Concept explainers

Analyzing the Effects of Transactions In T-Accounts

Precision Builders Construction Company was incorporated by Chris Stoschek. The following activities occurred during the year:

- a. Received from three investors $60,000 cash and land valued at $35,000: each investor was issued 1,000 shams of common stock with a par value of $0.10 per share.

- b. Purchased construction equipment for use in the business at a cost of $36,000: one-fourth was paid in cash and the company signed a note for the balance (due in six months).

- c. Lent $2,500 to one of the investors, who signed a note due in six months.

- d. Chris Stoschek purchased a truck for personal use: paid $5,000 down and signed a one-year note for $22,000.

- e. Paid $12,000 on the note for the construction equipment in (b) (ignore interest).

Required:

- 1. Create T-accounts for the following accounts: Cash. Notes Receivable. Equipment, Land, Notes Payable. Common Stock, and Additional Paid-in Capital. Beginning balances are $0. For each of the transactions (a) through (e). record the effects of the transaction in the appropriate T-accounts. Include good referencing and totals for each T-account.

- 2. Using the balances in the T-accounts. Till in the following amounts for the

accounting equation: Assets $_______ = Liabilities $ ______ + Stockholders’ Equity $_________

- 3. Explain your response to event (d).

- 4. Compute the market value per share of the stock issued in (a).

1.

Prepare T-accounts for the given accounts.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts for the given accounts are as follows:

| Cash | |||

| Beg. | 0 | ||

| (a) | 60,000 | 9,000 | (b) |

| 2,500 | (c) | ||

| 12,000 | (e) | ||

| 36,500 | |||

| Notes Receivable | |||

| Beg. | 0 | ||

| (c) | 2,500 | ||

| 2,500 | |||

| Land | |||

| Beg. | 0 | ||

| (a) | 35,000 | ||

| 35,000 | |||

| Notes Payable | |||

| 0 | Beg. | ||

| (e) | 12,000 | 27,000 | (b) |

| 15,000 | |||

| Common Stock | |||

| 0 | Beg. | ||

| 300 | (a) (1) | ||

| 300 | |||

| Additional Paid-in Capital | |||

| 0 | Beg. | ||

| 94,700 | (a) (12) | ||

| 94,700 | |||

Working note:

Calculate the value of common stock for event (a).

Calculate the value of additional paid in capital for event (a).

2.

Discuss the accounting equation effect for the given accounts.

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

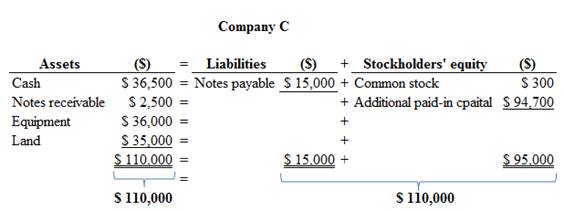

Accounting equation effect for given accounts is as follows:

Figure (1)

Therefore, the total assets are equal to the liabilities and stockholder’s equity.

3.

Explain the response to events (d).

Explanation of Solution

Transaction:

A transaction is a business event which has a monetary value that creates an impact on the business. The process of identifying the economic effects of each transaction of the business is known as transaction analysis.

Event (d) – In this case, there is no exchange of cash, goods or service. So it is not a transaction.

4.

Calculate the market value of per share.

Explanation of Solution

Stock:

Stock represents the number of shares owned by the investors (individual or group) in a Corporation.

Calculate the market value of per share

Here,

Total amount of cash received at the time of issuance of share is $95,000

Number of shares issued is 3,000 shares

Therefore, the market value of per share is $31.67.

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Accounting

- Prepare general journal entries for the following transactions, identifying each transaction by letter: (a) Gnu Company issued 5,000 shares of 1 par common stock to the Prendergas law firm as partial payment of fees incurred to incorporate the business. Gnu was short of cash, so Prendergas agreed to accept 10,000 cash and the shares of common stock in full settlement of its bill for 55,000. (b) Gnu issued 50,000 shares of 1 par common stock in exchange for a parcel of land for building a shopping plaza. (The list price for the land was 400,000; a similar parcel in the same area sold last week for 380,000. During the past month, the price at which Gnus common stock has traded on the open market has ranged from 5 to 12 per share. Two trades occurred yesterday at 7 and 10 per share.) (c) Gnu purchased 10,000 shares of 1 par value common treasury stock for 70,000. (This is the only treasury stock that Gnu holds.) (d) Gnu sold 4,000 shares of common treasury stock for 32,000. (e) Gnu sold 5,000 shares of common treasury stock for 30,000.arrow_forwardSeamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year:Feb. 24. Acquired 1,000 shares of Tett Co. stock for $85 per share plus a $150 brokerage commission.May 16. Acquired 2,500 shares of Issacson Co. stock for $36 per share plus a $100 commission.July 14. Sold 400 shares of Tett Co. stock for $100 per share less a $75 brokerage commission.Aug. 12. Sold 750 shares of Issacson Co. stock for $32.50 per share less an $80 brokerage commission.Oct. 31. Received dividends of $0.40 per share on Tett Co. stock.Journalize the entries for these transactions.arrow_forwardGlacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31:Year 1Jan. 18. Purchased 9,000 shares of Malmo Inc. as an available-for-sale investment at $40 per share, including the brokerage commission.July 22. A cash dividend of $3 per share was received on the Malmo stock.Oct. 5. Sold 500 shares of Malmo Inc. stock at $58 per share less a brokerage commission of $100.Dec. 18. Received a regular cash dividend of $30 per share on Malmo Inc. stock.31. Malmo Inc. is classified as an available-for-sale investment and is adjusted to a fair value of $36 per share. Use the valuation allowance for available-for-sale investments account in making the adjustment.Year 2Jan. 25. Purchased an influential interest in Helsi Co. for $800,000 by purchasing 75,000 shares directly from the estate of the founder of Helsi. There…arrow_forward

- Glacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31:Year 1 Jan. 18. Purchased 9,000 shares of Malmo Inc. as an available-for-sale investment at $40 per share, including the brokerage commission. July 22. A cash dividend of $3 per share was received on the Malmo stock. Oct. 5. Sold 500 shares of Malmo Inc. stock at $58 per share less a brokerage commission of $100. Dec. 18. Received a regular cash dividend of $30 per share on Malmo Inc. stock. 31. Malmo Inc. is classified as an available-for-sale investment and is adjusted to a fair value of $36 per share. Use the valuation allowance for available-for-sale investments account in making the adjustment. Instructions: Journalize the transactions.arrow_forwardPrepare journal entries to record the following transactions involving both the short-term and long-term investments of Cancun Corp., all of which occurred during the current year. a. On February 15, paid $160,000 cash to purchase GMI’s 90-day short-term notes at par, which are dated February 15 and pay 10% interest (classified as held-to-maturity). b. On March 22, bought 700 shares of Fran Inc. common stock at $51 cash per share. Cancun’s stock investment results in it having an insignificant influence over Fran. c. On May 15, received a check from GMI in payment of the principal and 90 days’ interest on the notes purchased in part a. d. On July 30, paid $100,000 cash to purchase MP Inc.’s 8%, six-month notes at par, dated July 30 (classified as trading securities). e. On September 1, received a $1 per share cash dividend on the Fran Inc. common stock purchased in part b. f. On October 8, sold 30 shares of Fran Inc. common stock for $54 cash per share. g. On October 30, received a…arrow_forwardDuring the year the following selected transactions affecting stockholders' equity occurred for Orlando Corporation: a. April 1: Repurchased 240 shares of the company's common stock at $30 cash per share. b. June 14: Sold 60 of the shares purchased on April 1 for $35 cash per share. c. September 1: Sold 50 of the shares purchased on April 1 for $25 cash per share. Required: 1. Prepare journal entries for each of the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 3 Repurchased 240 shares of the company's common stock at $30 cash per share. Note: Enter debits before credits. Date April 01 General Journal Debit Credit Record entry Clear entry View general journalarrow_forward

- Kramer Corporation had the following long-term Investment transactions. Prepare the journal entries Kramer Corporation should record for these transactions and events. Jan 2 Purchased 5,000 shares of Optic, Inc. for $42 per share plus $7,000 in fees and commission. These shares represent a 35% ownership of Optic. Oct 15 Received Optic, Inc. cash dividend of $2 per share. Dec 31 Optic reported a net income of $66,000 for the year.arrow_forwardYerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during a recent year:Feb. 2. Purchased for cash 5,300 shares of Wong Inc. stock for $20 per share plus a $110 brokerage commission.Mar. 6. Received dividends of $0.30 per share on Wong Inc. stock.June 7. Purchased 2,000 shares of Wong Inc. stock for $26 per share plus a $120 brokerage commission.July 26. Sold 6,000 shares of Wong Inc. stock for $35 per share less a $100 brokerage commission. Yerbury assumes that the first investments purchased are the first investments sold.Sept. 25. Received dividends of $0.40 per share on Wong Inc. stock.arrow_forwardThe following selected transactions occurred for Corner Corporation: Feb. 1 Purchased 400 shares of the company’s own common stock at $20 cash per share; the stock is now held in treasury. July 15 Issued 100 of the shares purchased on February 1 for $30 cash per share. Sept. 1 Issued 60 more of the shares purchased on February 1 for $15 cash per share. Required: Show the effects of each transaction on the accounting equation. Give the indicated journal entries for each of the transactions. What impact does the purchase of treasury stock have on dividends paid? What impact does the reissuance of treasury stock for an amount higher than the purchase price have on net income?arrow_forward

- Yerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during a recent year: Feb. 2 Purchased for cash 1,000 shares of Wong Inc. stock for $40 per share plus a $500 brokerage commission. Mar. 16 Received dividends of $0.30 per share on Wong Inc. stock. June 7 Purchased 700 shares of Wong Inc. stock for $49 per share plus a $350 brokerage commission. July 26 Sold 1,200 shares of Wong Inc. stock for $53 per share less a $600 brokerage commission. Yerbury assumes that the first investments purchased are the first investments sold. Sept. 25 Received dividends of $0.40 per share on Wong Inc. stock. In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank. Feb. 2 Investments-Wong Inc. Stock fill in the blank 2…arrow_forwardTarrant Corporation was organized this year to operate a financial consulting business. The charter authorized the following stock: common stock, $18 par value, 12,700 shares authorized. During the year, the following selected transactions were completed: a. Sold 6,300 shares of common stock for cash at $36 per share. b. Sold 2,300 shares of common stock for cash at $41 per share. c. At year-end, the company reported net income of $7,200. No dividends were declared. E11-5 Part 2 2. Prepare the stockholders' equity section of the balance sheet at the end of the year. Note: Amounts to be deducted should be indicated by a minus sign. Stockholders' equity Contributed capital: TARRANT CORPORATION Balance Sheet (Partial) At December 31, This year Total contributed capital Total stockholders' equity $ 0 0arrow_forwardGlacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31: Year 1 Jan. 18. Purchased 5,400 shares of Malmo Inc. as an available-for-sale investment at $36 per share, including the brokerage commission. July 22. A cash dividend of $0.45 per share was received on the Malmo stock. Oct. 5. Sold 1,600 shares of Malmo Inc. stock at $39 per share less a brokerage commission of $50. Dec. 18. Received a regular cash dividend of $0.45 per share on Malmo Inc. stock. Dec. 31 Malmo Inc. is classified as an available-for-sale investment and is adjusted to a fair value of $34 per share. Use the valuation allowance for available-for-sale investments account in making the adjustment. Year 2 Jan. 25. Purchased an influential interest in Helsi Co. for $670,000 by purchasing 73,500 shares directly from…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,