Use the following information for Exercises 2-47 through 2-49.

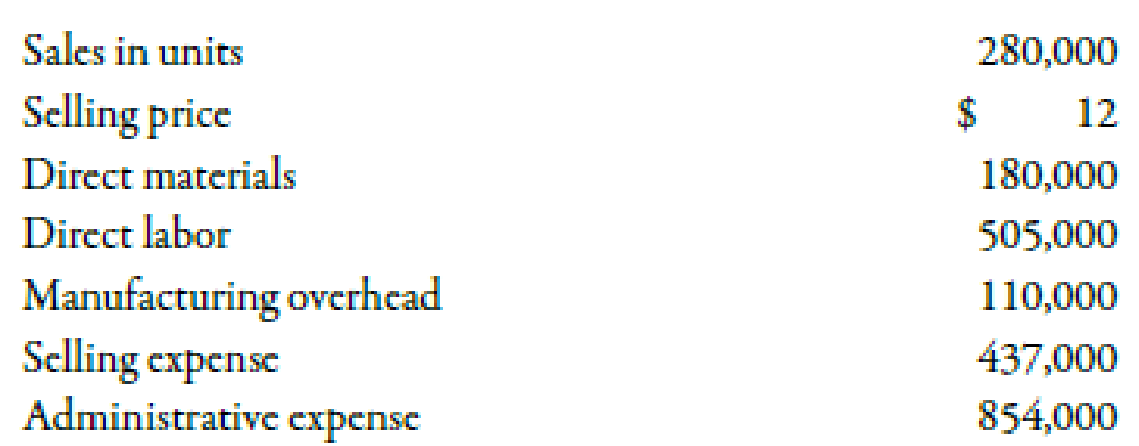

Jasper Company provided the following information for last year:

Last year, beginning and ending inventories of work in process and finished goods equaled zero.

Exercise 2-49 Income Statement

Refer to the information for Jasper Company on the previous page.

Required:

- 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.)

- 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.

1.

Prepare an income statement of Company S for the previous year along with the percentage of sales revenue represented by each line in the income statement.

Explanation of Solution

Income Statement:

The statement that shows revenue and expenses incurred over a period of time (usually one year) is called income statement. It is used for external financial reporting as it helps the outsiders and investors in evaluating the firm’s financial health.

The income statement of Company J for the previous year is given below:

| Company J | ||

| Income Statement | ||

| For Previous Year | ||

| Amount ($) | Percent | |

| Sales revenue | 3,360,000 | 100 |

| Cost of goods sold | 795,000 | 23.7 |

| Gross margin | 2,565,000 | 76.3 |

| Less: | ||

| Selling expense | 437,000 | 13 |

| Administrative expense | 854,000 | 25.4 |

| Net Income | 1,274,000 | 37.9 |

Table (1)

Therefore, the amount of net income and the percentage of net income are $1,274,000 and 37.9% respectively.

Working Notes:

Calculation of sales revenue:

Hence, the amount of sales revenue is $3,360,000.

Calculation of cost of goods sold:

Hence, the amount of cost of goods sold is $795,000.

Calculation of sales revenue percentage with respect to sales revenue:

The sales revenue percentage is 100%.

Calculation of COGS percentage with respect to sales revenue:

The COGS percentage with respect to sales revenue is 23.7%.

Calculation of gross margin percentage with respect to sales revenue:

The gross margin percentage with respect to sales revenue is 76.3%.

Calculation of selling expense percentage with respect to sales revenue:

The selling expense percentage with respect to sales revenue is 13%.

Calculation of administrative expense percentage with respect to sales revenue:

The administrative expense percentage with respect to sales revenue is 25.4%.

Calculation of net income percentage with respect to sales revenue:

The net income percentage with respect to sales revenue is 37.9%.

2.

Describe the way a manager can use the income statement to control the costs.

Explanation of Solution

The income statement reflecting each account in terms of percentage of sales helps in analyzing the effect of each expense on sales. The manager can identify those costs which are relatively high by analyzing percentage. It helps the manager to take necessary actions to control the administrative costs. In case of Company J, administrative expenses were almost double the selling expense. The manager will be able to find ways to control administrative expenses in future.

Want to see more full solutions like this?

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning