Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 22.30P

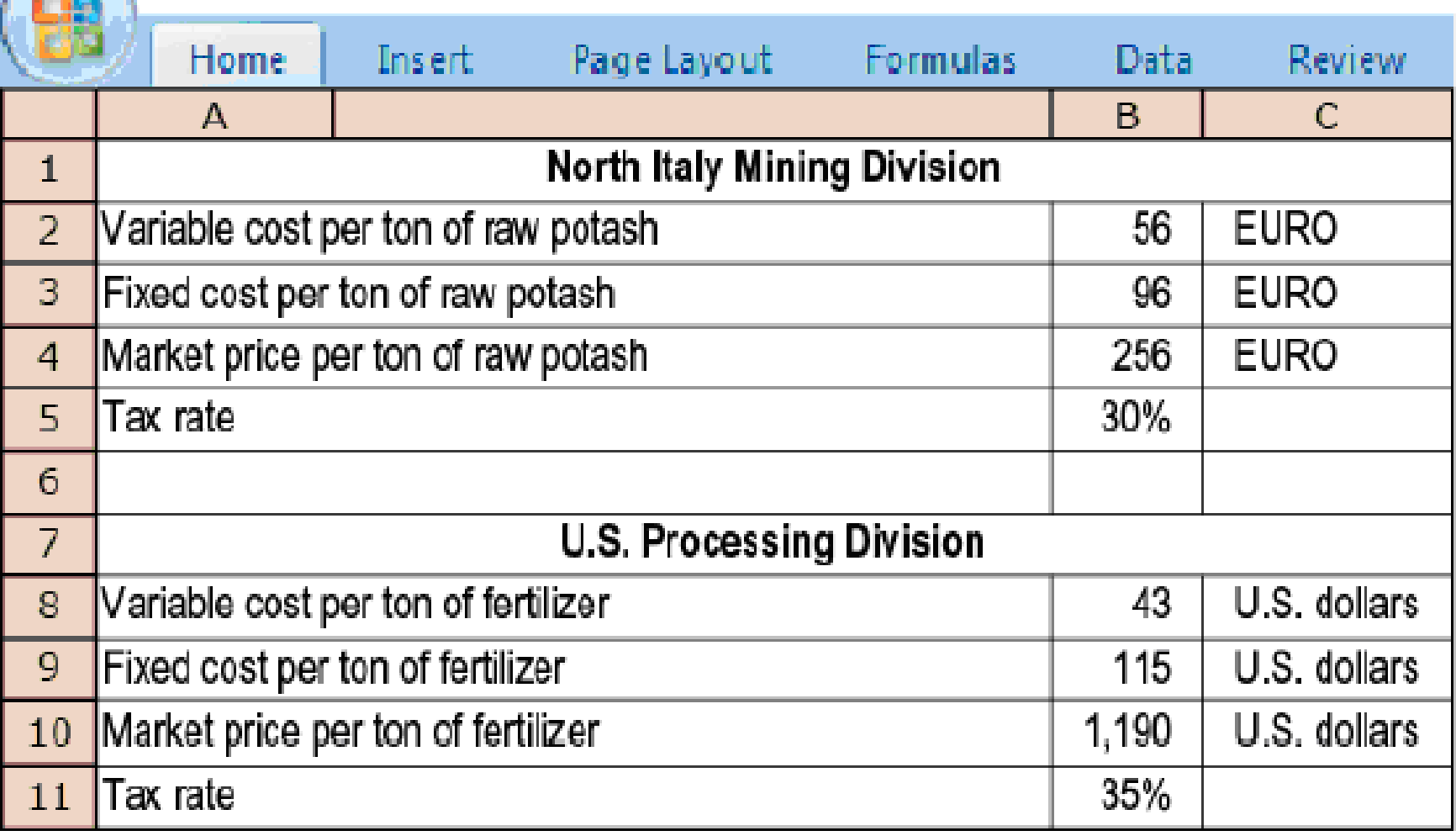

Multinational transfer pricing, global tax minimization. Express Grow Inc., based in Ankeny, lowa, sells high-end fertilizers. Express Grow has two divisions:

- North Italy mining division, which mines potash in northern Italy

- U.S. processing division, which uses potash in manufacturing top-grade fertilizer

The processing division’s yield is 50%: It takes 2 tons of raw potash to produce 1 ton of top-grade fertilizer. Although all of the mining division’s output of 8,000 tons of potash is sent for processing in the United States, there is also an active market for potash in Italy. The foreign exchange rate is 0.80 Euro = $1 U.S. The following information is known about the two divisions:

- A. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price.

- B. Compute the after-tax operating income, in U.S. dollars, for each division under the transfer-pricing methods in requirement 1. (Income taxes are not included in the computation of cost-based transfer price, and Express Grow does not pay U.S. income tax on income already taxed in Italy.)

- C. If the two division managers are compensated based on after-tax division operating income, which transfer-pricing method will each prefer? Which transfer-pricing method will maximize the total after-tax operating income of Express Grow?

- D. In addition to tax minimization, what other factors might Express Grow consider in choosing a transfer-pricing method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Multinational transfer pricing, global tax minimization. Express Grow Inc., based in Ankeny, Iowa, sells high-end fertilizers. Express Grow has two divisions:

The Burton Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Burton marketing division in Lille, France, imports 200,000 chainsaws annually from the United States. The following information is available:

U.S. income tax rate on the U.S. division’s operating income 40%

French income tax rate on the French division’s operating income 45%

French import duty 20%

Variable manufacturing cost per chainsaw $100

Full manufacturing cost per chainsaw $175

Selling price (net of marketing and distribution costs) in France $300

Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $175 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income…

The Burton Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Burton marketing division in Lille, France, imports 200,000 chainsaws annually from the United States. The following information is available:

U.S. income tax rate on the U.S. division’s operating income 40%

French income tax rate on the French division’s operating income 45%

French import duty 20%

Variable manufacturing cost per chainsaw $100

Full manufacturing cost per chainsaw $175

Selling price (net of marketing and distribution costs) in France $300

Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $175 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income…

Chapter 22 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 22 - Prob. 22.1QCh. 22 - Describe three criteria you would use to evaluate...Ch. 22 - What is the relationship among motivation, goal...Ch. 22 - Name three benefits and two costs of...Ch. 22 - Organizations typically adopt a consistent...Ch. 22 - Transfer pricing is confined to profit centers. Do...Ch. 22 - What are the three methods for determining...Ch. 22 - What properties should transfer-pricing systems...Ch. 22 - All transfer-pricing methods give the same...Ch. 22 - Prob. 22.10Q

Ch. 22 - Prob. 22.11QCh. 22 - Prob. 22.12QCh. 22 - Prob. 22.13QCh. 22 - Under the general guideline for transfer pricing,...Ch. 22 - How should managers consider income tax issues...Ch. 22 - Evaluating management control systems, balanced...Ch. 22 - Cost centers, profit centers, decentralization,...Ch. 22 - Prob. 22.18ECh. 22 - Prob. 22.19ECh. 22 - Multinational transfer pricing, effect of...Ch. 22 - Prob. 22.21ECh. 22 - Multinational transfer pricing, global tax...Ch. 22 - Prob. 22.23ECh. 22 - Prob. 22.24ECh. 22 - Transfer-pricing problem (continuation of 22-24)....Ch. 22 - Prob. 22.26PCh. 22 - Prob. 22.27PCh. 22 - Effect of alternative transfer-pricing methods on...Ch. 22 - Goal-congruence problems with cost-plus...Ch. 22 - Multinational transfer pricing, global tax...Ch. 22 - Transfer pricing, external market, goal...Ch. 22 - Prob. 22.32PCh. 22 - Transfer pricing, goal congruence, ethics. Cocoa...Ch. 22 - Prob. 22.34PCh. 22 - Transfer pricing, perfect and imperfect markets....Ch. 22 - Prob. 22.36PCh. 22 - Prob. 22.37P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- LTE Chem Co. is a small-size U.S. chemical company. Two divisions at the company, K1 and K2, are involved in an internal transfer of a chemical ingredient, KXB. Currently, K1 sells 10,000Kgs of KXB to K2 at a price of $ 14.50/kg. The manager at K1 claims that the cost of producing KXB has recently increased, proposing a new price of $ 16.00/Kg, which is the one he can realize by selling the ingredient to the market. K2 has recently approached an external supplier who can supply the 10,000Kgs at a cost of $ 15.10. The cost figures for producing a Kg of KXB at K1 are: Direct Materials. Direct Labor.. Variable Overhead Fixed Overhead $5.15 4.35 0.50 1.60 Required: a. Based on the figures above, what is the current acceptable range of prices for the 10,000Kgs? What would be the net loss or saving for the company as a whole if, on the other hand, K1 expects to forgo 5,000Kgs that could be sold at $ 16.00/Kg to external customers? b. Now assume that, to push external sales of KXB by K1,…arrow_forwardLTE Chem Co. is a small-size U.S. chemical company. Two divisions at the company, K1 and K2, are involved in an internal transfer of a chemical ingredient, KXB. Currently, K1 sells 10,000Kgs of KXB to K2 at a price of $ 14.50/kg. The manager at K1 claims that the cost of producing KXB has recently increased, proposing a new price of $ 16.00/Kg, which is the one he can realize by selling the ingredient to the market. K2 has recently approached an external supplier who can supply the 10,000Kgs at a cost of $ 15.10. The cost figures for producing a Kg of KXB at K1 are: Direct Materials.. Direct Labor.. Variable Overhead Fixed Overhead $5.15 4.35 0.50 1.60 Required: a. Based on the figures above, what is the current acceptable range of prices for the 10,000Kgs? What would be the net loss or saving for the company as a whole if, on the other hand, K1 expects to forgo 5,000Kgs that could be sold at $ 16.00/Kg to external customers? b. Now assume that, to push external sales of KXB by K1,…arrow_forwardCollyer Products Inc. has a Valve Division that manufactures and sells a standard valve as follows: Capacity in units Selling price to outside customers on the intermediate market Variable costs per unit Fixed costs per unit (based on capacity) 10,000 15 8 5 The company has a Pump Division that could use this valve in the manufacture of one of its pumps. The Pump Division is currently purchasing 10,000 valves per year from an overseas supplier at a cost of $14 per valve. 3. Assume again that the Valve Division is selling all that it can produce to outside customers on the intermediate market. Also assume that $2 in variable expenses can be avoided on transfers within the company, due to reduced selling costs. What is the acceptable range, if any, for the transfer price between the two divisions? Transfer price 4. Assume the Pump Division needs 20,000 special high-pressure valves per year. The Valve Division's variable costs to manufacture and ship the special valve would be $10 per…arrow_forward

- Pharoah Industries produces and sells electronic sound equipment. The company has production capacity of 20600 units and currently production schedule is for 18600 units. Each unit has a selling price of $25, variable product cost of $15, and variable selling cost of $2. Another division wishes to purchase 560 units. If Pharoah sells the units to the other division, it will avoid $1 of the variable selling costs. What is the minimum transfer price that will maximize corporate profits? $25 $15 $17 $16arrow_forwardThe Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshields per year. The market price is $450 per windshield. The Windshield division incurs total fixed costs of $3,000,000 per year. If the Windshield division has excess capacity, what is the range of possible transfer prices that could be used on transfers between the Windshield and Assembly divisions?arrow_forwardZumsteg Products, Incorporated, has a Pump Division that manufactures and sells a number of products, including a standard pump. Date concerning that pump appear below: Capacity in units Selling price to outside customers Variable cost per unit Fixed cost per unit (based on capacity) 72,800 #106 70.0 $20 The company has a Pool Products Division that could use this pump in one of its products. The Pool Products Division is currently purchasing 8,800 of these pumps per year from an overseas supplier at a cost of $99 per pump. Required: Assume that the Pump Division has enough Idle capacity to handle all of the Pool Products Division's needs. What is the acceptable ange, If any, for the transfer price between the two divisions? Note: Round your answers to 1 decimal place.arrow_forward

- Quest Motors, Inc., operates as a decentralized multidivision company. The Vivo division of Quest Motors purchases most of its airbags from the airbag division. The airbag division’s incremental cost for manufacturing the airbags is $90 per unit. The airbag division is currently working at 80% of capacity. The current market price of the airbags is $125 per unit. Q. If the two divisions were to negotiate a transfer price, what is the range of possible transfer prices? Evaluate this negotiated transfer-pricing policy using the criteria of goal congruence, evaluating division performance, motivating management effort, and preserving division autonomy.arrow_forwardThe Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshields per year. The market price is $450 per windshield. The Windshield division incurs total fixed costs of $3,000,000 per year. If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions?arrow_forwardBlossom Industries is a decentralized company with two divisions: mining and processing. They are both evaluated as profit centres. The mining division transfers raw diamonds to the processing division. The processing division is currently operating at 1 million kg below its capacity, while the mining division is operating at full capacity. The mining division can sell raw diamonds externally at $85 per kilogram. The unit cost of 1 kg of polished diamonds produced by the processing division is as follows: Raw diamonds $85 Direct materials 11 Direct labour ($20/hour) 31 Variable manufacturing overhead 21 Fixed manufacturing overhead* 55 Total unit cost $203 *Based on a capacity of 5.50 million kg per year.The processing division has just received an order from International Diamonds Co. for 300,000 kg of polished diamonds at a price of $185 per kilogram. Blossom has a policy that prohibits selling any product below total cost. The total cost of a kilogram…arrow_forward

- Blossom Industries is a decentralized company with two divisions: mining and processing. They are both evaluated as profit centres. The mining division transfers raw diamonds to the processing division. The processing division is currently operating at 1 million kg below its capacity, while the mining division is operating at full capacity. The mining division can sell raw diamonds externally at $85 per kilogram. The unit cost of 1 kg of polished diamonds produced by the processing division is as follows: Raw diamonds $85 Direct materials 11 Direct labour ($20/hour) 31 Variable manufacturing overhead 21 Fixed manufacturing overhead* 55 Total unit cost $203 *Based on a capacity of 5.50 million kg per year.The processing division has just received an order from International Diamonds Co. for 300,000 kg of polished diamonds at a price of $185 per kilogram. Blossom has a policy that prohibits selling any product below total cost. The total cost of a kilogram…arrow_forwardThe Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $240 per windshield and has capacity to make 630,000 windshields per year. The market price is $475 per windshield. The Windshield division incurs total fixed costs of $3,050,000 per year. If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions? he Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $240 per windshield and has capacity to make 630,000 windshields per year. The market price is $475 per windshield. The Windshield division incurs total fixed costs of $3,050,000 per year.If the Windshield division is operating at full capacity, what transfer price should be used on transfers between the Windshield and Assembly divisions?…arrow_forwardThe Windshield division of Jaguar Company makes windshields for use in its Assembly division. The Windshield division incurs variable costs of $280 per windshield and has capacity to make 590,000 windshields per year. The market price is $575 per windshield. The Windshield division incurs total fixed costs of $4,000,000 per year. If the Windshield division has excess capacity, what is the range of possible transfer prices that could be used on transfers between the Windshield and Assembly divisions? Transfer price per windshield will be at least but not more thanarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License