Concept explainers

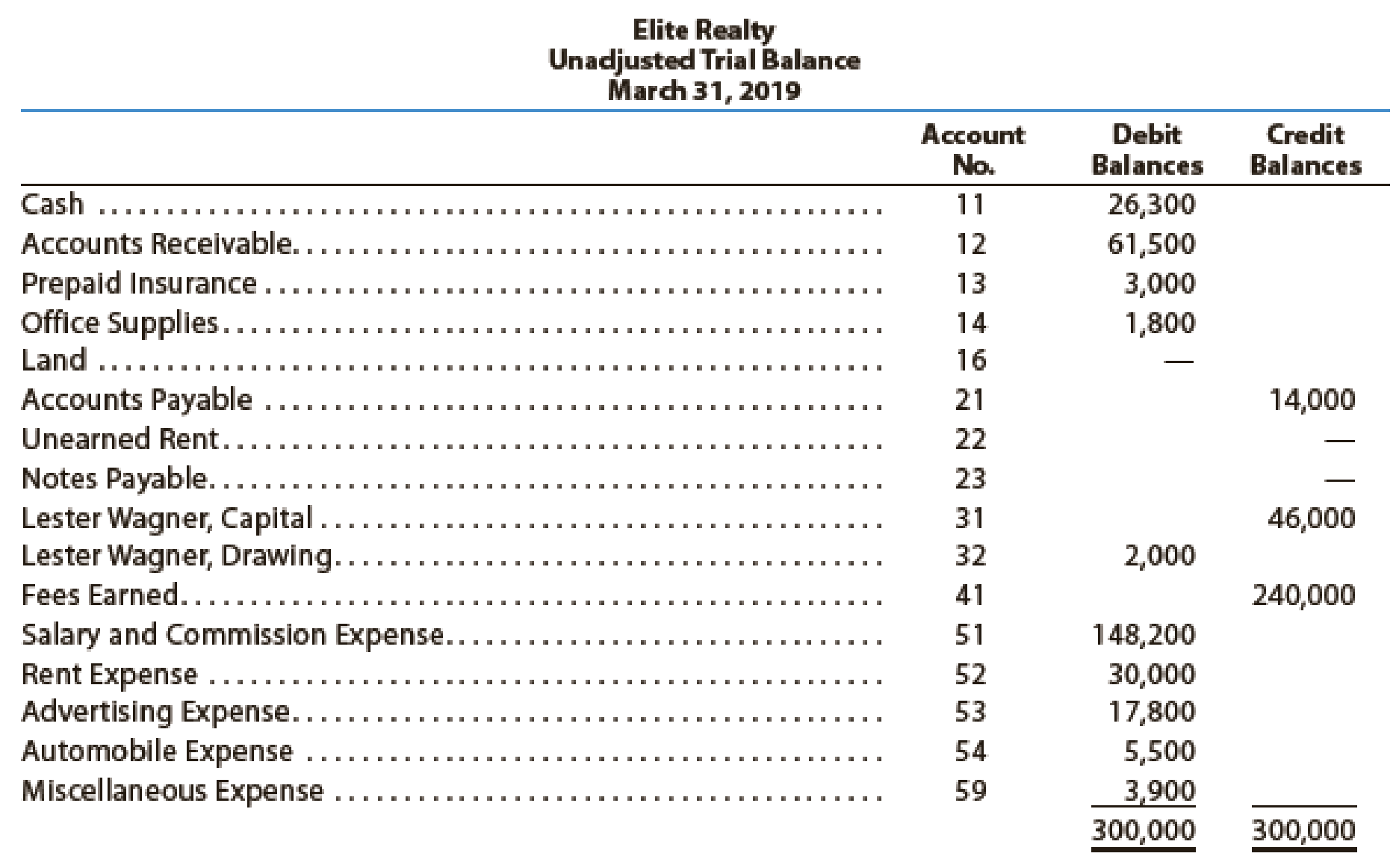

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted

The following business transactions were completed by Elite Realty during April 2019:

Apr. 1. Paid rent on office for month, $6,500.

2. Purchased office supplies on account, $2,300.

5. Paid insurance premiums, $6,000.

10. Received cash from clients on account, $52,300.

15. Purchased land for a future building site for $200,000, paying $30,000 in cash and giving a note payable for the remainder.

17. Paid creditors on account, $6,450.

20. Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, $325.

23. Paid advertising expense, $4,300.

Enter the following transactions on Page 19 of the two-column journal:

27. Discovered an error in computing a commission; received cash from the salesperson for the overpayment, $2,500.

28. Paid automobile expense (including rental charges for an automobile), $1,500.

29. Paid miscellaneous expenses, $1,400.

30. Recorded revenue earned and billed to clients during the month, $57,000.

30. Paid salaries and commissions for the month, $11,900.

30. Withdrew cash for personal use, $4,000.

30. Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of $10,000.

Instructions

- 1. Record the April 1, 2019, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (✓) in the Posting Reference column.

- 2. Journalize the transactions for April in a two-column journal beginning on Page 18.

Journal entry explanations may be omitted. - 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

- 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2019.

- 5. Assume that the April 30 transaction for salaries and commissions should have been $19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?

(2) and (3)

Journalize the transactions of April in a two column journal beginning on page 18.

Explanation of Solution

Journal:

Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Rules of debit and credit:

“An increase in an asset account, an increase in an expense account, a decrease in liability account, and a decrease in a revenue account should be debited.

Similarly, an increase in liability account, an increase in a revenue account and a decrease in an asset account, a decrease in an expenses account should be credited”.

Journalize the transactions of April in a two column journal beginning on page 18.

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2019 | Rent expense | 52 | 6,500 | ||

| April | 1 | Cash | 11 | 6,500 | |

| (To record the payment of rent) | |||||

| 2 | Office supplies | 14 | 2,300 | ||

| Accounts payable | 21 | 2,300 | |||

| (To record the purchase of supplies of account) | |||||

| 5 | Prepaid insurance | 13 | 6,000 | ||

| Cash | 11 | 6,000 | |||

| (To record the payment of insurance premium) | |||||

| 10 | Cash | 11 | 52,300 | ||

| Accounts receivable | 12 | 52,300 | |||

| (To record the receipt of cash from clients) | |||||

| 15 | Land | 16 | 200,000 | ||

| Cash | 11 | 30,000 | |||

| Notes payable | 23 | 170,000 | |||

| (To record the purchase of land party for cash and party on signing a note) | |||||

| 17 | Accounts payable | 21 | 6,450 | ||

| Cash | 11 | 6,450 | |||

| (To record the payment made to creditors on account) | |||||

| 20 | Accounts payable | 21 | 325 | ||

| Office supplies | 14 | 325 | |||

| (To record the payment made to creditors on account) | |||||

| 23 | Advertising expense | 53 | 4,300 | ||

| Cash | 11 | 4,300 | |||

| (To record the payment of advertising expense) | |||||

Table (1)

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2019 | Cash | 52 | 2,500 | ||

| April | 27 | Salary and commission expense | 11 | 2,500 | |

| (To record the receipt of cash) | |||||

| 28 | Automobile expense | 54 | 1,500 | ||

| Cash | 11 | 1,500 | |||

| (To record the payment made for automobile expense) | |||||

| 29 | Miscellaneous expense | 59 | 1,400 | ||

| Cash | 11 | 1,400 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 30 | Accounts receivable | 12 | 57,000 | ||

| Fees earned | 41 | 57,000 | |||

| (To record the revenue earned and billed) | |||||

| 30 | Salary and commission expense | 51 | 11,900 | ||

| Cash | 11 | 11,900 | |||

| (To record the payment made for salary and commission expense) | |||||

| 30 | L’s Drawing | 32 | 4,000 | ||

| Cash | 11 | 4,000 | |||

| (To record the drawing made for personal use) | |||||

| 30 | Cash | 11 | 10,000 | ||

| Unearned rent | 22 | 10,000 | |||

| (To record the cash received for the service yet to be provide) | |||||

Table (2)

(1) and (3)

Record the beginning balances of each accounts in the appropriate balance column of a four-column account, and post them to the ledger extending the account balance to the appropriate balance column after each posting.

Explanation of Solution

T-account:

An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account.

- The left or debit side.

- The right or credit side.

