FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

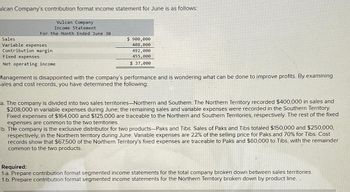

Transcribed Image Text:ulcan Company's contribution format income statement for June is as follows:

Vulcan Company

Income Statement

For the Month Ended June 30

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

$ 900,000

408,000

492,000

455,000

$ 37,000

Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining

sales and cost records, you have determined the following:

a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and

$208,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory.

Fixed expenses of $164,000 and $125,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed

expenses are common to the two territories.

b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $150,000 and $250,000,

respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks and 70% for Tibs. Cost

records show that $67,500 of the Northern Territory's fixed expenses are traceable to Paks and $60,000 to Tibs, with the remainder

common to the two products.

Required:

1-a. Prepare contribution format segmented income statements for the total company broken down between sales territories.

1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A condensed income statement by product line for Crown Beverage Inc. indicated the following for King Cola for the past year: Sales $236,100 Cost of goods sold 112,000 Gross profit $124,100 Operating expenses 142,000 Loss from operations $(17,900) It is estimated that 13% of the cost of goods sold represents fixed factory overhead costs and that 21% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. Question Content Area a. Prepare a differential analysis, dated March 3, to determine whether King Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential AnalysisContinue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2)January 21 Continue KingCola (Alternative 1) Discontinue KingCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forwardA condensed income statement by product line for British Beverage Inc. indicated the following for King Cola for the past year: Sales $235,100 Cost of goods sold 112,000 Gross profit $123,100 Operating expenses 145,000 Loss from operations $(21,900) It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether to Continue King Cola (Alternative 1) or Discontinue King Cola (Alternative 2). If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential AnalysisContinue King Cola (Alt. 1) or Discontinue King Cola (Alt. 2)March 3 Continue KingCola (Alternative 1) Discontinue KingCola (Alternative 2) Differential…arrow_forwardThe following information is available about the operations of the Delaware Publishing Company for the month of January. Find the missing values. Revenue (total sales) Fixed costs Variable costs Total costs Net Income $28,400 $85,700 $29,200arrow_forward

- A condensed income statement by product line for British Beverage Inc. indicated the following for Royal Cola for the past year: Sales $233,300 Cost of goods sold 111,000 Gross profit $122,300 Operating expenses 145,000 Loss from operations $(22,700) It is estimated that 12% of the cost of goods sold represents fixed factory overhead costs and that 23% of the operating expenses are fixed. Since Royal Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether Royal Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential Analysis Continue Royal Cola (Alt. 1) or Discontinue Royal Cola (Alt. 2) January 21 Continue RoyalCola (Alternative 1) Discontinue RoyalCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forwardGough Corporation has two divisions. Domestic and Foreign. Data from the most recent month appears below: 6. Total Company $668,000 Domestic Foreign $321,000 147,660 173,340 134,000 $ 39,340 Sales... Variable expenses. Contribution margin. Traceable fixed expenses. 220,530 447,470 335,000 112,470 $347,000 72,870 274,130 201,000 $ 73,130 Segment margin.. Common fixed expenses.. 73,480 $ 38,990 Net operating income.. The break-even in sales dollars for the company as a whole is closest to: A. $502,579 B. $107,216 C. $436,424 D. $609,794arrow_forward5arrow_forward

- Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement Sales Variable expenses Contribution margin Fixed expenses Net operating income For the Month Ended June 30 $750,000 336,000 414,000 378,000 $ 36,000 Management wants to improve profits and gathered the following data: a. The company is divided into two sales territories-Northern and Southern. The Northern territory recorded $300,000 in sales and $156,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern territory. Fixed expenses of $120,000 and $108,000 are traceable to the Northern and Southern territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $50,000 and $250,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks…arrow_forwardThe following income statements illustrate different cost structures for two competing companies: Income Statements Number of customers (a) Sales revenue (a $200) Variable cost (ax $140) Contribution margin Fixed cost Net income Company Name Hill 200 $40,000 N/A 40,000 (28,000) $12,000 Creek 200 $40,000 (28,000) 12,000 0 $12,000 Required a. Reconstruct Hill's income statement, assuming that it serves 400 customers when it lures 200 customers away from Creek by lowering the sales price to $120 per customer. b. Reconstruct Creek's income statement, assuming that it serves 400 customers when it lures 200 customers away from Hill by lowering the sales price to $120 per customer. Complete this question by entering your answers in the tabs below.arrow_forwardA condensed income statement by product line for British Beverage Inc. indicated the following for Royal Cola for the past year: Sales $236,800 Cost of goods sold 109,000 Gross profit $127,800 Operating expenses 145,000 Loss from operations $(17,200) It is estimated that 14% of the cost of goods sold represents fixed factory overhead costs and that 19% of the operating expenses are fixed. Since Royal Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis, dated March 3, to determine whether Royal Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter zero "0". Use a minus sign to indicate a loss. Differential Analysis Continue Royal Cola (Alt. 1) or Discontinue Royal Cola (Alt. 2) January 21 Continue RoyalCola (Alternative 1) Discontinue RoyalCola (Alternative 2) Differential Effecton Income(Alternative 2)…arrow_forward

- Need help with this questionarrow_forwardhas a shoes and a shirts division. The company reported the following segmented Income statement for last month: Sales Variable expenses Contribution Margin Fixed Expenses Net operating Income (loss) Multiple Choice O O O Division Shoes Shirts $4,200,000 $3,000,000 $1,200,000 2.000.000 1.500.000 1,500,000 1.300.000 200,000 O The company predicts that $200,000 of the fixed expenses being charged to the Shirts Division are allocated costs that will continue even if the Shirts Division is eliminated. The elimination of the Shirts Division will additionally cause a 20% drop in Shoes Division sales. If the company shuts down its Shirts Division, by how much will the company's overall net operating income change? 2,200,000 2.200.000 Increase by $240,000 Decrease by $300,000 Total Decrease by $330,000 Increase by $330,000 0 500.000 700,000 900.000 (200,000)arrow_forwardMarket Inc. has two divisions, Telbot and Heather Following is the Income statement for the past month 27 Total Talbot Beather $217, 500 $217,500 $435,000 195,750 65,250 261,000 21,750 152, 250 174,000 78, 300 78,300 156, 600 Sales Variable Costs Contribution Margin Fired Costs (allocated) Profit Margin $(56,550) $ 73,950 $ 17,400 What would Marker's proft margih be if the Talbot division was dropped and all fixed costs are unavoidable? Mutiole Choice $56.550 loss $4.350 loss $73.950 profitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education