Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1R

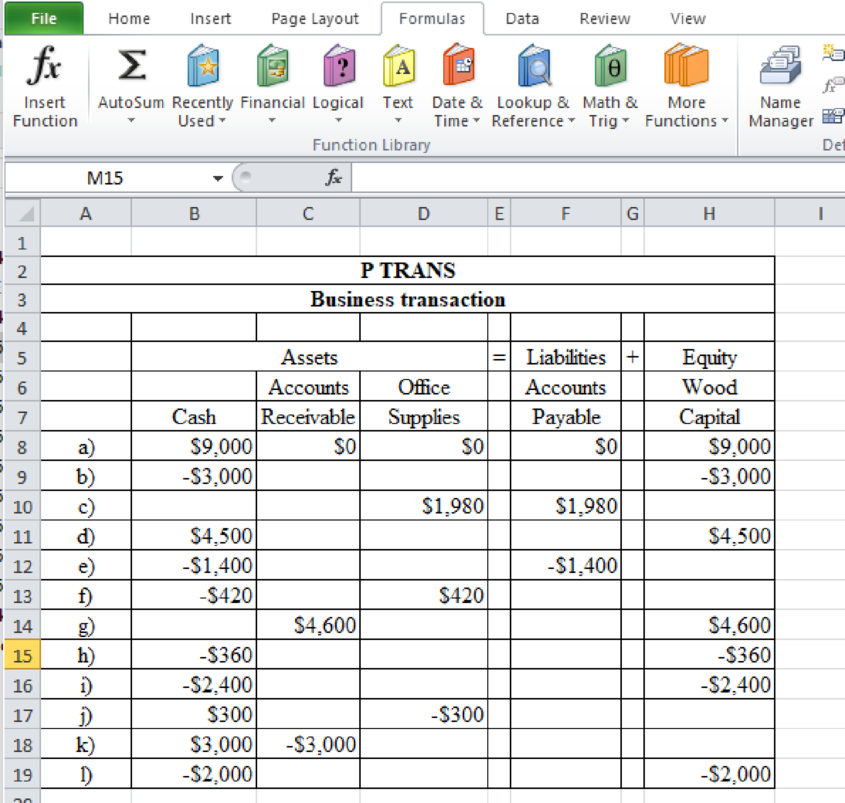

On June 1 of the current year, Wilson Wood opened Woodyʼs Web Services. This sole proprietorship had the following transactions during June.

- a. Opened a business checking account and made a deposit, $9,000.

- b. Paid rent for June for office space and computer equipment, $3,000.

- c. Purchased office supplies (stamps, pens, etc.) on account, $1,980.

- d. Received cash for services rendered, $4,500.

- e. Paid creditor for office supplies purchased on account, $1,400.

- f. Purchased office supplies for cash, $420.

- g. Billed clients for consultations performed on account, $4,600.

- h. Paid monthly internet service bill of $360.

- i. Paid the secretaryʼs salary of $2,400.

- j. Returned $300 of office supplies purchased in transaction f. Received a full refund.

- k. Received cash from clients previously billed, $3,000.

- l. Cash was withdrawn for ownerʼs personal use, $2,000.

REQUIREMENT

1. Review the printout of the worksheet PTRANS. You have been asked to complete the worksheet by recording these transactions.

Expert Solution & Answer

To determine

Show the printout of worksheet of PTRANS.

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Answer? ? Financial accounting question

Calculate the predetermined overhead tare

expert of general accounting answer

Chapter 1 Solutions

Excel Applications for Accounting Principles

Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - Prob. 7R

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY