FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

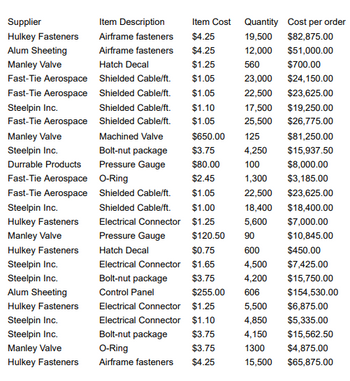

Convert the accompanying database to an Excel table to find:

a.The total cost of all orders.

b.Thetotal quantity of airframe fasteners purchased.

c. The total cost of all orders placed with Manley Valve.

Question content area bottom

Part 1

a. The total cost of all orders is

$?????? enter your response here.

Transcribed Image Text:Supplier

Hulkey Fasteners

Alum Sheeting

Manley Valve

Fast-Tie Aerospace

Fast-Tie Aerospace

Steelpin Inc.

Fast-Tie Aerospace

Manley Valve

Steelpin Inc.

Durrable Products

Fast-Tie Aerospace

Fast-Tie Aerospace

Steelpin Inc.

Hulkey Fasteners

Manley Valve

Hulkey Fasteners

Steelpin Inc.

Steelpin Inc.

Alum Sheeting

Hulkey Fasteners

Steelpin Inc.

Steelpin Inc.

Manley Valve

Hulkey Fasteners

Item Description

Airframe fasteners $4.25

Airframe fasteners

$4.25

Hatch Decal

$1.25

Shielded Cable/ft.

$1.05

Shielded Cable/ft.

$1.05

Shielded Cable/ft.

$1.10

Shielded Cable/ft.

$1.05

Machined Valve

Bolt-nut package

Pressure Gauge

O-Ring

Shielded Cable/ft.

Shielded Cable/ft.

Electrical Connector

Pressure Gauge

Hatch Decal

Electrical Connector

Bolt-nut package

Control Panel

Electrical Connector

Electrical Connector

Item Cost

Bolt-nut package

O-Ring

Airframe fasteners

$650.00

$3.75

$80.00

$2.45

$1.05

$1.00

$1.25

$120.50

$0.75

$1.65

$3.75

$255.00

$1.25

$1.10

$3.75

$3.75

$4.25

Quantity Cost per order

19,500 $82,875.00

12,000

$51,000.00

560

23,000

22,500

17,500

25,500

$700.00

$24,150.00

$23,625.00

$19,250.00

$26,775.00

125

$81,250.00

4,250

$15,937.50

100

$8,000.00

1,300

$3,185.00

22,500

$23,625.00

18,400

$18,400.00

5,600 $7,000.00

90

$10,845.00

600

$450.00

4,500

$7,425.00

4,200

$15,750.00

606

$154,530.00

5,500

$6,875.00

4,850

$5,335.00

4,150

$15,562.50

1300

$4,875.00

15,500

$65,875.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please refer to the following notes as given in the images. Part 1: Understanding Activity-Based Costing a) Define ABC and explain its fundamental principles. b) Compare ABC with traditional costing methods Please answer this questions fully explain your answer in details explanation without any plagiarism and don't copy from other websites. Original. Answers from experts. Answer both part a and b. [*^%/_<>>_/=@+++++×$-'"^&*(*?,::**>[[(&^%%^****>[[[^=÷××$&<>*arrow_forwardLarned Recreational builds two models of dune buggies: Sport and Custom. Both models require the same assembly and finishing process and are assembled in the same factory. They differ in the quality and detail of the materials. The following data reflect expected operations for the upcoming year. Number of units Direct materials cost per unit Conversion costs: Direct labor Overhead Total Sport 3,200 $ 400 Custom Required A Required B 1,800 $ 1,100 Total 5,000 $ 1,920,000 2,608,000 $ 4,528,000 Required: a. Larned Recreation uses operations costing and assigns conversion costs based on the number of units assembled. Compute the cost per unit of the Sport and Custom models for the upcoming year. b. The financial team at Larned suggests that a two-stage system be used to compute the product cost of the two models. Their recommendation is to assign direct labor cost based on the number of units and overhead cost based on direct materials cost. Compute the cost per unit of the Sport and…arrow_forwardH3. Accountarrow_forward

- Chapter 1: Applying Excel: Excel Worksheet (Part 1 of 2) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell C18 enter the formula "= B6". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts in both the traditional and contribution format income statements match the numbers in Exhibit 1-7. Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4,700. If you do not get these answers, find the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by clicking “Browse.” Next, click…arrow_forwardCan you please show me how to workout this problemarrow_forwardnot use ai pleasearrow_forward

- Please help me with b2, c1, and c2. Thanks!arrow_forwardBelow is a list of costs. Please identify each cost as either a product or period cost. Dragged and dropped options on the right-hand side will be automatically saved. For keyboard navigation... SHOW MORE ✓ Depreciation on office copier Depreciation on office building Insurance on office building Metal used in building a car Salary of CEO Salary of production manager Salary of assembly line workers Utilities of office building = = Product Period = Period = Period = Product = Product = = Period Periodarrow_forwardDo not give image formatarrow_forward

- Required information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning. Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses. Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,700 18,800 8,900 27,500 21,600 20,150 23,800 7,600 11,400 24,500 14,200 7,700 43,500 53,200 294,720 30,000 15,200 Pepper Company $ 19,750 22,350 14,700 23,500 44,200 14,100 18,400 9,600 16,250 52,000 13,120 3,700 58,000 54,700 391,1801 24,200 20,700 1. Compute the total prime costs for both Garcon Company and Pepper Company. 2. Compute the total conversion…arrow_forwardCheck image file for question Q1a. Allocate the service department costs to the two operating departments using the direct method. b.Allocate the service department cost to the two operating departments using ,I)the step-down method (Allocate administrative service first) . ii)the step down method (Allocoate Maintenance service first) c. Assuming you are the manager of the Daily Patient department.Discuss which method of cost allocation would you prefer.Justify your decision d.Mr Smith the financial controller of LabAid is convinced that the step-down method allocates more costs to the operating departments than the direct method.Do you agree with ,Mr Smith.Explain.arrow_forwardPlease don't give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education