Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 26, Problem 15P

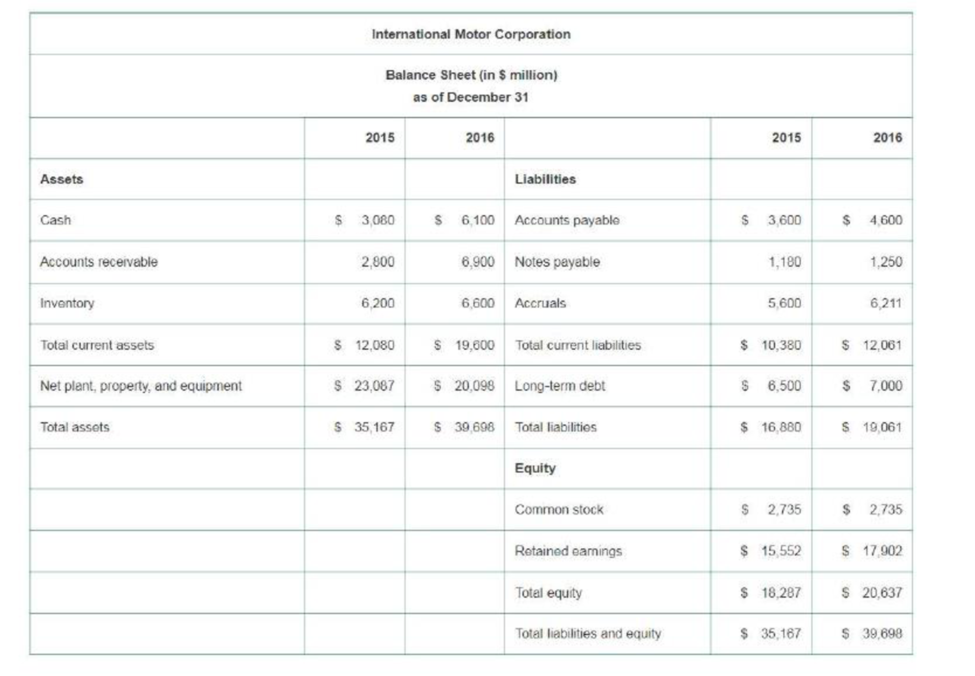

Use the financial statements supplied on the next page for International Motor Corporation (IMC) to answer the following questions.

- a. Calculate the cash conversion cycle for IMC for both 2015 and 2016. What change has occurred, if any? All else being equal, how does this change affect IMC’s need for cash?

- b. IMC’s suppliers offer terms of Net 30. Does it appear that IMC is doing a good job of

managing its accounts payable?

| International Motor Corporation | ||

| Income Statement (in $ million) for the Years Ending December 31 | ||

| 2015 | 2016 | |

| Sales | $ 60,000 | $ 75,000 |

| Cost of goods sold | 52,000 | 61,000 |

| Gross profit | $ 8,000 | $ 14,000 |

| Selling and general and administrative expenses | 6,000 | 8,000 |

| Operating profit | $ 2,000 | $ 6,000 |

| Interest expense | 1,400 | 1,300 |

| Earnings before tax | $ 600 | $ 4,700 |

| Taxes | 300 | 2,350 |

| Earnings after tax | $ 300 | $ 2,350 |

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the financial statements supplied below for International Motor Corporation(IMC) to answer the following questions.

Calculate the cash conversion cycle for IMC for both 2015 and 2016. What change has occurred, if any? All else being equal, how does this change affect IMC’s need for cash?

IMC’s suppliers offer terms of Net 30. Does it appear that IMC is doing a good job of managing its accounts payable?

Here is the complete worksheet I am working on for my homework. The blank spots I had to fill in are:

Income statement: sales and costs of goods sold for 2018

Balance sheet was cash and net fixed assets for 2018

Cash flow statements were: depreciation, accounts receivable and accts payable

Can you let me know if the information I have provided looks correct? I just want to make sure I am on the right track. Thank you!