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 26,300 | |||

| 1 | 18 | 6,500 | 19,800 | ||||

| 5 | 18 | 6,000 | 13,800 | ||||

| 10 | 18 | 52,300 | 66,100 | ||||

| 15 | 18 | 30,000 | 36,100 | ||||

| 17 | 18 | 6,450 | 29,650 | ||||

| 23 | 18 | 4,300 | 25,350 | ||||

| 27 | 19 | 2,500 | 27,850 | ||||

| 28 | 19 | 1,500 | 26,350 | ||||

| 29 | 19 | 1,400 | 24,950 | ||||

| 30 | 19 | 11,900 | 13,050 | ||||

| 30 | 19 | 4,000 | 9,050 | ||||

| 30 | 19 | 10,000 | 19,050 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 61,500 | |||

| 10 | 18 | 52,300 | 9,200 | ||||

| 30 | 19 | 57,000 | 66,200 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 3,000 | |||

| 5 | 18 | 6,000 | 9,000 | ||||

Table (5)

| Account: Office Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 1,800 | |||

| 2 | 18 | 2,300 | 4,100 | ||||

| 20 | 18 | 325 | 3,775 | ||||

Table (6)

| Account: Land Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 15 | 18 | 200,000 | 200,000 | |||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 14,000 | |||

| 2 | 18 | 2,300 | 16,300 | ||||

| 17 | 18 | 6,450 | 9,850 | ||||

| 20 | 18 | 325 | 9,525 | ||||

Table (8)

| Account: Unearned Rent Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 30 | 19 | 10,000 | 10,000 | |||

Table (9)

| Account: Notes Payable Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 15 | 18 | 170,000 | 170,000 | |||

Table (10)

| Account: Capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 46,000 | |||

Table (11)

| Account: Drawing Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 2,000 | |||

| 30 | 19 | 4,000 | 6,000 | ||||

Table (12)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 240,000 | |||

| 30 | 19 | 57,000 | 297,000 | ||||

Table (13)

| Account: Salary and commission expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 148,200 | |||

| 27 | 19 | 2,500 | 145,700 | ||||

| 30 | 19 | 11,900 | 157,600 | ||||

Table (14)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 30,000 | |||

| 1 | 18 | 6,500 | 36,500 | ||||

Table (15)

| Account: Advertising expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 17,800 | |||

| 23 | 18 | 4,300 | 22,100 | ||||

Table (16)

| Account: Automobile expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 5,500 | |||

| 28 | 19 | 1,500 | 7,000 | ||||

Table (17)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2019 | |||||||

| April | 1 | Balance | ✓ | 3,900 | |||

| 29 | 19 | 1,400 | 5,300 | ||||

Table (18)

(4)

Prepare an unadjusted trial balance of Company E at April 30, 2019.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance of Company E at April 30, 2019 as follows:

|

Company E Unadjusted Trial Balance April 30, 2019 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 19,050 | |

| Accounts receivable | 12 | 66,200 | |

| Prepaid insurance | 13 | 9,000 | |

| Office supplies | 14 | 3,775 | |

| Land | 16 | 200,000 | |

| Accounts payable | 21 | 9,525 | |

| Unearned rent | 22 | 10,000 | |

| Notes payable | 23 | 170,000 | |

| Capital | 31 | 46,000 | |

| Drawings | 32 | 6,000 | |

| Fees earned | 41 | 297,000 | |

| Salaries and commission expense | 51 | 157,600 | |

| Rent expense | 52 | 36,500 | |

| Advertising expense | 53 | 22,100 | |

| Automobile expense | 54 | 7,000 | |

| Miscellaneous expense | 59 | 53,000 | |

| Total | 532,525 | 532,525 | |

Table (19)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $532,525.

(5)

(A)

Explain whether the unadjusted trial balance in (4) balance.

Explanation of Solution

The unadjusted trial balance in (4) would still balance, since the debit equalized the credit in the original journal entry.

(B)

Journalize the correcting entry.

Explanation of Solution

The Correcting entry is as follows:

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2019 | Salary and commission expense | 51 | 7,200 | ||

| April | 30 | Cash | 11 | 7,200 | |

| (To record the correcting entry) | |||||

Table (20)

Working notes:

(C)

Identify whether the error made is a slide or transposition.

Explanation of Solution

Transposition error: At the time of posting a transaction when two digits of numbers are transposed, in such case the transposition error occurs.

Slide error: A slide error occurs, when the decimal point of an amount has been misplaced.

The account balance recorded as $11,900 instead of $19,100 is a transposition error. Since the two digits of the numbers are transposed.

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Accounting

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning