a)

To determine: Value of one month call option with $40 as an exercise price.

a)

Explanation of Solution

Given information:

Company H stock prices changes once in a month either by increase in 20% or decreases by 16.7%.

Current price level is $40 and interest rate is 1% per month.

Calculation of value of option:

First, it is necessary to find out the probabilities by using risk-neutral method.

Therefore, the value of p is 48% and,

Therefore, there is 48% of chances that price of stock will rise by 20% and a 52% chances that option will worth of $0 when it matures.

Therefore, the value of call is $3.82

b)

To determine: Value of delta.

b)

Explanation of Solution

Calculation of value of delta:

Hence, the value of option delta is 0.545

c)

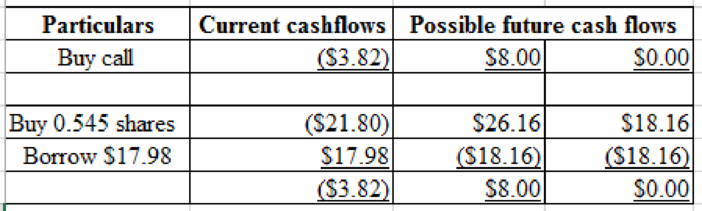

To determine: The way payoffs of this call option be replicated based on replicated portfolio method.

c)

Explanation of Solution

Calculation of value of call by using replicating portfolio method:

Hence, the value of call is $3.82

d)

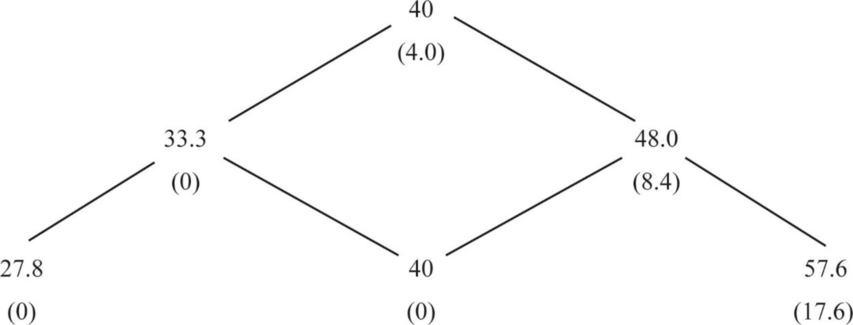

To determine: Value of two month call option with $40 as an exercise price.

d)

Explanation of Solution

Calculation of value of option:

The following option possibilities are as follows,

Month 1-a:

Hence the value of call under month 1-a is ‘0’

Month 1-b:

Therefore, value of the call under month 1-b is $8.4

Month 0:

Therefore, value of the call under month 0 is $4.0

e)

To determine: Value of delta.

e)

Explanation of Solution

Calculation of delta:

Hence, the delta value is 0.572

Want to see more full solutions like this?

Chapter 21 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- User A European call option with a strike price of 105 will expire in two years. The current stock price is $ 100. The value of u = 1.3 and the value of d = 0.8. The annual interest rate (based on continuous compounding)is 10%. Using a three-period binomial model (a)Determine the risk-neutral probability values at each end node (Hint: draw a tree) Please draw a binomial tree!!! Can you give me the steps (b)Find the expected value of the call in two years. (c)Find the current price of the call option.arrow_forwardThe stock price of Heavy Metal (HM) changes only once a month: either it goes up by 24% or it falls by 20.7%. Its price now is $48. The interest rate is 1.2% per month. What is the value of a one-month call option with an exercise price of $48? What is the option delta? The payoffs of the call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? What is the value of a two-month call option with an exercise price of $49? What is the option delta of the two-month call over the first one-month period?arrow_forwardGive typing answer with explanation and conclusion A call option has a strike price of $11, and a time to expiration of 0.8 in years. If the stock is trading for $20, N(d1) = 0.5, N(d2) = 0.12, and the risk free rate is 5.40%, what is the value of the call option?arrow_forward

- Consider the following data for a certain share. Current Price = S0 = Rs. 80 Exercise Price = E = Rs. 90 Standard deviation of continuously compounded annual return = \sigma = 0.5 Expiration period of the call option = 3 months Risk – free interest rate per annum = 6 percent a. What is the value of the call option? Use the normal distribution table. b. What is the value of a put option?arrow_forwardConsider an American Put option with time to expiry of 5 months and a strike price of 82. The current price of the underlying stock is 80. Divide the time to expiry into five 1-month intervals. In each interval, the stock price can either rise by 6, or fall by 6, with unknown probability. The risk-free rate is 4.2% per annum, continuously compounded. Use Binomial Model. (a) What is the evolution of the prices of the underlying asset in time? Show it on a binomial tree.arrow_forwardWhat are the prices of a call option and a put option with the following characteristics? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Stock price = $76 Exercise price = $75 Risk-free rate = 4.50% per year, compounded continuously Maturity = 4 months Standard deviation = 63% per year Call price $ Put price $arrow_forward

- What are the prices of a call option and a put option with the following characteristics? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Stock price = $74 Exercise price = $70 Risk-free rate= Call price Put price 4.40% per year, compounded continuously Maturity = 4 months Standard deviation = 62% per yeararrow_forwardThe stock price of ABC changes only once a month: either it goes up by 20% or it falls by 16.7%. Its price now is £40. The interest rate is 12.7% per year, or about 1% per month. Required: i Suppose a one-month call option on this stock has an exercise price of £40, what is the option delta? ii Show how the payoffs of this call option can be replicated by buying ABC’s stock and borrowing. iii Using the risk-neutral method to calculate the value of a one-month call option with an exercise price of £40. iv Construct a two-month binomial tree. What is the value of a two-month call option with an exercise price of £40? v Use put-call parity, what is the price for a one-month put with the same exercise price? And a two-month put with the same exercise price?arrow_forwardConsider a stock with a current price of P $27 Suppose that over the next 6 months the stock price will either go up by a factor of 1.41 or down by a factor of 071. Consider a call option on the stock with a strike price of $25 that expires in 6 months. The nsk-free rate is 6%. (1) Using the binomial model, what are the ending values of the stock price? What are the payoffs of the call option? (2) Suppose you write one call option and buy N shares of stock How many shares must you buy to create a portfolo with a riskless payoff Ge, a hedge portfolio)? What is the payoff of the portfolio? 13)What.is the.present.value of the hedge port- Tolot What &the value of phe calt.option? (4) What s a teplieatirg portfolio What is 2otrage?arrow_forward

- Consider the following data for a certain share. Current Price = So = Rs. 80 Exercise Price = E = Rs. 90 Standard deviation of continuously compounded annual return = 0 = 0.5 Expiration period of the call option 3 months Risk – free interest rate per annum = 6 percent a. What is the value of the call option? Use the normal distribution table. b. What is the value of a put option?arrow_forwardQuestion A Consider a two-period binomial model, where each period is 6 months. Assume the stock price is $50.00, = 0.20, r = 0.06 and the dividend yield = 3.5%. What is the lowest strike price where early exercise would occur with an American put option? ........Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line.arrow_forwardIn a one-period binomial model, assume that the current stock price is $100 and that it will rise by 10% with a probability of 45% or fall by 15% with a probability of 55% after one month. The annual risk-free rate of 2%. The call option price with an exercise price of $102 is equal to: O a $5.88 O b. $8.60 OC $5.33 Od $8.57 0.56.25arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning