Financial Accounting

4th Edition

ISBN: 9781259307959

Author: J. David Spiceland, Wayne M Thomas, Don Herrmann

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.1AP

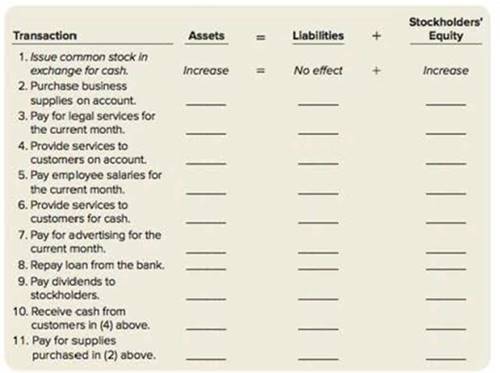

Below is a list of activities for Jayhawk Corporation.

Analyze the impact of transactions on the

Required:

For each activity, indicate whether the transaction increases, decreases, or has no effect on assets, liabilities, and stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What should be the price earning ratio of this company? Accounting

need help this questions

Answer please general accounting

Chapter 2 Solutions

Financial Accounting

Ch. 2 - Prob. 1RQCh. 2 - 2.List the steps we use to measure external...Ch. 2 - 3.Each external transaction will have a dual...Ch. 2 - 4.Describe the impact of each of these external...Ch. 2 - Prob. 5RQCh. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Prob. 8RQCh. 2 - Prob. 9RQCh. 2 - 10.Suzanne knows that an increase to an expense...

Ch. 2 - 11.What is a journal? What is a journal entry?Ch. 2 - Prob. 12RQCh. 2 - Prob. 13RQCh. 2 - Prob. 14RQCh. 2 - 15.Describe the events that correspond to the...Ch. 2 - 16.What does a T-account represent? What is the...Ch. 2 - Prob. 17RQCh. 2 - Prob. 18RQCh. 2 - Prob. 19RQCh. 2 - 20.If total debits equal total credits in the...Ch. 2 - List steps in the measurement process (LO21) Below...Ch. 2 - Balance the accounting equation (LO22) Using the...Ch. 2 - Suppose a local company has the following balance...Ch. 2 - Analyze the Impact of transactions on the...Ch. 2 - Understand the effect of debits and credits on...Ch. 2 - Prob. 2.6BECh. 2 - Record transactions (LO24) The following...Ch. 2 - Prob. 2.8BECh. 2 - Analyze T-accounts (LO25) Consider the following...Ch. 2 - Prob. 2.10BECh. 2 - Prob. 2.11BECh. 2 - Correct a trial balance (LO26) Your study partner...Ch. 2 - Listed below are several terms and phrases...Ch. 2 - Prob. 2.2ECh. 2 - Analyze the Impact of transactions on the...Ch. 2 - Analyze the Impact of transactions on the...Ch. 2 - Understand the components of retained earnings...Ch. 2 - Indicate the debit or credit balance of accounts...Ch. 2 - Associate debits and credits with external...Ch. 2 - Prob. 2.8ECh. 2 - Identify transactions (LO24) Below are recorded...Ch. 2 - Prob. 2.10ECh. 2 - Record transactions (LO24) Bearcat Construction...Ch. 2 - Correct recorded transactions (LO24) Below are...Ch. 2 - Correct recorded transactions (LO24) Below are...Ch. 2 - Prob. 2.14ECh. 2 - Post transactions to T-accounts (LO25) Consider...Ch. 2 - Identify transaction (LO25) Below are T-accounts....Ch. 2 - Prob. 2.17ECh. 2 - Prepare o trial balance (LO26) Below is the...Ch. 2 - Prob. 2.19ECh. 2 - Prob. 2.20ECh. 2 - Below is a list of activities for Jayhawk...Ch. 2 - Prob. 2.2APCh. 2 - Prob. 2.3APCh. 2 - Prob. 2.4APCh. 2 - Refer to the transactions described in P24A. Keep...Ch. 2 - Prepare a trial balance (LO26) Below are the...Ch. 2 - Prob. 2.7APCh. 2 - Prob. 2.8APCh. 2 - Prob. 2.9APCh. 2 - Analyze the impact of transactions on the...Ch. 2 - Prob. 2.2BPCh. 2 - Prob. 2.3BPCh. 2 - Record transactions (LO24) Flip Side of P25B Eli...Ch. 2 - Prob. 2.5BPCh. 2 - Prob. 2.6BPCh. 2 - Prob. 2.7BPCh. 2 - Prob. 2.8BPCh. 2 - Prob. 2.9BPCh. 2 - Prob. 2.1APCPCh. 2 - Prob. 2.2APFACh. 2 - The Buckle, Inc. Financial Analysis Financial...Ch. 2 - Prob. 2.4APCACh. 2 - Prob. 2.5APECh. 2 - Prob. 2.6APIRCh. 2 - Prob. 2.7APWC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License