Case summary:

Person X works for SA Company. He is bit confused on which investment option he must choose. Later, with the help of AS, financial service representative advice, X had decided to invest on diversified portfolio. He decided to invest 70% of his investment in equities, 5% in the

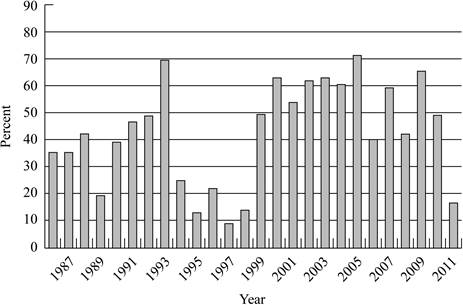

The graph represents the percentage of managed equity mutual funds beating the Vanguard 500 Index funds:

To determine: What investment decision would person X make for the equity portion of 401(k) account.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Fundamentals of Corporate Finance

- a) Assume we are now in mid- or late February 2022. After conducting your own analysis, you have made a decision to buy shares of ENV in March. However, your friend, Jaden who is a financial advisor for ENV tells you that ENV's earnings for the fourth quarter 2021 is higher than the analyst estimates. He suggests you to buy its shares immediately (i.e. in midor late February 2022) before this information is announced to the public (and price increases). Please state and explain which CFA Institute Code and Standards Jaden has breached. b) [Behavioural finance] After getting this information from Jaden, you refuse to take a position in the stock today and decide to continue to wait until March to buy it. What is the best terminology to describe your behaviour?arrow_forwardWhich investor would not qualify as "Accredited"? Group of answer choices A.The CFO of the company issuing the security B. An MBA graduate and CPA who now was a net worth of $500,000 through shrewd investments in the last 3 months C. A recent retiree who saved a little over $1M in their 401k during their career D. A university endowmentarrow_forwarda) Assume we are now in mid- or late February 2022. After conducting your own analysis, you have made a decision to buy shares of ENV in March. However, your friend, Jaden who is a financial advisor for ENV tells you that ENV's earnings for the fourth quarter 2021 is higher than the analyst estimates. He suggests you to buy its shares immediately (i.e. in midor late February 2022) before this information is announced to the public (and price increases). Please state and explain which CFA Institute Code and Standards Jaden has breached. b) [Behavioural finance] After getting this information from Jaden, you refuse to take a position in the stock today and decide to continue to wait until March to buy it. What is the best terminology to describe your behaviour? Answer only Barrow_forward

- You are an investment adviser. One of your clients approaches you for your advice on investing in equity shares of Alpha Company. You have collected the following data: Earnings per share last year $4.00 Payout ratio 0.40 Return on equity 0.25 Cost of equity capital 0.20 The company plans to increase the payout ratio to 50% after year 5. Required: i) Estimate the price of an equity share of this company using an appropriate dividend discount model and advise your client whether they should buy a share of the company. ii) Your client is keen to know whether there are any positive growth opportunities from their investment. Explain to your client the meaning of this concept using appropriate calculations. Note: Use two decimal places in your calculationsarrow_forwardAssume that you are nearing graduation and that you have applied for a job at a local bank. As part of the bank’s evaluation (interview) process, you have been asked to take an exam that covers several financial analysis techniques. The hiring decision depends on how you would answer the following questions: Part I: TVM Analysis. The first section of the test addresses time value money analysis.John andMaryareayoungcouple, who want to put their finance in order. Boththehusbandandthe wifeare27yearsagoandinstableemployment. They want to manage their savings and earnings to achieve a better return and reduce the risks. You want to help them with their financial planning by answering a series of questions as follows: ThegreatAlbertEinsteinoncesaid“Compoundinterestistheeighthwonderofthe world. He who understands it earns it...he who doesn't...pays it.” Whatisthefuture value of an initial $500 after 30 years if it is invested in an account paying 15 percent annual interest? What is the…arrow_forward1. As an investment analyst, you have been invited to address a group of workers who are almost left with almost 20 years to go on retirement. Explain at least three investment opportunities to them that can make life after retirement comfortable. 2. Adutwumwaa Company has been operating for the last five years. The company Directors have decided to list the company in the Ghana Stock Exchange. The company has therefore appointed you as the consultant for this assignment. Advise the company how it can be listed on the Stock Market and also the advantages and Disadvantages of Listing on the Stock Market.arrow_forward

- You are an employee at XYZ Bank. Your Bank is trying the construct an investment portfolio that matches its resources and goals. To do so, you and your team are required to evaluate the investment options available for your Bank and decide what is the best option to choose. A B C D E Value of the position 1,400,500 1,370,050 750,000 450,300 1,700,650 Duration 5 3 5 4 6 YTM 4% 3% 7% 8% 5.50% Potential adverse move in yield 0.30% 0.26% 0.43% 0.56% 0.37% Correlation A B C D E A 1 0.5 0.3 0.1 -0.2 B 1 0.2 -0.3 0.4 C 1 0.2 -0.3 D 1 -0.4 E 1 Weight A B C D E Scenario I…arrow_forwardAmy Tanner is an analyst for a US pension fund. Her supervisor has asked her to value the stocks of General Electric (GE) and General Motors (GM) Tanner wants to evaluate the appropriateness of the dividend discount model (DDM) for valuing GE and GM and has compiled the following data for the two companies from 211 to 2018. GE GM EPS ($) DPS ($) pay-out EPS ($) Ratio DPS ($) Year рay-out Ratio 2018 2.17 1.15 0.53 -68.45 1.00 -0.01 2017 1.99 1.03 0.52 -3.5 1.00 -0.29 2016 1.76 0.91 0.52 -18.5 2.00 -0.11 2015 1.61 0.82 0.51 4.94 2.00 0.40 2014 1.55 0.77 0.50 5.03 2.00 0.40 2013 1.51 0.73 0.48 3.35 2.00 0.60 2012 1.41 0.66 0.47 1.77 2.00 1.13 2011 1.27 0.57 0.45 6.68 2.00 0.30 For each of the stocks, do a critical analysis and suggest whether the DDM is appropriate for valuing the stocks.arrow_forwardPlease help with questions 1-3. I'm not sure how to start this You are discussing your 401(k) with Dan Ervin when he mentions that Sarah Brown, a representative from Bledsoe Financial Services, is visiting East Coast Yachts today. You decide that you should meet with Sarah, so Dan sets up an appointment for you later in the day. When you sit down with Sarah, she discusses the various investment options available in the company’s 401(k) account. You mention to Sarah that you researched East Coast Yachts before you accepted your new job. You are confident in management’s ability to lead the company. Analysis of the company has led to your belief that the company is growing and will achieve a greater market share in the future. You also feel you should support your employer. Given these considerations, along with the fact that you are a conservative investor, you are leaning toward investing 100 percent of your 401(k) account in East Coast Yachts stock. Assume the risk-free rate is 3.2…arrow_forward

- You are an investment adviser. One of your clients approaches you for your advice on investing in equity shares of Alpha Company. You have collected the following data: Earnings per share last year $6.00 Payout ratio 0.40 Return on equity 0.30 Cost of equity capital 0.20 The company plans to increase the payout ratio to 60% from year 5. Required: i) Estimate the price of an equity share of this company using an appropriate dividend discount model and advise your client whether they should buy a share of the company. ii) Your client is keen to know whether there are any positive growth opportunities from their investment. Explain to your client the meaning of this concept using appropriate calculations. Notes: You need to show detailed calculations in order to receive full marks for this question iii)If there are positive or negative growth opportunities, explain the reason for such opportunities.arrow_forwardHi there, I want help to solve this questions you are the CEO of Nelson Corporation, and the current stock price is $27.80. Pollack Enterprises announced today that it intends to buy Nelson Corporation. To obtain all the stock of Nelson Corporation, Pollack Enterprises is willing to pay $38.60 per share. At a meeting with your management, you realize that the management is not happy with the offer, and is against the takeover. Therefore, with the full support of your management team, you are fighting to prevent the takeover from Pollack Enterprises. Is the management of Nelson Corporation acting in the best interest of the Nelson Corpo ration stockholders? Explain your reasonarrow_forwardThe company has offered you a $5,000 bonus, which you may receive today, or 100 shares of the company’s stock, which has a current stock price of $50 per share. Mathematically, what is the best choice & why? 2. What are the advantages and disadvantages of each option? Be sure to support your answers.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning