College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

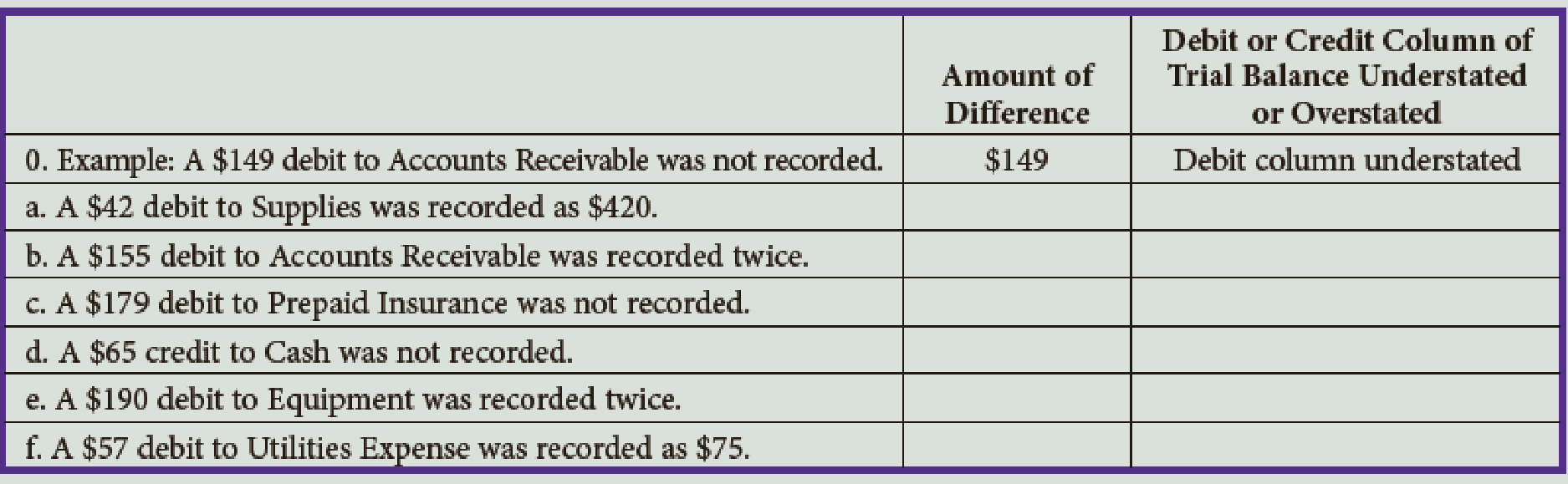

Chapter 2, Problem 7E

The following errors were made in journalizing transactions. In each case, calculate the amount of the error and indicate whether the debit or the credit column of the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance

columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they

are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in

column (3) is under- or overstated. Item (a) is completed as an example.

Note: Select "None" if there is no effect.

Description of Posting Error

a $2,720 debit to Rent Expense is posted as a

$2,270 debit

b. $5,440 credit to Cash is posted twice as two

credits to Cash

c. $2,570 debit to Prepaid Insurance is posted as a

debit to Insurance Expense.

d. $47,600 debit to Machinery is posted as a debit,

to Accounts Payable

e. $6,340 credit to Services Revenue is posted as a

$634 credit.

f. $1,760 debit to Store Supplies is not posted.

(1)

Difference

between

Debit and

Credit

Columns

$…

Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in column (3) is under- or overstated. Item (a) is completed as an example.

Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance

columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they

are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in

column (3) is under- or overstated. Item (a) is completed as an example.

Note: Select "None" if there is no effect.

(1)

Difference

between

Description of Posting Error

Debit and

Credit

Columns

Larger

Total

(2)

Column

with the

(3)

Identify Account(s)

Incorrectly Stated

(4)

Amount of account over- or understatement

a. $1,720 debit to Rent Expense is posted as a

$1,270 debit.

$

450 Credit

Rent Expense

Rent Expense is understated by $450

b. $3,440 credit to Cash is posted twice as two

credits to Cash.

c. $1,570 debit to Prepaid Insurance is posted as a

debit to Insurance Expense.…

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - Prob. 1ECh. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - What Would You Say? A fellow accounting student...Ch. 2 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting: Tools for Business Decision Making, 8th Edition

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

1. For Frank’s Funky Sounds, straight-line depreciation on the trucks is a

Learning Objective 1

a. variable cos...

Horngren's Accounting (12th Edition)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Posting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in column (3) is under- or overstated. Item (a) is completed as an example. (Select "None" if there is no effect.)arrow_forwardIf an incorrect amount is journalized and posted to the accounts, how should the error be corrected?arrow_forwardFor each of the following situations, indicate whether itrepresents an accounting error and explain why it is or isnot an error. Also state whether a trial balance would indicate that an error exists for each situation.d. The debit side of a journal entry was recorded in theaccounts, but the credit side was not.arrow_forward

- After preparing the trial balance, the accountant finds that the total of debit side is OMR 125,600 and Total of Credit Side OMR 126,500. This difference should be treated before rectification of errors wasarrow_forwardThe collection of accounts of Customer Alexander is recorded as a credit to the ledger of Customer Sean. What is the effect of the error in the total assets of the entity?arrow_forwardThe following errors will not be revealed by the trialSelect one: a. Balances incorrectly recordedb. Balances omittedc. Posting to the wrong accountd. Casting of debit or credit columns.arrow_forward

- A debit balance in which of the following accounts would indicate a likely error? a.Notes Payable b.Supplies c.Salaries Expense d.Accounts Receivablearrow_forwardIdentify the errors in the following trial balance. All accounts have normal balances.arrow_forwardWhich of the following errors will cause the trial balance totals to be unequal? A. posting the debit portion of a journal entry incorrectly when the credit portion of the entry is correctly posted B. recording the same transaction more than once C. recording the same erroneous amount for both the debit and the credit parts of a transactionarrow_forward

- Which of the following errors in the journal entry will not be detected by trial balance.a) Debit part is overstated but credit part is correctly recordedb) Debit part is correctly recorded but credit part is understatedc) Both debit and credit parts are overstated by the same amountd) Debit part is correctly recorded but credit part is overstatedBoş bırakarrow_forwardc. Assume that the unadjusted trial balance on July 31 shows a credit balance for Accounts Receivable. Does this credit balance mean an error has occurred?arrow_forward21.Which of the following errors will not cause the debit and credit columns of the trial balance to be unequal? a. A debit was entered in an account as a credit. b. The balance of an account was incorrectly computed. c. The account balance was carried to the wrong column of the trial balance. d. A debit entry was recorded in the wrong account.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY