This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

4. Restore the total number of machine-hours in the Assembly Department to 3000 machine-hours. What happens to the selling price forJob 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 50,000direct labor-hours? Does it increase, decrease, or stay the same as in pail 2 above? Why?

Selling price: The cost incurred by selling the product in the market is known as the selling price.

Determine the selling price for Job 408 when the machine hours in Assembly department are restored to 3000 hours and the Direct Labor hours in the said department are reduced from 80000 hours to 50000 hours.

Answer to Problem 4AE

Solution:

The pre-determined rate per direct labor hour increases from $10 to 13.75. As a result of which the total cost increases leading to an ultimate increase in the selling price for Job 408.Explanation of Solution

The calculation is done in the workbook and it is explained below,

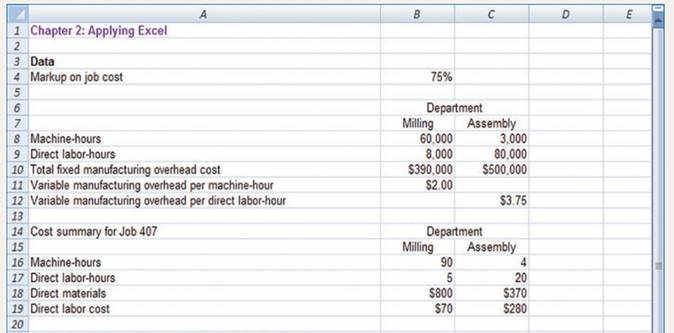

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 6000 |

| 2 | Direct Labour Hours | 8000 | 50000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $3.75 |

| Cost Summary for job 408 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 40 | 10 |

| 7 | Direct Labour Hours | 2 | 6 |

| 8 | Direct Materials | $700.00 | $360.00 |

| 9 | Direct Labour cost | $50.00 | $150.00 |

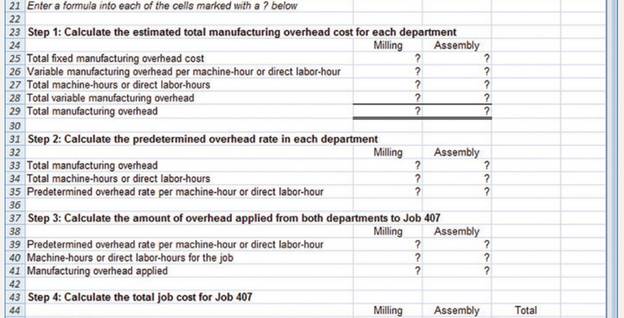

| Enter a formula into each of the cells marked with ? below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,00,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 50000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $1,87,500.00 |

| 14 | Total manufacturing overhead (10 + 13) | $4,20,000.00 | $6,87,500.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $4,20,000.00 | $6,87,500.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 50000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $7.00 | $13.75 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 408 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $7.00 | $13.75 |

| 19 | Machine hours or direct labour hours for the job (given) | 40 | 6 |

| 20 | Manufacturing overhead applied (18 x 19) | $280.00 | $82.50 |

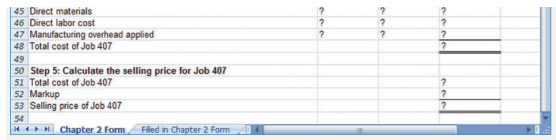

| Step 4: Calculate the total job cost for Job 408 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $700.00 | $360.00 |

| 22 | Direct Labour cost (given) | $50.00 | $150.00 |

| 23 | Manufacturing overhead applied (20) | $280.00 | $82.50 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,030.00 | $592.50 |

| Total cost of Job 407 (Milling + Assembly) | $1,622.50 | ||

| Step 5: Calculate the selling price for Job 408 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,030.00 | $592.50 |

| 26 | Mark-up (24 x 75%) | $772.50 | $444.38 |

| 27 | Selling price of Job 407 (25 + 26 ) | $1,802.50 | $1,036.88 |

| 28 | Total Selling Price of Job 408 (Milling + Assembly) | $2,839.38 | |

When the direct labor hours are reduced from 80000 hours to 50000 hours, the cost increases since the pre-determined rate per direct labor hour increases from $10 to $13.75. As a result of which the total cost increases leading to an ultimate increase in the selling price.

Since selling price is calculated as per the Cost plus Markup method it is directly related to an increase or a decrease in the cost.

Want to see more full solutions like this?

Chapter 2 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

- This section has a nine-part comprehensive problem with multiple questions to address. Download the Chapter 9 Comprehensive Problem Template below to complete all parts. You will need your Bergevin and MacQueen book for reference. Redlands Inc. reported standard and actual costs for the product that it manufactures: Item Direct material price Direct materials quantity Direct labor price Direct labor quantity Factory overhead cost Machine hours per unit Number of finished products made Number of finished products sold Sales price per unit Standard $3 per lb. 2 lbs. $5 3 hours $2 per machine hour 2 machine hours 10 10 $40 Actual $2 per lb. 4 lbs. $7 2 hours 3 machine hours 12 11 $40arrow_forwardOakwood Company produces maple bookcases. The following information is available for the production of a recent order of 500 bookcases. Process time Inspection time Move time Wait time 1. Compute cycle time. 2. Compute cycle efficiency. 19 days 1 day 4 days 17 days 3. Management believes it can reduce move time by 1 day and wait time by 2 days by adopting lean manufacturing techniques. Compute cycle efficiency assuming the predictions are correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute cycle time. Inspection time Move time Process time Wait time Cycle time Cycle Time Required 3 Time 0arrow_forwardRefer to the information for Smooth Move Company on the previous page. Suppose a customerwants to have its company logo affixed to each paperweight using a label. Smooth Move wouldhave to purchase a special logo labeling machine that will cost $12,000. The machine will be ableto label the 15,000 units and then it will be scrapped (with no further value). No other fixedoverhead activities will be incurred. In addition, each special logo requires additional direct materials of $0.20.Required:CONCEPTUAL CONNECTION Should Smooth Move accept the special order? By how muchwill profit increase or decrease if the order is accepted?arrow_forward

- PLEASE INCLUDE THE EXCEL FORMULAS!! Thanks!! Please don't forget to check your worksheet by changing the units sold in the Data to 6,000 for Year 2 before submitting the response to my question. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isn’t, check cell C41. The formula in this cell should be =IF(C26<C27,C26*C36+(C27-C26)*B36,C27*C36).] If your worksheet is operating properly, the net operating income under both absorption costing and variable costing should be $(34,000) for Year 2. That is, the loss in Year 2 is $34,000 under both methods. If you do not get these answers, find the errors in your worksheet and correct them. Assume that the units produced in year 2 were sold first. If someone can help I will give a thumbs up. Thanks for the help! :)arrow_forwardRequired information [The following information applies to the questions displayed below.] Odessa, Incorporated, manufactures one model of computer desk. The following data are available regarding units shipped and total shipping costs: Month January February March April May June July Number of Units Total Shipping Shipped 40 45 25 50 55 65 35 Cost $ 2,950 2,800 2,100 3,350 3,300 3,900 2,000 Required: 1. Prepare a scattergraph of Odessa's shipping cost and draw the line you believe best fits the data. Instructions: 1. Click on a point to the right of the graph. 2. Click within the graph to place the point. 3. Enter the exact coordinates in the dialog box that appears to the right of the graph. 4. Click save. 5. To change coordinates already saved, click on a point already placed in the graph, and enter revised coordinates in the dialog box that opens. 6. Use the line tool provided to plota regression line for this data with ending coordinates of (100, 5100). To use the line tool, first…arrow_forwardMatch each of the following cost items with the value chain business function where you would expect the cost to be incurred: Cost Item 1. Labor time to repair products under warranty 2. Radio commercials 3. Labor costs of delivering customer orders 4. Testing of competitor's product 5. Direct manufacturing labor costs 6. Development of order tracking system for online sales 7. Design cost of new product brochures 8. Hours spent designing childproof bottles 9. Training costs for representatives to staff the customer call center 10. Installation of robotics equipment in manufacturing plant Business Functionarrow_forward

- Oficina Bonita Company manufactures office furniture. An unfinished desk is produced for $37.15 and sold for $65.45. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $6.15. Prepare a differential analysis. Round your answers to two decimal places. Line Item Description Sell UnfinishedDesks(Alternative 1) Process Further intoFinished Desks(Alternative 2) DifferentialEffects(Alternative 2) Revenues per desk $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Costs per desk fill in the blank 4 fill in the blank 5 fill in the blank 6 Profit (loss) per desk $fill in the blank 7 $fill in the blank 8 $fill in the blank 9 Should the company sell unfinished desks or process further and sell finished desks?Oficina Bonita Company should .arrow_forwardConvert the accompanying database to an Excel table to find: a.The total cost of all orders. b.Thetotal quantity of airframe fasteners purchased. c. The total cost of all orders placed with Manley Valve. Question content area bottom Part 1 a. The total cost of all orders is $?????? enter your response here.arrow_forwardGuppy Inc. is a small distributor of mechanical pencils. Guppy identifies its three major activities and cost pools as ordering, receiving and storage, and shipping, and it reports the following details for 2019: (Click the icon to view the activity and cost pool details.) Revenues Costs: Begin by calculating the operating income. Then, calculate the per unit amounts. (Round the per unit amounts to the nearest cent.) Purchase cost of pencil packs Ordering costs Receiving and storage Shipping Total costs Operating income Total C Per Unit For 2019, Guppy buys 250,000 pencil packs at an average cost of $3 per pack and sells them to retailers at an average price of $7 per pack. Assume Guppy has no fixed costs and no inventories. Calculate Guppy's operating income for 2019.arrow_forward

- Williams Performance Co. manufactures sports cars. After making a sale, the salesperson sends the car to be detailed before the customer takes it home. Detailing the car takes 15 minutes at a cost of $16 per hour for direct labor and $6 per car for materials. If the average salesperson sells six cars per day, what is the average cost per 5-day week for detailing cars? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) What is the answer/how do you get it?arrow_forwardmodel for the most recent iPhone as well as a deluxe model. Management has designed an ABC system with the following activity cost pools and activity rates for these models: Check my wark Activity Cost Pool Supporting manufacturing Order processing Activity Rates $ 2 per direct labour-hour $20 per order $61 per custoner Customer service Management would like an analysis of the profitability of a particular customer, Cell City, which has ordered the following products over the last 12 months: Standard Deluxe Model Model 200 Number of cases Number of orders Direct labour-hours per case Selling price per case Direct materials cost per case 6e 2 e. 25 $440 0.40 60 $417 $ 20 The company's direct labour rate is $20 per hour. Required: Using the company's ABC system, compute the customer margin of Cell City.arrow_forwardAlbedo Incorporated manufactures high-end replacement telescope lenses for amateur and professional astronomers who are seeking to upgrade the performance of their telescopes. You have just become employed as a staff accountant at Albedo, and Jordan Coleman, the controller, has asked you to help with maintenance cost estimation for the lens manufacturing process. You review the manufacturing process and decide that the best cost driver for maintenance costs is machine hours. The data below are from the previous fiscal year for maintenance costs and machine hours: Month Maintenance Costs Machine Hours $ 3,210 4,650 5,175 3,350 3,100 1 2 3 4 5 6 7 8 9 10 11 12 2,950 2,900 2,900 4,120 4,350 3,500 3,775 2,750 3,900 4,050 2,690 2,500 2,580 2,300 2,500 3,160 3,325 2,780 3,000 Required: 1. What is the cost equation for maintenance costs using the high-low method? (Round "slope (unit variable cost)" to 2 decimal places. Negative amounts should be indicated by a minus sign.)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning