Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

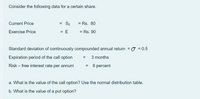

Transcribed Image Text:Consider the following data for a certain share.

Current Price

= So

= Rs. 80

Exercise Price

= E

= Rs. 90

Standard deviation of continuously compounded annual return = 0 = 0.5

Expiration period of the call option

3 months

Risk – free interest rate per annum

= 6 percent

a. What is the value of the call option? Use the normal distribution table.

b. What is the value of a put option?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following information is provided: The risk-free rate is 2% The expected market returns are 11% If the beta of an asset changes from 0.8 to 1.5, what is the additional return that you require on this asset (in %, please round on 2 decimals)?arrow_forwardSuppose risk-free rate of return = 2%, market return = 7%, and Stock B’s return = 11%. Calcuate Stock B’s beta. If Stock B’s beta were 0.80, what would be its new rate of return?arrow_forwardAssume an interest rate of zero. A Call option and a Put option with the same exercise price, X = 100p are priced at 9p for the Call and 4p for the Put. By completing the table below (attached) show that the net position at expiry is zero.arrow_forward

- please answer as soon as possible?arrow_forwardAssume the one period binomial model with initial share price £400, up and down factors u = 1.25, d = 0.9 and interest compounded at nominal rate (per time period) of 5%. Consider an option with payoff (S(0) + S(1))/2. The replicating portfolio for this option at time 0 will have shares and pounds in a bank. State your answers to three significant figures.arrow_forwardStock A has an expected return of 13.52 percent. Stock B has an expected return of 9.24 percent. Assuming the Capital Asset Pricing Model holds, and Stock A's beta is greater than Stock B's beta by 0.32, what is the expected market risk premium (in percent)? Answer to two decimalsarrow_forward

- Data: S0 = 102; X = 115; 1 + r = 1.1. The two possibilities for ST are 146 and 84. Required: The range of S is 62 while that of P is 31 across the two states. What is the hedge ratio of the put? Form a portfolio of one share of stock and two puts. What is the (nonrandom) payoff to this portfolio? What is the present value of the portfolio? Given that the stock currently is selling at 102, calculate the put value.arrow_forwardSuppose you have the following information concerning a particular options.Stock price, S = RM 21Exercise price, K = RM 20Interest rate, r = 0.08Maturity, T = 180 days = 0.5Standard deviation,= 0.5 a. What is correct of the call options using Black-Scholes model? * Look for N(d1) and N(d2) from the cumulative standard normal distribution table:arrow_forwardWhat is portfolio A's CAPM beta based on your analysis? Round off your answer to three digits after the decimal points. State your answer as a percentage point as 1.234. Compute the Treynor measure for portfolio B. Round off your answer to three digits after the decimal point. State your answer as 1.234arrow_forward

- Consider the 1-period binomial model with a bond with A(0) = 60 and A(1) = 70 and a stock with S(0) = 4X and S^u(1) 6Y and S^d(1) = 3Z. = 1. What is the price (payoff) C(1) of a call option with strike price 28? 2. same... with strike price 45? 3. same... with strike price 72? 4. Set up a system of linear equations to determine a replicating portfolio for the call option from part 2 (strike price 45). 5. Solve it and determine the price C(O). 6. Compute, tabulate, and plot the price C(O) as you vary the strike price of the option from 28, 29, ..., 71, 72.arrow_forwardConstruct a hedge portfolio and by using the binomial option pricing model and find the values of Pu and Pd; and P. Explain the answer and describe the hedge portfolio. A stock currently priced at $100. One period later it can go up to $125, an increase of 25 percent, or down to $80, a decrease of 20 percent. Assume a put option is available with an exercise price of $100. Consider the example in a two-period world. The risk-free rate is 7 percent. The inputs are summarized as follows S = 100 d = 0.80 u = 1.25 X= 100 r = 0.07arrow_forwardAssume a security follows a geometric Brownian motion with volatility parameter = 0.2. Assume the initial price of the security is 21 and the interest rate is 0. It is known that the price of a down-and-in barrier option and a down-and-out barrier option with strike price 19 and expiration 30 days have equal risk-neutral prices. Compute this common risk-neutral price.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education