Financial & Managerial Accounting

14th Edition

ISBN: 9781337119207

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 23.1EX

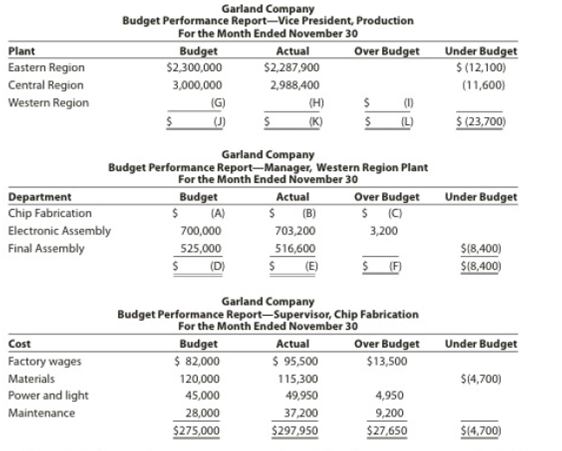

Budget performance reports for cost centers

Partially completed budget performance reports for Garland Company, a manufacturer of light duty motors, follow:

- A. Complete the budget performance reports by determining the correct amounts for the lettered spaces.

- B. Compose a memo to Cassandra Reid, vice president of production for Garland Company, explaining the performance of the production division for November.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

what amount and direction during that same period?

General Accounting Mcq

What is wildwoods gross profit??

Chapter 23 Solutions

Financial & Managerial Accounting

Ch. 23 - Prob. 1DQCh. 23 - Differentiate between a profit center and an...Ch. 23 - Weyerhaeuser developed a system that assigns...Ch. 23 - What is the major shortcoming of using income from...Ch. 23 - In a decentralized company in which the divisions...Ch. 23 - How does using the return on investment facilitate...Ch. 23 - Why would a firm use a balanced scorecard in...Ch. 23 - Prob. 8DQCh. 23 - When is the negotiated price approach preferred...Ch. 23 - When using the negotiated price approach to...

Ch. 23 - Budgetary performance for cost center Vinton...Ch. 23 - Service department charges The centralized...Ch. 23 - Income from operations for profit center Using the...Ch. 23 - Profit margin, investment turnover, and ROI Briggs...Ch. 23 - Residual income The Commercial Division of Galena...Ch. 23 - Transfer pricing The materials used by the...Ch. 23 - Budget performance reports for cost centers...Ch. 23 - Divisional income statements The following data...Ch. 23 - Service department charges and activity bases For...Ch. 23 - Service department charges In divisional income...Ch. 23 - Service department charges and activity bases...Ch. 23 - Divisional income statements with service...Ch. 23 - Prob. 23.8EXCh. 23 - Profit center responsibility reporting XSport...Ch. 23 - Return on investment The income from operations...Ch. 23 - Prob. 23.11EXCh. 23 - Determining missing items in return on investment...Ch. 23 - Profit margin, investment turnover, and return on...Ch. 23 - Prob. 23.14EXCh. 23 - Prob. 23.15EXCh. 23 - Determining missing items from computations Data...Ch. 23 - Prob. 23.17EXCh. 23 - Building a balanced scorecard Hit-n-Run Inc. owns...Ch. 23 - Decision on transfer pricing Materials used by the...Ch. 23 - Prob. 23.20EXCh. 23 - Prob. 23.1APRCh. 23 - Profit center responsibility reporting for a...Ch. 23 - Divisional income statements and return on...Ch. 23 - Effect of proposals on divisional performance A...Ch. 23 - Divisional performance analysis and evaluation The...Ch. 23 - Prob. 23.6APRCh. 23 - Budget performance report for a cost center The...Ch. 23 - Profit center responsibility reporting for a...Ch. 23 - Divisional income statements and return on...Ch. 23 - Effect of proposals on divisional performance A...Ch. 23 - Divisional performance analysis and evaluation The...Ch. 23 - Prob. 23.6BPRCh. 23 - Prob. 1ADMCh. 23 - Domino's Pizza: Franchise segment return on...Ch. 23 - Prob. 3ADMCh. 23 - Prob. 23.1TIFCh. 23 - Prob. 23.3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rodriguez Company pays $522,160 for real estate with land, land improvements, and a building. The land is appraised at $265,080; land improvements are appraised at $106,032; and a building is appraised at $159,048. Required: Allocate the total cost among the three assets.arrow_forwardDetermine the equivalent units in process for direct materials and conversion costsarrow_forwardA company has a net income of $790,000 and 55,300 outstanding shares. What is the earnings per share? Helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY