Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 4MAD

Break-even number of guests for a theme park

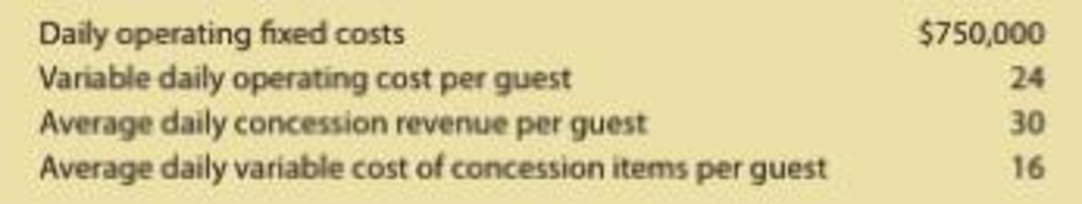

MusicLand Theme Park has an average daily admission price of $60 per guest. The following financial data are available for analysis:

Additional operating data indicate that the park averages 24,000 daily guests during the weekdays and 40,000 average daily guests on Saturdays and Sundays.

- A. Determine the break-even number of guests per day at the theme park.

- B. How much profit does MusicLand earn on an average weekday?

- C. How much profit does MusicLand earn on an average weekend day?

- D. Determine the revised break-even if the daily fixed costs increased to $1,000,000.

- E. Would the theme park still remain profitable for an average weekday under the scenario in (d)?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial Accounting

What is the firm's average accounts payable balance for this general accounting question?

Kindly help me with accounting questions

Chapter 20 Solutions

Financial And Managerial Accounting

Ch. 20 - Describe how total variable costs and unit...Ch. 20 - Which of the following costs would be classified...Ch. 20 - Describe how total fixed costs and unit fixed...Ch. 20 - In applying the high-low method of cost estimation...Ch. 20 - If fixed costs increase, what would be the impact...Ch. 20 - Prob. 6DQCh. 20 - Prob. 7DQCh. 20 - Both Austin Company and Hill Company had the same...Ch. 20 - Prob. 9DQCh. 20 - What does operating leverage measure, and how is...

Ch. 20 - High-low method The manufacturing costs of...Ch. 20 - Contribution margin Waite Company sells 250,000...Ch. 20 - Prob. 3BECh. 20 - Prob. 4BECh. 20 - Sales mix and break-even analysis Conley Company...Ch. 20 - Prob. 6BECh. 20 - Margin of safety Jorgensen Company has sales of...Ch. 20 - Classify Costs Following is a list of various...Ch. 20 - Identify cost graphs The following cost graphs...Ch. 20 - Identify activity bases For a major university,...Ch. 20 - Identify activity bases From the following list of...Ch. 20 - Identify fixed and variable costs Intuit Inc....Ch. 20 - Relevant range and fixed and variable costs Child...Ch. 20 - High-low method Ziegler Inc. has decided to use...Ch. 20 - High-low method for a service company Continental...Ch. 20 - Contribution margin ratio Young Company budgets...Ch. 20 - Contribution margin and contribution margin ratio...Ch. 20 - Break-even sales and sales to realize operating...Ch. 20 - Prob. 12ECh. 20 - Prob. 13ECh. 20 - Prob. 14ECh. 20 - Break-even analysis Media outlets such as ESPN and...Ch. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Prob. 19ECh. 20 - Prob. 20ECh. 20 - Prob. 21ECh. 20 - Break-even sales and sales mix for a service...Ch. 20 - Margin of safety A. If Canace Company, with a...Ch. 20 - Prob. 24ECh. 20 - Operating leverage Beck Inc. and Bryant Inc. have...Ch. 20 - Classify costs Seymour Clothing Co. manufactures a...Ch. 20 - Prob. 2PACh. 20 - Prob. 3PACh. 20 - Prob. 4PACh. 20 - Prob. 5PACh. 20 - Contribution margin, break-even sales,...Ch. 20 - Classify costs Cromwell Furniture Company...Ch. 20 - Break-even sales under present and proposed...Ch. 20 - Prob. 3PBCh. 20 - Prob. 4PBCh. 20 - Prob. 5PBCh. 20 - Contribution margin, break-even sales,...Ch. 20 - Prob. 1MADCh. 20 - Prob. 2MADCh. 20 - Prob. 3MADCh. 20 - Break-even number of guests for a theme park...Ch. 20 - Prob. 1TIFCh. 20 - Communication Sun Airlines is a commercial airline...Ch. 20 - Profitability strategies Somerset Inc. has...Ch. 20 - Prob. 5TIFCh. 20 - Analysis of costs for a shipping department Sales...Ch. 20 - Taylor Corporation is analyzing the cost behavior...Ch. 20 - Kimber Company has the following unit costs for...Ch. 20 - Bolger and Co. manufactures large gaskets for the...Ch. 20 - Eagle Brand Inc. produces two products as follows:...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hii expert please given correct answer general Accounting questionarrow_forwardSUBJECT - GENERAL ACCOUNT Department E had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $14,114. Of the $14,114, $8,395 was for material and $5,719 was for conversion costs. 14,000 units of direct materials were added during the period at a cost of $25,963. 15,000 units were completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process. Direct labor was $33,809 and factory overhead was $19,934. If the average cost method is used what would be the conversion cost per unit? a. $1.91 b. $5.31 c. $3.45 d. $1.73arrow_forwardFinancial Accounting Question solve this problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License