FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

Transcribed Image Text:oped

ook

ences

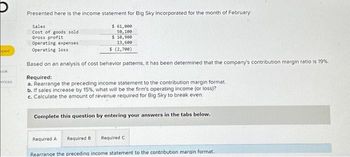

Presented here is the income statement for Big Sky Incorporated for the month of February:

$ 61,000

50,100

$ 10,900

13,600

$ (2,700)

Sales

Cost of goods sold

Gross profit

Operating expenses

Operating loss

Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 19%.

Required:

a. Rearrange the preceding income statement to the contribution margin format

b. If sales increase by 15%, what will be the firm's operating income (or loss)?

c. Calculate the amount of revenue required for Big Sky to break even.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Rearrange the preceding income statement to the contribution margin format.

Transcribed Image Text:a. Rearrange the preceding income statement to the contribution margin format.

b. If sales increase by 15%, what will be the firm's operating income (or loss)?

c. Calculate the amount of revenue required for Big Sky to break even.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Rearrange the preceding income statement to the contribution margin format.

Required A Required B Required C

$

a. Rearrange the preceding income statement to the contribution margin format.

b. If sales increase by 15%, what will be the firm's operating income (or loss)?

c. Calculate the amount of revenue required for Big Sky to break even.

0

Required A

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

0

If sales increase by 15%, what will be the firm's operating income (or loss)?

Note: Do not round intermediate calculations.

< Required A

Break even

Required B >

a. Rearrange the preceding income statement to the contribution margin format.

b. If sales increase by 15%, what will be the firm's operating income (or loss)?

c. Calculate the amount of revenue required for Big Sky to break even.

Complete this question by entering your answers in the tabs below.

Calculate the amount of revenue required for Big Sky to break even.

< Required B

Required C >

Required C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Similar questions

- Which of the following QBO features can be used to save a transaction that will be re-used in the future? Multiple Choice Saved transactions (+) New icon Recurring transactions None of the choices is correct.arrow_forwardWrite me a human paragraph without using Al about what a memorandoms of understanding is and how it is usedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education