Income Statement

For the year:

2016

2017

2018

Sales

$ 120,000

$ 150,000

$ 180,000

Cost of Goods Sold

$ 100,000

$ 120,000

Gross Profit

$ 60,000

General, Selling, & Administrative Expense

$ 50,000

Depreciation

$ 8,500

Net Income

$ 1,500

Balance Sheet

For the year ending:

2017

2018

Assets

Cash

$…

1. How much cash is received from sales to customers for year 2021? Assume all the sales were made on credit basis

. 2. What is the net increase or decrease in the Cash account for year 2021?

Chapter 26 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 26.1 - What is the firms cash cycle? How does it differ...Ch. 26.1 - How does working capital impact a firms value?Ch. 26.2 - Prob. 1CCCh. 26.2 - Prob. 2CCCh. 26.3 - Prob. 1CCCh. 26.3 - Prob. 2CCCh. 26.4 - What is accounts payable days outstanding?Ch. 26.4 - What are the costs of stretching accounts payable?Ch. 26.5 - What are the benefits and costs of holding...Ch. 26.5 - Prob. 2CC

Ch. 26.6 - Prob. 1CCCh. 26.6 - Prob. 2CCCh. 26 - Prob. 1PCh. 26 - Prob. 2PCh. 26 - Aberdeen Outboard Motors is contemplating building...Ch. 26 - Prob. 4PCh. 26 - Prob. 5PCh. 26 - Prob. 6PCh. 26 - The Fast Reader Company supplies bulletin board...Ch. 26 - Prob. 8PCh. 26 - Prob. 9PCh. 26 - Prob. 10PCh. 26 - The Mighty Power Tool Company has the following...Ch. 26 - What is meant by stretching the accounts payable?Ch. 26 - Prob. 13PCh. 26 - Your firm purchases goods from its supplier on...Ch. 26 - Use the financial statements supplied on the next...Ch. 26 - Prob. 16PCh. 26 - Which of the following short-term securities would...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- After reviewing the information, calculate the following ratios for Nestlé for 2021:1) Inventory turnover2) Profit margin3) Return on assets4) Free cash flowRound all answers to two decimal places.arrow_forwardRefer to the financial statements and related disclosure notes of The Kroger Company for the fiscal year endingJanuary 30, 2016. You can locate the report online from “investor relations” at www.kroger.com.Notice that Kroger’s net income has increased over the three years reported. To supplement their analysis ofprofitability, many analysts like to look at “free cash flow.” A popular way to measure this metric is “structuralfree cash flow” (or as Warren Buffett calls it, “owner’s earnings”), which is calculated as net income from operations, plus depreciation and amortization, minus capital expenditures.Required:Determine free cash flows for Kroger in each of the three years reported. Compare that amount with net incomeeach year. What pattern do you detect?arrow_forwardCC1) La Sorpresa, S.A., a leading local company, knows that in order to know the rotations necessary to quantify its cash cycle, it is essential to apply some financial ratios. So how often it pays its suppliers, how often it rotates its inventories, and how often it charges its customers, will have to be calculated with the following data: Total sales of the company..........................$4'586,109.47Proportion of credit sales....................... 60%Average customer balance............................. $ 343,958.21Cost of sales ratio...................... 55%Average inventory balance...................... $ 420,393.37Average supplier balance................... $ 288,004.21Beginning Inventory................................................ $ 385,554.55 The company spends about $8.125 million in operating cycle investments. With this data it is necessary to calculate: 1) The operating cycle.2) The cash conversion cycle.3) The cash turnover.4) The minimum cash balance.arrow_forward

- CC1) La Sorpresa, S.A., a leading local company, knows that in order to know the rotations necessary to quantify its cash cycle, it is essential to apply some financial ratios. So how often it pays its suppliers, how often it rotates its inventories, and how often it charges its customers, will have to be calculated with the following data: Total sales of the company..........................$4'586,109.47Proportion of credit sales....................... 60%Average customer balance............................. $ 343,958.21Cost of sales ratio...................... 55%Average inventory balance...................... $ 420,393.37Average supplier balance................... $ 288,004.21Beginning Inventory................................................ $ 385,554.55 The company spends about $8.125 million in operating cycle investments. With this data it is necessary to calculate: 1) The operating cycle.2) The cash conversion cycle.3) The cash turnover.4) The minimum cash balance.…arrow_forwardAssume that the company has a current ratio of 1.2. Now which of the above actions would improve this ratio. Which of the following actions would improve (i.e., increase) this ratio?• Use cash to pay off current liabilities.• Collect some of the current accounts receivable.• Use cash to pay off some long-term debt.• Purchase additional inventory on credit (i.e., accounts payable).• Sell some of the existing inventory at cost.arrow_forwardSuppose your company sells goods for $450, of which $275 is received in cash and $175 is on account. The goods cost your company $155 and were paid for in a previous period. Your company also recorded salaries and wages of $145, of which only $45 has been paid in cash. How would i answer the following questions?? Calculate the amount that should be reported as net cash flow from operating activities. Calculate the amount that should be reported as net income. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2).arrow_forward

- You are considering two possible companies for investment purposes. The following data is available for each company. Company A Net credit sales, Dec. 31, 2019 $540,000 Net Accounts receivable, Dec 31, 2018 $120,000 Net accounts receivable, Dec 31, 2019 $180,000 Number of days sales in receivables ratio, 2018 103 days Net Income, Dec. 31, 2018 $250,000 Company B Net credit sales, Dec. 31, 2019 $620,000 Net Accounts receivable, Dec 31, 2018 $145,000 Net accounts receivable, Dec 31, 2019 $175,000 Number of days sales in receivables ratio, 2018 110 days Net Income, Dec. 31, 2018 $350,000 Additional Information: Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet…arrow_forwardAfter reviewing the information, calculate the following ratios for 2021. 1) Inventory turnover2) Profit margin3) Return on assets4) Free cash flow Round all answers to two decimal places.arrow_forwardAn analyst has collected the following information regarding GoNa Grocers: Earnings before interest and taxes (EBIT) - P700 million Earnings before interest, taxes and depreciation (EBITDA) -P850 million Interest expense is P200 million Depreciation is the company’s only non-cash expense What is the company’s net cash flow?arrow_forward

- Vison software reported the following amounts on its balance sheets at December 31, 2020, 2019, and 2018 *Data table provided* Sales and profits are high. Nevertheless, Vision is experiencing a cash shortage. Perform a vertical analysis of Vision Software's assets at the end of years 2020, 2019, and 2018. Use the analysis to explain the reason for the cash shortage.arrow_forwardDuring 2018, the cash flows related to Global Data, Inc.'s lending and borrowing activities are summarized as follows: Cash lent to borrowers Payment to retire bonds payable Proceeds from borrowing at bank (note payable) Interest received from borrowers Interest payments made on bonds payable SS S A Moving to the next question prevents changes to this answer. S S If Global Data's income statement for 2018 reports interest expense of $25,200, then Interest Payable decreased by $15,800 O True O False 132,600 367,500 220,500 31,500 41,000 Daning 2015, the cash flowy related to Global Dhes, lac's leading and borrowing activities are varied as follows Cash letto borrowers Payment to rebods payable Proceeds free borrowing at back cote payable) Interest received from borrowers we pays de onbeads payable True Ĉ D S S 5 367,500 220.500 31.500 41,000arrow_forwardSuppose your company sells goods for $300, of which $200 is received in cash and $100 is onaccount. The goods cost your company $125 and were paid for in a previous period. Your companyalso recorded salaries and wages of $70, of which only $30 has been paid in cash.Required:1. Show the journal entries to record these transactions.2. Calculate the amount that should be reported as net cash flow from operating activities.3. Calculate the amount that should be reported as net income.4. Show how the indirect method would convert net income (requirement 3) to net cash flowfrom operating activities (requirement 2).5. What general rule about converting net income to operating cash flows is revealed by youranswer to requirement 4?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License