Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 23E

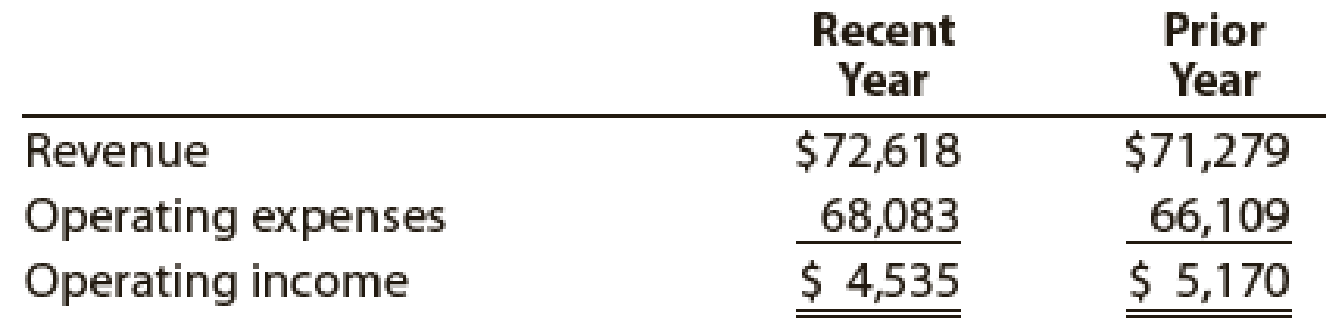

The following data (in millions) are taken from the financial statements of Target Corporation:

- a. For Target Corporation, determine the amount of change in millions and the percent of change (round to one decimal place) from the prior year to the recent year for:

- 1. Revenue

- 2. Operating expenses

- 3. Operating income

- b.

What conclusions can you draw from your analysis of the revenue and the total operating expenses?

What conclusions can you draw from your analysis of the revenue and the total operating expenses?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting question

Provide correct option general Accounting

Hello tutor please given correct answer general Accounting

Chapter 2 Solutions

Financial Accounting

Ch. 2 - What is the difference between an account and a...Ch. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - eCatalog Services Company performed services in...Ch. 2 - If the two totals of a trial balance are equal,...Ch. 2 - Assume that a trial balance is prepared with an...Ch. 2 - Assume that when a purchase of supplies of 2,650...Ch. 2 - Assume that Muscular Consulting erroneously...Ch. 2 - Assume that Sunshine Realty Co. borrowed 300,000...Ch. 2 - Checking accounts are a common form of deposits...

Ch. 2 - State for each account whether it is likely to...Ch. 2 - State for each account whether it is likely to...Ch. 2 - Prepare a journal entry for the purchase of office...Ch. 2 - Prob. 2PEBCh. 2 - Prepare a journal entry on April 30 for fees...Ch. 2 - Prepare a journal entry on August 13 for cash...Ch. 2 - Prepare a journal entry on December 23 for the...Ch. 2 - Prepare a journal entry on June 30 for the...Ch. 2 - Prob. 5PEACh. 2 - On August 1, the supplies account balance was...Ch. 2 - For each of the following errors, considered...Ch. 2 - For each of the following errors, considered...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following errors took place in journalizing...Ch. 2 - Prob. 8PEACh. 2 - Prob. 8PEBCh. 2 - The following accounts appeared in recent...Ch. 2 - Oak Interiors is owned and operated by Fred Biggs,...Ch. 2 - Outdoor Leadership School is a newly organized...Ch. 2 - The following table summarizes the rules of debit...Ch. 2 - During the month, Midwest Labs Co. has a...Ch. 2 - Identify each of the following accounts of...Ch. 2 - Concrete Consulting Co. has the following accounts...Ch. 2 - On September 18, 2019, Afton Company purchased...Ch. 2 - The following selected transactions were completed...Ch. 2 - During the month, Warwick Co. received 515,000 in...Ch. 2 - a. During February, 186,500 was paid to creditors...Ch. 2 - As of January 1, Terrace Waters, Capital had a...Ch. 2 - National Park Tours Co. is a travel agency. The...Ch. 2 - Based upon the T accounts in Exercise 2-13,...Ch. 2 - Based upon the data presented in Exercise 2-13,...Ch. 2 - The accounts in the ledger of Hickory Furniture...Ch. 2 - Indicate which of the following errors, each...Ch. 2 - The following preliminary unadjusted trial balance...Ch. 2 - The following errors occurred in posting from a...Ch. 2 - Identify the errors in the following trial...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following data (in millions) are taken from...Ch. 2 - The following data (in millions) were taken from...Ch. 2 - Connie Young, an architect, opened an office on...Ch. 2 - On January 1, 2019, Sharon Matthews established...Ch. 2 - On June 1, 2019, Kris Storey established an...Ch. 2 - Elite Realty acts as an agent in buying, selling,...Ch. 2 - The Colby Group has the following unadjusted trial...Ch. 2 - Ken Jones, an architect, opened an office on April...Ch. 2 - Prob. 2PBCh. 2 - On October 1, 2019, Jay Pryor established an...Ch. 2 - Valley Realty acts as an agent in buying, selling,...Ch. 2 - Tech Support Services has the following unadjusted...Ch. 2 - The transactions completed by PS Music during June...Ch. 2 - Buddy Dupree is the accounting manager for On-Time...Ch. 2 - Prob. 5CPCh. 2 - The following discussion took place between Tony...Ch. 2 - Prob. 7CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License