Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134128528

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.26AE

Compute Cost of Goods

Compute the Cost of Goods Manufactured and Cost of Goods Sold for West Nautical Company for the most recent year using the amounts described next. Assume that the Raw Materials Inventory contains only direct materials.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule02:52

Students have asked these similar questions

Get correct answer general accounting question

The Ford Company developed the following

Do fast answer of this accounting questions

Chapter 2 Solutions

Managerial Accounting (5th Edition)

Ch. 2 - (Learning Objective 1) Which of the following...Ch. 2 - (Learning Objective 2) Which of the following is...Ch. 2 - (Learning Objective 3) A cost that can be traced...Ch. 2 - (Learning Objective 4) Period costs are often...Ch. 2 - (Learning Objective 4) Conversion costs consist of...Ch. 2 - (Learning Objective 4) Which of the following is...Ch. 2 - Prob. 7QCCh. 2 - (Learning Objective 5) Which of the following...Ch. 2 - Prob. 9QCCh. 2 - Prob. 10QC

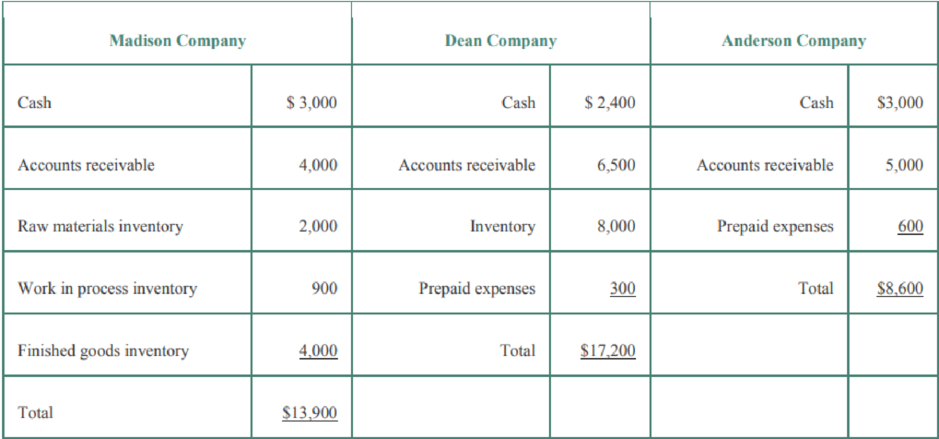

Ch. 2 - Short Exercises S2-1 Identify types of companies...Ch. 2 - Identify type of company from balance sheets...Ch. 2 - Classify costs by value chain function (Learning...Ch. 2 - Classify costs as direct or indirect (Learning...Ch. 2 - Prime costs Cost objects Product costs Assigned...Ch. 2 - Prob. 2.6SECh. 2 - Classify product costs and period costs (Learning...Ch. 2 - Classify a manufacturers costs (Learning Objective...Ch. 2 - Classify costs incurred by a dairy processing...Ch. 2 - Determine total manufacturing overhead (Learning...Ch. 2 - Prepare a retailers income statement (Learning...Ch. 2 - Compute Cost of Goods Sold for a merchandiser...Ch. 2 - Calculate direct materials used (Learning...Ch. 2 - Compute Cost of Goods Manufactured (Learning...Ch. 2 - Describe other cost terms (Learning Objectives 6...Ch. 2 - Classify costs as fixed or variable (Learning...Ch. 2 - Prob. 2.17SECh. 2 - Classify costs along the value chain for a...Ch. 2 - Classify costs along the value chain for a...Ch. 2 - Value chain and sustainability efforts (Learning...Ch. 2 - Prob. 2.21AECh. 2 - Construct an income statement using product and...Ch. 2 - Work backward to find missing amounts (Learning...Ch. 2 - Prepare a retailers income statement (Learning...Ch. 2 - Compute direct materials used and Cost of Goods...Ch. 2 - Compute Cost of Goods Manufactured and Cost of...Ch. 2 - Continues E2-26A: Prepare income statement...Ch. 2 - Determine whether information is relevant...Ch. 2 - Prob. 2.29AECh. 2 - Classify costs along the value chain for a...Ch. 2 - Classify costs along the value chain for a...Ch. 2 - Value chain and sustainability efforts (Learning...Ch. 2 - Classify and calculate a manufacturers costs...Ch. 2 - Construct an income statement using product and...Ch. 2 - Work backward to find missing amounts (Learning...Ch. 2 - Prob. 2.36BECh. 2 - Compute direct materials used and Cost of Goods...Ch. 2 - Compute Cost of Goods Manufactured and Cost of...Ch. 2 - Continues E2-38B: Prepare income statement...Ch. 2 - Determine whether information is relevant...Ch. 2 - Prob. 2.41BECh. 2 - Classify costs along the value chain (Learning...Ch. 2 - Determine ending inventory balances (Learning...Ch. 2 - Prepare income statements (Learning Objective 5)...Ch. 2 - Prob. 2.45APCh. 2 - Prob. 2.46APCh. 2 - Classify costs along the value chain (Learning...Ch. 2 - Determine ending inventory balances (Learning...Ch. 2 - Prepare income statements (Learning Objective 5)...Ch. 2 - Prob. 2.50BPCh. 2 - Prob. 2.51BPCh. 2 - Calculate operating income (Learning Objective 5)...Ch. 2 - Prob. 2.53ACT

Additional Business Textbook Solutions

Find more solutions based on key concepts

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

What is a qualitative forecasting model, and when is its use appropriate?

Operations Management

Preference for current ratio and quick ratio. Introduction: Current ratio explains the liquidity position of a ...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this question solution general accountingarrow_forwardchoose best answerarrow_forwardIngram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage? please provide answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY