College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 3PA

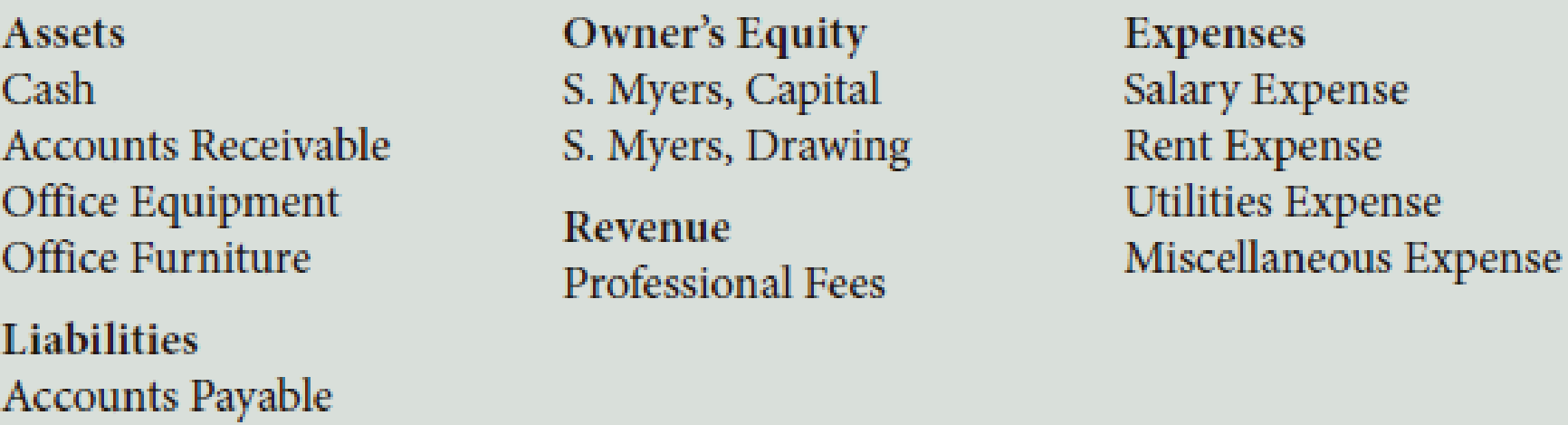

S. Myers, a speech therapist, opened a clinic in the name of Myers Clinic. Her accountant prepared the following chart of accounts:

The following transactions occurred during June of this year:

- a. Myers deposited $40,000 in a bank account in the name of the business.

- b. Bought waiting room chairs and tables on account, $1,330.

- c. Bought a fax/copier/scanner combination from Max’s Equipment for $595, paying $200 in cash and placing the balance on account, Ck. No. 1001.

- d. Bought an intercom system on account from Regan Office Supply, $375.

- e. Received and paid the telephone bill, $155, Ck. No. 1002.

- f. Sold professional services on account, $1,484.

- g. Received and paid the electric bill, $190, Ck. No. 1003.

- h. Received and paid the bill for the state speech therapy convention, $450, Ck. No. 1004.

- i. Sold professional services for cash, $2,575.

- j. Paid on account to Regan Office Supply, $300, Ck. No. 1005.

- k. Paid the rent for the current month, $940, Ck. No. 1006.

- l. Paid salary of the receptionist, $880, Ck. No. 1007.

- m. Myers withdrew cash for personal use, $800, Ck. No. 1008.

- n. Received $885 on account from patients who were previously billed.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of June 30, 20--. - 6. Prepare an income statement for June 30, 20--.

- 7. Prepare a statement of owner’s equity for June 30, 20--.

