual Report 2022 to answer the Questions. Assess the company’s working capital position by analyzing its current assets and liabilities using common methods and measures. Evaluate the efficiency of the company’s working capital management strategies, including inventory management, accounts receivable, and accounts payable. Based on your assessment and evaluation above, provide brief recommendations in point form for improving the company’s working capital management practices.arrow_forward

- Barry’s Superstore wishes to prepare financial plans. Use the financial statements on the next page and the other information provided below to prepare the financial plans. The following financial data are also available: (1) The firm has estimated that its sales for next year will be $130,000. (2) The firm expects to pay $30,000 in cash dividends. (3) The firm wishes to maintain a minimum cash balance of $25,000. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm’s ending inventory represents 60% of Cost of Goods Sold. (6) A new machine costing $15,000 will be purchased next year. (7) Accounts payable will increase by 5%. (8) Unearned Revenue will be earned. (9) Notes Payable would decrease by $5000. (10) Short-Term Investments and common stock will remain unchanged. Requirement: a. Prepare a pro forma income statement for the year ended December 31, 2021, using the percent-of-sales method. Tax Rate is expected to be 15%. b. Prepare a pro forma balance…arrow_forwardBarry’s Superstore wishes to prepare financial plans. Use the financial statements on the next page and the other information provided below to prepare the financial plans. The following financial data are also available: (1) The firm has estimated that its sales for next year will be $130,000. (2) The firm expects to pay $30,000 in cash dividends. (3) The firm wishes to maintain a minimum cash balance of $25,000. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm’s ending inventory represents 60% of Cost of Goods Sold. (6) A new machine costing $15,000 will be purchased next year. (7) Accounts payable will increase by 5%. (8) Unearned Revenue will be earned. (9) Notes Payable would decrease by $5000. (10) Short-Term Investments and common stock will remain unchanged. Requirement: Prepare a pro forma income statement for the year ended December 31, 2021, using the percent-of-sales method. Tax Rate is expected to be 15%. Prepare a pro forma balance…arrow_forwardA firm has $600,00 in current assets and $150,000 in current liabilities. If it uses cash to pay $50,000 in accounts recievalbes will the current ratio increase or decraese? Will the net working capital increase or decrease or stay the same? Why?arrow_forward

- You are a financial Manager of Chevron Corp. You need to assess the effectiveness of working capital management of the company for 2018 using the following data. What is the 2018 Inventory turnover? 2017 Account Receivable = 15,353,000 2018 Account Receivable = 15,050,000 2017 Inventory = 5,585,000 2018 Inventory = 5,704,000 2017 Accounts Payable = 14,565,000 2018 Accounts Payable = 13,953,000 2017 Sales = 134,674,000 2018 Sales = 158,902,000 2017 Cost of Sales = 95,114,000 2018 Cost of Sales = 113,997,000 2017 Purchases = 95,114,000 2018 Purchases = 123,435,000arrow_forward1.How is the company's financial performance based on the data? 2.What do you think are the factors affecting the number of bookings throughout the year? 3. What can you say about the company's revenue for 2020? Regardless if it's good or not, give strategic decisions that can help improve the revenue from its current status 4. What are your analysis and insights on the Financial statement.arrow_forwardhttps://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf (Use the link the answer the question below) Working Capital Management : Use Republic Bank Limited Annual Report 2022 to answer the Questions. Assess the company’s working capital position by analyzing its current assets and liabilities using common methods and measures. Evaluate the efficiency of the company’s working capital management strategies, including inventory management, accounts receivable, and accounts payable. Based on your assessment and evaluation above, provide brief recommendations in point form for improving the company’s working capital management practices.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license