FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Differential analysis for a discontinued product

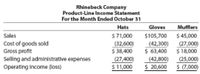

The condensed product-line income statement for Rhinebeck Company for the month of

October is as follows: (Refer the image )

Fixed costs are 20% of the cost of goods sold and 30% of the selling and administrative expenses. Rhinebeck Company assumes that fixed costs would not be materially affected if the Gloves line were discontinued.

a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative 2).

b. Should the Mufflers line be retained? Explain.

Transcribed Image Text:Rhinebeck Company

Product-Line Income Statement

For the Month Ended October 31

Hats

$ 71,000

(32,600)

$ 38,400

(27,400)

$ 11,000

Gloves

Mufflers

Sales

$105,700 $ 45,000

Cost of goods sold

Gross profit

Selling and adminilstrative expenses

Operating Income (loss)

(42,300)

$ 63,400

(42,800)

$ 20,600

(27,000)

$ 18,000

(25,000)

$ (7,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 900,000 408,000 492,000 455,000 $ 37,000 Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $208,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $164,000 and $125,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $150,000 and…arrow_forwardPlease help answerarrow_forwardProvide correct solutionarrow_forward

- Michie Company's management accountant prepared the following income statement relating to its second year of operations using the absorption costing format: Michie Company Income Statement (Absorption Costing) Year Ended December 31, Year 2 Sales Cost of goods sold: Beginning inventory Variable and fixed manufacturing costs Cost of goods available for sale Less ending inventory Total cost of goods sold Gross margin Less operating costs: Variable selling and administrative costs Fixed selling and administrative costs Net income (50,000 x $ 20.00) (10,000 $ 10.00*) (45,000 x $ 10.00*) (55,000 $10.00) (5,000 * $ 10.00) $ 1,000,000 $ 100,000 450,000 550,000 50,000 (500,000) $ 500,000 (50,000 x $ 2.00) $ 100,000 150,000 Variable manufacturing costs of $8.00 plus fixed manufacturing costs of $2.00. (250,000) $ 250,000arrow_forward(a) Prepare a profit statement for each of the two months of November and December 2007 using: (i) (ii) (b) Prepare a reconciliation of the differences in net profit reported under the two systems for each of the two months. QUESTION 5 Total absorption costing Marginal costing Jamlee Investment Ltd is planning to make 120,000 units per period of a new product. The following standards have been set: Direct Material A Direct Material B Direct Labour: Production Per Unit 1.2 kgs at K11 per kg 4.7 kg at K6 per Kg Operation 1 Operation 2 Operation 3 Overheads are absorbed at the rate of k30 per labour hour. All direct operatives are paid at the rate of K8 per hour. Actual results for the period were: 42 minutes 37 minutes 11 minutes 126,000 units Direct Labour Material A Material B Required (a) Calculate the standard cost for one unit (b) Calculate the labour rate variance and labour efficiency variances. (c) Calculate the material price and usage variances. (d) Explain the terms…arrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Jopl Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (4,600 units) Cost of goods sold: Cost of goods manufactured (5,200 units) Inventory, April 30 (700 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Joplin Company Variable Costing Income Statement For the Month Ended April 30 Variable cost of goods sold: If the fixed manufacturing costs were $29,484 and the fixed selling and administrative expenses were $12,590, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. 1:110 $109,200 (14,700) Fixed costs: $138,000 (94,500) $43,500 (25,700) $17,800arrow_forward

- 1. Assume that the company uses absorption costing A) compute the unit product cost B) prepare an income statement for a year(do not leave empty spaces;input a 0 whatever it is required) 2. Assume the company uses variable costing A) compute the unit product cost B) prepare an income statmement(input 0 on empty spaces)arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Crown Beverage Inc. indicated the following for Royal Cola for the past year: Sales $236,700 Cost of goods sold 111,000 Gross profit Operating expenses Loss from operations $125,700 144,000 $(18,300) It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since Royal Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether Royal Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Revenues Differential Analysis Continue Royal Cola (Alt. 1) or Discontinue Royal Cola (Alt. 2) January 21 Continue Royal Discontinue Royal Cola (Alternative 1) Cola (Alternative 2) 236,700 Differential…arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc. indicated the following for Vim Cola for the past year: Sales $234,600 Cost of goods sold (111,000) Gross profit $123,600 (144,000) $(20,400) Operating expenses Operating loss It is estimated that 15% of the cost of goods sold represents fixed factory overhead costs and that 23% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated November 2 to determine whether Viem Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Vim Colo November 2 Line Item Description Revenues Costs: Variable cost of goods sold Variable operating expenses Fixed costs Profit…arrow_forward

- Diff Analysis & Product Pricing:arrow_forwardProduct Alpha has revenue of $101,590, variable cost of goods sold of $51,430, variable selling expenses of $21,010, and fixed costs of $36,680, creating a loss from operations of $7,530. Required: 1. Prepare a differential analysis as of December 10 to determine whether Product Alpha should be continued (Alternative 1) or discontinued (Alternative 2), assuming that fixed costs are unaffected by the decision. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "0". A colon (:) will automatically appear if required. 2. Determine if Product Alpha should be continued (Alternative 1) or discontinued (Alternative 2). Prepare a differential analysis as of December 10 to determine whether Product Alpha should be continued (Alternative 1) or discontinued (Alternative 2), assuming that fixed…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education