Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 2, Problem 1PA

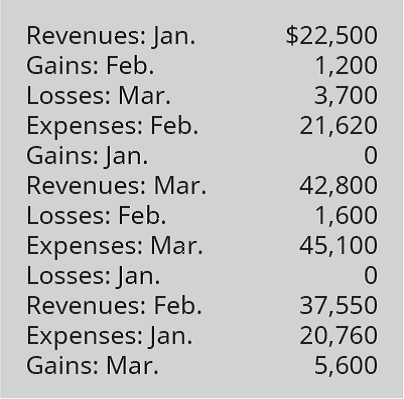

The following information is taken from the records of Baklava Bakery for the year 2019.

A. Calculate net income or net loss for January.

B. Calculate net income or net loss for February.

C. Calculate net income or net loss for March.

D. For each situation, comment on how a stakeholder might view the firm’s performance. (Hint: Think about the source of the income or loss.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following information is taken from the records of Baklava Bakery for the year 2019

A. Calculate net income or net loss for January.B. Calculate net income or net loss for February.C. Calculate net income or net loss for March.D. For each situation, comment on how a stakeholder might view the firm’s performance. (Hint: Thinkabout the source of the income or loss.)

Problem 1: Viance Queen Company

Required:

Compute for the company’s profitability and operating efficiency ratios for 2019

Compute for the financial health ratios of the company for 2019

A.Profitability ratio

a.Gross Profit Ratio

b. Operating income margin

c. Net profit margin

d. Return on Assets:

ROA (NI/Total Assets)

ROA (NI/Average Assets)

ROA (EBIT/Total Assets)

ROA (EBIT/Average Assets)

ROE (NI/Capital)

ROE (NI/Average Capital

B.Operating Efficiency

a. Asset Turnover

b. Fixed Asset Turnover

c. Inventory Turnover

d. Days in Inventory

e. AR Turnover

f. Days in AR

C.Financial Health/ (Solvency and Liquidity) Solvency ratio:

a. Debt to equity ratio

b. Debt Ratio

c. Equity Ratio

d. Interest Coverage Ratio

Liquidity ratio:

a. Current Ratio

b. Quick Ratio

Consider the comparative balance sheet and income statement for Starbucks provided in the shown Figures . Based on these financial statements, determine the following for the year September 30, 2018: Solve, a. Return on assets employed. b. Return on owner’s equity. c. Current ratio.

Chapter 2 Solutions

Principles of Accounting Volume 1

Ch. 2 - Which of these statements is not one of the...Ch. 2 - Stakeholders are less likely to include which of...Ch. 2 - Identify the correct components of the income...Ch. 2 - The balance sheet lists which of the following? A....Ch. 2 - Assume a company has a $350 credit (not cash)...Ch. 2 - Which of the following statements is true? A....Ch. 2 - Owners have no personal liability under which...Ch. 2 - The accounting equation is expressed as ________....Ch. 2 - Which of the following decreases owners equity? A....Ch. 2 - Exchanges of assets for assets have what effect on...

Ch. 2 - All of the following increase owners equity except...Ch. 2 - Which of the following is not an element of the...Ch. 2 - Which of the following is the correct order of...Ch. 2 - The three heading lines of financial statements...Ch. 2 - Which financial statement shows the financial...Ch. 2 - Which financial statement shows the financial...Ch. 2 - Working capital is an indication of the firms...Ch. 2 - Identify the four financial statements and...Ch. 2 - Define the term stakeholders. Identify two...Ch. 2 - Identify one similarity and one difference between...Ch. 2 - Identify one similarity and one difference between...Ch. 2 - Explain the concept of equity, and identify some...Ch. 2 - Explain the difference between current and...Ch. 2 - Identify/discuss one similarity and one difference...Ch. 2 - Name the three types of legal business structure....Ch. 2 - What is the accounting equation? List two examples...Ch. 2 - Identify the order in which the four financial...Ch. 2 - Explain how the following items affect equity:...Ch. 2 - Explain the purpose of the statement of cash flows...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, place an (X)...Ch. 2 - For each of the following items, identify whether...Ch. 2 - For the items listed below, indicate how the item...Ch. 2 - Forest Company had the following transactions...Ch. 2 - Here are facts for the Hudson Roofing Company for...Ch. 2 - Prepare an income statement using the following...Ch. 2 - Prepare a statement of owners equity using the...Ch. 2 - Prepare a balance sheet using the following...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each of the following independent situations,...Ch. 2 - For each of the following items, identify whether...Ch. 2 - For the items listed below, indicate how the item...Ch. 2 - Gumbo Company had the following transactions...Ch. 2 - Here are facts for Haileys Collision Service for...Ch. 2 - Prepare an income statement using the following...Ch. 2 - Prepare a statement of owners equity using the...Ch. 2 - Prepare a balance sheet using the following...Ch. 2 - The following information is taken from the...Ch. 2 - Each situation below relates to an independent...Ch. 2 - The following information is from a new business....Ch. 2 - Each of the following situations relates to a...Ch. 2 - For each of the following independent...Ch. 2 - Olivias Apple Orchard had the following...Ch. 2 - Using the information in PA6, determine the amount...Ch. 2 - The following ten transactions occurred during the...Ch. 2 - The following information is taken from the...Ch. 2 - Each situation below relates to an independent...Ch. 2 - The following information is from a new business....Ch. 2 - Each of the following situations relates to a...Ch. 2 - For each of the following independent...Ch. 2 - Mateos Maple Syrup had the following transactions...Ch. 2 - Using the information in PB6, determine the amount...Ch. 2 - Choose three stakeholders (or stakeholder groups)...Ch. 2 - Assume you purchased ten shares of Roku during the...Ch. 2 - A trademark is an intangible asset that has value...Ch. 2 - For each of the following ten independent...Ch. 2 - The following historical information is from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Have your own shopping habits changed with the ease of online shopping? If so, how? Do you expect them to chang...

Principles of Management

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Cost Accounting (15th Edition)

Relevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in Janu...

Principles of Accounting Volume 2

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

E5–26 Journalizing adjusting entries including estimate sales returns

Learning Objective 3, 4

Emerson St. Boo...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is taken from the records of Rosebloom Flowers for the year 2019. A. Calculate net income or net loss for January. B. Calculate net income or net loss for February. C. Calculate net income or net loss for March. D. For each situation, comment on how a stakeholder might view the firms performance. (Hint: think about the source of the income or loss.)arrow_forwardPrepare an income statement using the following information for CK Company for the month of February 2019.arrow_forwardUsing the following select financial statement information from Black Water Industries, compute the accounts receivable turnover ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Black Water Industries?arrow_forward

- Prepare an income statement using the following information for DL Enterprises for the month of July 2018.arrow_forwardThe following select account data is taken from the records of Reese Industries for 2019. A. Use the data provided to compute net sales for 2019. B. Prepare a simple income statement for the year ended December 31, 2019. C. Compute the gross margin for 2019. D. Prepare a multi-step income statement for the year ended December 31, 2019.arrow_forwardOn March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forward

- Here is the operating data for Yalis Cleaning, Inc.: After analyzing the transactions, prepare a vertical analysis schedule for the company for 2021 and 2020 using service revenue as the base amount. Round percentages to two decimal places.arrow_forwardfirst discuss the use of the income statement, in general, for decision-making. Then, calculate the net operating income and operating margin for this year and last year using the table information below and discuss what these figures mean for the company (i.e. what ‘story’ do they tell the reader). ..arrow_forwardProblem 1: Viance Queen Company Required: Compute for the company’s profitability and operating efficiency ratios for 2019 Compute for the financial health ratios of the company for 2019 A.Profitability ratio Return on Assets: ROA (EBIT/Average Assets) ROE (NI/Capital) ROE (NI/Average Capitalarrow_forward

- Identify summary information about Netflix, Inc. company. This information includes basic descriptions of the company's location, activities, industry, financial health, and financial performance. Go to the Yahoo! Finance website, type in Netflix, Inc., and then use the links (such as Financials) to locate the information necessary to answer the following questions with regard to December 31, 2019. Your answer is partially correct. What is the company's net income? Over what period was this measured? Net income of $ thousand during the year ended December 31, 2019arrow_forwardProblem 1: Viance Queen Company Required: Compute for the company’s profitability and operating efficiency ratios for 2019 Compute for the financial health ratios of the company for 2019 A.Profitability ratio a. Return on Assets: ROA (NI/Total Assets) ROA (NI/Average Assets) ROA (EBIT/Total Assets) ROA (EBIT/Average Assets) ROE (NI/Capital) ROE (NI/Average Capitalarrow_forwardA paragraph stating your evaluation of the company’s performance and financial status for the quarter ending March 30, 2022. In your evaluation, state whether: o the business is profitable?o it is able to pay its current obligations/liabilities?o its assets are financed more by debts or equity?o its retained earnings increased or decreased during the quarter and why? You may state any other insights you have on the company’s financial statements. Justify your evaluation and support your discussion with relevant calculations or ratios.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License