Concept explainers

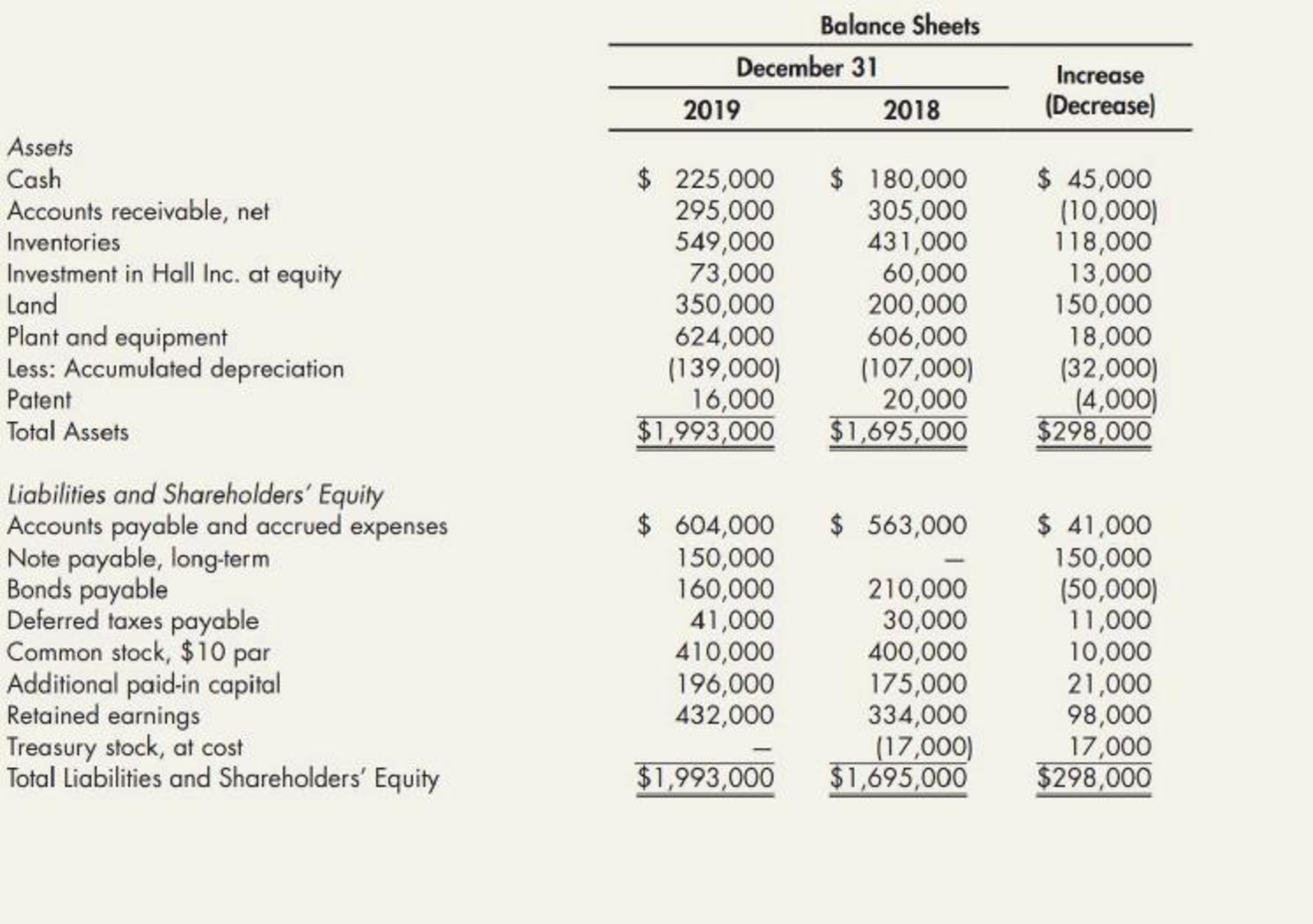

Comprehensive The following are Farrell Corporation’s balance sheets as of December 31, 2019, and 2018, and the statement of income and

Additional information:

- a. On January 2, 2019, Farrell sold equipment costing $45,000, with a book value of $24,000, for $19,000 cash.

- b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for $23,000 cash.

- c. On May 14, 2019, Farrell sold all of its

treasury stock for $25,000 cash. - d. On June 1, 2019, Farrell paid $50, 000 to retire bonds with a face value (and book value) of $50, 000.

- e. On July 2, 2019, Farrell purchased equipment for $63, 000 cash.

- f. On December 31, 2019, land with a fair market value of $150,000 was purchased through the issuance of a long-term note in the amount of $150,000. The note bears interest at the rate of 15% and is due on December 31, 2021.

- g.

Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting.

Required:

- 1. Prepare a spreadsheet to support a statement of

cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. - 2. Prepare the statement of cash flows.

(Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13.

Required:

- 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019,

balance sheet items for the adjustedtrial balance . Use a retained earnings balance of $291,000 in this adjusted trial balance.) - 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

1.

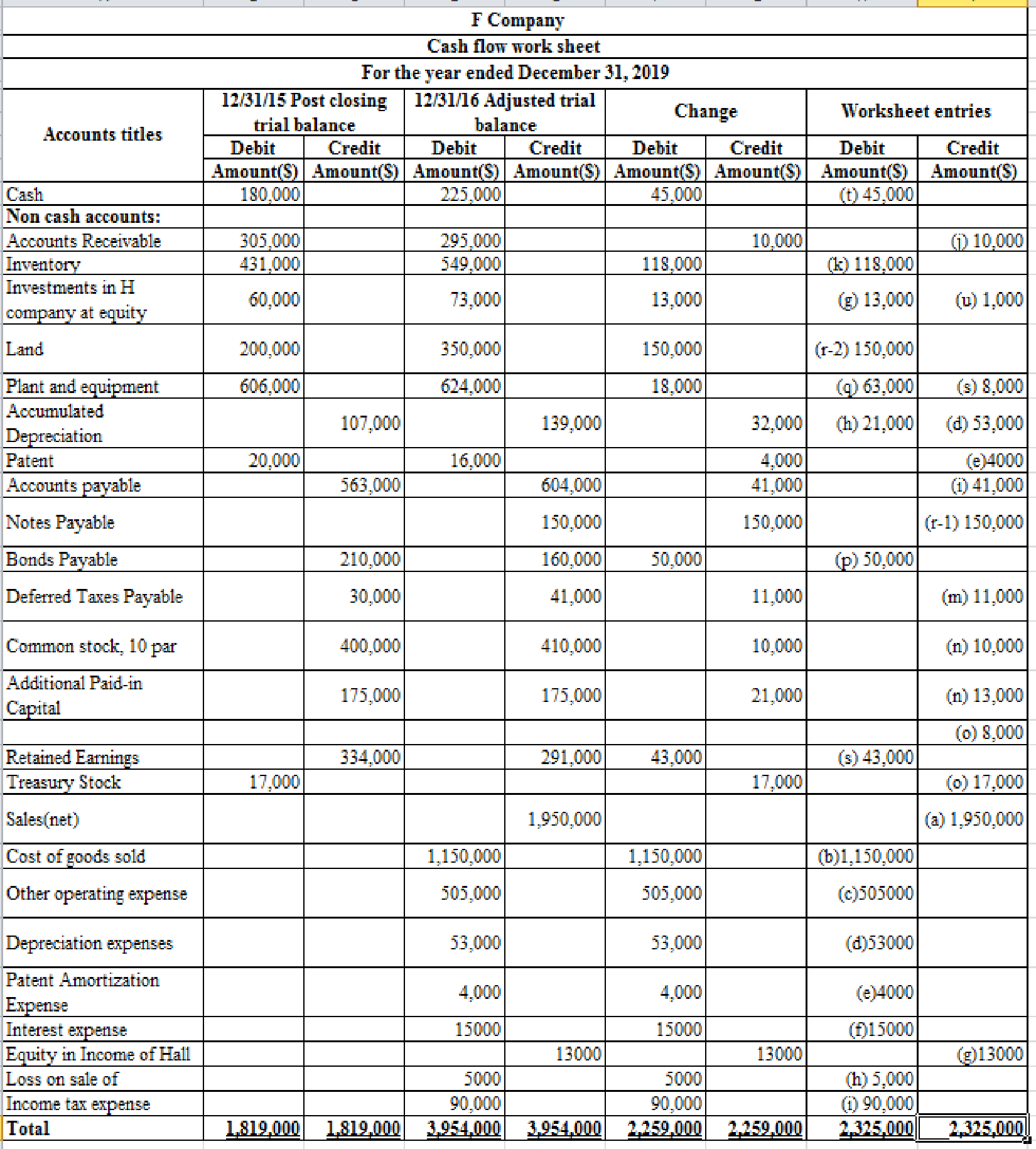

Prepare a spreadsheet to support the statement of cash flows under direct method of F Company for the year ended December 31, 2019.

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare a spreadsheet to support the statement of cash flows under direct method.

Table (1)

Table (2)

Working notes:

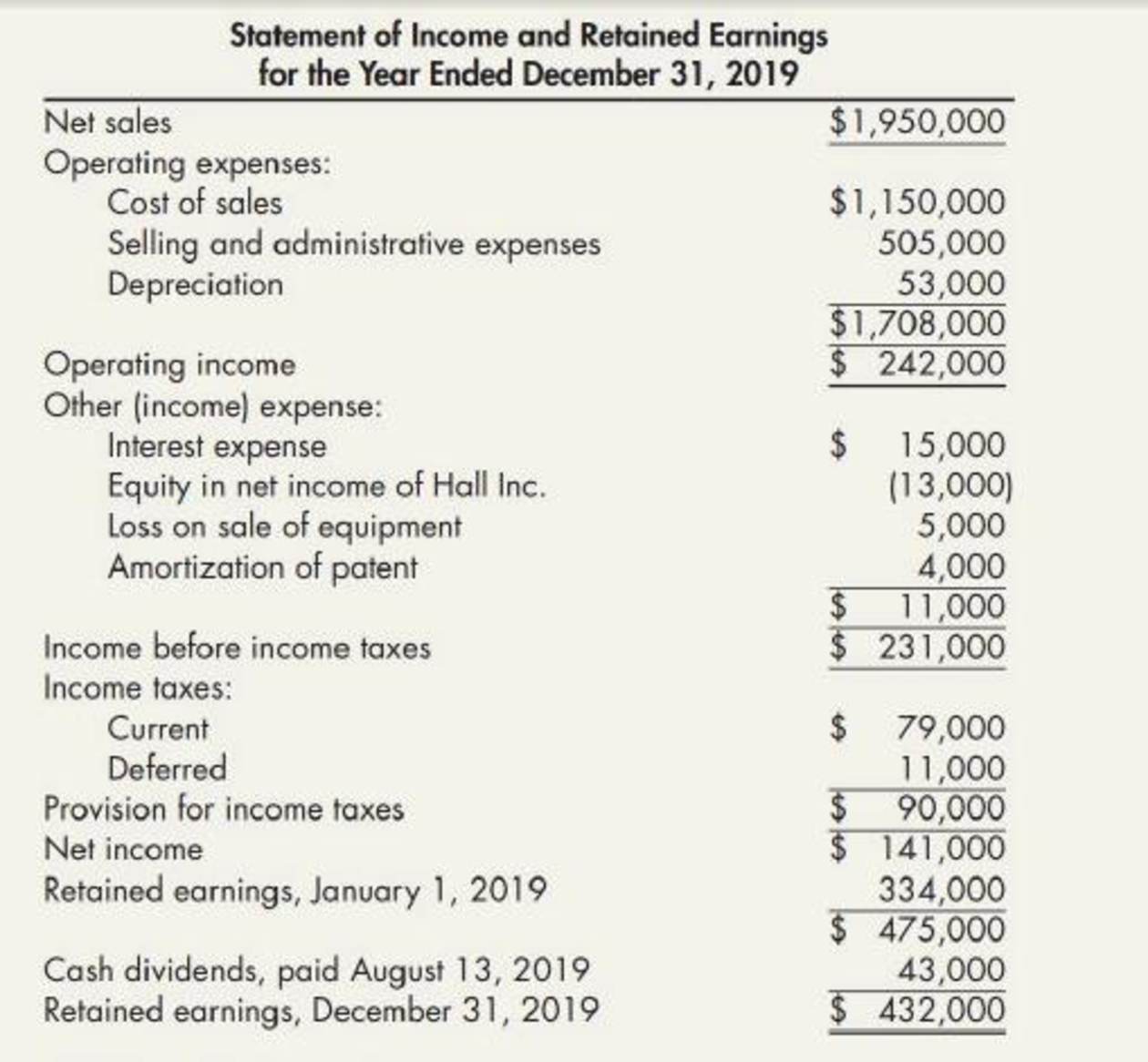

a) Net sales for the year are $1,950,000.

b) Cost of goods sold is $1,150,000.

c) Other operating expenses are $505,000.

f) Interest expense is $15,000.

h) Loss on sale of equipment is $5,000.

i) Income tax expense is $90,000.

j) Calculate the accounts receivable.

k) Calculate the increase in inventory.

l) Calculate the accounts payable.

m) Calculate the deferred tax

n) Calculate proceeds from sale of common stock.

o) Calculate proceeds from sale of treasury stock.

p) Calculate the payment to retire bonds.

q) Purchase of equipment is $63,000.

r-1) Issuance of long-term note is $150,000.

r-2) Calculate issuance of long-term note to purchase land.

s) Payment of cash dividends is $43,000.

t) Calculate net increase in cash.

Therefore, net increase in cash is $45,000.

2.

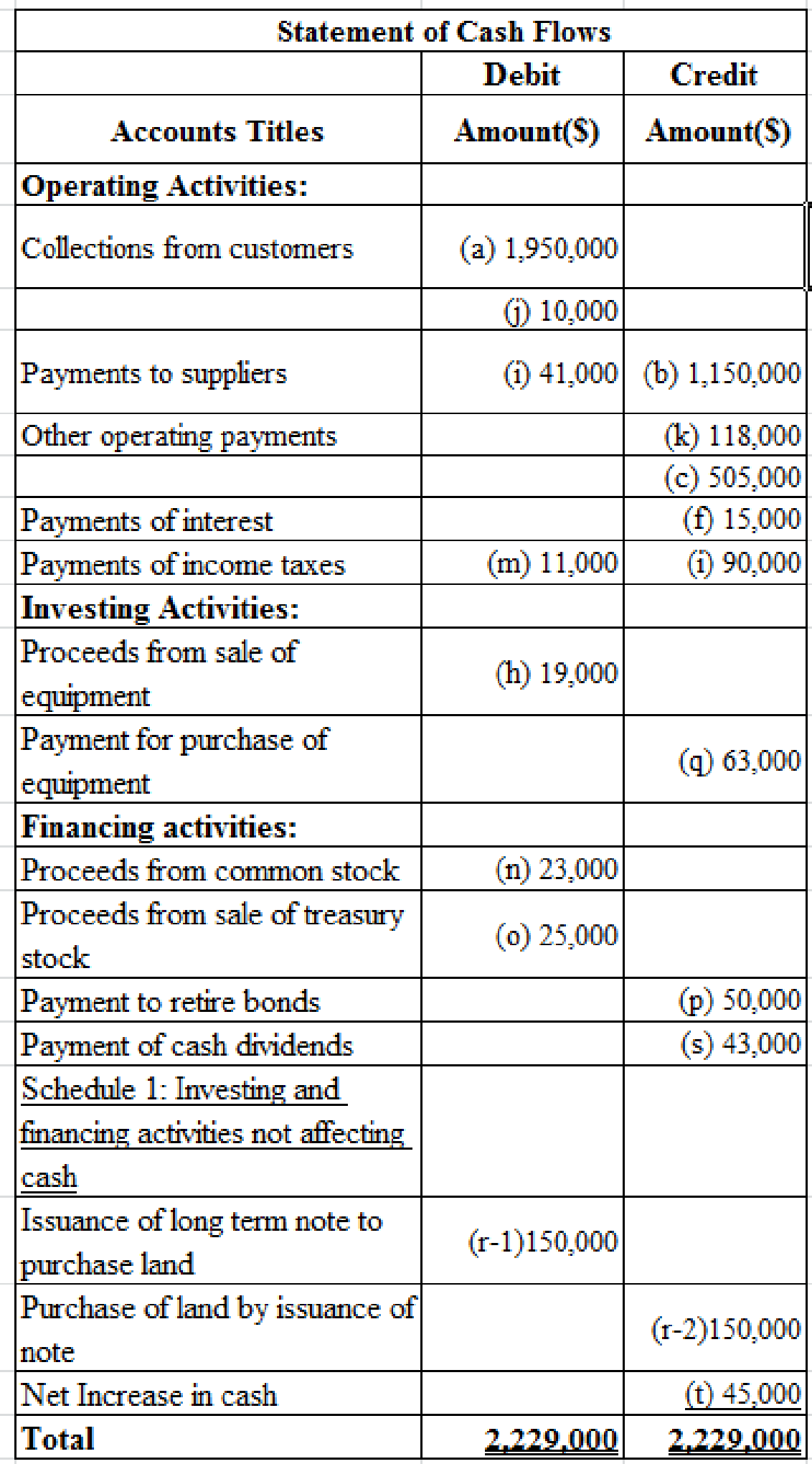

Prepare a statement of cash flows of F Company for the year 2019.

Explanation of Solution

Prepare a statement of cash flows of F Company for the year 2019.

| F Company | ||

| Statement of cash flows | ||

| For Year Ended December 31, 2019 | ||

| Particulars | Amount($) | Amount($) |

| Operating Activities: | ||

| Cash inflows: | ||

| Collections from customers | 1,960,000 | |

| Cash inflows from operating activities | 1,960,000 | |

| Cash outflows: | ||

| Payments to suppliers | (1,227,000) | |

| Other operating payments | (505,000) | |

| Payments of interest | (15,000) | |

| Payments of income taxes | (79,000) | |

| Cash outflows from operating activities | (1,826,000) | |

| Net cash provided by operating activities | 134,000 | |

| Investing Activities: | ||

| Proceeds from sale of equipment | 19,000 | |

| Payment for purchase of equipment | (63,000) | |

| Net cash used for investing activities | (44,000) | |

| Financing Activities: | ||

| Proceeds from sale of common stock | 23,000 | |

| Proceeds from sale of treasury stock | 25,000 | |

| Payment to retire bonds | (50,000) | |

| Payment of cash dividend | (43,000) | |

| Net cash used for financing activities | (45,000) | |

| Net increase in cash (see Schedule 1) | 45,000 | |

| Cash, January 1, 2019 | 180,000 | |

| Cash, December 31,2019 | 225,000 | |

| Schedule 1: Investing and Financing Activities Not Affecting Cash | ||

| Investing Activities: | ||

| Purchase of land by issuance of long-term note | (150,000) | |

| Financing Activities: | ||

| Issuance of long-term note to purchase land | 150,000 | |

Table (3)

Therefore, the net increase in cash is $45,000.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,