- 8. Prepare a balance sheet as of June 30, 20--.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Lena, Carrie, and Margaret work for a family physician. The doctor is knowledgeable about office management practices and has segregated the cash receipt duties as follows: Lena opens the mail and prepares a triplicate list of money received. Lena sends one copy of the list to Carrie, the cashier, who deposits the receipts daily in the bank. Margaret, the recordkeeper, receives a copy of the list and posts payments to the patients' accounts. About once a month, the office clerks have an expensive lunch they pay for as follows. First Carrie endorses a patient's check in the doctor's name and cashes it at the bank. Lena then destroys the remittance advice accompanying the check. Finally, Margaret posts payment to the customer's account as a miscellaneous credit. The three justify their actions by their relatively low pay and knowledge that the doctor will likely never miss the money. What went wrong with the doctor's internal controls?

Lena, Carrie, and Margaret work for a family physician. The doctor is knowledgeable about office management practices and has segregated the cash receipt duties as follows: Lena opens the mail and prepares a triplicate list of money received. Lena sends one copy of the list to Carrie, the cashier, who deposits the receipts daily in the bank. Margaret, the recordkeeper, receives a copy of the list and posts payments to the patients' accounts. About once a month, the office clerks have an expensive lunch they pay for as follows. First Carrie endorses a patient's check in the doctor's name and cashes it at the bank. Lena then destroys the remittance advice accompanying the check. Finally, Margaret posts payment to the customer's account as a miscellaneous credit. The three justify their actions by their relatively low pay and knowledge that the doctor will likely never miss the money.

Would a bank reconciliation uncover this office fraud?

Rick Rambis operates a ski lodge center at Bull Mountain in Alaska. He has just received the monthly bank statement at October 31 from Bull National Bank. The bank statement shows an ending balance at October 31 of $750. The following items are listed on the statement:1. The bank collected rent revenue for Rick in the amount of $330.2. Service charge of $10.3. Two NSF checks from customers totaling $110.4. Printing check charge of $11.In reviewing his cash records and the bank statement, Rick identifies the following:1. Outstanding checks totaling $603.2. Deposit in transit on October 31 of $1,770.3. An error made by Rick: Rick recorded a salary check for $31 but it cleared the bank at $310.Rick’s cash records show a balance on October 31 of $1,997.Requireda) Reconcile the bank account.b) Prepare journal entries that should be made as a result of the bank reconciliation.c) What should the balance in Rick’s Cash account be after the reconciliation?d) What total amount of cash should the…

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - Prob. 1ECh. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - What Would You Say? A fellow accounting student...Ch. 2 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tracy has the following transactions written down and plans on entering them into her register. Her starting balance is $178.85. She wrote checks for $37.12, $45.60, and got a check from her friend for $40 she owed her. What is Tracy's current balance in the account?arrow_forwardPrepare the following journal entry, all transactions that occurred in January: The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400. A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.arrow_forwardOn September 30, Hector’s petty cash fund of $100 is replenished. At the time, the cash box contained $18 cash and receipts for taxi fares ($40), delivery charges ($12), and office supplies ($30).Prepare the journal entry to record the replenishment of the fund.arrow_forward

- Your Client, Ashley Mason, is an artist who specializes in henna tattoos. Four years ago, she entered into a five-year contract to rent a kiosk inside the local mall to sell henna tattoos to customers. She called the business “Ashley’s Arm Brands” and hired two other local artists to assist in the work. She opened a separate bank account to keep track of the business cash, and she tracked all expenses and income using a detailed spreadsheet. She is not incorporated. In the first year, the business did fairly well, but then revenues and customer interest declined. Another local artist opened a competing henna studio at a nearby location that seemed to get more foot traffic and was able to bring in celebrity artists to complete work. Ashley increased her marketing and advertising, including creating both a webpage and a Facebook page, offered discounts and contests, and created deals with other kiosks to increase business. Ashley works at the mall kiosk almost 40 hours a week. She is…arrow_forwardBlue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardHarriet Knox, Ralph Patton, and Marcia Diamond work for a family physician, Dr. Gwen Conrad, who is in private practice. Dr. Conrad is knowledgeable about office management practices and has segregated the cash receipt duties as follows. Knox opens the mail and prepares a triplicate list of money received. She sends one copy of the list to Patton, the cashier, who deposits the receipts daily in the bank. Diamond, the recordkeeper, receives a copy of the list and posts payments to patients' accounts. About once a month the office clerks have an expensive lunch they pay for as follows. First, Patton endorses a patient's check-in Dr. Conrad's name and cashes it at the bank. Knox then destroys the remittance advice accompanying the check. Finally, Diamond posts payment to the customer's account as a miscellaneous credit. The three justify their actions by their relatively low pay and knowledge that Dr. Conrad will likely never miss the money. 1. Who is the best person in Dr. Conrad's…arrow_forward

- Prepare journal entries for the following transactions, using the accounts in the order listed: PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. On June 1, Kellie Company had decided to initiate a petty cash fund in the amount of $1,200. DR CR On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. DR DR DR DR DR DR or CR? CR On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. DR DR DR DR DR DR or CR?…arrow_forwardHarriet Knox, Ralph Patton, and Marcia Diamond work for a family physician, Dr. Gwen Conrad, who is in private practice. Dr. Conrad is knowledgeable about office management practices and has segregated the cash receipt duties as follows. Knox opens the mail and prepares a triplicate list of money received. She sends one copy of the list to Patton, the cashier, who deposits the receipts daily in the bank. Diamond, the recordkeeper, receives a copy of the list and posts payments to patients’ accounts. About once a month the office clerks have an expensive lunch they pay for as follows. First, Patton endorses a patient’s check in Dr. Conrad’s name and cashes it at the bank. Knox then destroys the remittance advice accompanying the check. Finally, Diamond posts payment to the customer’s account as a miscellaneous credit. The three justify their actions by their relatively low pay and knowledge that Dr. Conrad will likely never miss the money. Required 1. Who is the best person in Dr.…arrow_forwardKathy Concepcion operates KC, a perfume and soap store. The company uses special journals. KC provides a special column for 12% VAT in its sales and purchases journal. VAT is included in the purchases, freight and sales amounts. All collections are immediately deposited. All payments amounting to $5,000 and above are made by checks. During May, the following transactions were completed: May 1 – Invested cash of $250,000 and merchandise of $50,000 to open the business. Deposited $200,000 of the cash investment with Citibank May 2 – Signed a contract of lease with Robinson’s Landholdings and made an advance payment for two month’s rent, $18,000. Check no. 201. Voucher 101. Paid for taxes and licenses to the BIR, $1,200 May 3 – Purchased merchandise on account from Subic, $ 13,440 Terms: 2/10, n/30. Purchase Invoice 422 May 5 – Purchased store supplies on account from Goodwill Bookstore, $1,792. Terms: 1/10, n/30. Purchase Invoice 422 May 8 – Sold merchandise on account to Rustan, $11,760…arrow_forward

- Consider each of the transaction below independently. All expenditures were made in cash In march, the Cleanway Laundromat bought equipment. Cleanway paid $5,000 down and signed a noninterest-bearing note requiring the payment of $30,000 in nine months. The cash price for the equipment was $34,000. Prepare all necessary journal entries to record each the transaction. Use this format: Date Account Titles DR CRarrow_forwardDaryl Swan operates four video rental stores. She has just received the monthly bank statement at October31, 2019 from Bank of Montreal, and the statement shows an ending balance of $4,180. Listed on thestatement are an EFT rent collection by the bank for Swan of $150, a service charge of $15, four NSFcheques totalling $100, and a $20 charge for printed cheques. In reviewing her cash records, Swanidentifies outstanding cheques totalling $306 and an October 31 deposit in transit of $1,002. DuringOctober she recorded a $315 cheque for the salary of a part-time employee as $31. Swan’s Cash accountshows an October 31 cash balance of $5,145.Required:1. Prepare a bank reconciliation for Daryl Swan to determine how much cash Swan actually has atOctober 31, 2019?arrow_forwardBev Wynn, vice president of operations for Dillon County Bank, has instructed the bank’s computer programmer to use a 365-day year to compute interest on depository accounts (liabilities). Bev also instructed the programmer to use a 360-day year to compute interest on loans (assets).Discuss whether Bev is behaving in a professional manner.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY